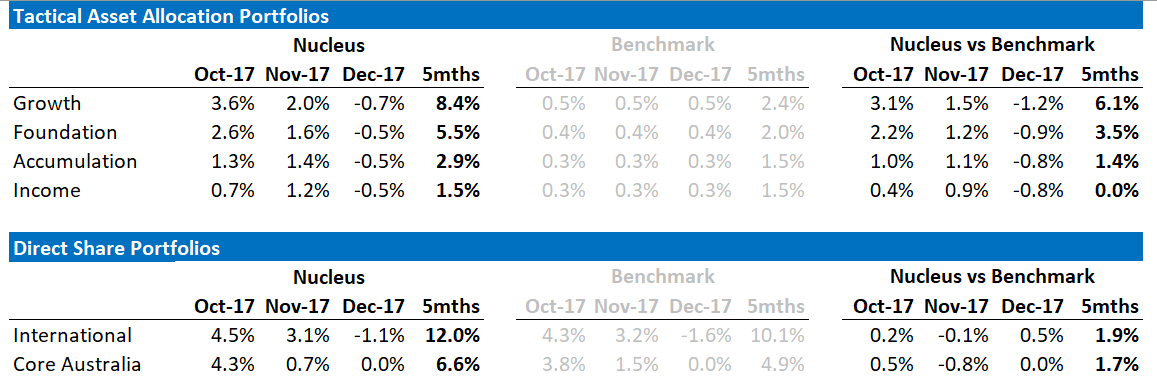

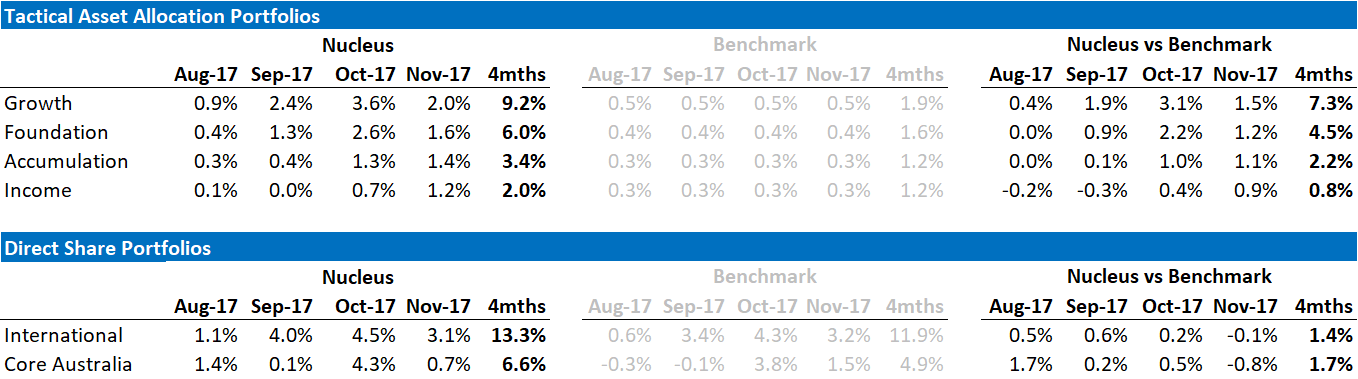

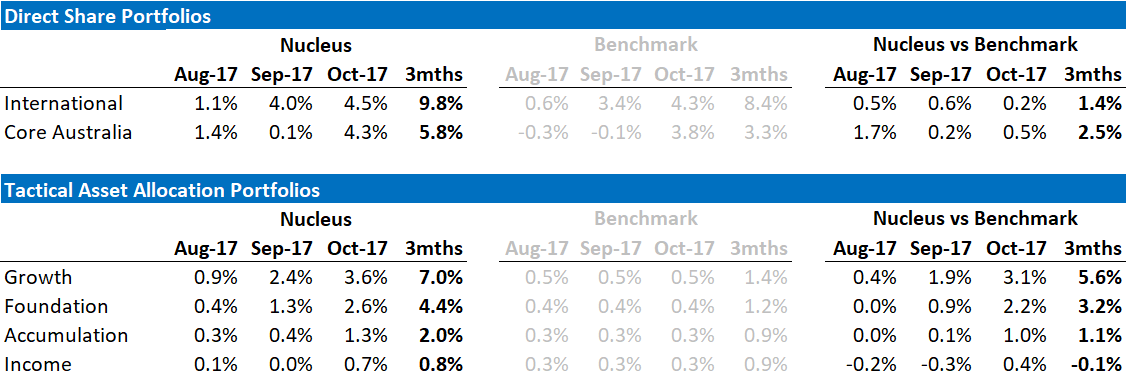

December 2017 Performance

Good news: Stock selection continues to support performance with our international portfolio outperforming a falling world market. Bad news: Statistically, December was the worst month so far for our Tactical Portfolios. Perspective: A 3-day fall in global shares (priced in AUD) between Christmas ...