July 2022 Performance

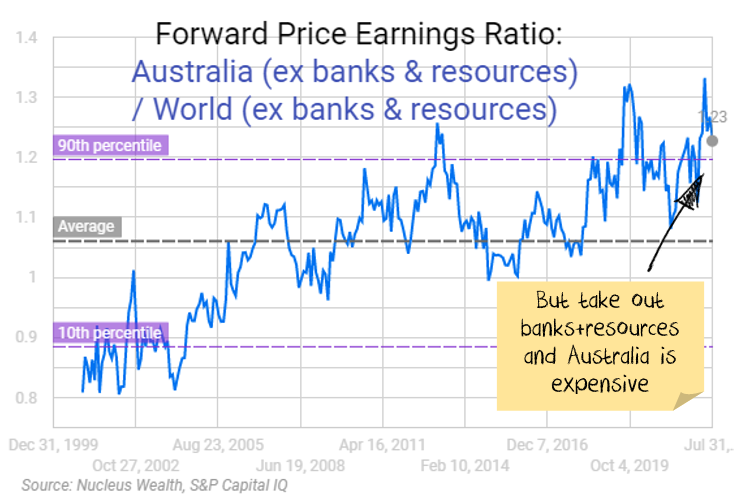

After crashing lower in June, stock markets staged a comeback in July. The ASX rose 5% and International stock markets rose 6.4%. While our Australian portfolio outperformed on the back of a lower exposure to resources, our international lagged the world market due to a lower exposure to tech ...