As Australia continues to shed its industrial base, the US is rebuilding. Morgan Stanley with the note.

US Reshoring Momentum Is Outpacing Early Expectations

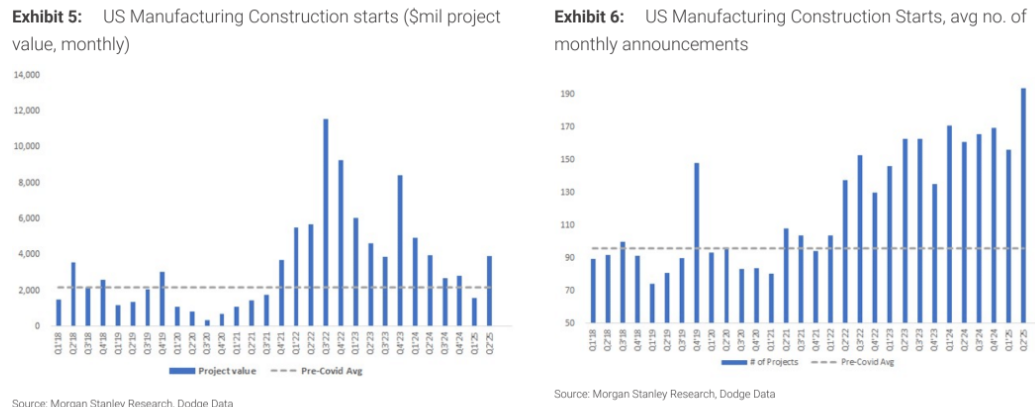

Our US Industrials analysts note that May US manufacturing construction starts sustained the strength seen in April, and activity is tracking at ~2x the pre-Covid run rate.

The average project size in 2Q through May is at a 12-month high, although it is pacing below the “mega-project” wave of 2021-23.

Our team views the latest data as a signal of a broader pickup in overall domestic investment that supports their US$10 trillion US Reshoring thesis.

In addition, they see scope for project activity to ramp over the next 12 months as clarity on tariffs and other rules enterprises to better assess project ROI, potentially unlocking additional projects that are currently on hold.

What strikes me is how much more effective (so far) Biden’s manufacturing carrots – via the CHIPS an IRA – were in triggering industrial buildout than the stick of tariffs have so far been.

It is very early days but this is a fascinating real time experiment in how to rebuild an industrial base within a developed economy.

$10tr does not strike me as realistic, not least because Trump’s Big Beautiful Bill just unwound a bunch of the renewable energy manufacturing incentives embedded in the IRA, creating a headwind for his own reshoring.

July 2, 2025