Investment markets are late in the economic cycle, the issue being that you never know when the end will come. However, there are some signs that it is not here yet for US equities at least – and there is the potential that US equities will hold the rest of the world out of the abyss for a little while longer.

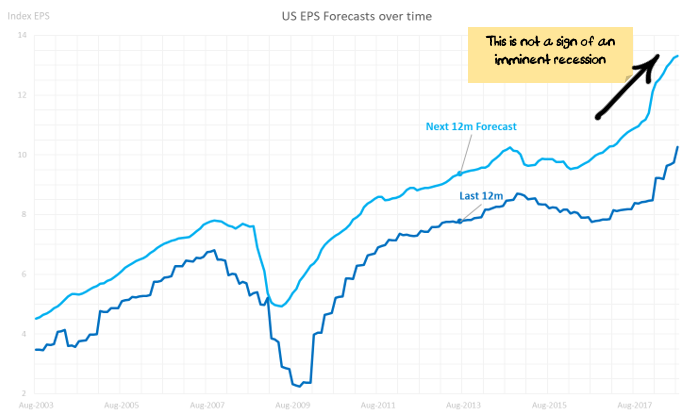

The main factor that gives me comfort with the US market is the strong earnings growth that continues to define the US market. In general, when forecasts earnings are rising strongly markets don’t have 20%+ corrections:

There are occasional exceptions, the Asian / Russian Rouble / Long Term Capital Management crisis being one of them where the US market fell 20% in a few weeks despite an uptrend in earnings. However, it is worth noting a few things that characterised this crisis:

- The Asian crisis started in May 1997 with an attack on the pegged Thai baht. The crisis rolled through the rest of Asia over the rest of 1997. From May 1997 until the time The Russia Rouble crisis occurred in late 1998, the US market had already risen 40%. The Russian crisis sparked the collapse of Long Term Capital Mangement, a US hedge fund which was so highly leveraged that it needed a bailout organised by the NY Fed so that it wouldn’t bring the financial system down.

- So, while the correction came in the middle of increasing earnings, it was a financial shock from excessive leverage rather than the start of a recession. Also, the crisis needed to spread directly to the US before the US stock market reacted.

You do get smaller ~10% corrections in the middle of earnings booms, although again they are more likely to be reactions to shorter-term issues rather than the start of significant bear markets.

The more common outcome is that earnings peak either before or at the market peak:

So, what I am suggesting is that the end of this economic cycle is unlikely to begin until earnings growth slows down and we start seeing earnings downgrades rather than upgrades. And so far that is not likely.

With considerable earnings growth yet to come over the next six months from tax cuts and increased buybacks, we expect earnings to continue to grind higher for the next two quarters:

Often the peak in earnings also represents the peak in the economic cycle, but if you took cover every time earnings flattened you would miss a lot of good times as well. The logical inference I’m drawing is that when US earnings flatten, it might herald the end of the US economic cycle, but with rapidly rising US earnings it is unlikely that the end of the US economic cycle is here.

Australia is a completely different story – I’ll deal with that in a different post: