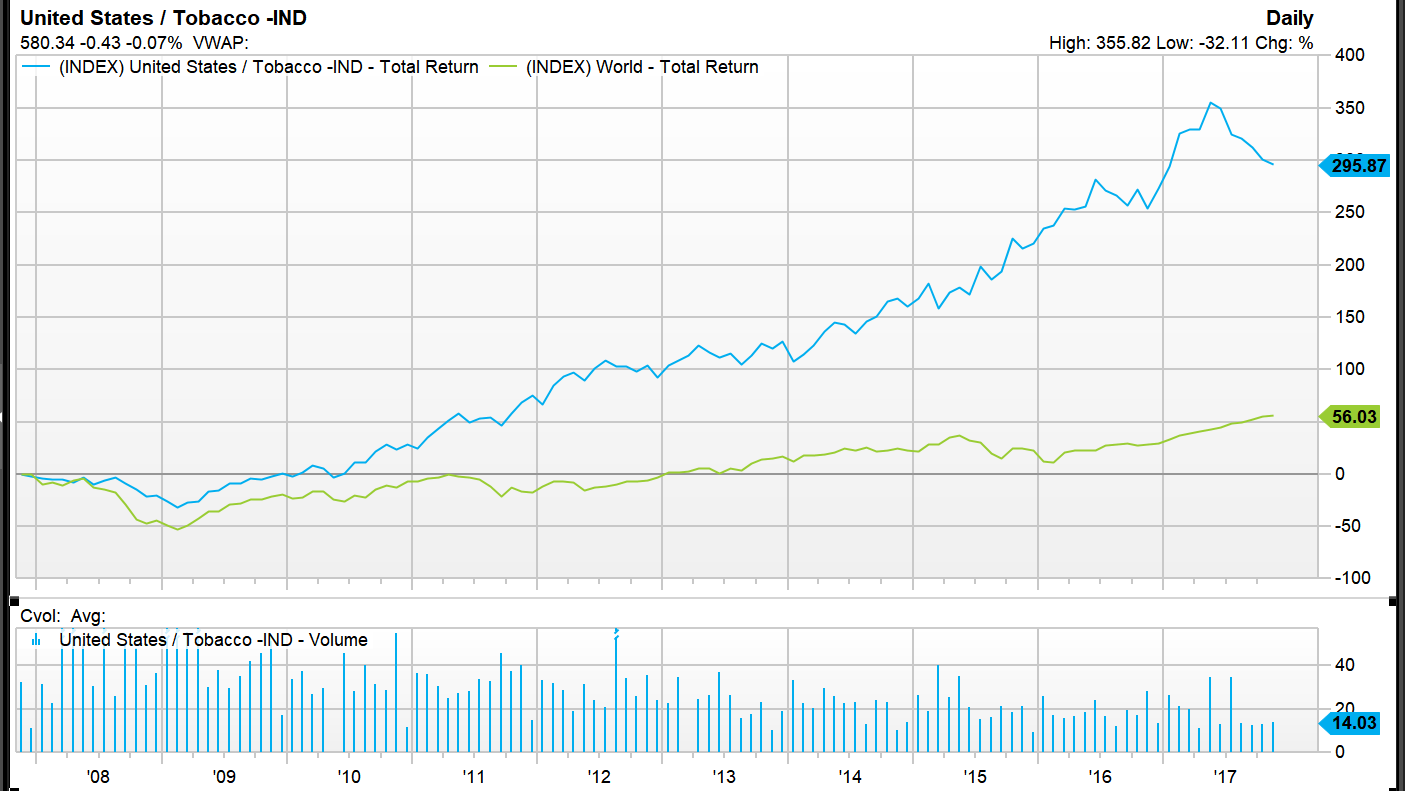

Stocks to short for your grandkids

Richard Bookstaber recently put out an interesting post on sectors that he thought had problems on a 30-40 year view. Richard is the author of a number of good finance books - I liked A Demon of Our Own Design: Markets, Hedge Funds, and the Perils of Financial Innovation and I have his new one The ...