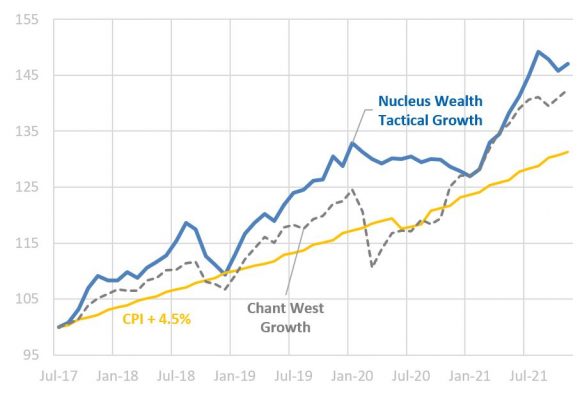

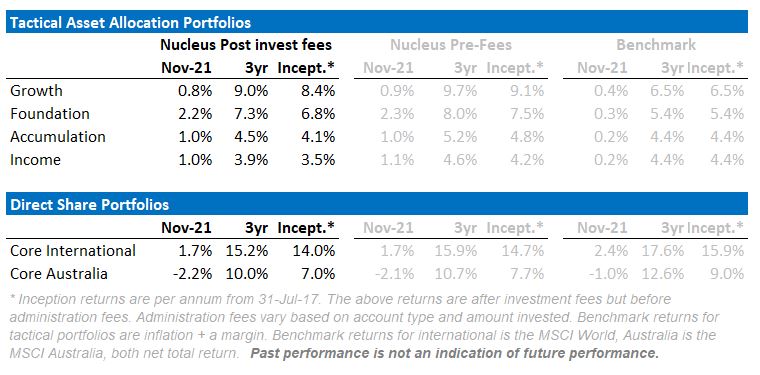

November saw a strong performance from all of our tactical portfolios, our growth portfolio rose 0.9% vs the median growth fund of 0.3%, and our Accumulation and Income portfolios rose 1% as bond markets recovered their losses from the prior months. Stock markets remained strong.

We expect international equities provide some protection from a growth slowdown. While the Aussie dollar is likely to rise if the energy crisis worsens, it is more likely to fall over the medium term. This will hedge the downside under the worst scenarios while still providing some upside in the better ones.

Sowing the seeds of another lost decade

This month, rather than the usual commentary we have a post from our economist Leith on sowing the seeds of another lost decade:

Sowing the seeds of another ‘lost decade’ for the Australian Economy

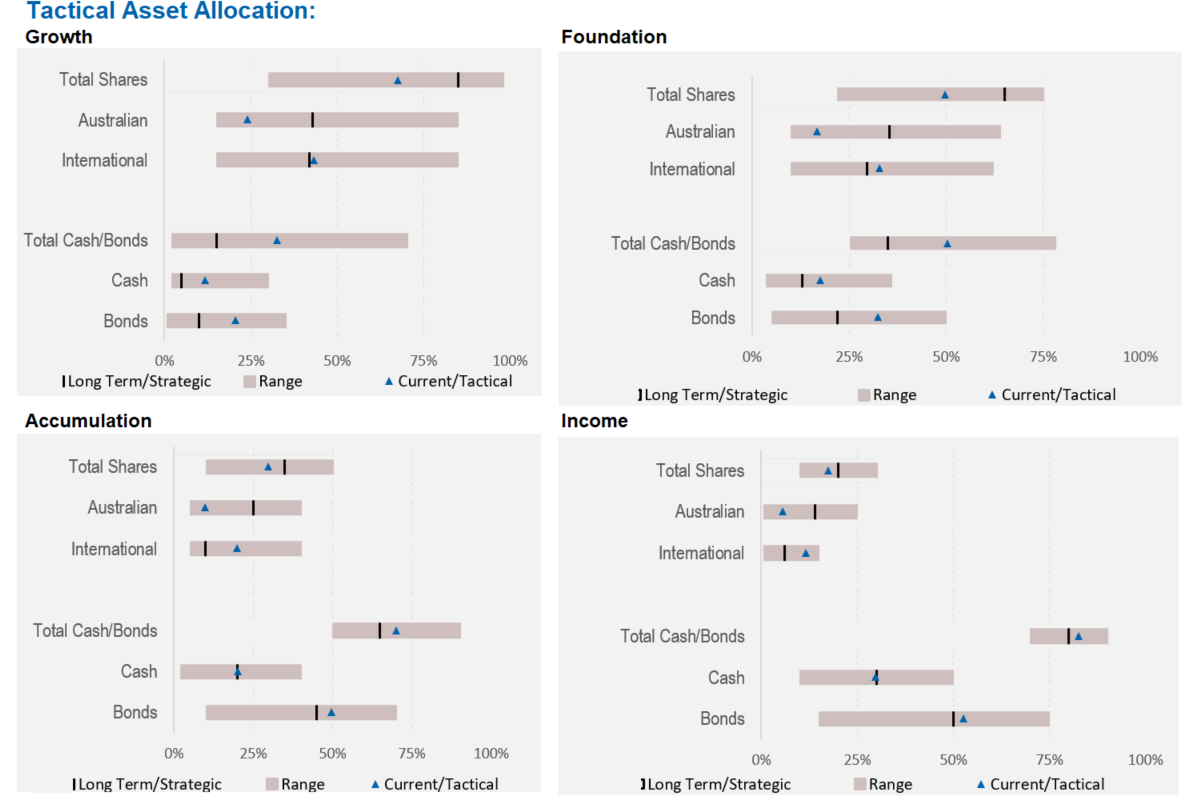

Asset allocation

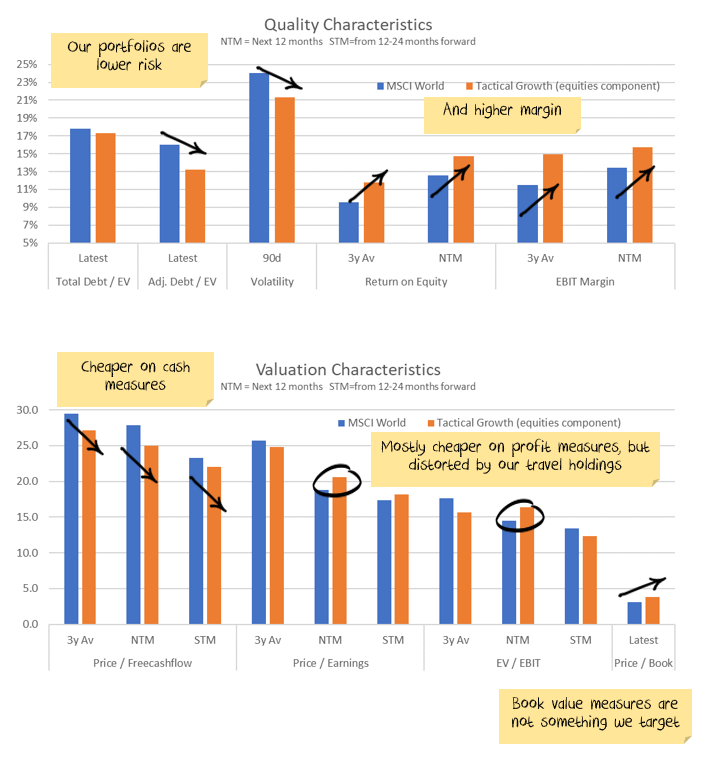

Stock markets are expensive. Debt levels are extremely high. Government/central bank support continues but is slowing. Earnings growth had been really strong but has come to a halt.

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might reverse its tightening on property sectors. Biden may get through additional stimulus, driving increases to minimum wages.

We are significantly underweight Australian shares, with the view that the Australian market will be the one most affected by a slowdown in China:

Australian equities have been a good source of investment performance in recent months. We switched out of them and into international equities and cash. For the last few months, the timing has been good. Not so during October where markets have shrugged off the China issues. We have largely built the defensive side of the portfolio up, changing out of value winners like resources, banks and cyclical industrials.

Performance Detail

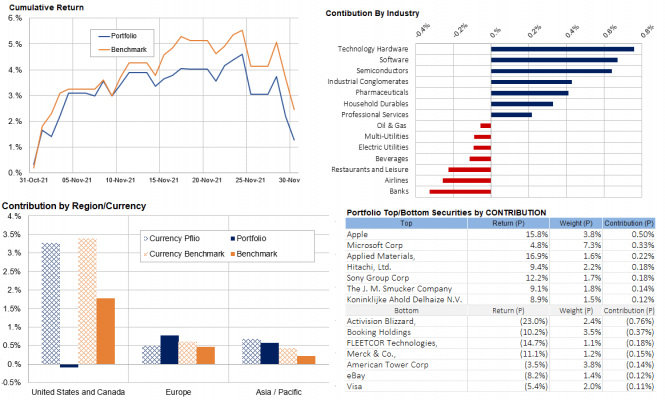

Core International Performance

November saw a strong rebound off the October lows that tapered off on Omicron worries at month-end. Over the month it was risk-on. Technology and pharmaceuticals continued their surge, but the prospect of a new variant meant financials and travel was sold off on the uncertainty. Regionally our US stocks were flat with this month’s performance-driven a strong contribution from Japan and Europe.

Currency tailwinds helped the portfolio as the AUD was sold off on risk worries. Over the month we reviewed our holdings, replaced some underperformers and included some companies leveraged to robotic manufacturing ( ABB, Schneider Electric), we also took profits on our October Energy position.

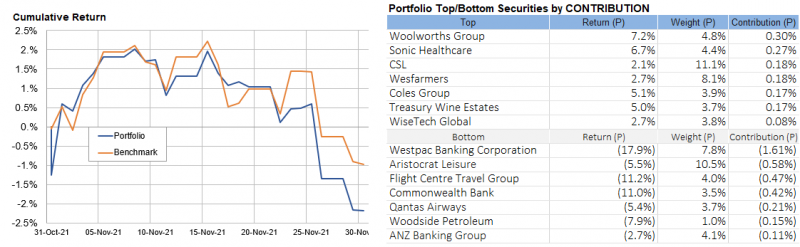

Core Australia Performance

The Core Australian portfolio tracked the index then underperformed toward the end of the month due largely to our Travel sector overweight in the light of the Omicron worries. In November we reduced our BHP and Woodside Petroleum exposures.

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.