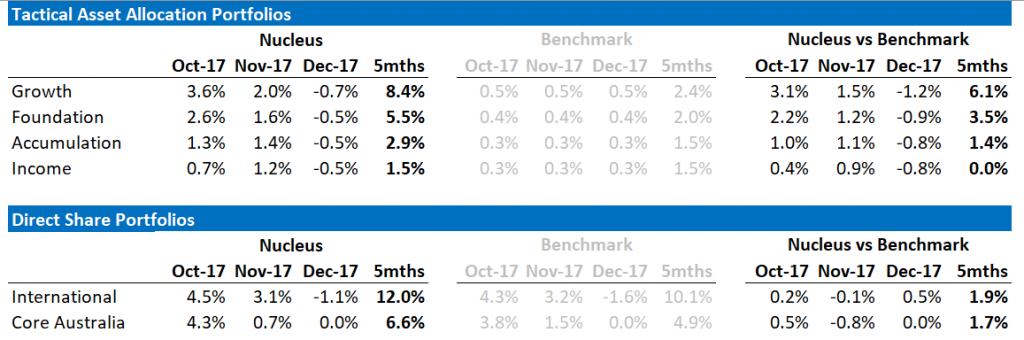

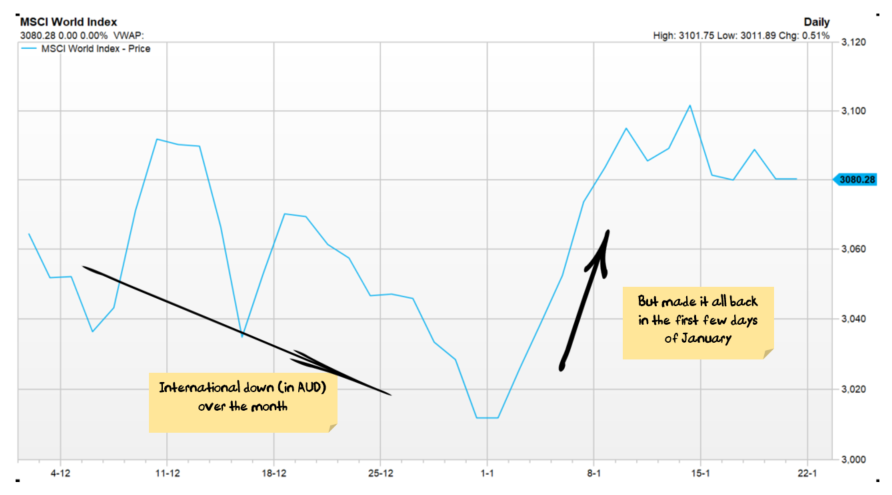

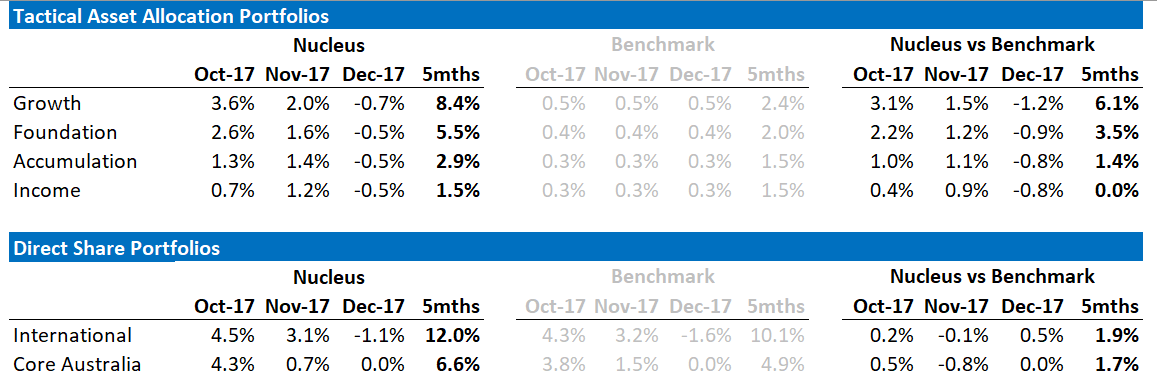

Good news: Stock selection continues to support performance with our international portfolio outperforming a falling world market. Bad news: Statistically, December was the worst month so far for our Tactical Portfolios. Perspective: A 3-day fall in global shares (priced in AUD) between Christmas and New Year was the only reason for the negative performance, and this reversed quickly after New Year to leave global shares well above November levels.

With the benefit of hindsight (and measured over far shorter periods than we would ever like our mistakes to be evaluated over!), the decision we made in November to sell down and take some profits in our equity positions was timely, and the decision to add most of those positions back at the start of January was even more so.

But we are clearly playing with fire, this late in the cycle. Our tactical asset allocation continues to be based on getting as much exposure as we dare to over-valued equities that continue to get even more over-valued while maintaining protection in case it all unravels.

Undoubtedly over the next 6-12 months, we will either regret (a) not owning enough stocks if the stock market careens higher or (b) owning too many stocks if the day of reckoning arrives earlier than we expect. For now, we are of the belief that our portfolios have the right mix to minimise both regrets.

In our last monthly report we spent a lot of time trying to justify our decision to take some profits:

While we think there is still significant scope for the Australian dollar to fall, we need to balance this with valuations and potential risks. To this end, we took some profits in a number of portfolios and increased our cash weights.

It’s a nuanced argument – balancing potential upside vs the risks. We have taken the view that we would prefer to see stock markets lower or a period of consolidation to allow fundamentals to catch up with prices.

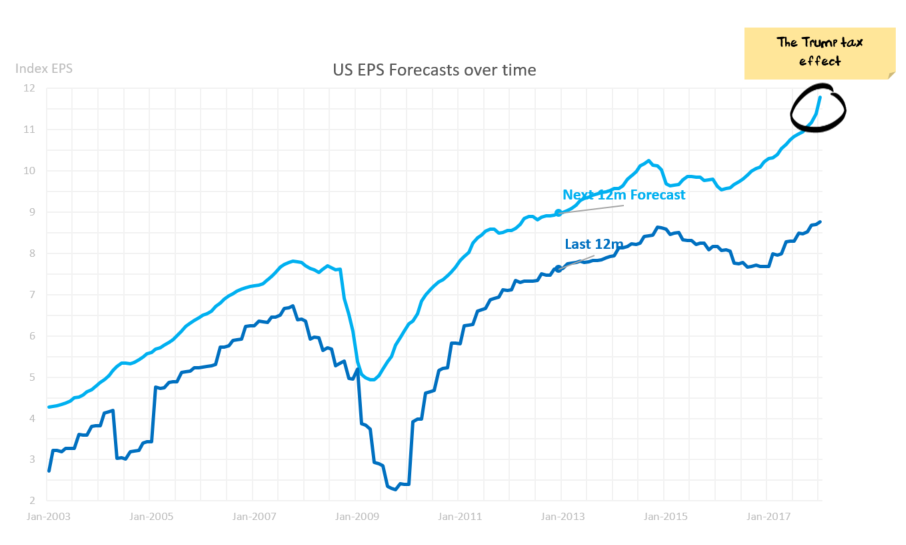

To be clear, we don’t think that we have reached the end of the current investment cycle, especially so as the long-awaited Trump tax cuts are on the verge of triggering a late-cycle US boom.

With a fall in international equities (priced in Australian dollars) and a big rally in the Australian dollar (vs the US dollar, it was more muted vs the Euro/Yen) we reversed part of that decision and added to our holdings at the start of January.

The returns above include fees and trading costs on a $500,000 portfolio. Note that individual client performance will vary based on the amount invested, ethical overlays and the date of purchase. The benchmark returns do not include fees.

Is it all unravelling?

A 7% rise in the Australian dollar and a ~10% rise in commodities from early December through mid-January doesn’t help any of our portfolios. In fact, we are positioned for the opposite. But our portfolios managed to eke out some gains over the same period, a testament to the power of asymmetric returns and some favourable stock selection.

At this point in the cycle, resources will turbo-charge your return – in both directions and so we have largely steered clear. International investments continue to represent a good risk/return trade-off for Australian investors – if the world is headed for a boom on the back of synchronised growth then Australian investors benefit from rising share prices (offset by the rising AUD), if trouble strikes then a falling AUD will provide protection.

Global Synchronised Growth?

Over the last month or so markets have seen increasing oil prices, an increasing Australian dollar, a weak US dollar, rallying commodity prices, strong manufacturing indexes in Europe and the US.

Most of these are inter-related.

The increasing AUD / rallying commodity prices are driven by the same trend – strong manufacturing surveys. The theme is that strong global growth will lead to strong commodity prices and so the Australian dollar rallies.

The crucial question (as usual) will come down to China.

Chinese growth from 1990 to 2005 was driven by increasing trade, increasing urbanization, improving demographics and prioritization of capital expenditure over consumers. All of that is changing (see our primer for more details).

Since the financial crisis, China has relied on the same drivers of growth, but rather than being a consequence of economic need it has been driven by increases in debt. So, synchronized global growth is a huge opportunity for China to rebalance its economy.

The question is will China use the strength in the US and Europe to rebalance its economy?

If No

If the answer is no, then we are probably headed for an epic boom/bust. Europe emerging from the depths, US turbocharged from tax cuts, Japan showing signs of life, if China keeps it foot to the debt accelerator then it could all add up to boom-time economic performance. Until the debt runs out. And the sugar hit from US tax cuts wears off. And European/Japanese structural problems re-emerge.

This is not our base case, but it is entirely possible. If this is the case then resources stocks are the place to be invested, the Australian dollar will stay high and the lucky country will stay lucky.

In summary the high will be higher for Australia, the crash will be more severe – but the crash will be a fair way off.

Our portfolios are probably going to increase in this scenario, but not as fast as the market.

If Yes

This makes the most sense for China – use the economic strength in Europe and the US to rebalance the Chinese economy. This is our base case. We expect that China will make a gradual transition to more consumption and less capital expenditure, and our portfolios are positioned for this outcome.

The danger is that the Chinese economy slows too quickly – which would see share prices fall – basically a re-run of 2014/2015. While our current portfolios have some protection from this event, under this scenario we would be reducing our shareholdings further.

I note that this is the most uncertain of the assumptions that are driving asset allocation at the moment. It is our key focus currently – particularly as winter shutdowns are distorting statistics.

The Way Forward

As a reminder, we look at the key themes facing our portfolios as being:

- China: Rebalancing is occurring, the question is how fast Chinese authorities allow it to occur.

- Trump: Taxes are through as we expected. Our expectation for the USD to increase on the back of this has so far proved wrong.

- Europe: Grinding recovery. We are not expecting great things, but note that the number of political risks has reduced in recent months. The major long-term issue is still the significant imbalances between Germany and most of the rest of the Eurozone.. The next flashpoint is the March Italian election but that is not bothering markets for now.

US

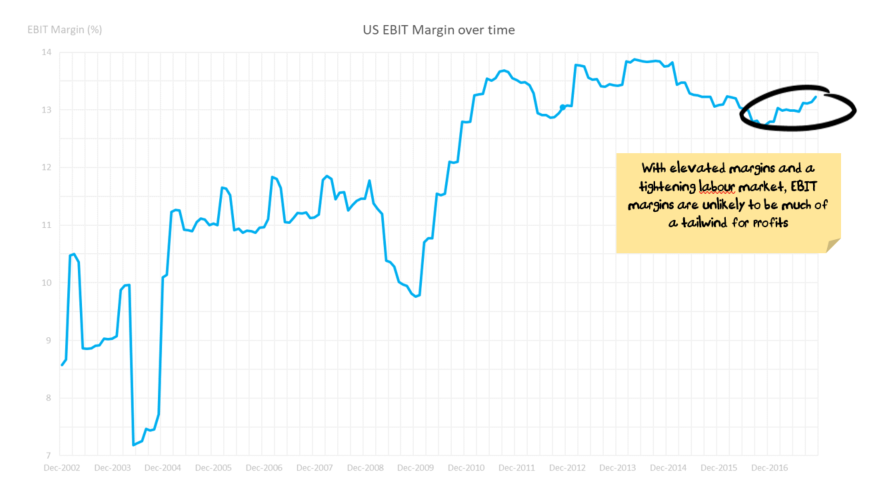

Our core position is that Trump is trying to engineer a boom. It will not be sustainable and will likely be followed by a bust that leaves the US economy in a worse position but that is a future problem – positioning the portfolio for the boom is the current issue.

The proposed tax cuts are badly targeted by giving most of the benefit to the rich and to companies, trickle down is unlikely to work, the tax cuts are unsustainable, and they are only a short-term “sugar hit” for the US economy. But it is going to be such a huge stimulus that you don’t want to stand in the way of it as an investor.

So, we want to play the boom, keeping a sharp eye on the bust. Our portfolio positioning on this basis remains:

- overweight international stocks from an asset allocation perspective

- overweight stocks with US exposures – subject to valuation. The practical implementation of this has been buying non-US stocks that are exposed to the US.

China

In China data continues to be muddied by winter/pollution shutdowns. Our view is:

- the shift to consumption-led growth rather than investment-led growth will require a greater shift than many recognize. This shift will be a significant negative for commodities/the Australian dollar

- current growth rates are unsustainably high, inflated by rapidly increasing Chinese debt. The increase in debt has been required in order to hit the growth targets, so removing the growth targets will help refocus local party officials to more sustainable policies

- activity still seems to be slowing, although the next few months are going to be more difficult to get an accurate read on economic activity as the Communist Party Conference in Beijing has led to the shutting down of a considerable amount of industrial manufacturing, in particular, steel production. We would expect that some of the strength in commodity prices in July/August reflected the bringing forward of production in front of the shut down. Then, the weakness in September represents the shutdown. Finally, there is likely to be a bounce in Q1 2018 due to “catch-up” production. So, the true trajectory is going to be difficult to ascertain accurately until we are through this period.

- the Chinese housing market appears headed into a soft landing thanks to macroprudential tightening so a possible path ahead for rebalancing is a muted not busting housing cycle that supports consumption while weighing on investment;

- we are probably 6-12 months away from being able to see whether the removal of growth targets makes a big difference or not – they have the potential to foreshadow a seismic shift to a more sustainable growth model. I suspect the outcome will be that with the Communist Party Conference done now the impetus will switch to slowing the economy as much as possible, but with any sign of unrest the debt taps will be turned back on.

Our expectation is that China is going to continue to “glide” lower to try to normalize the capital expenditure to consumption in-balance that we discussed in our recent webinar.

It is our view that the Chinese economy will continue to slow over the coming years – Japanese style lost decades, and low inflation/deflation remain more likely than a dramatic bust, which means a grind lower for commodities and the Australian dollar.

Our portfolio positioning on this basis remains:

- considerably underweight Australian stocks from an asset allocation perspective

- underweight resource stocks within equity portfolios

Tactical Asset Allocation Portfolio Positioning

In our tactical portfolios, we own cash, bonds, international shares and Australian shares. We tend to blend these portfolios for clients so that each investor receives an exposure tailored to their own risk and income requirements.

The broad sweep of our asset allocation over the last 12 months was to ride the Trump Boom, switch into Europe in March / April as the US became overvalued and then switch back into the US as the Euro rallied and the USD fell. Most recently we reduced our international holdings after an almost 15% rise in 4 months and the Australian dollar falling to $0.75. With the bounce in the Australian dollar, we have added once more to our international holdings.

Over the month our bond holdings detracted from performance, as investors priced in synchronised global growth. We expect this to reverse at some stage and highlight these assets are a hedge in case the stock market falls.

We remain underweight shares in aggregate, overweight international equities and significantly underweight Australian.

Tactical Foundation Portfolio

Our tactical foundation portfolio is designed for investors with lower balances, it uses exchange-traded funds for its international exposure rather than direct shares. The reason for this is parcel sizes, you can’t buy half a Google (Alphabet) share directly and so we use exchange-traded funds which buy baskets of stocks instead. The tactical portfolio is a balanced fund, not as aggressive in its holdings as the growth fund nor as conservative as our income fund.

In November in the tactical foundation portfolio, we sold down our international exposure from overweight to neutral. After the Australian dollar rose 7%, we reversed part of this trade. The fund continues to be underweight Australian stocks.

Equities

Footlocker continued its recovery. Footlocker fell by 30%+ in the months after we purchased it due to fears of online competition. After much soul-searching on the viability of the business going forward, we decided to increase our weight and the stock jumped almost 50% over November, and has added another 10% since then. Boeing increased 3% over December, we bought more at the start of January just in time to see the stock rise another 10%. Other big performers for the month included Michael Kors (+25% then +5%), Southwest Airlines (+20% then +5%) and United Therapeutics (+18% then +11%).

At the other end of the spectrum, a number of Tech and Auto stocks were weak in December, Skyworks was the worst down 12%; Lam Research, Applied Materials, GM and Peugeot were all down 5-7%.

Defensives are expensive and so as we are letting go of some of our higher growth holdings, we are generally avoiding the traditional defensive sectors like REITs, Utilities, Telcos and Infrastructure. Our view is that (just as the central banks intend) lower risk investors continue to “shuffle up the risk spectrum”, and they have bid the price of traditional defensive sectors to levels that make investment difficult.

We are looking for a mix of the more stable industrial, consumer staples and healthcare stocks to get a similar defensive exposure without having to pay the nosebleed prices in the traditional defensive portfolios.

We have been overweight a range of automotive stocks and suppliers but have been winding the holdings back following a stellar share price run in the sector. The purchases were largely a value play as most of the sector trades on low multiples over growth concerns.

Our biggest call is underweight energy. In particular oil producers. We have blogged a lot about the oil price, the thumbnail sketch of the sector is that:

- the short term is not positive for the sector with oversupply and OPEC needing to cut production to try to prop up the oil price.

- the long term is not positive with increasing electrification of cars and falling battery prices limiting the upside

- the mid-term might be good if an undersupply emerges and before electric cars put a dent in oil demand and assuming US shale costs don’t keep falling

Meanwhile, oil stocks are pricing $60-$70 oil prices in perpetuity. The mid-term is going to have to be spectacular to justify current share prices, let alone getting any share price growth.

Having said that, it is a big risk to our portfolio being underweight energy. If there are geo-political ructions, particularly in the Middle East, we would probably underperform. October saw the oil price rise once more, largely on the back of hurricane-related supply constraints, but we remain comfortable with our holding and expect much of this to be a short-term issue.

Our sole holding in the energy sector, Neste Energy is up around 50% over the past few months, which has shielded up a little from the rising oil price. Neste is a Finnish oil refiner, making a significant investment in green technologies and is well regarded by a number of sustainable rating firms including being in the Global 100 most sustainable companies, the Dow Jones Sustainability index and CDP.

We are underweight financials – mainly as we can’t find US financials that are cheap enough to justify purchasing. We have been trawling the European banks for value. Insurance continues to be a sore spot, there was some bounce back in insurance company share prices in October after a hurricane-affected September, but shareprices have been weak since then. We are looking to continue to build holdings in the sector with the view that after such severe losses in 2017 that insurance premiums will rise significantly.

We have a reasonable tech / IT exposure. There are a number of smaller tech stocks that we own, in particular, a range of semiconductor stocks where we like the growth outlook. It is worth noting that part of the reason for Apple increasing the price of its latest phone is an increase in memory and components. This is a positive for semi-conductor stocks more generally, especially if a “feature war” breaks out in the smartphone space. We current hold a range of stocks that should be helped by this trend (Lam, Applied Materials, Skyworks, and to a lesser extent Cisco).

Epilogue

In summary, our view continues to be that Australian investors are better off holding international investments at this point in the cycle.

Our intention is that our portfolio is positioned to take advantage of our key themes but minimise risk in the event that our themes take longer than expected to resolve themselves.

We usually find that big picture macro themes take a long time to resolve themselves in financial markets, but when macro theme resolve themselves they do so quickly – usually too quickly to reposition your portfolio if you are not already invested.

Register your interest now (if you haven’t already):

Damien Klassen is Head of Investments at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Integrity Private Wealth Pty Ltd, AFSL 436298.