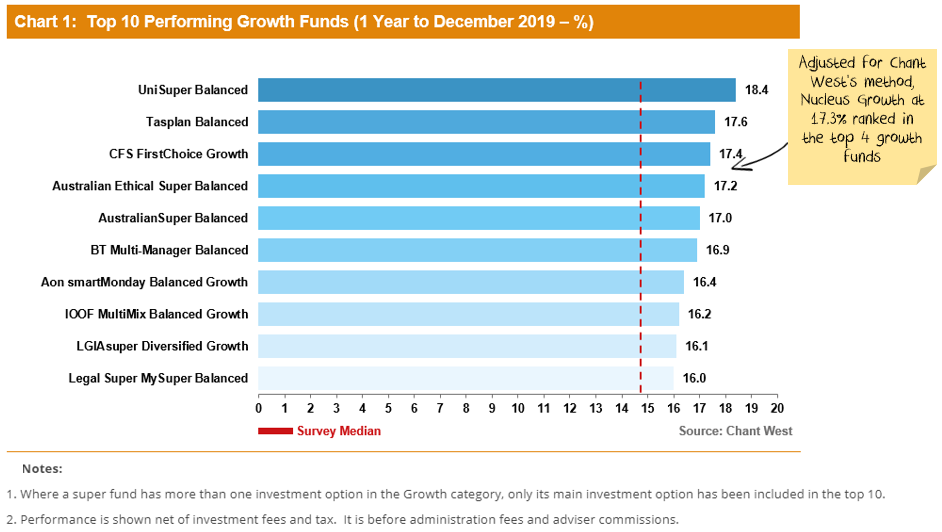

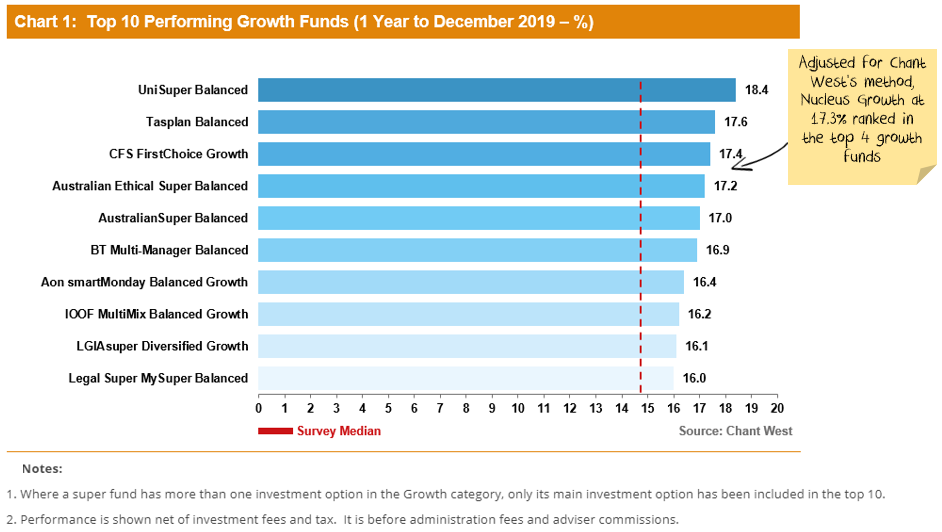

2019 was a banner year for investment returns. Our own funds performed well throughout the year, highlighted by our growth fund up 17.8%*. This puts it in the top 4 growth superannuation funds according to researcher Chant West:

Other Nucleus funds also had significant gains, our International direct share portfolio led with 27.2% returns over the year, our tactical funds ranged between 8.1% for our most conservative Income portfolio to 17.8% for our Growth portfolio.

ASIC requires fund managers to disclaim that past performance is not an indication of future performance. That is especially true of 2019. Returns were in particular juiced by the steep falls in share markets that we saw late in 2018 that meant 2019 started from a low base.

The returns over 2019 highlight the issue of remaining too conservatively positioned and not investing tactically. Anyone huddling in cash following the bloodbath in share markets at the end of 2018 missed the upside of being more active with asset allocation.

We are expecting this to be a feature of markets going forward. With very low-interest rates and low expected returns, investors will need to be more nimble to extract investment returns.

Despite the good result over 12 months, December was not a strong month for our portfolios. However, the rocket under share market returns in January has reversed any losses in December. See the performance section at the bottom of this post for full details.

2019 self-assessment

We put our success during 2019 down to a number of key factors:

- keeping enough exposure to equities (despite our cautious outlook) to not fall too far behind rocketing share markets

- tactically very high exposure to long-dated bonds at the start of 2019, taking advantage of falling bond yields

- keeping significant international shares, which outperformed Australian shares

- avoiding issues in Hong Kong

What could we have done better?

- We pulled back our equity holdings mid-year, too early given the rapid rise we have seen since

- We rotated at the same time away from cyclical stocks (which tend to both rise and fall faster) to more defensive names. Not doing this would have led to further outperformance

- We could have been more active in trading our bond positions. While we had the overall move right, we have been overly cautious in trading these positions.

2019 lesson 1: Up is usually the case

In many facets of life, a more cautious approach is the responsible option.

However, the natural tendency is for stock markets to rise more quickly over time than cash or bonds. Being too cautious in investing is a recipe for underperformance. Particularly for superannuation.

Yes, there are a lot of things that can go wrong with the stock market and the economy. But there is always something that could go wrong.

The hurdle needs to be higher for a negative outlook than for a positive one.

2019 lesson 2: Trump wants to be re-elected

Trump’s best quality is that he is not ideologically wedded to many things. I won’t go into his worst qualities. This means he is capable of changing his mind when the facts change. Or when his favourite opinion poll, the stock market, falls.

Trump genuinely wants to support the economy fiscally and has no fear of deficits.

In our assessment, this is the right strategy as monetary policy has been exhausted. While tax cuts to the richest are one of the least effective ways to stimulate fiscally, Trump’s willingness to do so has been relatively unique in the developed world.

Our view continues to be that the trade deal was little more than an agreement to:

- make an actual deal sometime in the future.

- stop escalating tariffs until after the US election.

- keep buying goods from each other in the meantime.

All of the core issues remain unresolved. But it seemed as if any time stocks fell there was an announcement about the imminent trade deal.

2019 lesson 3: Kick the can

The motto of the political class ever since the crisis seems to be:

Why delay doing something until tomorrow when we can probably wait until the day after.

Whatever the problem, if there is a short term gain for long term pain, current politicians will take that option.

For investment markets, it meant more of the same.Goldilocks economic growth. Low enough to keep inflation down, not so high that central banks stop quantitative easing. Which means ever-lower interest rates. And financial assets keep increasing in value.

Which means ever-increasing inequality, which keeps wages low and profits high.

A 2020 re-run?

A repeat of most of these themes in 2020 is not impossible. It is where we have been for close to a decade.

The main problem I have is with valuations. Under the same conditions with stock markets 25% cheaper, I would be buying stocks.

The problem is the confluence of uncertainty with a reliance on political outcomes and little margin of safety in stock market valuations. The combination is enough to keep us wary. For the moment.

Another argument is that there is no alternative. Stocks are expensive, but so is everything else. This is partly true. Bonds are expensive, but cash is always fair value. We are also of the view that Australian bonds have room to become more expensive.

During December, we moved our asset allocation around a little. We have topped up on 5-year bonds as rising bond yields conflicted with our negative view on the Australian economy. We also added some more UK exposure and continue to shift our stock selection into stocks that we believe will benefit in the medium term from companies moving supply chains away from China.

Longer-term, stagnant growth is going to be on the menu until we see governments spending money. And probably “helicopter” money. Given the current state of economics, that will probably take a sizeable economic crisis. Until then, we expect more of the same – slow growth and a grind lower.

December Performance

We are comfortable with the view that the defensive position is warranted. If markets shoot higher, then we will underperform, but we think the trade-off is justified. Downside protection is more important at this point in the cycle than chasing stock markets higher.

Tactical Asset Allocation Portfolio Positioning

In our tactical portfolios, we own cash, bonds, international shares and Australian shares. We tend to blend these portfolios for clients so that each investor receives an exposure tailored to their own risk and income requirements.

Over / Underweight positions by portfolio

Source: Nucleus Wealth

The broad sweep of our asset allocation over the last 18 months was to ride the Trump Boom, winding back on equities as share markets advanced and topping up when they fell but maintaining an underweight position in shares. Now, it is about an appropriate level of protection as the current business cycle draws to a close.

We have positioned our portfolios to be about market weight international shares, significantly underweight Australian shares, overweight bonds and overweight cash.

Investment Outlook

Australian shares are still considerably more expensive than most international comparisons with weaker growth expected. We retain large cash and bond balances to hedge against volatility and with the expectation capital protection will be necessary for the next few months.

Our key focus is on:

- Chinese growth, gauging the extent of the slow down and the policy response to the trade war

- Trying to work out how sustainable the effect of the Australian election will be on house prices, and how damaging the bushfires will be to the Australian economy

- Gauging the damage that a Boris Johnson led Brexit might cause

* Nucleus performance data is expressed after investment fees but before administration costs. Administration costs vary by portfolio balance and whether the account is a superannuation account or not. Past performance is not an indication of future performance.