Is the US about to boom or to bust?

It's a very big debate for asset allocators by very big people that I respect on both sides.

In the boom camp is Steve Blitz at TSLombard.

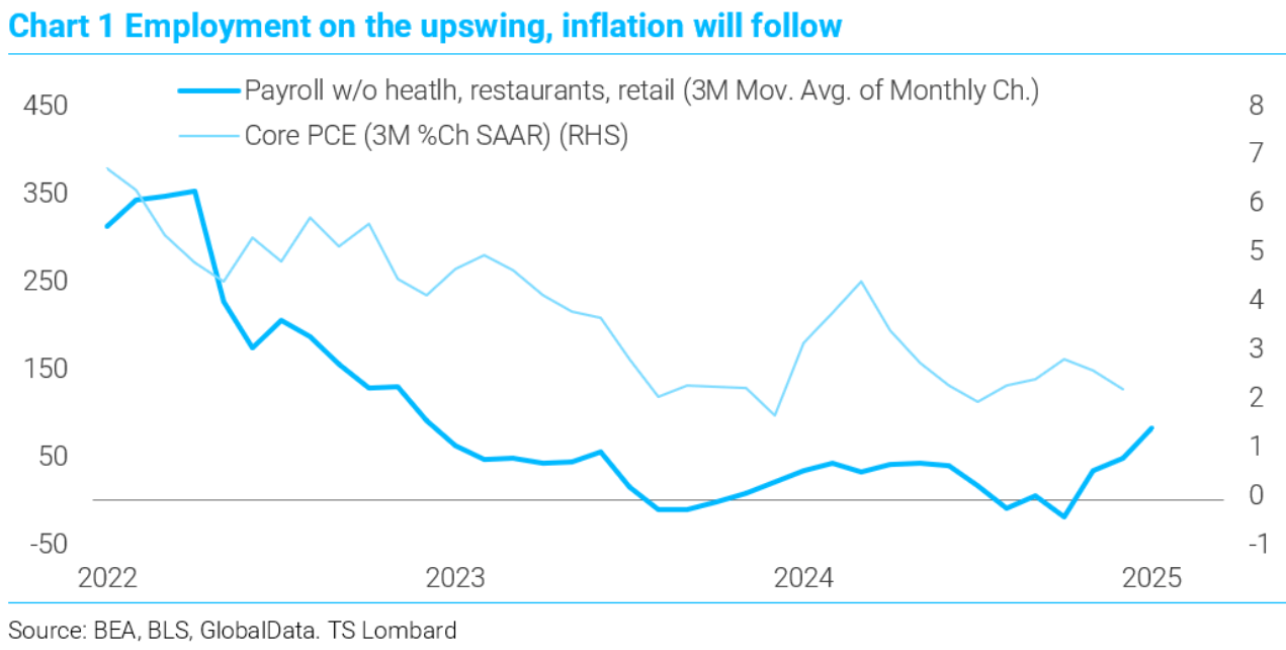

January employment data and the revisions have a simple message – the economy has been picking up steam since mid-24, a charge now fueled by a 100BP cut in financing rates.

It is time to turn the page from those dueling narratives of “the economy is in recession” and “can the Fed manage a soft landing” to the tale that the data tell –growth, and inflation will follow.

Total employment for 2024 was revised down by 0.4%, not even a misdemeanor in statistical terms and hardly the capital crime some were expecting.

Looking at the revised mid-24 monthly payroll changes, if the Fed had those numbers at the time, they would’ve cut in July (wrote as much at the time) instead of waiting and making up for the delay by cutting 50BP in Sep (anecdotal information clued them in on their error).

In the end, they made the expected 100BP cut to a Taylor-neutral level by Dec and have kept a negative inventory cycle from taking hold–seeds of which are evident in Q3 and Q4 downswings in inventory growth.

Employment has been on the the upswing since summer, inflation will follow (Chart 1). Jan payroll figures were low (weak hiring in autos and temp, strong in real estate and healthcare, 0 in restaurants).

The BLS says the LAfires and bad weather had no impact.

Keep these initial reports in perspective, as subsequent revisions can sharply change the narrative.

Nov and Dec were adjusted up by a combined 111,000 and the diffusion index is 55.No Fed cuts in 2025, unless Trump’s tariff tirades reverse growth, and that is far from his intention.

If you buy this argument, then you want to stay long US assets, short bonds and long DXY until we see the whites of the Fed's eyes.

However, I would make three points.

- US productivity is booming, mitigating wage inflation risks.

- Trump's immigration policy is a bait and switch to student exports from illegals also mitigating wage inflation risks.

- My main issue is that employment is a lagging, not a leading indicator. The last few months have seen dramatic changes to the US growth outlook, which is where we find Michael Hartnett at BofA.

Zeitgeist I: “SPW is my new International”...investor on rotating from Magnificent 7.

Zeitgeist II: “Trump's traffic light is the stock market and stocks telling himto keep tariffs light, so no reason to sell”...investor on trade war.

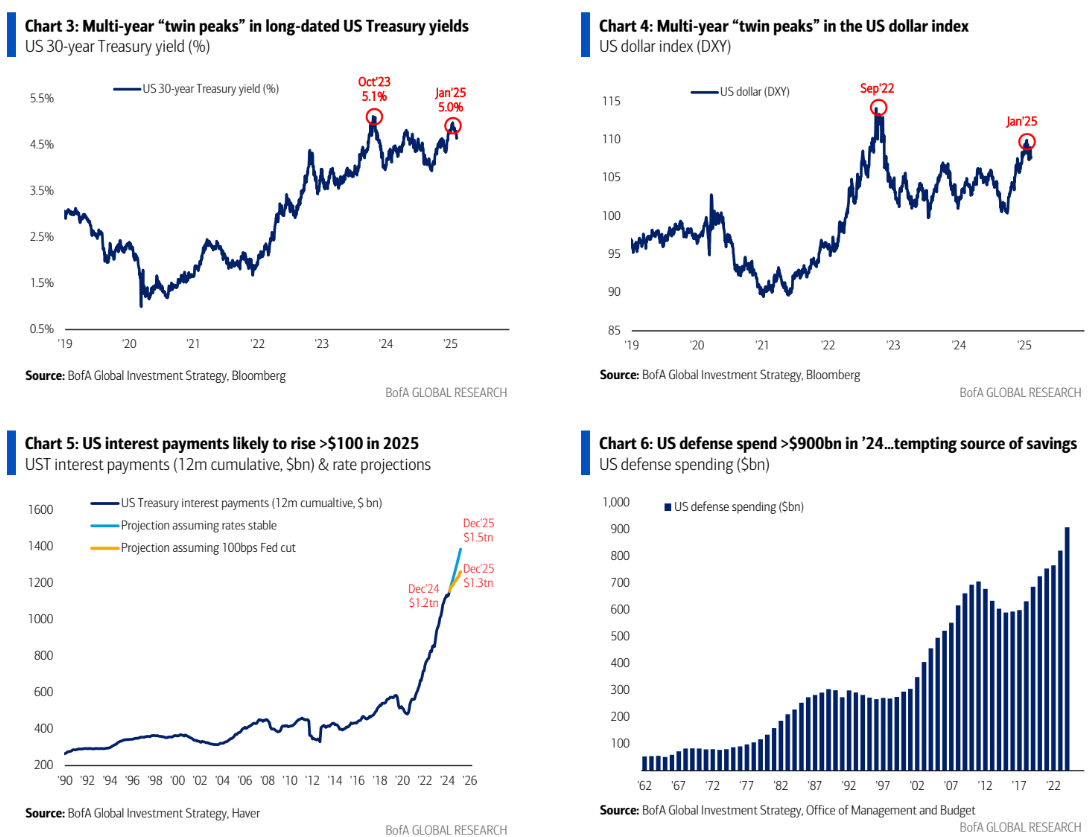

Tale of the Tape:multi-year“twin peaks” in bond yields & US dollar (Charts3-4) thus far“risk-on” in ’25 (XBD at new highs); regional banks & REITs breaking above ‘21/’22 highs (KRE>$70, VNQ>$100) biggest tell investors need to close their big bond UW.

The Price is Right: YTD equity returns (US$):Brazil 12%, Germany 10%, China 6%, UK 6%, Australia 6%, Canada 4%, US 3%, Japan 1%; international stocks front-running peak US exceptionalism, geopolitical peace (Middle East/Russia/Ukraine), no escalation in US-China trade war (only one that matters).

The Biggest Picture: no “twin peaks” in gold price (new highs...BofA forecast=$3000/oz); big history = big gold bulls (1930s depression, 1970s stagflation, 9/11, GFC, populism in 2020s–Chart2), and regime change Trump 2.0 determined to make history.

The Big Picture: US stocks at all-time highs, gold at all-time high, crypto at all-time high, yet US Treasury prices-50% below 2020 all-time high; asset prices past 5 years have traded themes of Anything but Bonds (ABB), Anyone but Populists (ABP), Anywhere but China (ABC), All-In on AI (AIAI); Q1’25 investors remain positioned for up-in-US stocks, up-in-US dollar, up-in-UST yields as Trump 2.0=“US exceptionalism-squared”; investor zeitgeist is stay risk-on until a. 2nd wave inflation causes Fed hikes, b.US growth surprises down (via say fiscal tightening/payrolls <50k/credit event).

The BIG Trade: in contrast well long “BIG” in '25, expect contrarian outperformance of Bonds, International stocks, Gold.

On Bonds:

•Make Treasuries Great Again...we expect US Treasury yields to fall below 4%; $37tn of government debt & budget deficit of 9% GDP past 5 years huge catalyst for 50% jump in US nominal GDP since 2020; the $7tn US governmentis now 3rd largest economy in world, and Trump/Musk need US government recession to arrest US debt spiral (interest payments rise $100-300bn next 12 months–Chart5), and persuade GOP deficit-hawkish Freedom Caucus to back Trump tax cuts (via budget reconciliation); DOGE (Department of Government Efficiency) targets $1tn of public sector savings; BofA Global Research Economics base case is $150-300bn in savings, but could rise to $500bn (1.5% of GDP) if administration successful on spending impoundment & layoff-related litigation; US defense budget (>$900bn in'24 vs $630bn in '19–Chart6) remains tempting source of savings as “forever wars”end; US government recession is bond positive;

•Big government to small government also bond-positive via labor market; US public sector (government/education/health) accounts for 1/3 of US payrolls, created 1 of every 4 new jobs this decade, public sector payrolls currently growing 3% YoY vs.<1% YoY inprivate sector (Chart8); smaller government =public sector jobs down =US payrolls peak in H1’25; in addition new immigration policy = bond bullish...US-Mexico border encounters falling sharply (800k in Q4’23, 300k in Q4’24, likely fall toward zero in Q1’25); note 3.9mn jump in number of foreign-born workers since Jan’20 (Chart7) accounted for >90% of increase in US labor supply, an increase that boosted profit margins & consumer spending, bond-negative catalysts set to reverse as supply of foreign workers falls in‘25/’26;

•“All great bull markets begin with a bear market rally”; unloved Treasuries in bear market rally in ’25, remain best allocation hedge for “top” in asset prices, and bond risk-reward improving...we calculate 'low risk' bond portfolio (20% T-bills, 20% 30-year US Treasury, 20% IG, 20% HY, 20% EM) generates 9-10% if US Treasury yields fall back toward 4%, and we expect US Treasury yields to fall below 4% in’25.

On International:

•Global stocks simply a “cheap with catalysts”play in‘25; China stocks trading on 10x, UK & Emerging Markets on 12x, Europe on 14x vs US forward PE of 22x; bad geopolitics great for tech/defense-heavy, energy-independent US, less good for mercantilist, oil-dependent Asia & Europe...but geopolitics in ’25 shifting from bad to good; manufacturing recessions good for US growth stocks but manufacturing recession ending (global PMIs up from 45-50 two-year contraction range to 50-55 expansion range), positive for global value stocks; China/Europe easing fiscal policy in’25 (contrast to US in’25), funding reconstruction in Ukraine & Middle East, more Europe & Japan defense spending, stimulating China consumer; we long China on no escalation of US-China trade/tech war, won’t go long Japan until Nikkei can prove it can rally with stronger yen, long Europe but expect profit-taking on Feb 23rd German election and Feb/March Russia/Ukraine peace talks;

•Trade war won’t end ’25 bid for International; yes, implementation of US tariffs (now delayed) on $1.4tn of China/Mexico/Canada imports would have caused spike from 2% to 6% in US duties as % of imports (Chart9); and yes, backdrop more vulnerable to big trade war in 2025 than in 2018 (when US taxes had just been cut, global manufacturing was booming with all PMIs 55-60–Table1), inflation no threat (CPI had averaged 1.5% since GFC), tech less dominant (Magnificent 7=15%of S&P500 vs.33% today); but 2025 reality is there are 2 trade wars...the real strategic one with China, and tactical ones with everyone else; latter to remain transactional; and too much for US & China to lose with big escalation of US-China trade war...political misstep for Trump to allow 2nd wave of inflation, China less reliant on US exports (China exports to US=2.8% of China GDP today vs. 7.2% in'07–Chart10), and neither side likely to pursue “MAD” tech war...US/allies control>90% of global semiconductor manufacturing, China extracts 60% and processes 85%of world's rare earth minerals.

My main issue with this is if Trump does not go big with China tariffs, then why did anybody vote him in?

The point on inflation is well made, but declaring peace with China has its own political price.

Hartnett is too sanguine on Trump rationality.

Finally, here is Vimal Gore.

...markets have largely given up on meaningful rate cuts this year. But the real driver of monetary policy shouldn’t be inflation but liquidity. Global liquidity has tightened dramatically since the election, with the US dollar surging to multi-year highs, fuelled by market positioning ahead of Trump’s return and escalated by his tariff threats.

The strong dollar has acted like a wrecking ball for financial conditions, draining liquidity and tightening funding markets. This squeeze is already dampening economic surprises – a leading indicator of weakening growth. Yet, markets are still pricing in less than half a percentage point of Fed rate cuts for 2025, implying the central bank will remain patient. That assumption is flawed.

Another major force has been the US Treasury’s aggressive cash management strategy. After last year’s debt ceiling resolution, the Treasury moved to replenish its cash reserves, effectively pulling billions of dollars out of circulation. This massive withdrawal has drained liquidity from the financial system, compounding the tightening effect already caused by rising rates and a stronger dollar.

...With funding stress rising and real rates still elevated, the question is no longer if the Fed will act, it’s when. We believe 1 per cent of rate cuts are likely to be needed by the end of 2025. Coupled with a weaker US dollar, this shift will inject much-needed liquidity, setting the stage for a strong market response.

...Beyond boosting fixed-income returns, liquidity tailwinds have historically fuelled outperformance in long-duration high-beta assets – particularly technology stocks, AI plays, and bitcoin. These sectors are best positioned to benefit as conditions ease.

So, we have gone from rate hikes to rate cuts over the course of three excellent analysts.

I side largely with the latter two though I'm not quite so dovish as Gore who predicts another 100bps this year.

To some extent, this is a sequencing question which I would answer as follows.

- Markets are already beginning to price Hartnett's scenario as international assets outperform US. Blitz's outlook is being discounted.

- I see Gore's outlook as coming later than he.

So, it is topping DXY and underperforming US assets versus Europe and Japan for now, then a return to US dominance later as (China) tariffs persist and US easing resumes.

I won't touch Chinese assets unless it is a very fast trade. Sovereign risk is extreme and its economy is stuffed, if boosted sometimes by vouchers.

Commodities fall into this category as well.