International stock markets ripped higher in August and both the Australian dollar and bond yields fell, completing a trifecta of investment themes that we have been positioned for. With this backdrop all of our portfolios performed strongly:

Given our portfolio tilt toward Quality stocks, our portfolios once again performed strongly over the month of August. Our International fund was up 4.5%, Australia up 0.6% and the tactical funds up between 0.9% and 2.7%.

The international performance was boosted by the Australian dollar devaluation tailwind (USD up 0.6%) and our underweight position in Emerging markets.

Global bond yields fell in August on emerging market fears, with US 10-year yields declining 0.12% to 2.85%. Australian 10 year yields fell more than US yields, ending the month at 2.52%, the equal lowest since December 2017 – benefitting our bond positions.

With so many of our portfolio positions being rewarded both this month and last month, we have begun to make some portfolio changes to reposition for the next wave.

Trade

August also saw tariffs imposed on Turkey by the US, sparking a sell-off in Emerging Markets globally. On a day to day basis, there has been considerable volatility in stocks as news lurched between negative (worsening news from China / US trade talks) and positive (progress in Europe / US and Mexico / US trade talks).

Our expectation (acknowledging the outcome is very uncertain) is China and the US will not reach a quick agreement and China will resort to further debt-driven investment spending to ensure that its economy is not overly affected. This has a number of implications for our stock holdings.

Earnings

August saw the winding down of the US and European reporting seasons and the start of a month-long period of Australian company reports. The US reporting season was good, with forward earnings continuing to rise – this is where our portfolio is most exposed. European earnings were less positive, and Australian earnings are weak.

On the whole the global reporting seasons saw earnings expectations exceeded by most companies, however, there were a few disappointments on the updated outlooks and guidance. In the US, with the notable exception of Facebook, most Technology companies delivered impressive results (the NASDAQ was the best performing US index) while Value companies were also rewarded when they showed evidence that any margin compression was contained. European results were more subdued with contagion concerns from Turkey seeing indices there retrace. Locally it was more of a similar story to the US, with the high P/E multiple stocks outperforming their Value peers ( with the notable exception of the Telecom sector where we saw industry consolidation via a merger).

Looking in more detail at the domestic reporting results, more than half of companies saw upward revisions to cost estimates, though they still remain relatively benign from a historical context. The few pockets of cost pressure came from higher raw materials prices and higher US labour costs. Dividends were on the rise with upward surprises from cash-flow rich resource companies and a number of Industrials. Higher growth expectations in company outlooks were amply rewarded with the Technology and Health stocks the stellar performers over the month.

In Australia, Scott Morrison became the 30th Prime Minister of Australia replacing Malcolm Turnbull, after an impasse on the government’s energy policy. With a weakening housing market, Australia is hoping that a pick up in capital expenditure will rescue growth – and so political uncertainty will not help.

Investment Outlook

We continue to believe Investment markets are late in the cycle, the issue remains that no one knows how late. Here is a summary of what we saw over August and how it is affecting our thinking :

- Europe: Growth continues to weaken, with business confidence down as anxiety over the US-China trade war grows. The question remains if the slowdown in the first six months of the year is a pullback from high rates of growth last year, or a sign of a looming downturn. We have largely been targeting European multi-nationals with global revenue streams as a shield from a weakening domestic economy.

- China: Chinese factories posted their weakest expansion in 14 months in August, due to the fifth drop in exports in a row; new export orders – an indicator of future activity – have contracted for the longest stretch since the first half of 2016. While Policymakers are accelerating approvals for infrastructure projects, reducing business costs and stimulating via the financial sector, the question remains whether this will put a floor under the cooling economy. We expect significant government support and increased lending to be a feature of the next twelve months in China.

- US: The reporting season showed the US economy continues to power ahead, however, the trifecta of increases in the first half—the dollar, interest rates, and crude oil may ultimately mute this growth. At the moment of all the markets, the US remains the most attractive though we have been cycling into more defensive exposures of late.

- Emerging Markets: As US rates rise, investor fears over idiosyncratic risks in emerging markets have climbed, including Argentina’s fiscal woes, Turkey’s twin deficits, Brazil’s contentious elections and South Africa’s land-reform bill. We have avoided emerging markets and few of our companies have direct exposure. We currently don’t hold any of the European banks with direct exposure to Turkish Loans.

Tactical Asset Allocation Portfolio Positioning

In our tactical portfolios, we own cash, bonds, international shares and Australian shares. We tend to blend these portfolios for clients so that each investor receives an exposure tailored to their own risk and income requirements.

The broad sweep of our asset allocation over the last 18 months was to ride the Trump Boom, switch into Europe in March / April last year as the US became overvalued and then switch back into the US as the Euro rallied and the USD fell.

We have been using rallies in stock markets to reduce our holdings.

We remain underweight shares in aggregate, overweight international shares and significantly underweight Australian shares. Given the strong performance of our portfolios in recent months, we are currently reweighting.

Tactical Foundation Portfolio

Our tactical foundation portfolio is designed for investors with lower balances, it uses exchange-traded funds for its international exposure rather than direct shares. The reason for this is parcel sizes, you can’t buy half a Google (Alphabet) share directly and so we use exchange-traded funds which buy baskets of stocks instead. The tactical foundation portfolio is a balanced fund, not as aggressive in its holdings as the growth fund nor as conservative as our income fund.

In August this fund increased by 2.0%. The fund continues to be underweight Australian stocks.

Equities

We continue to have a considerable tech / IT exposure that has produced handsome rewards this month. The portfolio was largely unchanged as we monitored the second quarter results, although in early September we have been trading a number of stocks where the quality has been declining or are looking expensive. We are beginning to see to see some investor rotation into the unloved Value stocks that we have targeted and whose performance has languished this year.

Domestically, with the increased demand for Quality stocks stretching valuations. We have booked some profits in Treasury Wines, CSL and Cochlear and increased our exposure to the Commodity sector, accumulating some Rio Tinto following its share price weakness post result and the growing likelihood of further Chinese stimulus.

Performance to date

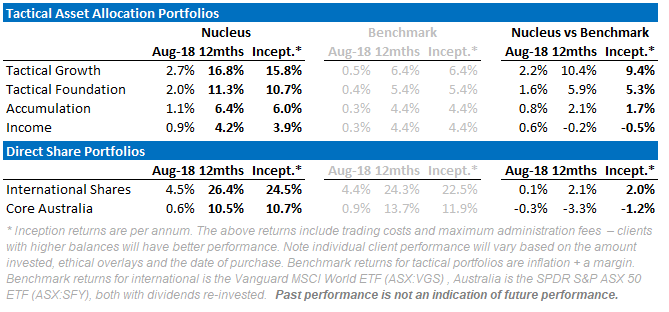

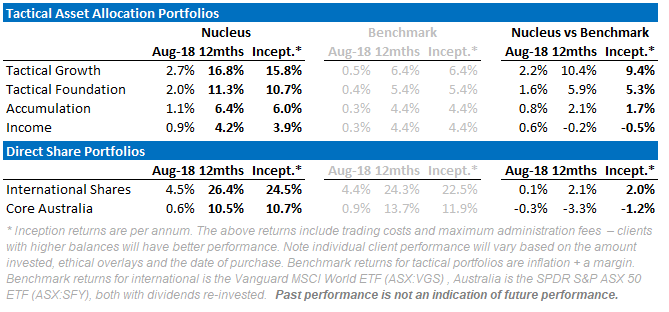

Portfolio performance can be cut a number of different ways. At its most basic level, you should care about the total return. At the next level, you should care about the total return relative to some sort of benchmark.

As you dig deeper, you should also be interested how the return was achieved – for example if your fund manager is taking lots of risk but only performing slightly better than the market then you should be concerned. Similarly, if you can get market returns but at a much lower risk then that may be an appropriate trade-off.

Our portfolios to date have been taking less risk and in most cases out-performing benchmarks. The disclaimer is that they have only been running for 13 months, and that is not enough time to make definitive judgements.

We manage our portfolios for investors through separately managed accounts, which have a host of benefits including transparency, individual tax treatment, direct ownership, customisations (including ethical overlays) and low trade costs.

However, because separately managed accounts are either subtly different (due to slightly different stock weights) or explicitly different (due to ethical screening) for every customer, there is not one performance figure that we can quote.

The table below shows performance for a client paying the maximum administration fee. We have not added in any benefit for franking credits or for withholding tax credits.

Epilogue

In summary, our view continues to be that Australian investors are better off holding international investments at this point in the cycle.

We retain relatively large cash balances to hedge against volatility and to look for a cheaper entry point. If markets continue to be weak then we will look to buy more equities. We are concerned about the potential for trade wars or an emerging markets crisis. These will be a key focus for us over the next few months.

Our intention is that our portfolio is positioned to take advantage of our key themes but minimise risk in the event that our themes take longer than expected to resolve themselves.

July and August have been a lesson for investors in positioning. The big picture macro themes that drove performance over the two months have been in place for a considerable period of time, but the price movements occurred over a very short period. The issue now is positioning your portfolio for the next move.

Damien Klassen is Head of Investments at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Integrity Private Wealth Pty Ltd, AFSL 436298.