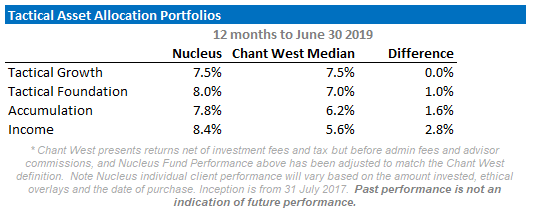

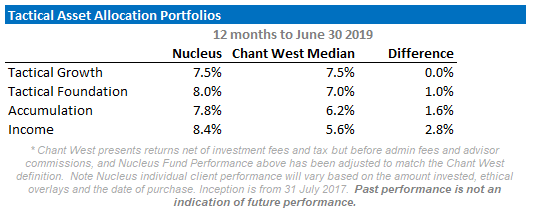

Putting a portfolio together sometimes feels like catching waves: you position the portfolio for a number of themes, wait for the right wave to lift the performance, and then readjust your positioning for the next wave. The 2019 year to June was one such year with all of our tactical portfolios picking the right swell and delivering strong performance. Three out of four of our tactical funds delivered returns that put them in the top 10 of superannuation funds (according to Chant West) and the fourth was just outside the top ten:

Some of these categories don’t precisely match our asset positioning but, for the most part, that would only make our performance look better – our income fund in particular returned 8.4% while carrying less than a 20% weight to growth assets for most of the year:

Now we are waiting for the next wave building on the horizon.

We are not expecting this one to be anywhere near as pleasant. Assets are priced for perfection and we are expecting conditions to be far from perfect: corporate earnings are clearly weakening globally, inflation is weak globally, central banks know that they are out of ammunition and are begging governments to borrow, largely governments are ignoring them. The one major exception is the US, although borrowing to give companies and the richest 1% a major tax cut is not what central bankers would have preferred.

This leaves most of the world relying on US growth to lift exports and demand enough to offset their own government’s failure to act. And with US growth now slowing after the sugar hit of tax cuts last year a range of countries, particularly in Europe, are being exposed as having no actual growth plan other than hope that someone else will do the heavy lifting.

Australian growth plans are only slightly more advanced than Europe’s:

The current Australian government’s economic plan is to try to re-ignite the housing boom by convincing the world’s most indebted consumer to borrow more.

At the moment the plan has four parts, the first being relatively simple: target the main group that isn’t already geared to the eyeballs (first home buyers) and encourage them to borrow up to 95% of the value of a house.

The second part is more complicated. The royal commission into banking deemed the banks were breaching responsible lending rules and APRA (the regulator in charge) was pilloried for being too close to the banks and allowing banks to set their own standards. This slowed the meteoric rise in debt and saw house prices tumble. The current government’s response has been:

- Three days after the election APRA announced it was looking at loosening credit conditions and letting the banks calculate their own risk.

- The head of APRA for the period in which the banks were deemed to be lending irresponsibly was given a new five-year term

- The assistant Treasurer recently told The Australian Financial Review that he will press financial regulators to review their restrictions on bank lending to help ease a credit squeeze and to “get credit flowing” to home borrowers.

A cynical observer might think that the current government’s plan is to encourage banks to resume lending irresponsibly. It is admittedly hard to come up with an alternative motive for its actions.

The third part of the plan is subtle. The Reserve Bank of Australia has been publicly begging the government to spend money on productive infrastructure in order to boost jobs and get wages to grow. The government is refusing, which effectively leaves the Reserve Bank no option but to continue to cut interest rates, and lower interest rates will presumably encourage Australia’s indebted consumer to become even more indebted.

The fourth part is back to simple. When your existing citizens are too indebted to borrow more, you need to get some new citizens:

Maybe everything will work out fine. History suggests otherwise.

The real question for asset allocation is what to do in the meantime. The current government has at least three years in power, plenty of scope to increase government debt to support the housing sector in novel ways and no compunctions about trying to convince Australian consumers to borrow even more.

Blowing the property bubble meaningfully larger is probably beyond the Australian government, but arresting the fall in prices seems likely.

The risk is some sort of global shock or broader economic downturn. Australia has already “broken glass in case of emergency” to prop up the housing market and many of the policies that could be employed in a crisis have already been employed – meaning that in the event of a genuine crisis the downside is going to be more pronounced.

Asset Allocation

Which leaves a measure of conflict in asset allocation – do you try to ride a short term stabilisation in the Australian economy and run the risk that any global crisis is likely to be devastating? Valuations have made part of the decision with the Australian market looking increasingly expensive.

So where does an asset allocator turn? In 2018 with a slowing Australian economy, stagnant wage growth and ten-year government bond yields of 2.8% we felt being overweight bonds was an easy decision (investors make money on bonds when yields fall).

At the time we were one of the only voices expecting rate cuts in Australia. Now the first two rate cuts have occurred and further cuts are a consensus opinion.

While we were expecting Australian ten-year bond yields to fall to these levels (1.3%), we weren’t expecting them to fall so quickly – the last 6 months has been dramatic.

Keep in mind that the Reserve Bank of Australia has an inflation target of 2-3%. At current yields, the bond market is suggesting that it will not meet that mandate for the next ten years. Which, in the context of the European and Japanese examples, anemic wage growth, world-leading private indebtedness and an overvalued housing market, is probably a reasonable assumption – unless something changes.

We are of the view that stagnant growth is going to be on the menu until we see governments spending money. And probably “helicopter” money. Given the current state of economics, that will probably take some sort of reasonably large economic crisis. Until then we expect more of the same – slow growth and a grind lower.

As the bond yields have fallen we have been taking profits, although we remain overweight.

The low yields present an asset allocation quandary. I was hoping that by this stage we would have seen equity prices that were more reasonable, giving us the opportunity to switch out of our bonds and into equities. But equities are looking expensive. Not irrationally expensive, but certainly more expensive than we would have thought given the uncertain and low growth outlook. So are now holding lots of cash, looking for the right opportunity.

June Performance

Stocks reversed their May falls into June. Our portfolios are showing the signs of being overly defensive, underperforming over the month. We are comfortable with the view that the defensive position is warranted – if markets shoot higher then we will underperform but we think the trade-off is warranted given that downside protection is more important at this point in the cycle than chasing stock markets higher:

Outlook

Australian shares are still considerably more expensive than most international comparisons with poorer growth expected. We retain large cash and bond balances to hedge against volatility and in the expectation that capital protection will be important during 2019.

Our key focus is on:

- Chinese growth, gauging the extent of the slow down and the policy response to the trade war

- Trying to work out how sustainable the effect of the Australian election will be on house prices

- Gauging the damage that a Boris Johnson led hard Brexit might cause