Harness the power of Macrobusiness in your portfolio

David, Leith and the team at Macrobusiness have have partnered with the like-minded asset manager, Nucleus Wealth, to bring you the MB Fund. Both David and Leith sit on the investment team at Nucleus Wealth.

The MB Fund is run and operated by Nucleus Wealth.

The MB Fund encompasses over 50 years experience in global markets and provides the Macrobusiness readership with an exciting opportunity to convert the many themes of the blog into a competent and fully featured investment solution.

Investing Made Simple

Simple online tailoring process

Create and customise your portfolio within 10 minutes through our online onboarding portal

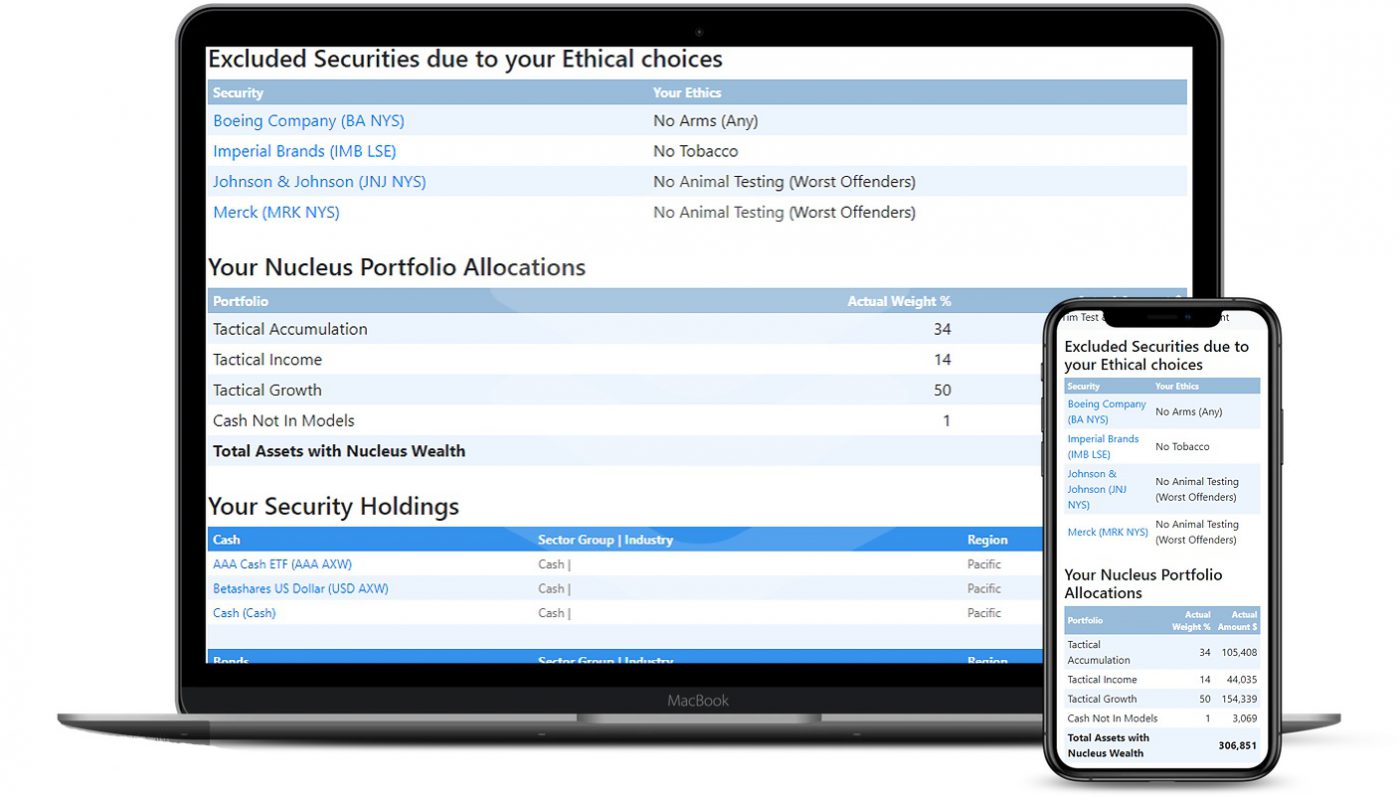

Built for transparency

At any time you can view your enitre portfolio in our portal, informing you of your asset weightings, which stocks you own and why

Change your account preferences anytime through the dashboard

Your portfolio of worldwide stocks, cash and bonds is generated. Deposit or withdraw anytime through a simple bank transfer

Trusted Third Party Protection

All client capital is held and maintained by our Managed Account providers, backed by the largest global banks.

Most investment funds are one-size-fits-all

You get the Henry Ford’s Model T experience: any colour you like, as long as it’s black.

Every investor gets the same fund.

Stockbrokers ask you to do it all

Go to a stockbroker and you get every car part in crates – but you must build the whole car yourself.

You get the flexibility, but also the responsibility of running a diversified, risk managed portfolio.

Nucleus gives you the best of both

Nucleus sits between the extremes. Factory-built and tested, safety options available, but you choose how and what to customise.

We help you choose the approach that suits your goals, risk tolerance, other investments and values.

1. Investment Approach

Match the market or aim to beat it?

- Direct Indexing – Customisable market exposure: Track the index with flexibility

- Active Investing – Seek higher returns or lower risk: Targeted stock selection

2. Asset Mix

What’s your preferred risk/return profile?

- 📈 Only Stocks – Higher long term return, more volatility

- 🔁 Stocks + Bonds – Balanced exposure, lower risk

3. Screens (Exclusions)

Remove sectors that you don’t want.

🚫 Tobacco | 🚫 Fossil Fuels | 🚫 Australian Housing | + over 70 other screens

4. Tilts (Add Themes)

Add exposure to sectors you believe in.

🤖 Artificial Intelligence | ⚡ Clean Energy | 🪙 Gold Stocks | + over 80 other tilts

Featured In:

Direct Indexing: Annual Fees

Nucleus can invest across a number of different platforms. Below we show the fees on our cheapest options. Trading fees start from just 0.099% of the value traded.

0.33%0.55%

-

Low trading costs

-

No ongoing fees on foreign currency

-

No ongoing fees on a range of ETFs

0.165%0.20%

-

Low trading costs

-

No ongoing fees on foreign currency

-

No ongoing fees on a range of ETFs

-

Currency hedging available

0.11%0.145%

-

Low trading costs

-

No ongoing fees on foreign currency

-

No ongoing fees on a range of ETFs

-

Discounted investment fees

-

Currency hedging available

Active Investment: Annual Fees

Nucleus can invest across a number of different platforms. Below we show the fees on our cheapest options. Trading fees start from just 0.099% of the value traded.

0.803%1.025%

-

Low trading costs

-

No ongoing fees on foreign currency

-

No ongoing fees on a range of ETFs

0.638%0.675%

-

Low trading costs

-

No ongoing fees on foreign currency

-

No ongoing fees on a range of ETFs

-

Currency hedging available

0.55%0.675%

-

Low trading costs

-

No ongoing fees on foreign currency

-

No ongoing fees on a range of ETFs

-

Discounted investment fees

-

Currency hedging available

How do our fees compare?

Getting to the bottom of investment fees can be difficult - for many companies intentionally so.

Many funds have multiple layers of fees and they may not be showing you all of the fees.

In the tables here we show the average and median fees for all Australian Superannuation funds as assessed by the Australian Prudential Regulation Authority.

In a broad sense:

- Nucleus Direct Indexing is one of the cheapest ways to invest either inside of super or outside of super.

- Nucleus Active and Tactical funds tend to be cheaper than the average fund

| Amount of Money Invested |

||||||

| $10,000 | $25,000 | $50,000 | $250,000 | $500,000 | $1m | |

| Data for all Australian Super Funds | ||||||

| - Average | 1.66% | 1.36% | 1.26% | 1.15% | N/A | N/A |

| - Median | 1.52% | 1.26% | 1.16% | 1.07% | N/A | N/A |

|

Nucleus Super on DASH*

|

|

|

|

|||

| - Direct Indexing | 0.60% | 0.60% | 0.60% | 0.60% | 0.60% | 0.44% |

| - Tactical or Active | 1.08% | 1.08% | 1.08% | 1.08% | 1.08% | 0.92% |

|

Nucleus Super on Praemium*

|

|

|

|

|||

| - Direct Indexing | N/A | N/A | N/A | 0.65% | 0.55% | 0.44% |

| - Tactical or Active | N/A | N/A | N/A | 1.20% | 1.03% | 0.92% |

|

Nucleus on Interactive Brokers (SMSF or Non-Super)

|

|

|

|

|||

| - Direct Indexing | 0.33% | 0.33% | 0.33% | 0.33% | 0.33% | 0.25% |

| - Tactical or Active | 0.80% | 0.80% | 0.80% | 0.80% | 0.80% | 0.72% |

Source: Australian Prudential Regulation Authority (APRA) Heatmaps

* Nucleus calculations assuming a 40% weight to international stocks

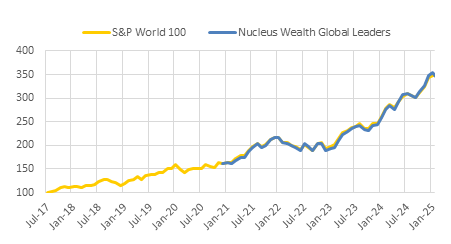

Performance: Growth Portfolios

Global Direct Index

| Period | Return |

|---|---|

| 1y | 10.2% |

| 3y | 15.1% p.a. |

| Incept. | 16.5% p.a. |

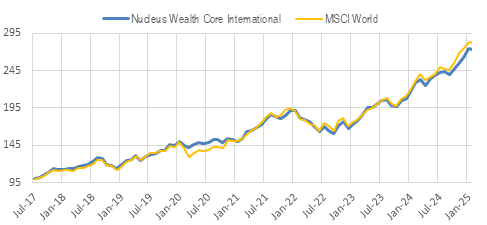

Core International

| Period | Return |

|---|---|

| 1y | 11.2% |

| 5y | 12.4% p.a. |

| Incept. | 12.9% p.a. |

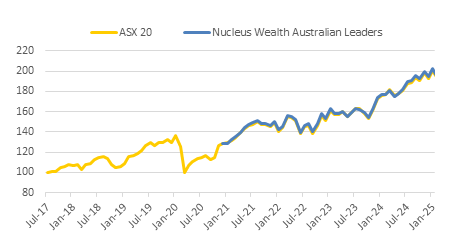

Australian Direct Index

| Period | Return |

|---|---|

| 1y | 3% |

| 3y | 6.1% p.a. |

| Incept. | 9.2% p.a. |

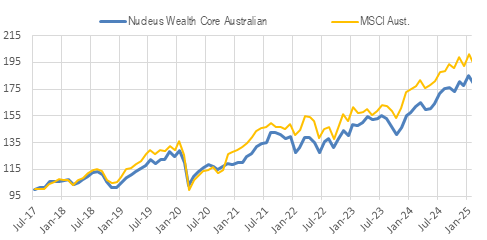

Core Australia

| Period | Return |

|---|---|

| 1y | 6.6% |

| 5y | 11.3% p.a. |

| Incept. | 7.6% p.a. |

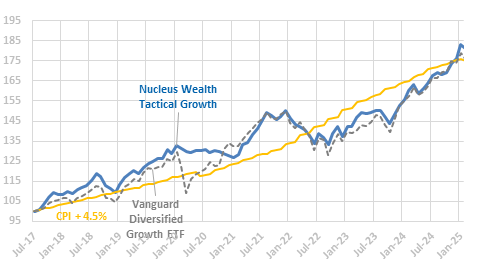

Tactical Growth

| Period | Return |

|---|---|

| 1y | 7.5% |

| 5y | 6.1% p.a. |

| Incept. | 7.5% p.a. |

Multi-award winning portfolios

Nucleus Direct Indexing is leading the way in personalized investment solutions, offering direct ownership of global and Australian shares for tailored portfolios.