Stock markets boomed again in November. Australian stocks were up 7%, International stocks also boomed, but were held down by a higher Australian dollar. Bond markets rose. Mostly, performance was a reaction to slightly better inflation, perceived changes in tone from central banks and a shift in China toward opening up.

We spoke last month about China’s shift, and that there are two ways to read the string of announcements:

- China is starting down the “whatever it takes” path. The current policies may not be enough, but they are a sign that China will keep adding more stimulus until the problem is fixed.

- The sixteen elements of the plan do not change the fundamental demand for new construction. For the most part, you can categorise the elements as either (a) directives to various banks to lend more to developers, mostly focussed on completing existing projects (b) reduced debt constraints or rules on individuals buying houses. The plan is to avert catastrophe rather than return to the old normal.

The stockmarket has clearly chosen the first as the interpretation. I suspect the second is more likely, however the first may be true. We did remove our underweights to resources. Stocks are clearly in a celebratory mood, and there are risks standing in front of that train. However, we will be looking for the opportunity to go back underweight as the second scenario becomes apparent.

As the market bounced in October, we added to our stock holdings. Last week we subtracted from our stock holdings. We are calling time on the latest stock market rally and took profits on those trades.

We expect weak stock markets as the central banks raise rates to slow demand, shrinking company profits. With that in mind, the key factor to watch in the coming months to tell if we are wrong or right is the change in corporate profitability. The reporting season in the US showed some signs of weakening earnings, but not enough to confirm our thesis yet.

The 2023 Recession The World Has To Have

In 1990, Australia faced high inflation and raised rates until the economy went into recession. Paul Keating famously dubbed it the recession that we had to have. The world is facing the same situation. Central bankers have confirmed that they are willing to cause a recession to bring down interest rates. We believe them.

There are a number of major factors we will be watching into 2023.

Inflation

Inflation is clearly weakening. We are seeing deflation in transport, deflation in goods. But services inflation is still running hot, particularly in the US.

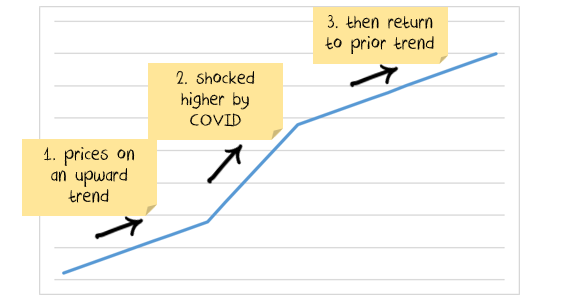

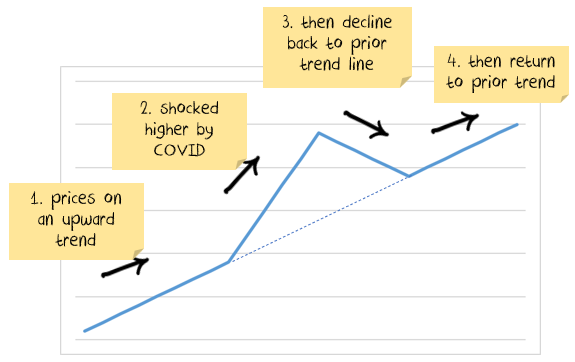

There are two ways to consider reversion:

1. While central banks will force inflation back to 2%, prices will remain structurally higher.

2. Prices have been temporarily shocked, but will return to the prior trend

Goods are probably more likely to be in the second category, services more likely to be in the first. Given the Ukraine war, gas prices are likely to be in the first category. Oil is more transportable, and so probably has a chance for either.

The shape of future inflation or deflation depends on how many things you think will fit into each profile.

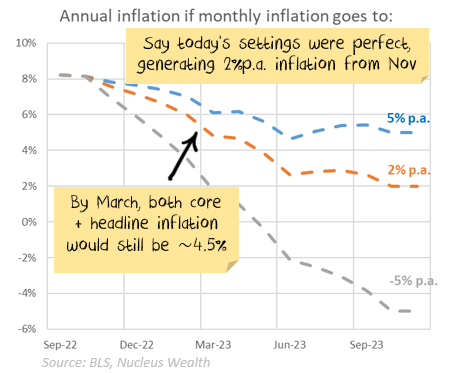

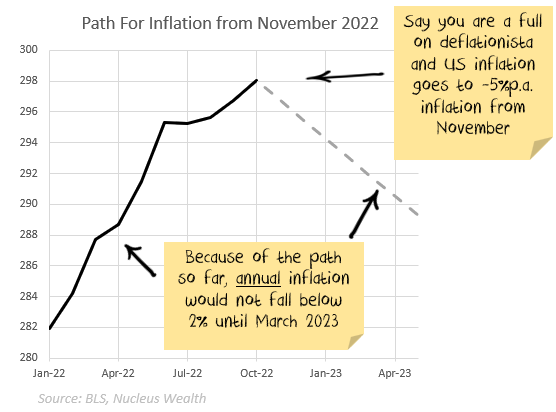

The way the maths are at the moment, annual inflation is going to remain high for some time. If inflation went immediately to a 2%p.a. rate (and last month it did), by March next year both core and headline inflation would still be above 4.5%:

Say you were expecting imminent deflation in many categories. If the US started printing -0.7% per month inflation (i.e. -5% inflation annualised) every month from November, annualised inflation would still be above 2% until March 2023.

My expectation is still that central banks want to jump up and down a few times on the corpse of inflation to make sure that it is truly dead before reversing course. With that in mind, I’m expecting very low inflation or deflation by mid-2023. But, even with that expectation, the headline annual inflation figure will stay high for at least six months.

Will markets celebrate inflation falling over the next few months the same way? If so buy equities now. Or is this a buy the rumor of lower inflation, sell the fact as earnings get hit by weaker demand? If so sell.

Recessionary Signs

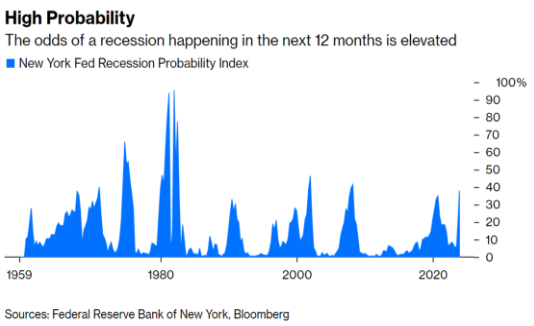

There are a lot of signs that the economy is headed into a recession. Inverted yield curves, forward orders in surveys, crashing Korean exports, falling oil prices and many more:

But it will take time to emerge. Because of its high exposure to resources, traditionally the Australian stock market does much better than the world market when the world economy booms, but much worse when it busts.

Because of the energy shock in Europe, we expect prices for gas and coal (both major Australian exports) to weaken, but remain far above prior levels. Which will help the Australian economy hold up this time.

The two questions for investors are:

- The other major export, iron ore. And for that the answer lies in China.

- How Australian households hold up in the face of record tightening by the central bank.

Chinese re-opening

China has had four attempt in the past dozen years to wean itself off its property construction addiction. They lost their nerve on three prior occasions. The latest announcements might be signs that China has once again lost its nerve. As an Australian investor, we need to respect the upside risk that such a pivot would create for commodity prices and the Australian dollar. Especially when coupled with reopening plans.

Medically, exiting COVID zero is going to be bumpy:

- China has an incredibly efficient COVID testing regime.

- It does not have an effective vaccine.

- China does not have enough intensive care.

- Will we see accurate figures on deaths?

- The virus is more transmissive than when it tore through other countries, it might be bad, but it might be over quickly.

Economically, there will be stops and starts:

- It is likely, in the first instance, that the private sector will lock down anyway as the virus tears through.

- There are questions about how long will China take before emerging. China need to change their narrative about the dangers. We don’t expect an economic emergence to take long, but I’m not sure.

- There will likely be a re-opening boom. How long it lasts has many questions.

- China did not transfer as much to ordinary citizens as many other countries – there will be pent up demand but it may be less than elsewhere.

- But, we also need to recognise that the announced property measures so far are not enough to re-ignite the property boom. There will need to be more announcements.

- And if they do not come, investors will need to be ready to pivot. In that scenario there is considerable downside for the Australian dollar and commodities.

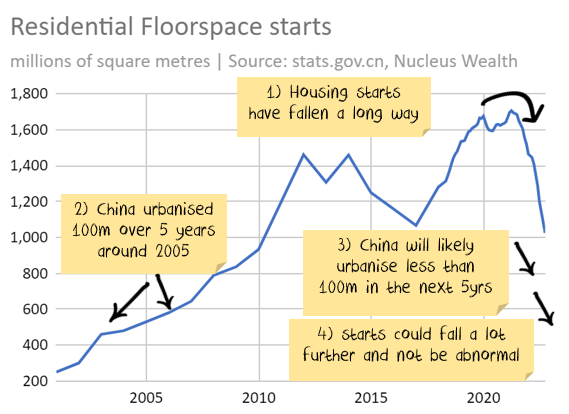

As we discussed last month, for the Australian economy, it mostly hinges on property.

The question now is what is the right level for housing starts to return to:

- If you benchmark to the last 5 years, housing starts could grow 60%.

- If you measure it by other countries (including China itself), housing starts could fall another 40% to reach the level of similar countries.

So it will take time to see the effects if the building boom genuinely is back.

Three areas to watch:

1. Credit locking up in the property development sector.

This is happening right now. The new measures are designed to ease this problem. The average yield on dollar bonds issued by junk-rated Chinese companies has more than doubled, and capital raising is difficult.

Twelve months ago we thought the options looked like the following:

- If there are no meaningful measures, then we are looking at a full-blown financial crisis. Very negative for stock markets, particularly Australia.

- More likely, steps will be implemented to help the better companies but not let up on over-indebted companies.

- At the bullish end, China could over-egg the response, opening up the credit taps. This scenario would be short-term positive for stock markets, particularly commodities, subject to the below risks.

The new measures still seem to be like scenario b) above. But with each announcement we get closer to scenario c). In recent days, China has dropped its mantra “houses are for living, not speculation”.

Is this a sign that they are once again going to encourage houses for speculation?

2. Property buyer confidence

China has some of the most expensive housing in the world relative to income. Should buyers lose faith in the value of properties, then a house price crash could result. This could occur even if the first issue is solved. Which would leave developers in a much worse position.

There are signs that Chinese property buyers are spooked. There is not a lot in the measures to solve this problem. Watch this space.

3. House price wealth effects

This is the problem facing almost every country. High property prices increase inequality, reduce economic growth and damage productivity. But all of those are longer-term problems.

The short-term effect of rising prices is to increase spending and consumer confidence. And politicians love short-term gains at the expense of long-term losses. Falling home prices offer the opposite.

The problem is worse for China than elsewhere. Both homeownership and investment in real estate are much higher in China than in most other countries.

Australian economy

On one hand, the Australian consumer has been relatively strong, global commodity prices for our main exports are booming and it looks like an acceptable solution to high energy prices is almost complete.

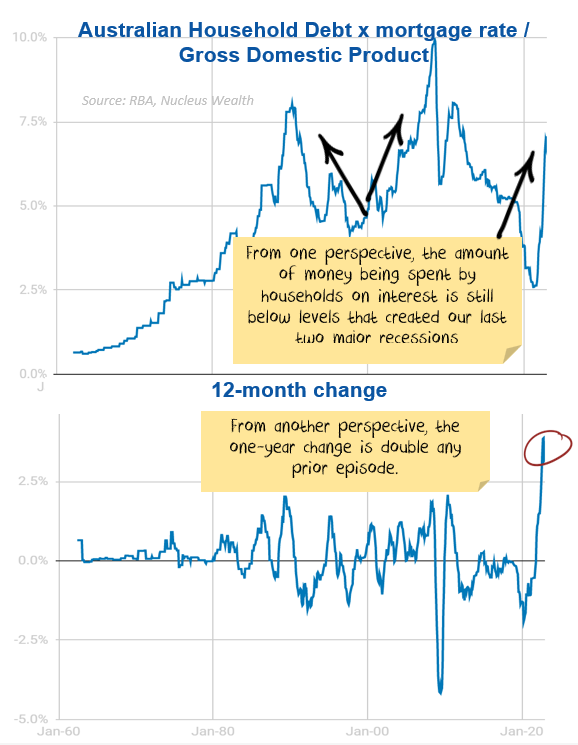

On the other, wage growth is still low, savings are being run down, and the Australia consumer is in the process of going through the largest increase in interest rates ever. As a proportion of GDP, the increase in interest costs is looking to be about double prior episodes:

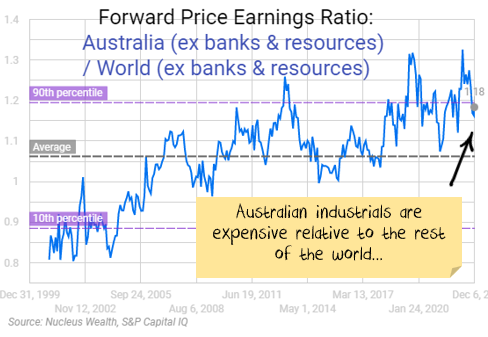

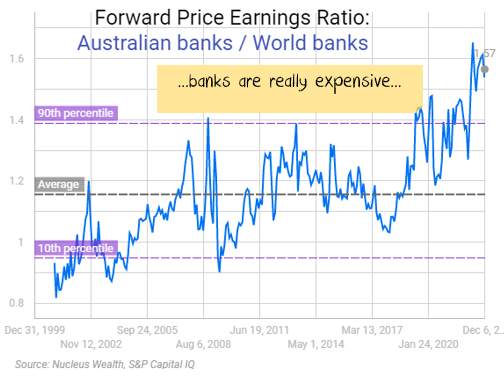

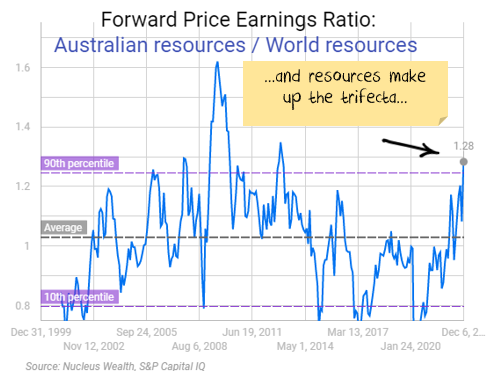

Add to that, Australian stocks look significantly more expensive than an already expensive world index. Australia is trading at or above the 90th percentile of valuations in the past 25 years, relative to world sectors:

Net Effect

And there is one more major risk. Suppose China has returned as a demand driver in the commodity space. If so, this will add to inflation, and the US central bank is more likely to keep raising interest rates until it breaks something else.

Investing is always a trade off between economic outlook and price. Prices look expensive, the economic outlook is troubled.

Have we seen this all before?

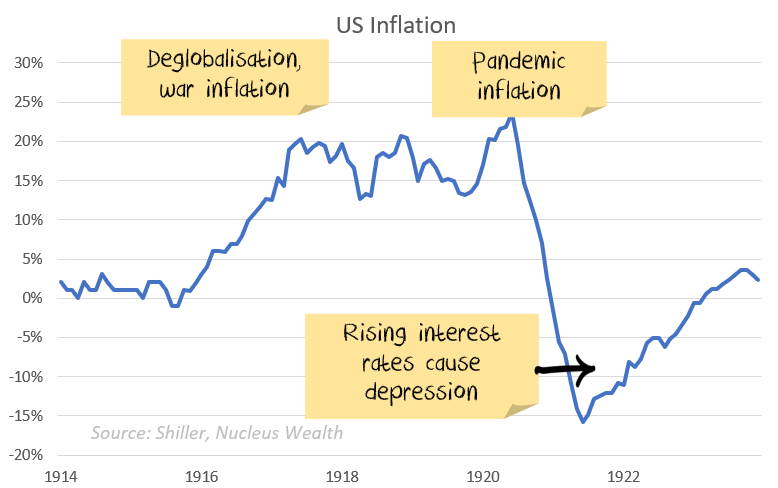

- Globalised supply chains reversing into more local production due to geopolitical tensions

- A pandemic disrupting supply chains

- A surge in inflation due to supply issues

- Central banks hiking rates into a supply-side shock

Yes, we have. Following World War I, all of the above factors were in place.

By 1920, inflation in the US was running at 15%. The US central bank hiked rates from 3.5% to 5.6% to curb demand. By 1921 the US was in a depression, with inflation of -10%.

The analogy is not exactly the same. But, trying to use interest rates to solve supply chain problems is at the core. There are more similarities than there are differences.

Investment Outlook

I have some pretty clear ideas about which trends are sustainable and which ones aren’t in the long term. However, the short-term is far less clear:

- The sanctions on Russia are unlikely to be lifted anytime soon. The short-term effect is probably commodity shortages. In the longer term, it seems likely that we will see a re-orientation, Russia will supply more to countries like China and India, less to Europe. For some commodities (oil, wheat) this will be easier. For others (gas) it will be extremely difficult.

- The Omicron variant looks to be resolving in the direction we expected, ripping through economies without too much harm and leaving behind an acceptance that COVID is endemic. In China, rolling lockdowns look like they will cease soon.

- The geopolitical energy crisis in Europe has turned acute and infected Australia. This will subtract from European growth in the short term. There are glimmers of hope for Australian energy with price caps. There will be a rush to alternative energy sources in the long term.

- Supply chains continue to improve.

- Governments continue to withdraw (or not replace) stimulus. There will be a fiscal shock into 2023. The question is whether the private economy will be strong enough to withstand it. Leading indicators suggest profits will be lower.

- Central banks have made it clear that they will try to solve the Russian-induced energy issues and supply chain-induced inflation by raising interest rates. The odds of a policy error have increased significantly.

- China still has not bailed out the property sector. The latest changes are not a bailout… but they may morph into one. China is trying to ensure that houses under construction get built, small businesses have access to credit, infrastructure building continues, and failing developers do not crash the economy. But China is yet to show any signs of turning back to the old days of debt-driven property developer excesses. In the short term, commodities have been booming with an expectation of China changing. If China doesn’t continue to roll out new measures, the commodity market will deflate again.

It is still not the time for intransigence. Events are still moving quickly. But we have positioned the portfolio towards the most likely outcome and are gradually increasing the weights as more data arrives.

Bond yields have risen significantly. If the world heads for recession this is a buying opportunity. The problem in the short term is that the narrative “high inflation, central banks raising rates = sell bonds” seems to be coming to an end. Although there may be another last hurrah as the US central bank looks to rein in the stock market optimism.

And the mix of higher volatility, leading to deleveraging of risk parity trades and momentum means yields could yet go higher. We are invested for bond yields to reverse.

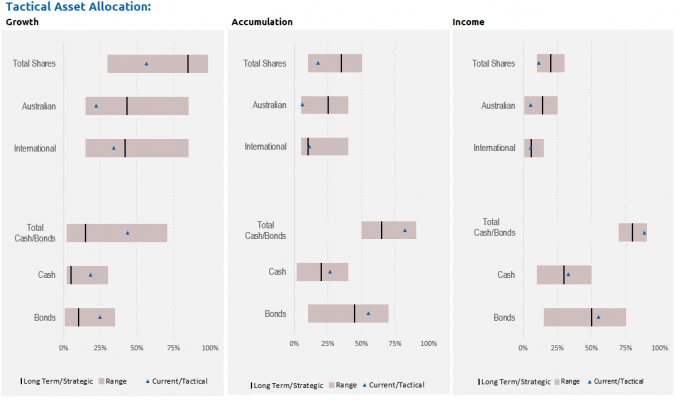

Asset allocation

After being very expensive for a number of years, stock markets are now flirting with fair value. Debt levels are extremely high. Earnings growth had been really strong but has come to a halt. There are signs it is starting to reverse.

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

But, any number of other factors could force this off course and see unexpected inflation. COVID mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might reverse its tightening on property sectors. Biden may get through additional stimulus, driving increases to minimum wages.

We are significantly underweight Australian shares, and as noted above, overweight bonds, with the view that the Australian market is more quickly affected by rising interest rates and more affected by a global recession:

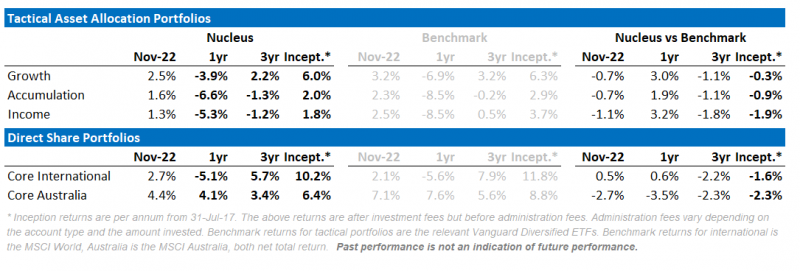

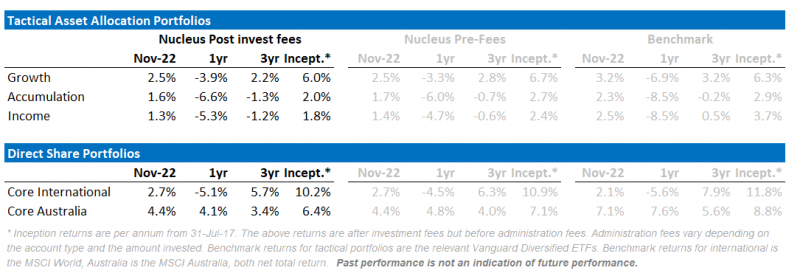

Performance Detail

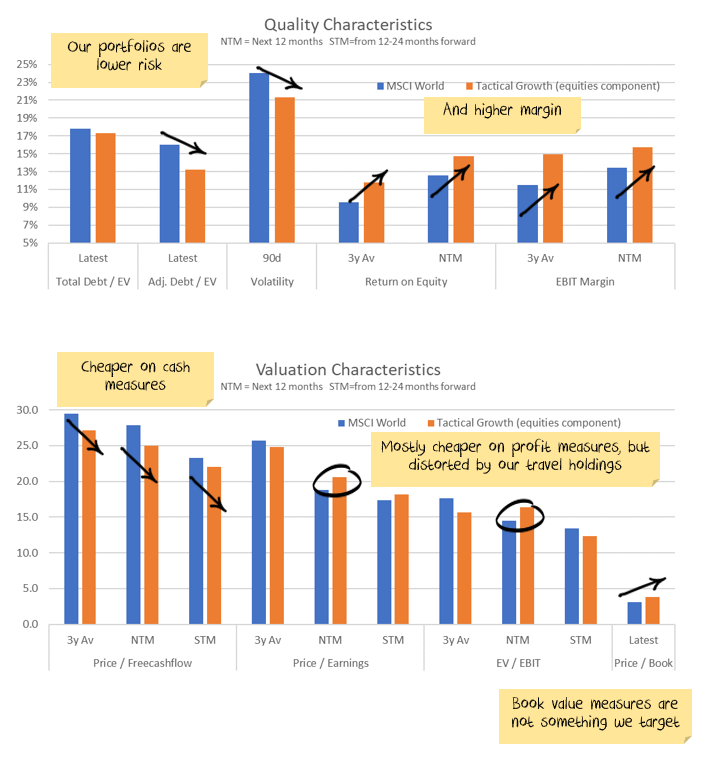

Core International Performance

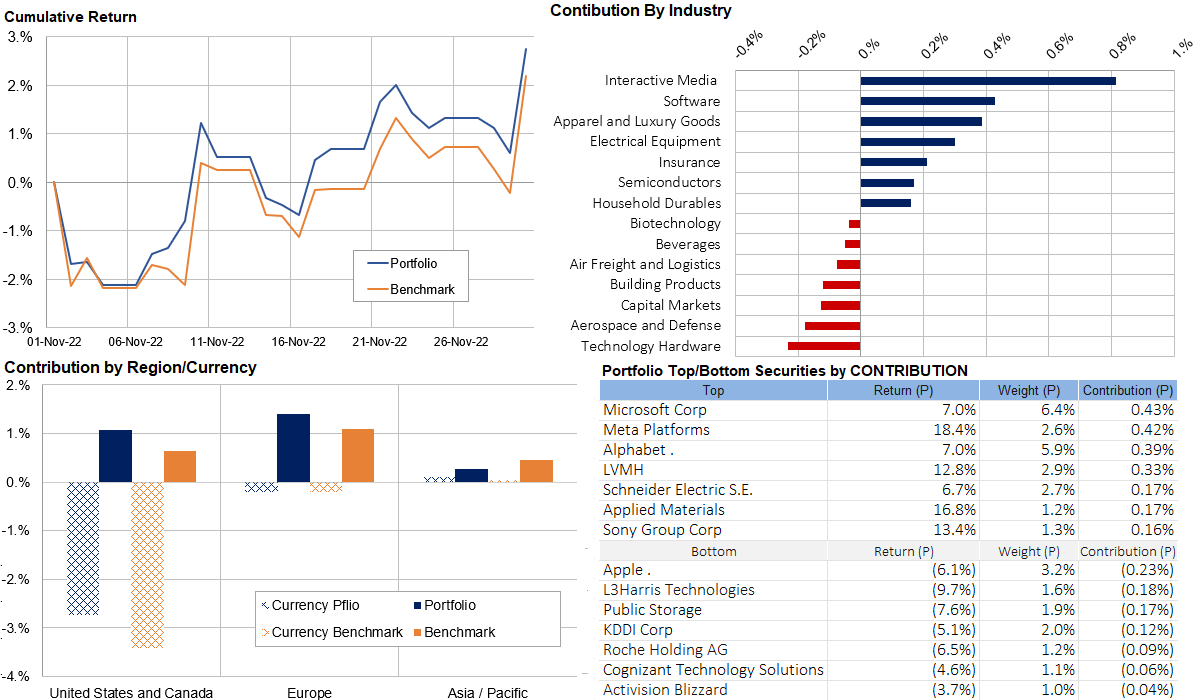

After an initial hiccup, November saw the Santa Rally continue with currency being the key detractor this month. The USD weakened with the Fed’s dovish signalling. FAANG stocks that were dumped in October staged a recovery in November and our portfolio performed well as quality stocks were generally sought after. The weakening USD meant our European stocks outperformed their US peers in AUD terms. We took the opportunity of the dip early in the month to add some more quality (LVMH, Alphabet, Microsoft) which proved timely.

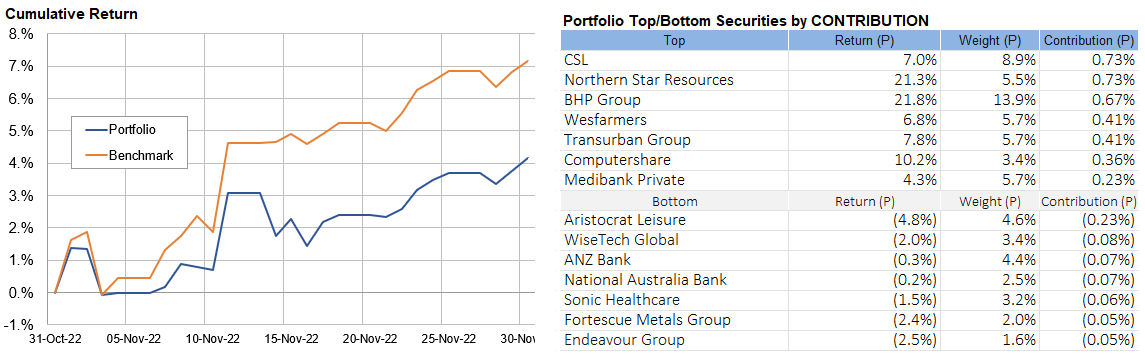

Core Australia Performance

Domestically equities took off with the announcements in China of new measures to prop up the ailing property sector which gave commodities an unexpected boost. We had expected the government to stand firm this time round so were caught short Resource stocks and thus missed out on much of the initial Resource driven performance. We subsequently up-weighted our iron ore exposure expecting the rally to continue into Xmas. We also took the opportunity to increase our defensive exposures via APA (pipelines) and Transurban (motorways).