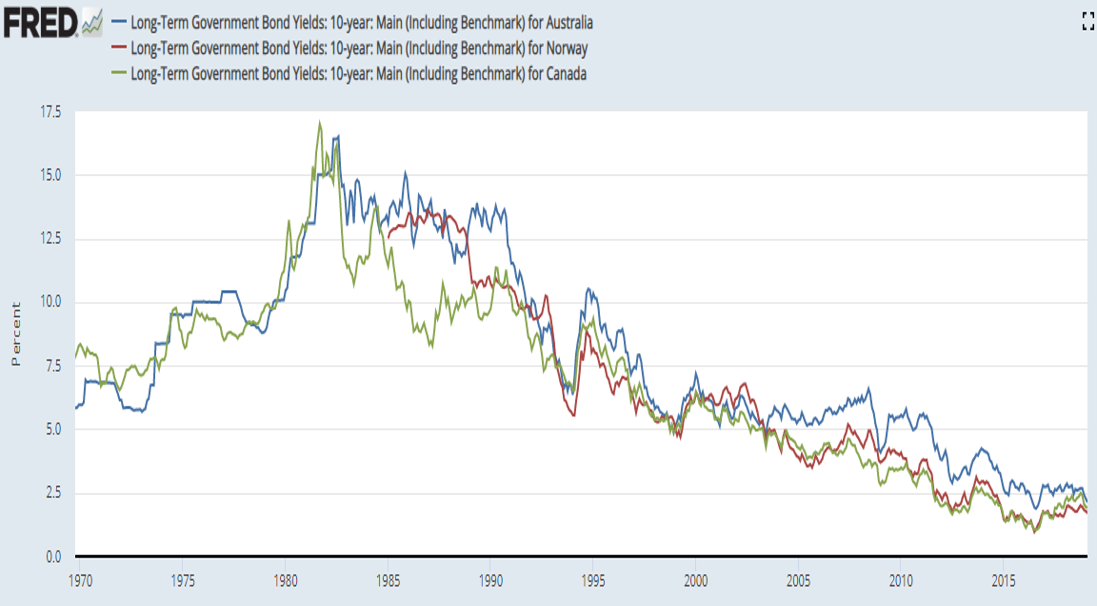

Bond Yields: Are we there yet?

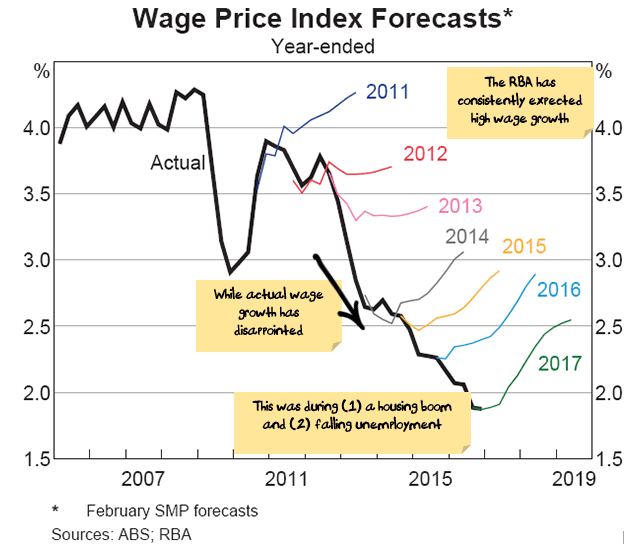

We have long been of the view that the Reserve Bank is misdiagnosing the economic environment and interest rates are not going up any time soon. Over the past few months, interest rate markets have joined our pessimism and bond yields have fallen - netting a tidy profit on longer-dated bond ...