Nucleus Wealth is an Australian investment fund that started in 2016. Nucleus Wealth offers significant points of difference in the way the fund invests for potential investors/clients, with the aim of providing a transparent and easy-to-understand investment solution.

Every client of Nucleus Wealth has their own bespoke portfolio of shares, bonds and cash held on a third-party platform called Praemium in a Separately Managed Account (you will sometimes see this called an SMA). More information on Praemium and Separately Managed Accounts below.

Because the client has their own individual portfolio, they can individually tailor the account using over 30 different ethical and portfolio tailoring options- from this, Nucleus Wealth can offer free investment advice on an appropriate portfolio for the client’s needs.

Nucleus Wealth predominantly operates online. Regularly updated blogs, reports, podcasts and articles are available on the company’s website, as well as calling and email services. The Nucleus Wealth client onboarding portal not only details every share and bond in the client’s portfolio, but more importantly why they are in the portfolio. While clients are welcome for an in-person visit at the Nucleus Wealth office, the company’s hope is that the unparalleled transparency and online investment support is enough to give clients all of the information needed to make investment choices.

Praemium is a platform that administers investments and performs trading of stocks on behalf of Nucleus Wealth clients.

Nucleus Wealth chose Praemium as its investment platform because Praemium is fully backed by global and local banks, such as JPMorgan, HSBC and ANZ, offering the gold standard for client asset protection.

A separately managed account (SMA) is a portfolio of individual securities managed on the client’s behalf by a professional asset management firm, such as Nucleus Wealth. Separately managed accounts offer the investor the benefits of direct share ownership. Dividends, distributions and franking credits are confined to the client’s account, whilst the client still has the hands off nature of a professionally managed investment solution. Separately managed accounts have been around for some time, and have grown in popularity in the last 5 years.

Super Accounts:

Personal Superannuation – For clients looking to rollover funds from their existing personal superannuation account, or looking to open a new account

SMSF with Individual Trustees – For clients looking to invest money in the name of a Self Managed Super Fund they control that has individual trustees

SMSF with a Corporate Trustee – For clients looking to invest money in the name of a Self Managed Super Fund they control that has a corporate trustee

Non-Super Accounts:

Individual – For clients looking to invest personal money in their own name (not in superannuation)

Joint – For clients looking to invest personal money in the name of 2 people (e.g. the client and their partner)

Company – For clients looking to invest money in the name of a company they have control of

Trust with Individual Trustees – For clients looking to invest money in the name of a trust they control that has individual trustees

Trust with a Corporate Trustee – For clients looking to invest money in the name of a trust they control that has a corporate trustee

A self managed super fund (SMSF) is a superannuation trust structure that provides benefits to its members upon retirement. The main difference between Self Managed Super Funds and other super funds is that Self Managed Super Fund members are also the trustees of the fund. More information on Self Managed Super Funds here.

Nucleus Wealth has put together an online onboarding tool, which there is no obligation to invest, but offers the ability to tailor and view an indicative portfolio as we would invest on your behalf today. The whole process is paperless and can be completed in 10-15 minutes.

You can invest through all major ownership types, including personal superannuation, individual, joint names, Self Managed Super Funds, Trusts and Companies.

You have the ability to tailor your investments using over 30 different ethical and portfolio screens, which effectively knocks out stocks from your portfolio that do not meet your requirements.

You can also seek free personal financial advice through the ‘Limited Advice’ path, which will ask questions about important factors such as your time frame for investments, risk appetite and feelings towards volatility.

From there, Nucleus Wealth can then recommend a portfolio (or blend of portfolios) from our company’s range that is appropriate for your answers.

You can also opt to just select the portfolios off-the-shelf using the ‘Self Directed’ option.

The full portfolio, as Nucleus Wealth would invest today, fees and initial brokerage estimates are available at the review stage of the onboarding portal.

All information displayed on the screen is available in document form, along with the product disclosure statement (PDS), which will be sent to you before you decide whether to invest.

There is also the ability for Nucleus Wealth to make a referral to a third-party face-to-face advice network if you feel you need broader advice.

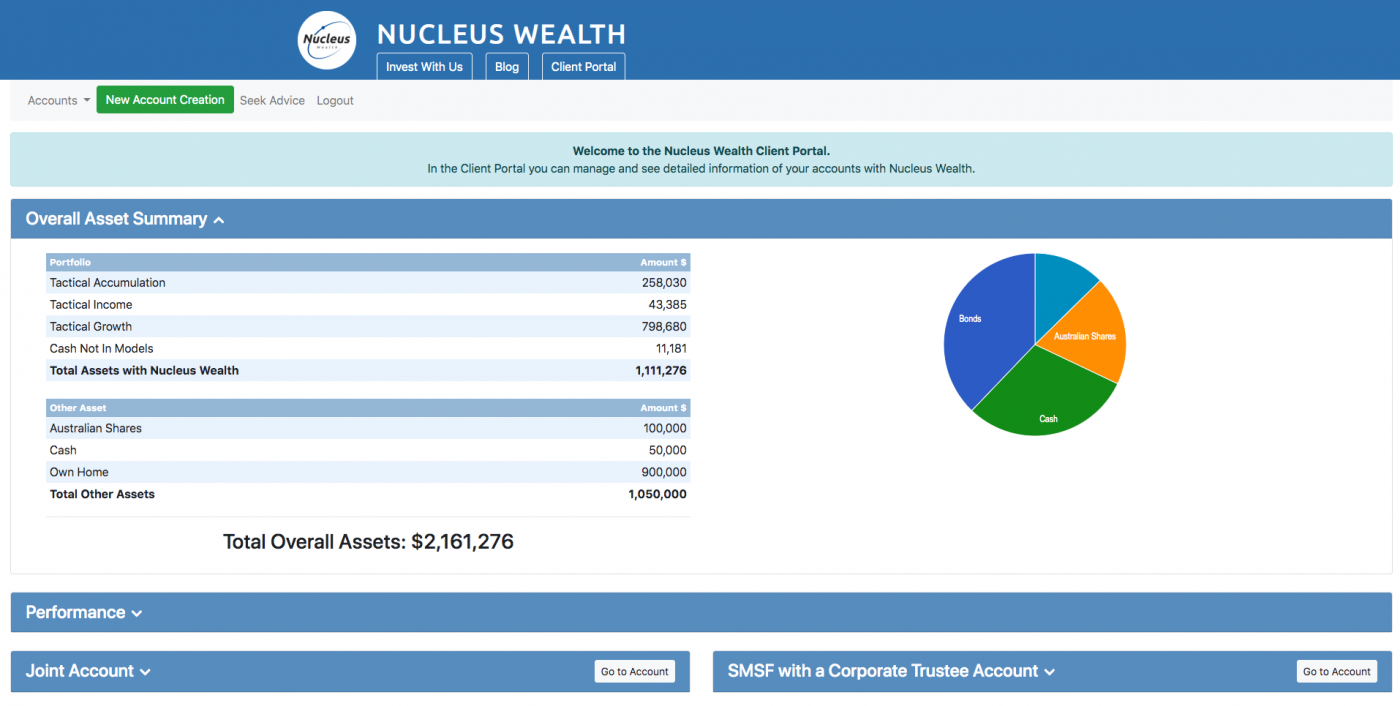

Once aboard, you will have your own fully-featured client dashboard that provides a wealth of information. At any time, you will be able to see your portfolio’s asset allocation, sector and region analysis, as well as if there is an investment-grade analyst report for every holding in your portfolio.

In this dashboard, you will also be able to make additional changes to your portfolio, such as seeking further investment advice or other portfolio adjustments and modifying your ethical and portfolio screens.

You will also have access to Praemium’s award-winning client portal that provides cash flow and depositing information along with performance statistics and reporting.

As an investor, you can expect an in-depth monthly performance report, which details the macroeconomic drivers and narratives that are at work in your portfolio.

Nucleus Wealth also has our popular live weekly webinar series, giving you some serious insight into the themes that are front of mind of our company’s investment team.

MacroBusiness is an Australian investment blog. David Llewellyn-Smith & Leith Van Onselen from MacroBusiness are partners with Nucleus Wealth, and are on the board as Chief Strategist & Chief Economist respectively. David in particular has a lot of input with Nucleus Wealth’s long-term strategic investment direction.

The MacroBusiness Fund (also known as MB Fund) and Nucleus Wealth Fund are the same product. David, Leith and the MacroBusiness team have partnered with the like-minded asset manager, Damien Klassen from Nucleus Wealth, to create the fund for investors.

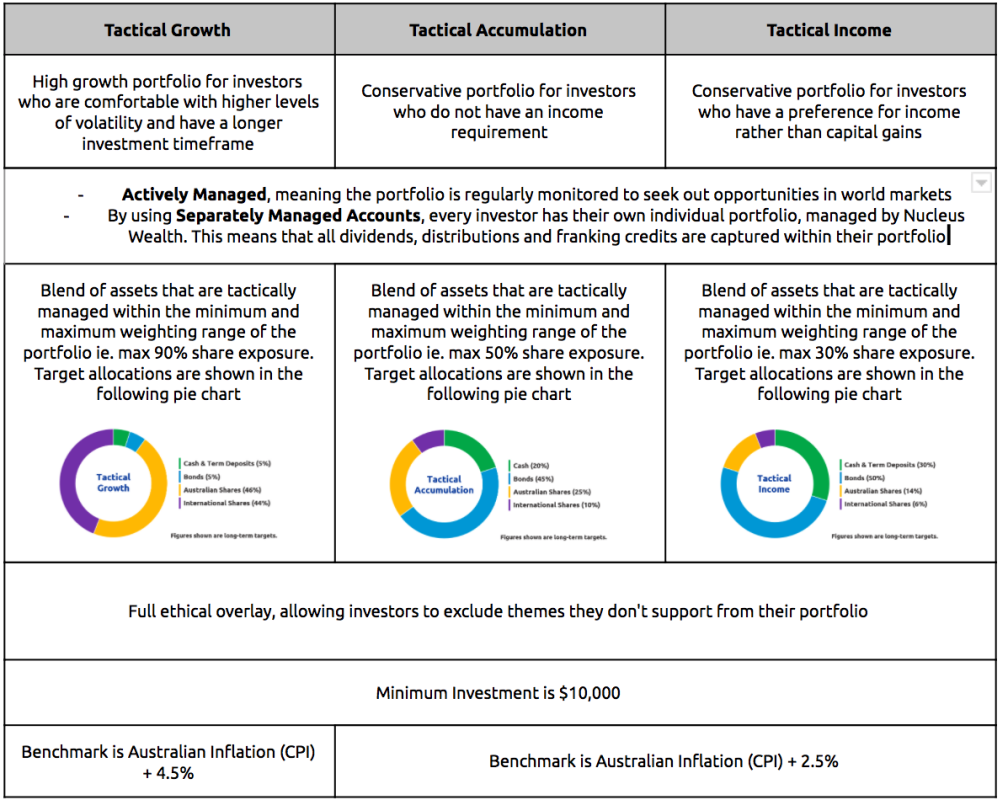

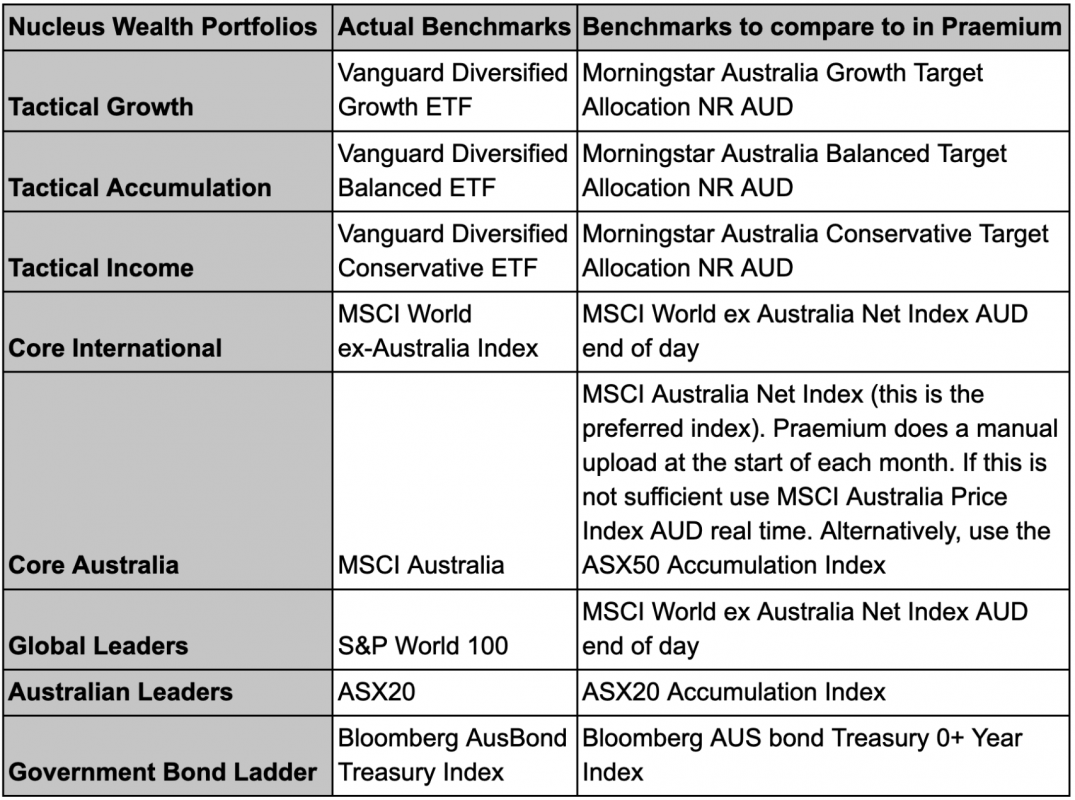

Active Portfolios

Tactical Growth – $10,000

Tactical Accumulation – $10,000

Tactical Income – $10,000

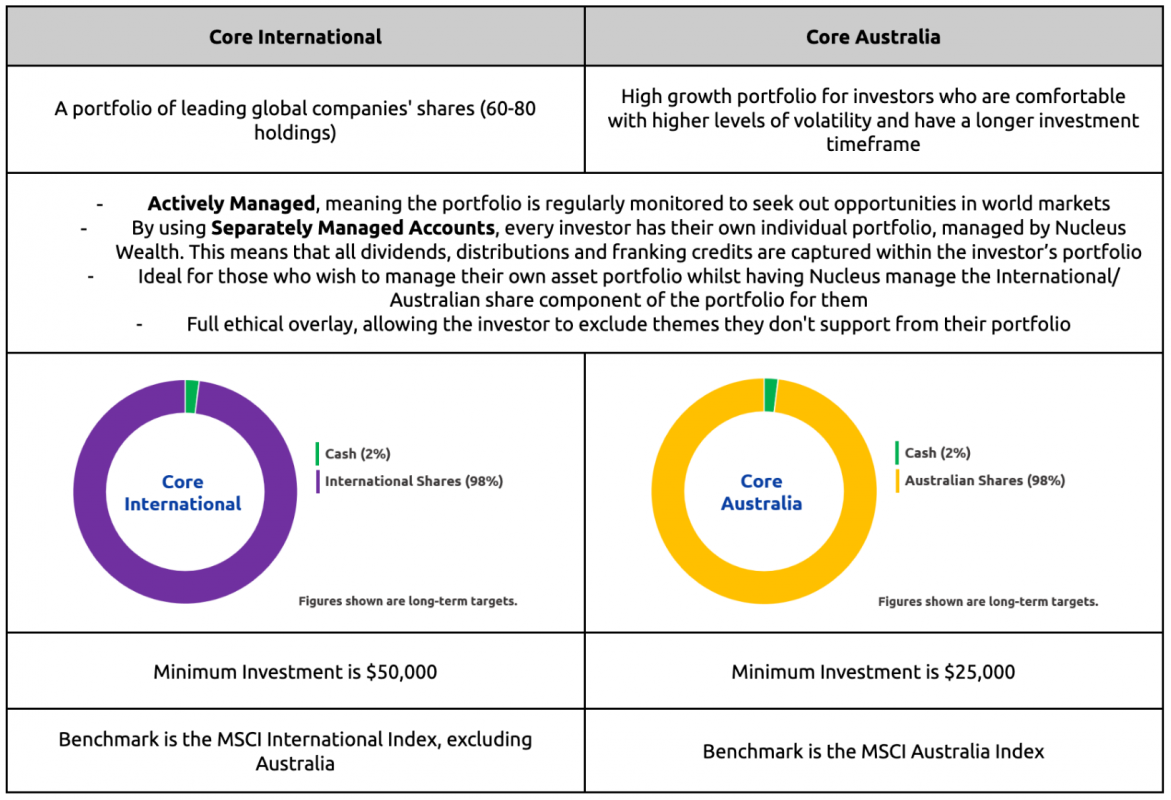

Core International – $50,000

Core Australia – $25,000

Passive Portfolios

Global Leaders – $50,000

Australian Leaders – $15,000

Government Bond Ladder – $20,000

Note that all of these minimums are a guide to the investment required to get adequate diversification. Nucleus Wealth will accept lower balances on request.

The minimum account funding is not set in stone, but is more so indicative of the level of funding required to have access to the number of securities included in the target portfolio.

Nucleus Wealth is able to fund accounts with less, however it might mean you might miss out on certain stocks and bonds, making the performance of the given portfolio slightly different to the target portfolio.

Nucleus Wealth uses a third-party platform called GreenID, which cross-checks your data against several databases including the electoral roll. This is in compliance with the Anti-Money Laundering (AML) Laws.

No.

Cash held on your behalf by Praemium is held in an omnibus account and thus not protect by the Financial Claims Scheme.

Nucleus Wealth has products that may suit your needs. We encourage you to have a phone conversation with one of our financial advisors to discuss this.

You don’t necessarily have to be an Australian citizen, but you do have to be an Australian resident for tax purposes. See if you qualify as an Australian resident for tax purposes here.

Your investment with Nucleus Wealth is under the most secure structure.

Nucleus Wealth provides investments through market-leading investment structures that keep our client’s assets as safe as can be. These structures are called Separately Managed Accounts (SMAs) and can be set up in a variety of account types: from Individual to Joint, to Trust and Super. These are managed by our platform administrator, Praemium.

One of the benefits of these account types is how secure they are. Your assets are held in your own name with major global custodians JPMorgan (international securities), HSBC (Australian securities), and ANZ (AUD Cash). Nucleus Wealth serves as the model manager, instructing Praemium to make trades and manage your portfolio for you. Nucleus Wealth does not have any access to the funds of your separately managed account, or the ability to instruct the movement of those funds anywhere other than your bank account.

Further information here.