June 2025 Performance

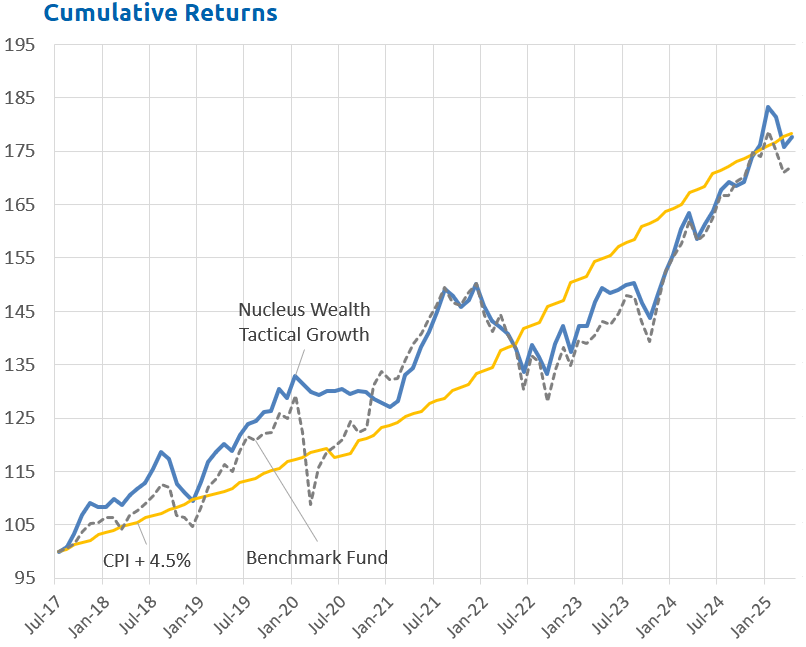

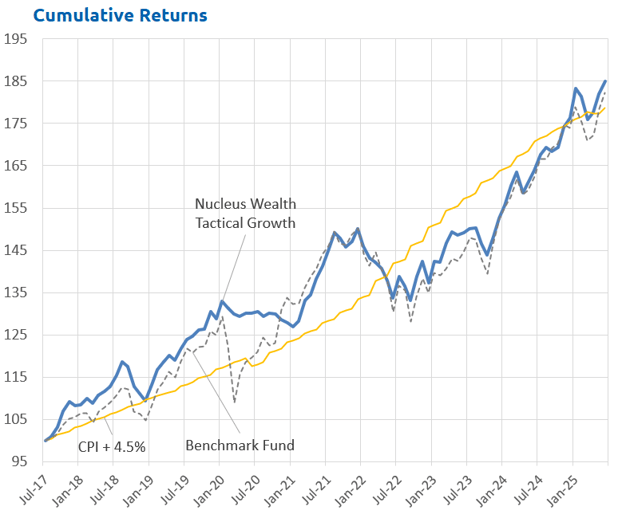

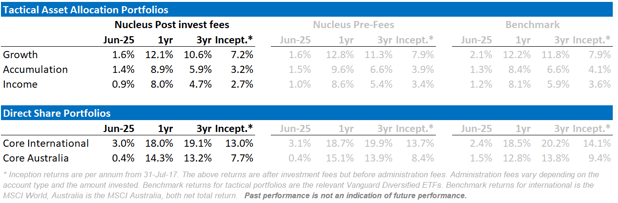

The financial year end 30 June was volatile. But, after all was said and done, our international fund finished up over 18%, our Australian fund finished up over 15%. Our tactical growth finished up over 12%. All of our funds look attractive relative to their benchmarks, especially as they were all significantly less volatile than the market.

But the outlook is as uncertain now as it has been any time in the last few years. Putting together an investment strategy in this environment is difficult to say the least.

What is the broader strategy behind Trump's policies?

At times, Trump has been questioned on policies, giving an answer that contradicts previous statements. Then, he has doubled down, making the new answer his policy. The idea of a leader acting purely on impulse creates a scary environment for investors. How can you craft any investment strategy if decisions are made on a whim?

An alternative theory is that Trump is playing 4D chess. It will all become clear at some point in the future. For mere mortal investors, this is effectively the same. How do you craft an investment strategy when the 4D chess playing is so complex that it appears a lot like incompetence?

Another option is that while Trump is impulsive, he has advisors influencing him. I.e the real power lies with these advisers and donors. This is also uncertain. If the decision-making is driven by changing influencers, investors need to constantly identify which adviser holds sway. Do we believe Elon Musk's view of the world or (trade guru) Peter Navarro's? Treasury Secretary Scott Bessent's take or podcaster Steve Bannon's? The investment strategy problem now is the constantly changing pecking order.

Prof. Scott Galloway offers yet another perspective, suggesting Trump is simply driven by personal financial gain. It is all about the grift. Accepting jets, building golf courses, starting cryptocurrencies. For investors, the investment strategy is to try and align yourself with Trump's interests and hope they don't change.

The path of least resistance theory

Our take is an amalgam of the above. There's an element of narcissism and a tendency to improvise. There's a focus on personal financial gain. But more broadly, there is an experimental approach: throwing ideas to see what sticks. Consider the scenario of accepting a $500 million plane from Qatar. If there's insufficient pushback, Trump proceeds; if not, he backs off. It's about testing boundaries. The method involves assessing where pain points arise—stock markets, supporter reaction, or other avenues.

Pushback from liberal media isn't a concern. It is probably invited. Trump shows more interest in how the Supreme Court might rule. The term "TACO"—Trump Always Chickens Out—captures the idea that he often reverses course. It reflects a strategy of gauging how much political or economic pain is bearable.

Trump was all for Elon Musk's cuts to spending, while they were largely symbolic. When they became more than bluster, Musk fell from favour. Trump supports the Bessent plan. Except the reducing the deficit part - that seems hard. Trump would love to replace the Fed chair with someone who would do as Trump says - but market reactions scared him off. For now.

Traditional trade negotiations are hard, they take years, sometimes decades. The good thing about Trump's "trade agreements" is that they aren't agreements. They are mostly vague statements of intent. We have already had multiple announcements about US/China trade "deals" and I fully expect a steady stream of announcements of "deals" for years. Vague statements of intent are much easier than actual deals.

Assuming Trump will take the path of least resistance (while still being able to claim victory) seems like a reasonable first principle for investors.

Maybe this much chaos is paradoxically stable?

When a decision involves only a handful of variables, companies tally the pros and cons, run a cost-benefit analysis, and arrive at a judgment that feels both deliberate and defensible. If wage costs, tariff levels and transport costs are the only variables, companies can compare options side-by-side and make a reasoned choice.

Add more factors, and the mental spreadsheet balloons. Businesses face unpredictable tariff levels, unclear interest rate trajectories, and fluctuating supply chain stability. Concerns extend to potential kleptocracy and influence from political donations. Unclear policies deter investment and expansion. Business owners grapple with myriad questions: Are interest rates rising or falling? Is there a labor shortage going to lead to higher wages? Or will an economic slowdown leave the US with a labor surplus? Will tariffs lead to inflation?

Companies have probably reached information overload. To cope, humans fall back on heuristics—simple rules of thumb that slice through the complexity. Most likely? Just keep doing what you did last year and wait to see what happens.

Maybe we have reached "enough" chaos and uncertainty that companies no longer try to anticipate. This 'wait and see' approach might help sustain economic momentum, despite the potential negatives.

What does this mean economically?

The assumption is that Trump has a trial-and-error strategy where market-positive actions are retained, and unfavourable ones discarded.

While long-term benefits might be questionable, the short-term strategy is good for companies. Running up the deficit, cutting interest rates, getting rid of regulations. These are all tried and true ways to increase short term growth at the expense of long term growth. All are positive for company earnings.

The danger is that there are a lot of potential landmines that can blow up investors. Misjudgement on tariffs, constitutional over-reach, geopolitical pushback, inflation and fifty other factors could push the economy into recession.

Net effect is a narrow path to strong short term growth.

From an investment perspective, keeping a reasonable amount of cash ready for possible downturns could be advantageous. While it's challenging to predict specific outcomes, maintaining a balance of liquidity and investment ensures participation in market upturns.

What does this mean for stock selection?

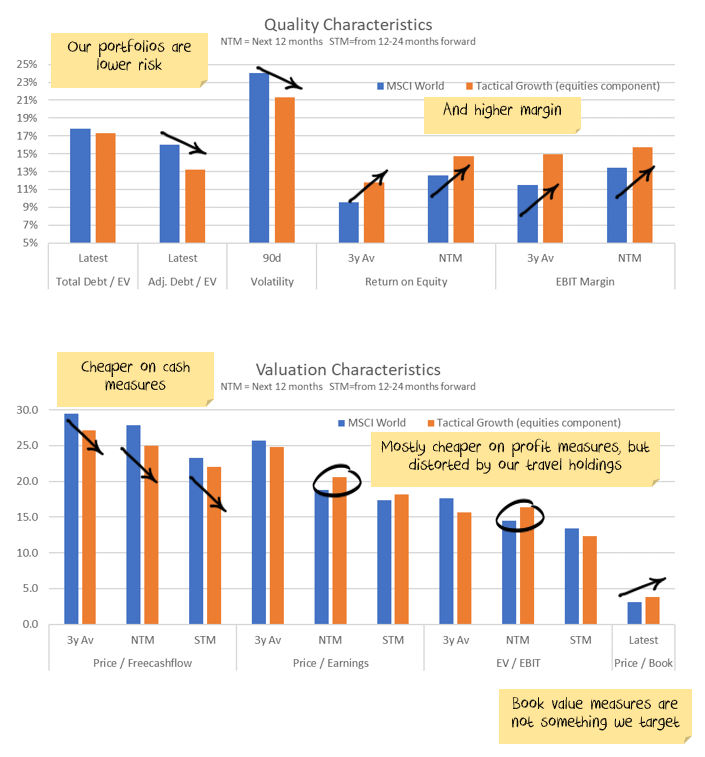

In our view stock selection should focus on quality companies. Momentum trading is going to be too risky, vulnerable to sudden whims. Growth stocks will boom the most if markets rise, but fall harder if Trump hits any economic landmines. Better to limit our exposure to these. Value stocks are cheaper but pose their own challenges. They usually lack margin control. A company with a 3% margin, say a tyre manufacturer, has limited control over costs. An unfavorable tariff decision could severely impact such businesses. Quality companies with a 50-60% margin have more scope to survive. They are not immune to tariffs, but they are less likely to face losses or relocation pressures.

We are prioritising companies with high margins and minimal debt for portfolio stability. The goal is to use market volatility to acquire quality stocks when they fall, maintaining reasonable cash balances for market pullbacks.

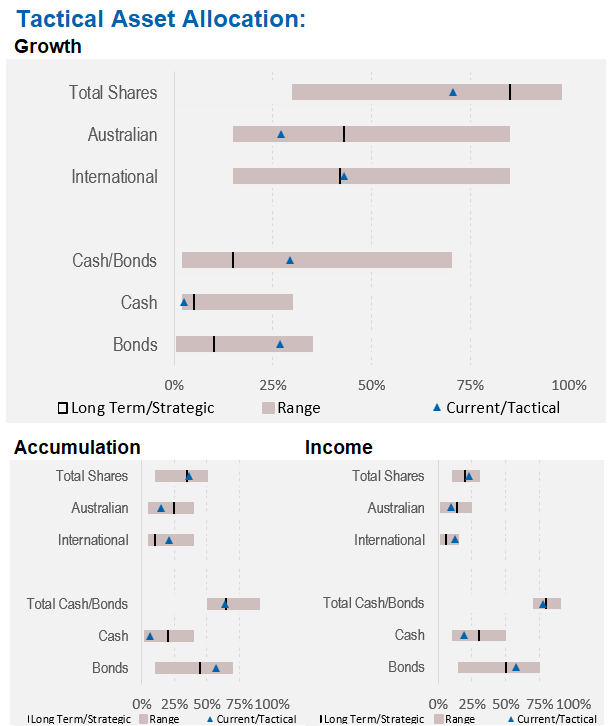

Asset allocation

We are underweight shares overall, significantly underweight Australian shares. We are overweight bonds, and with lots of foreign cash:

Performance Detail

Core International Performance

June saw a strong rally driven by US markets. Semiconductors were notably re-rated following their recent retreat. Currency was a detractor as the $A rose vs the US, but helped our European returns.

Core Australia Performance

Australian equities tried to follow global trends but our portfolio faltered toward financial year end as our defensive stocks dragged on performance after a number of good monthly contributions.