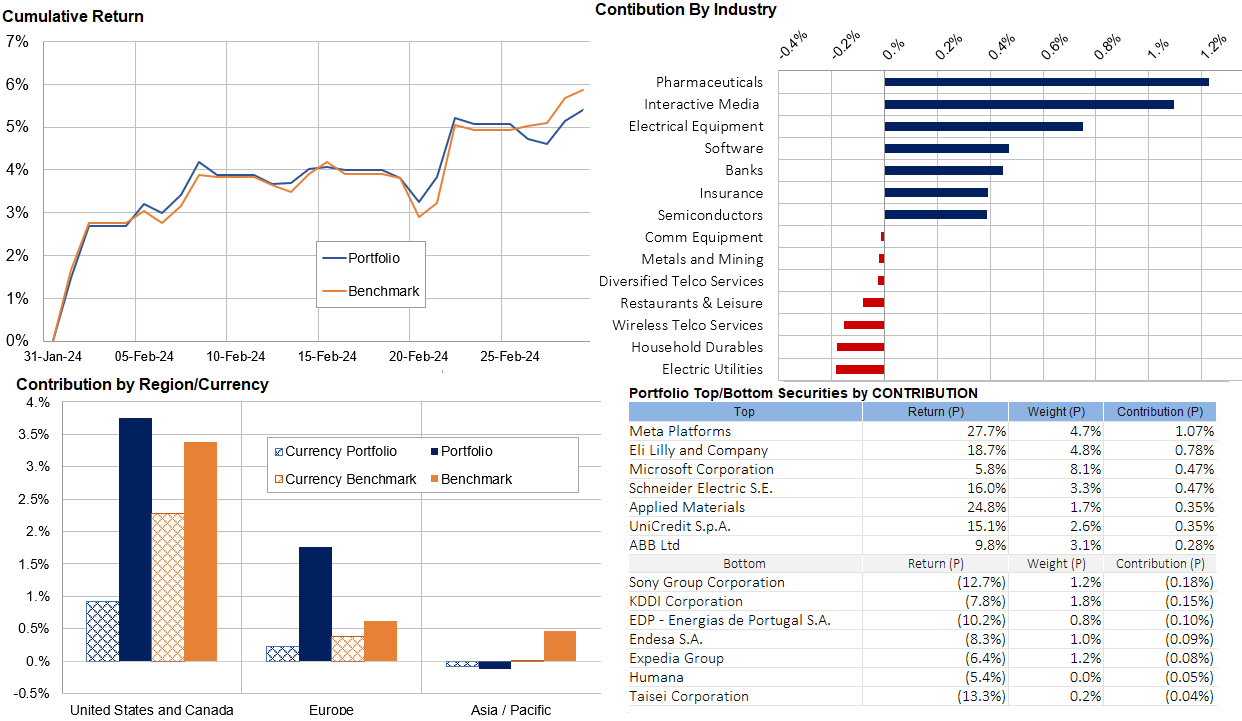

February 2024 Performance

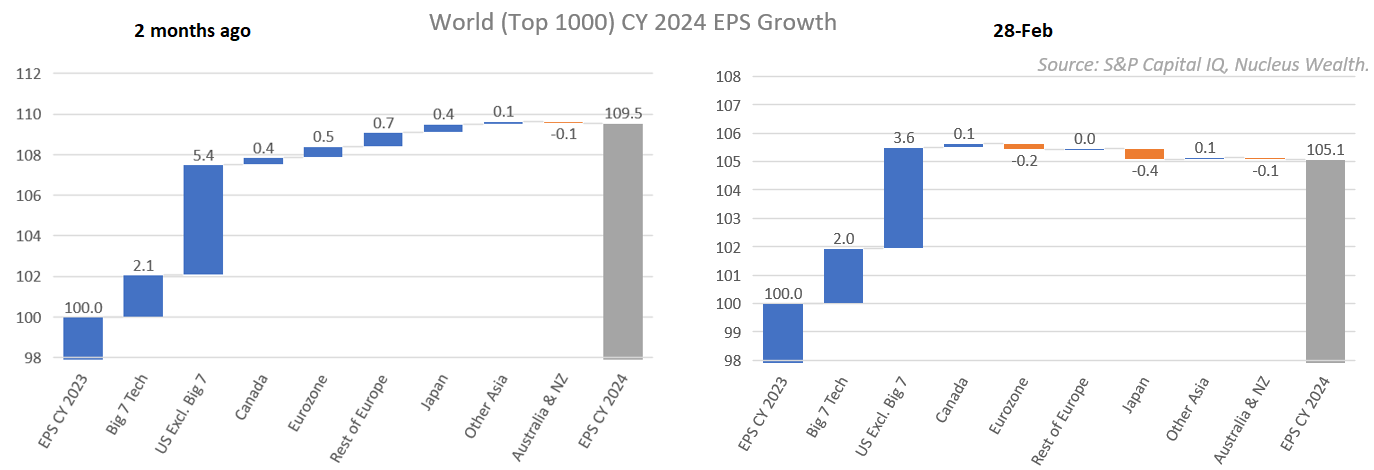

February was a strong month for all of our portfolios. Markets continue to rally and our heavy overweight to international stocks continues to support performance. International stocks are up almost 30% over the last 12 months vs Australia less than 10%. Our direct index international portfolio, ...