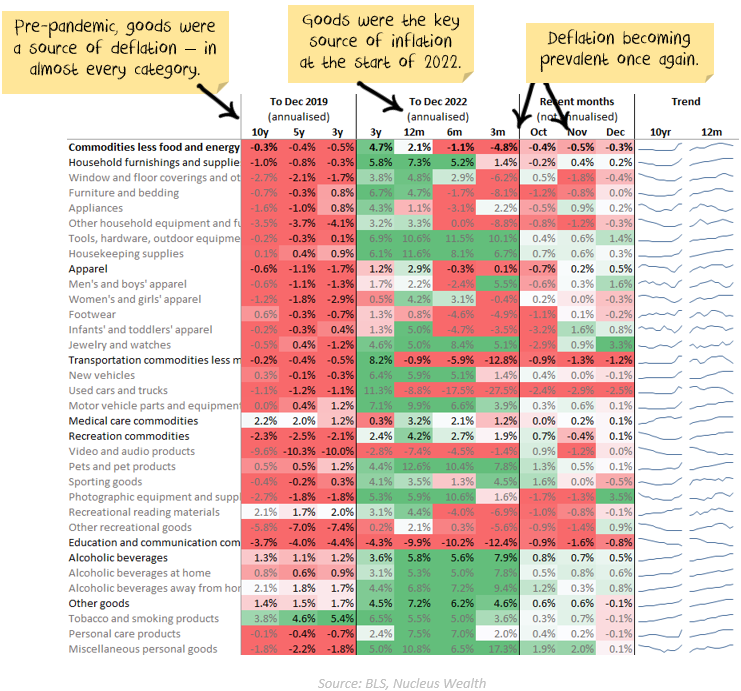

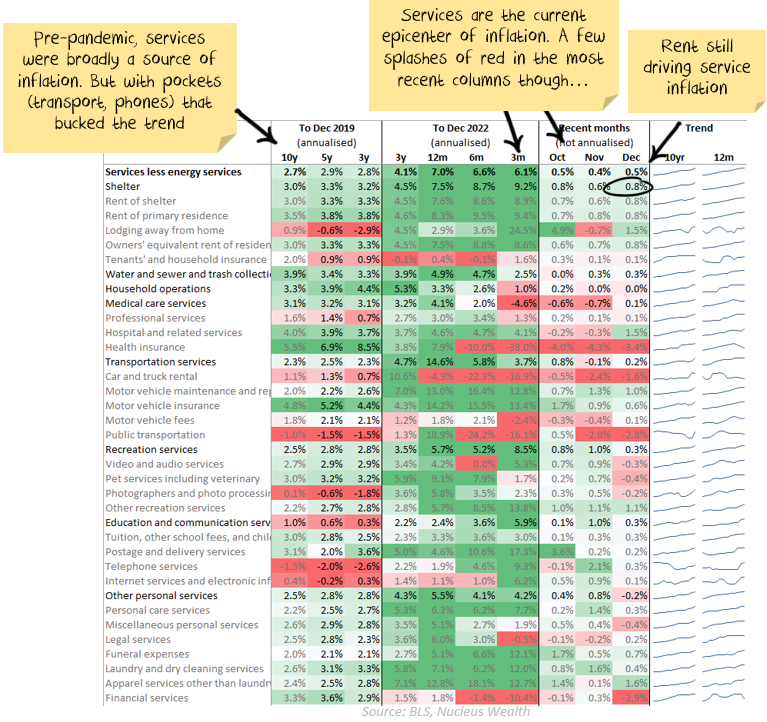

US inflation came in around expectations. It is probably getting better, but there is still the opportunity to see what you want in the numbers. If your view is that inflation is heading for deflation, then look to goods falling at an annualised rate of 4.8% over the last quarter, and continued falls in energy costs. If your view is inflation will remain high, look to services rising at an annualised 6.1% over the last quarter.

The latest buzzword, supercore inflation (basically services inflation excluding housing & utilities), can also give you whatever flavour you were looking for. Take it as defined, and supercore inflation is running at its long term average, 2.4%, annualised over the last quarter. But make some adjustments to match PCE inflation (which the Fed follows more closely), and you can argue that it is still running at 6.5%.

And then just take the headline rate. If you look at the annual figures, 6.4% is your number. Both six month and three month annualised numbers are under 2%. There is enough ambiguity in the data to tell whatever story you want to tell…

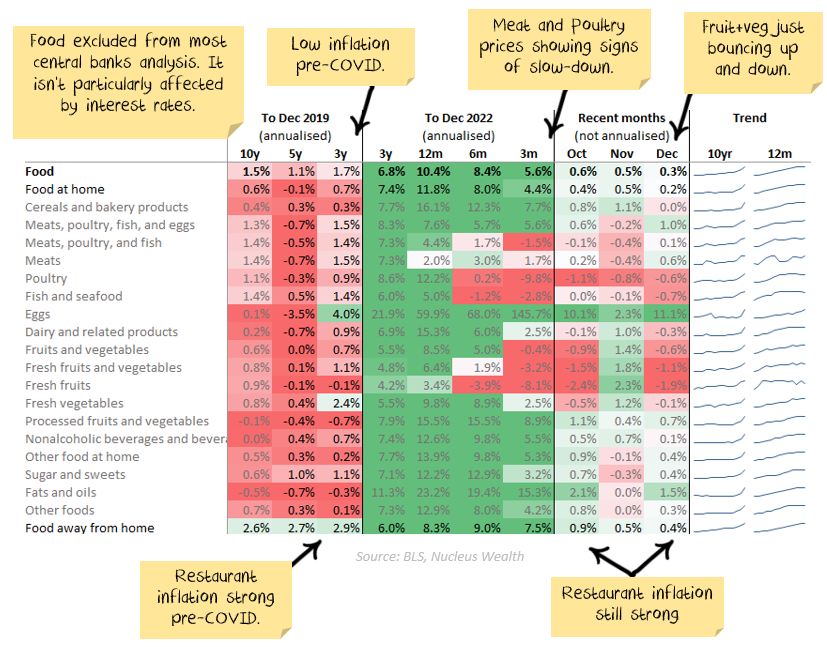

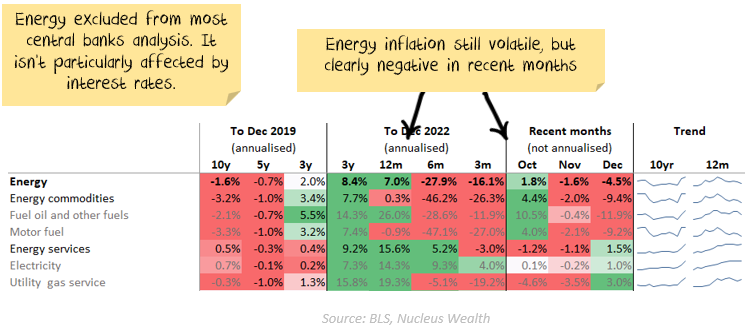

See the tables below:

Going forward

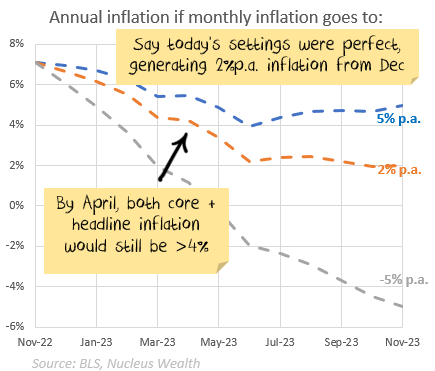

The way the maths are at the moment, annual inflation is going to remain high for some time. If inflation went immediately to a 2%p.a. rate, by April both core and headline inflation would still be above 4%:

The stock market reaction was a lot more muted this month. My expectation is still that central banks want to ensure inflation is truly dead before reversing course. With that in mind, I’m expecting very low inflation or deflation by mid-2023. But, even with that expectation, the headline annual inflation figure will stay high for at least four months.

Will markets celebrate inflation falling over the next few months? If so buy equities now. Or is this a buy the rumor of lower inflation, sell the fact as earnings get hit by weaker demand? If so sell.