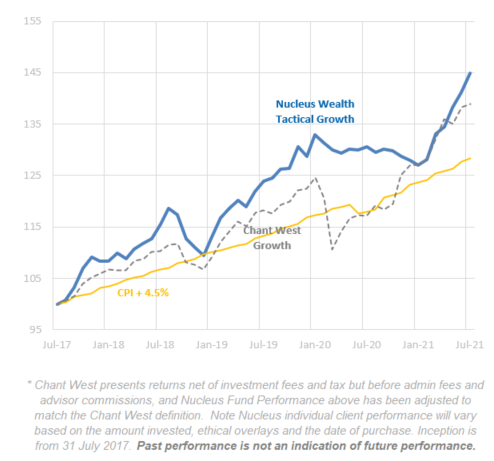

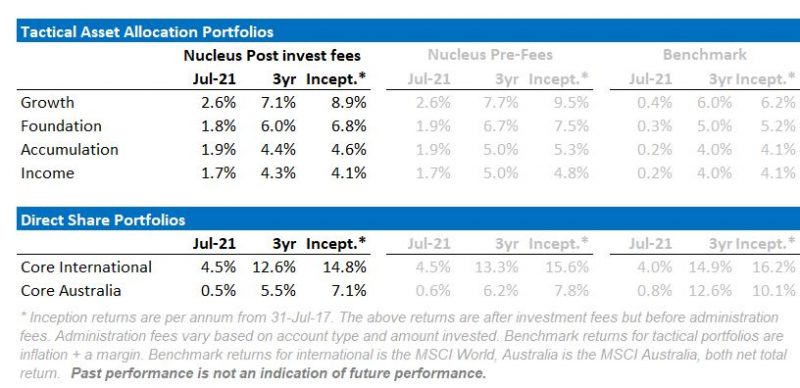

July was another strong month for the stock market. Our tactical portfolios performed well, up between 1.7% and 2.6% over the month. And August has been more of the same. We have been selling Australian stocks into the rallies, believing there will be a slow down in the next few months led by China. International equities provide some protection from this. We expect the Aussie dollar to continue to fall. This will hedge the downside under the worst scenarios while still providing some upside in the better ones.

In a market distorted by various authorities, the problem is that if both central banks and governments revert to stimulus, then the market will probably go higher. Our view is that governments won’t act quickly this time. See below for our thoughts on China. The US central bank has been talking tapering, so it needs to reverse course. Which is probably going to take time.

Net effect: caution is the byword. But we are watching for signs that the delta outbreak will give enough cover for governments and central banks to resume stimulus.

COVID-19

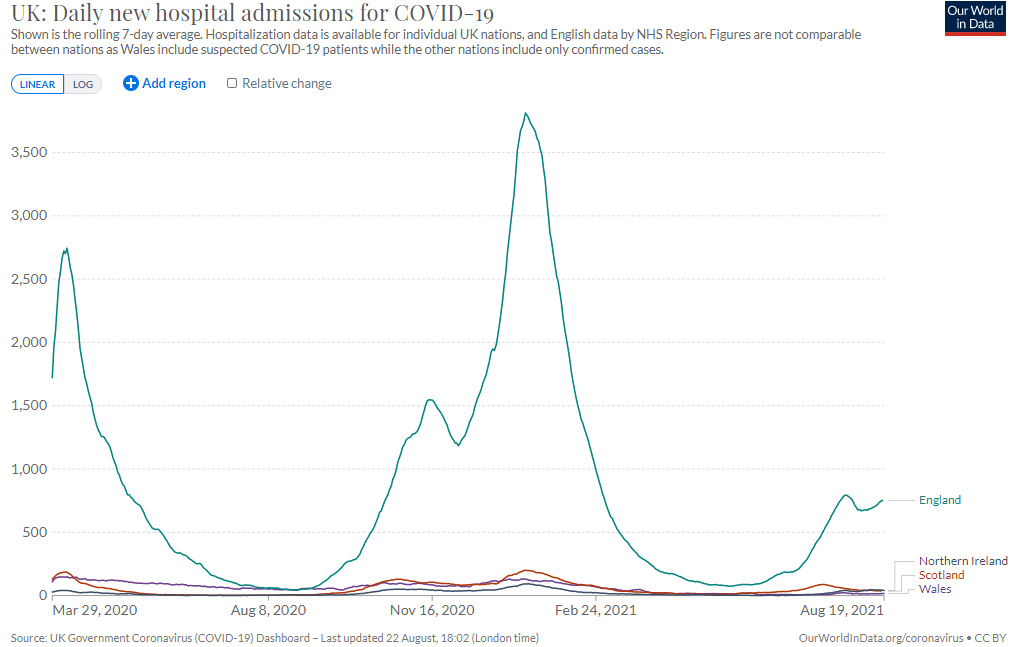

There are two main countries to watch. The UK is the primary test case. What happens when a (mostly) vaccinated population opens up without regard to the virus. Case counts are up. Hospitalisations are up but nowhere near prior levels. Vaccinated people appear well protected from the most negative outcomes. I’m optimistic, but the results are inconclusive so far.

The US is also a fascinating experiment in which levels of vaccination matter. Effectively there is a giant experiment with 50 states having varying lockdown rules, vaccination levels and economic support. Vaccination levels are lower than in the UK, and both cases and hospitalisations are increasing.

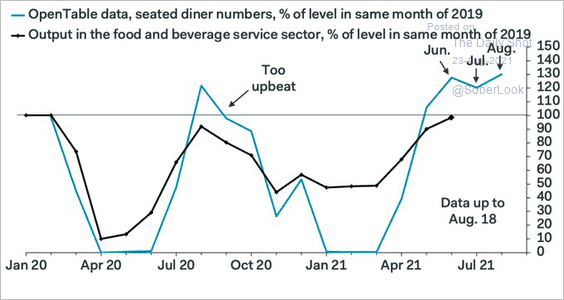

The most interesting factor is going to be the effect on consumption. At some stage, countries will treat the COVID as endemic and return to more normal consumption patterns. For now, it looks as though the US might already be there:

But this can change.

Asset allocation

Stock markets are expensive. Debt levels are extremely high. But earnings growth is strong. Really strong. And government/central bank support continues.

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might reverse its tightening on property sectors. Biden may get through additional stimulus, driving increases to minimum wages.

Last month we spoke about moving towards our aspirational portfolio. A barbell portfolio with long-dated bonds, defensive equities and growth equities would be a good option. Underweight banks, resources, cyclical equities. Overweight international stocks. With growth concerns rising, we switched more quickly into this portfolio than we had anticipated and are now considerably underweight Australian stocks:

Australian equities have been a good source of investment performance in recent months. We switched out of them and into international equities and cash. So far, the timing has been good. We have largely built the defensive side of the portfolio up, changing out of value winners like resources, banks and cyclical industrials.

Inflation Update

We covered inflation in a lot of detail in our four-part series earlier this year. So far, the inflation cycle is playing out largely as foreshadowed. In particular, the inventory supercycle.

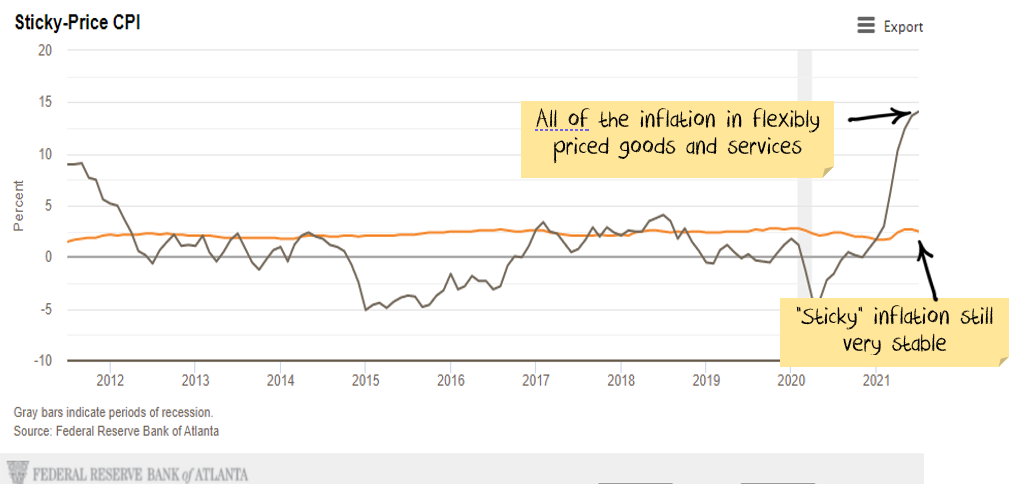

Inflation is still elevated, but the categories are not the types of categories where entrenched inflation shows up:

Commodity inflation is peaking

Many commodities are showing signs that the inventory supercycle has finished. Lumber, iron ore, copper, oil, all have rolled over in recent weeks.

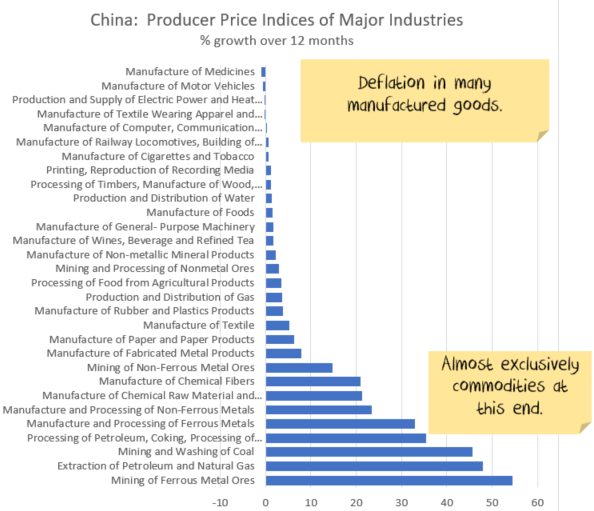

In China, consumer price inflation is subdued at 1%. Producer price inflation is booming, up 9% leading some to suggest China will be exporting inflation soon. Bollocks. The components of PPI are extraordinary. 30-50% increases in commodity industries, lowflation and deflation elsewhere:

This means commodity prices, which are now falling, are going to start detracting from inflation.

Where might we be wrong?

If we are wrong, then wage growth will be where inflation shows up.

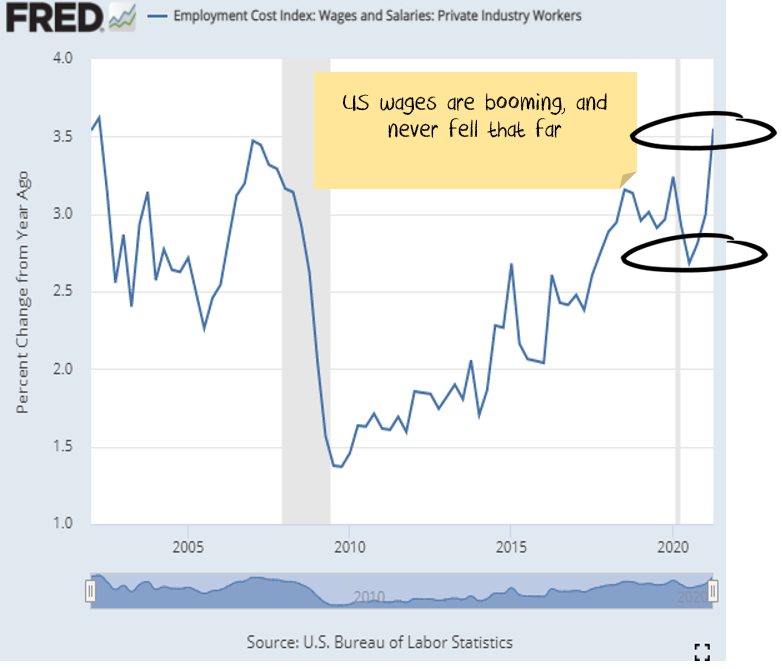

Internationally, wage growth is starting to show. UK wage growth is back to pre-pandemic levels. US wage growth as well:

The difficulty unentangling temporary vs structural issues

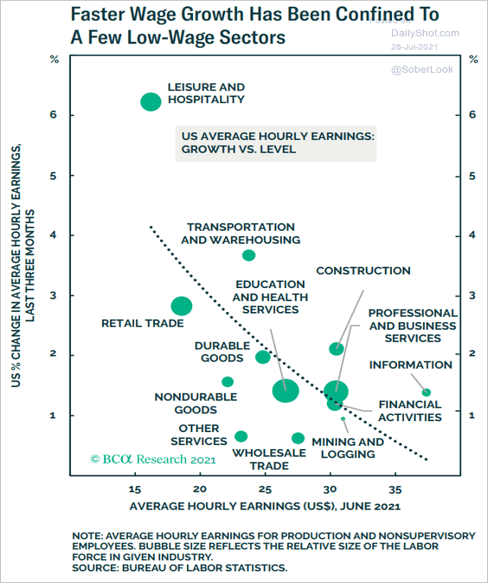

The interesting factor is that wage growth is very high in low paid roles that were disrupted the most by the pandemic:

Is it possible that employees in these roles are demanding higher wages to cater for the uncertainty? More consistent work with a lower risk of being sent home with no pay, or the opportunity to work from home, suddenly looks more attractive.

The problem is untangling structural changes from temporary ones. If there is a one-off shift upwards to cater for the uncertainty, then inflation won’t ensue. And potentially, wage growth will drift lower as the next generation of youths without the memory of losing work at a moments notice enters the workforce.

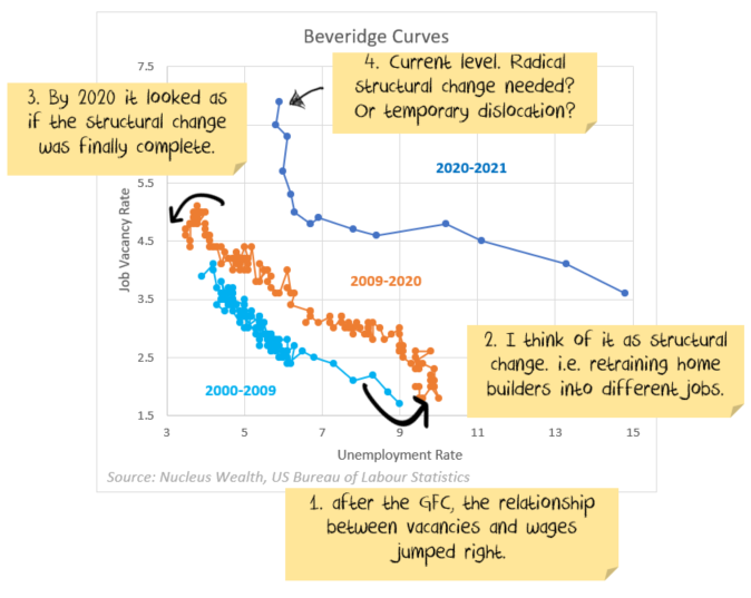

Job ads vs unemployment indicate a structural change

There has clearly been a structural change in the workforce. One way to see this effect is to look at the number of job ads vs the unemployment rate. The financial crisis saw the relationship take a big step up and to the right:

There has clearly been an even larger structural change due to COVID. However, some of that change is likely temporary. Hostesses, waiters, tourism are all likely to need to hire back staff at some stage. The manufacturing sector boomed, with consumers diverting the money they would have spent on services to goods. But this is reversing now.

My expectation is that there will be structural changes. There will be sectors that will never return to pre-pandemic levels. But most of the differences are temporary.

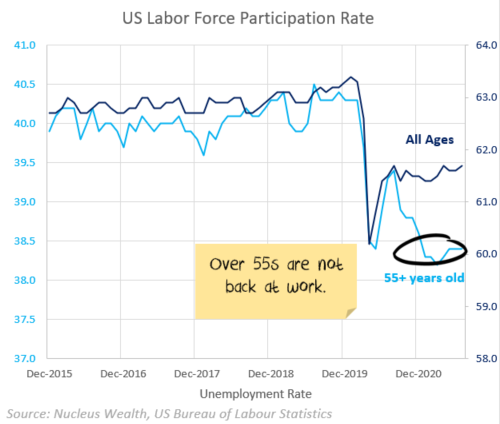

Are older workers gone for good?

Another factor is the loss of older workers. Most recessions see these workers leave the workforce and never return. The pandemic so far is showing the same trend, with the participation rate for over 55s down significantly:

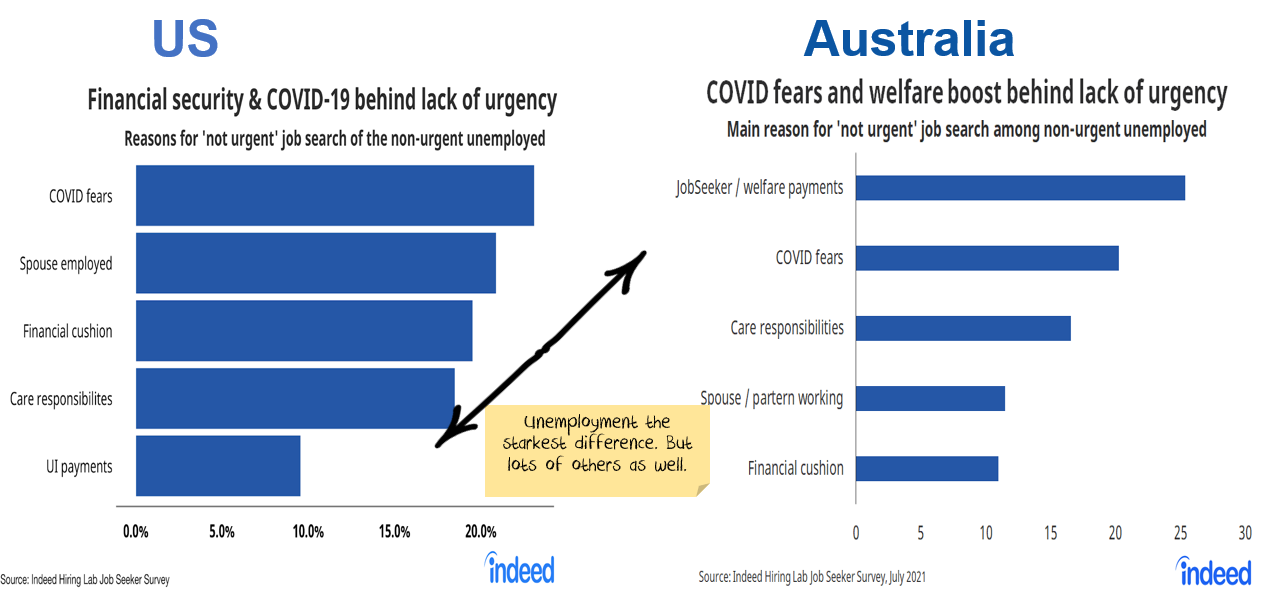

What are the other reasons for not working?

There are some surprisingly large differences between Australia and the US over the reason for not working:

However, it is also clear that there is no single reason which will drive participation up.

Other factors affecting wage growth in Australia

- Cognitive dissonance on behalf of Australian governments. Public sector wages recently hit a record low. Governments are the nation’s largest employers – higher/lower wages will affect the rest of the market.

- While wage growth expectations have increased now from economists and unions, households are still expecting record low wage increases.

- Work from home opens up companies to employing people in lower-cost regions. Including international. Basically, it flattens the supply curve for workers (in some industries), keeping wage growth low.

- After years of running massive levels of immigration, COVID has crashed immigration levels. This has led to short term rises in wages. Both major parties are expecting to re-introduce massive levels of immigration.

Net effect

There are signs of growth in wages. But there are a host of headwinds. We are still expecting inflation to moderate.

As I have said many times, and will no doubt continue to say:

We are not in a normal market. We are reliant on government and central bank support. So policy error remains the number one risk.

Performance Detail

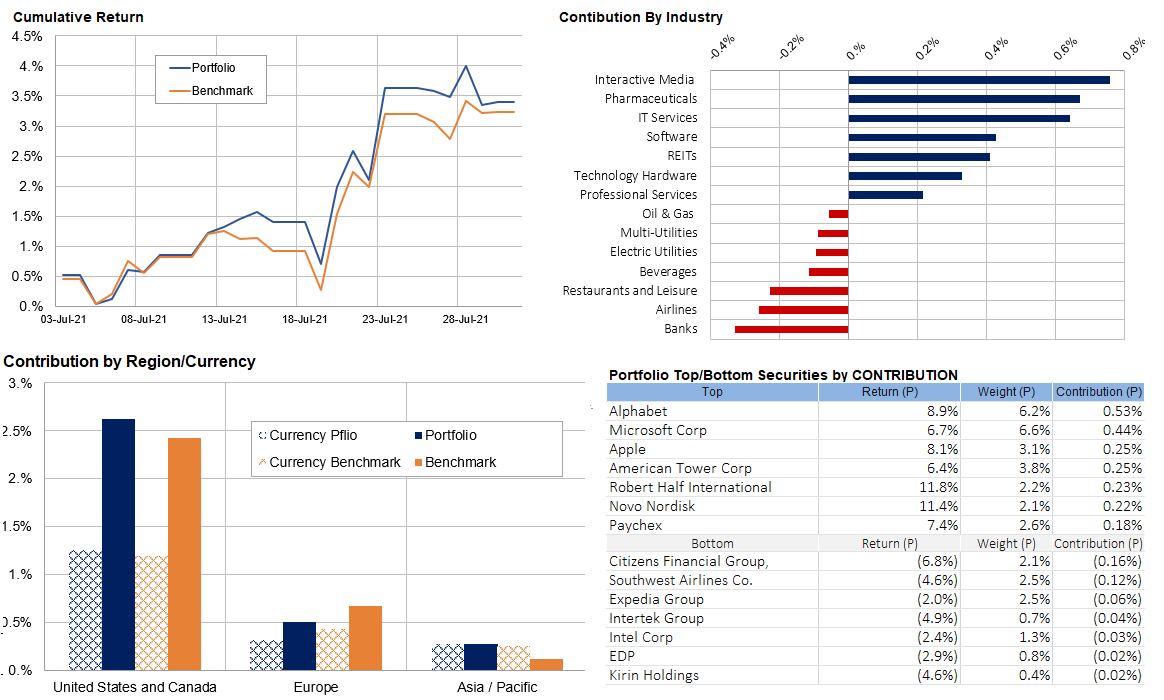

Core International Performance

During July the market switchback into Technology/Growth and especially the FAANGs gained pace which saw our Core International put on 4.5% over the month, beating its benchmark. A good month for pharmaceuticals assisted the outperformance. Banks and our travel exposures were the main detractors. Regionally the US remained the driver, European stocks underperformed while our Asia holdings had a good month.

Overall the currency effect assisted all the returns especially the weakening of the AUD vs the USD. In July we trimmed our Oil exposures.

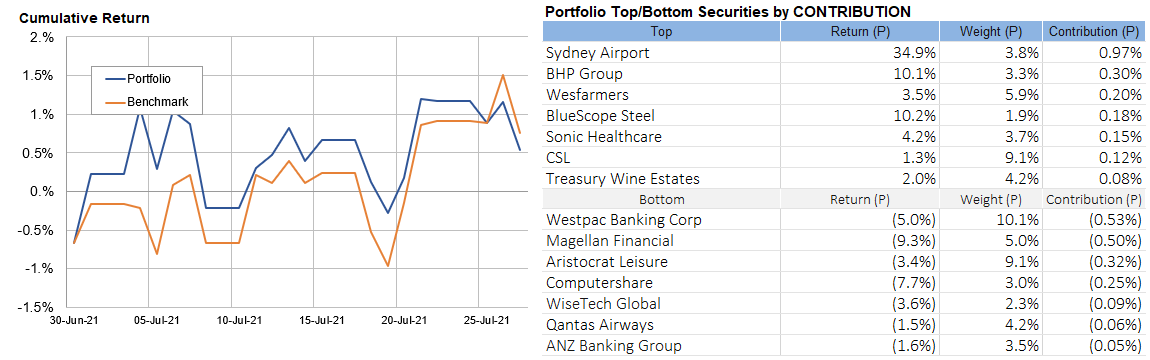

Core Australia Performance

The Core Australian portfolio underperformed the index in July. Travel stocks and Banks the key detractors. Over the month we reduced our Woodside Petroleum exposure.

Postscript: Client question

I’m a devotee of value-based investing and view the current market as high risk. With your tactical income fund what strategy have you in place to deal with a rising interest rate client i.e. bonds falling in value and the resulting share market volatility?

There are a few things to unpack with this question:

1. Value-based investing and the current market being high risk.

You get no arguments from me there. The problem is timing and government intervention. If you avoid equities, your key risk is earnings boom more than expected. By my numbers:

- the median stock P/E is about 15% above both its 10 and 25-year averages

- it more like 20% in the US and on a cashflow basis

- it gets worse the more expensive you go – i.e. the 25th percentile (expensive) of stocks is about 25% more expensive than average but the 75th (cheap) is only 5% more expensive than average. The 90th percentile is actually cheaper than average.

- could earnings be 15% better than expectations based on government support and pandemic-led productivity gains? Quite possibly. That would put valuations back to their 10/25 year averages.

The danger of being out of the market is that government support remains high, bond yields low, inequality remains high. There is a surplus of investment over consumption and so valuations bounce between being (say) 5% and 25% more expensive than in the past. If we are trapped in this scenario for the next decade, then markets might continue to grind higher and more conservative investors might never get a signal to invest.

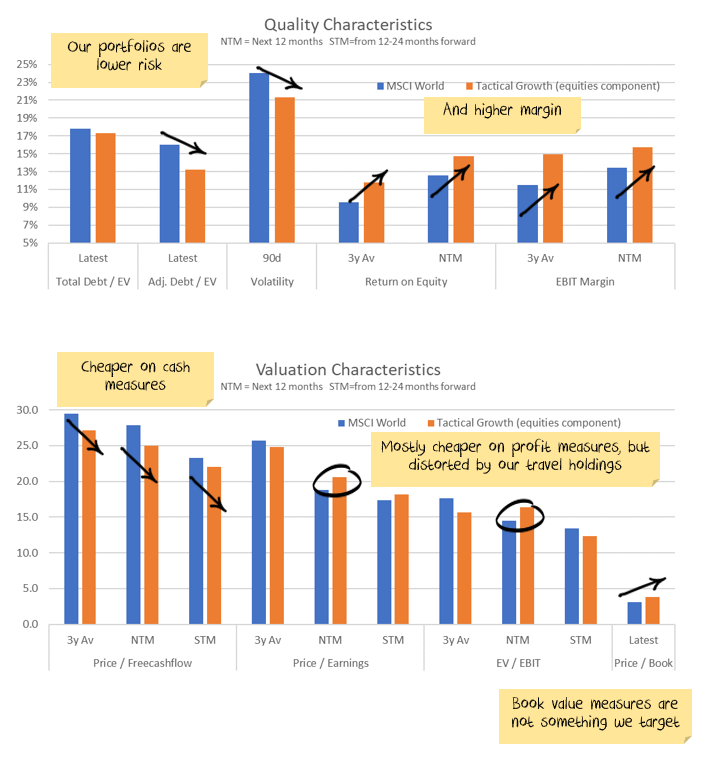

2. What have we done to mitigate risk

In our portfolios we are currently employing the following strategies to mitigate risk:

- We are underweight equities in general.

- We choose stocks based on a trade-off between value and quality – these stocks tend to outperform in market corrections.

- We have taken a barbell approach to stock selection within our portfolios: a mix of defensives for protection at one end of the barbell, combined with some quality growth stocks (i.e. profitable growth stocks) at the other. In this way, we still have some exposure to a rising market, while maintaining a defensive position.

- We are heavily overweight international stocks. The Australian dollar tends to work as a shock absorber, when markets undergo weakness the Australian dollar tends to fall, offsetting any stock losses.

- We are holding some cash in international currency for the same reason

- We are closely monitoring growth (particularly in China) and the reaction of central banks to determine if we need more protection.

3. How will our portfolios perform in a rising interest rate environment.

Not particularly well. We are looking for the opposite: inflation to fade, growth to weaken and interest rates to range trade for the next few years. See our inflation series for more.

The reason we are so transparent with our holdings and positioning is that we want you to be able to understand where you are exposed and to change your weights where you disagree with our outlook.

This means, as a client of ours you have four choices:

- Choose portfolios from our selection that match your view. We have a range of both passive (i.e. index funds) and active (where we control the weights) that you can choose from.

- Add in other stocks or funds to balance the overall holdings.

- Ask us for more information about our views, maybe we can convince you that we are appropriately positioned?

- Take your investment elsewhere and (hopefully!) come back to us when our views are more in line with yours. Obviously we would prefer you to invest with us. But we have designed the transparency and communication process to keep you informed so that you aren’t invested in a strategy that you disagree with.

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.