Grantham: The cost of a conscience

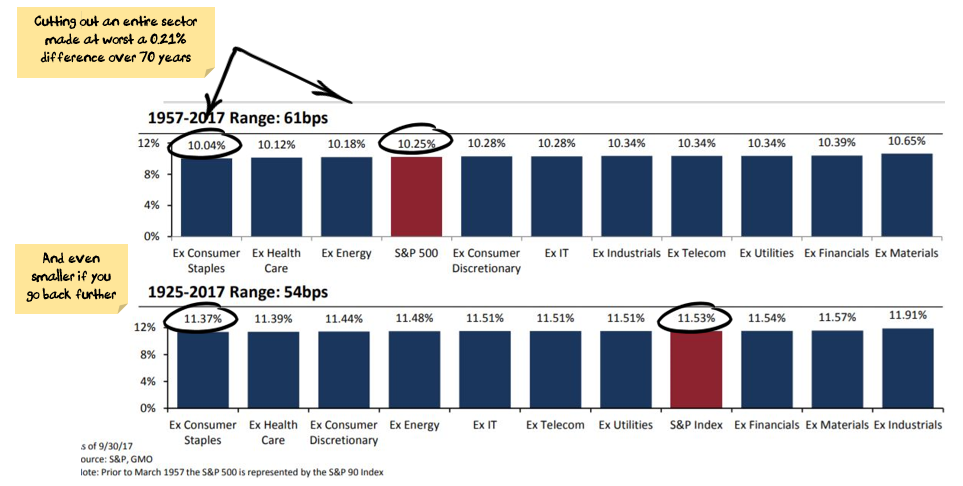

I belatedly found this slide deck from a GMO presentation from earlier in the year talking about climate change and investing at the LSE: http://www.lse.ac.uk/GranthamInstitute/news/the-mythical-peril-of-divesting-from-fossil-fuels/