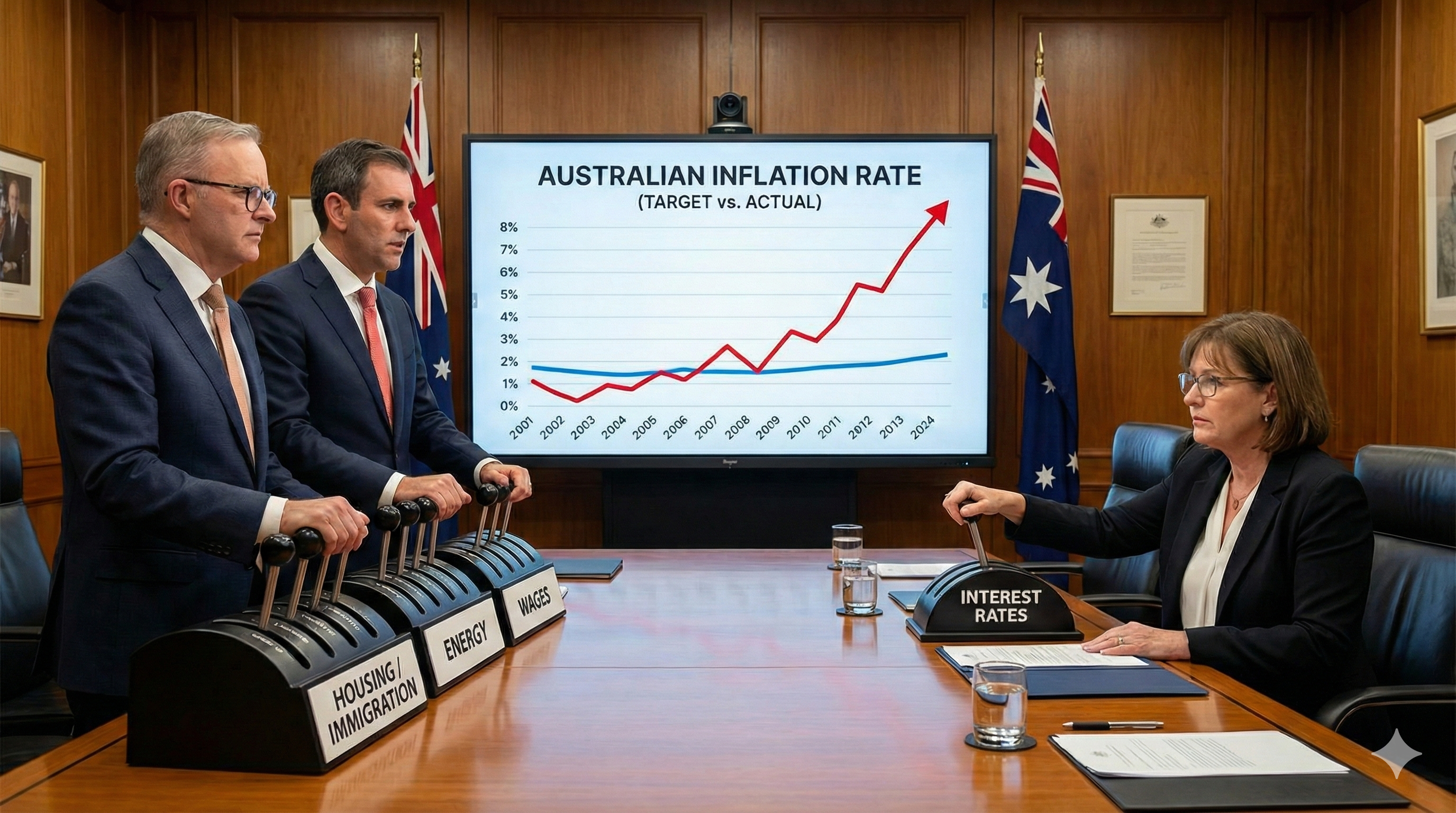

The investment consequences of higher Australian inflation

I’ve been watching Australia’s inflation story unfold with a mix of familiarity and unease. Each new data release feels like déjà vu: price pressures that refuse to cool, warnings from the Reserve Bank of Australia (RBA) that feel increasingly stern, and a sense that the path forward is narrowing rather than widening. As I look across the Pacific and see the U.S. Federal Reserve trying to talk itself into a rate cut, Australia appears frozen in place—locked into a stubborn inflation narrative that seems determined to stretch into next year.

What follows is an attempt to make sense of this policy stalemate: what’s driving it, what the RBA is really responding to, and why the economy looks uncomfortably like a slow-moving stagflation scenario. And importantly, where this all leads for markets and investors.

Australian Inflation Keeps Surprising on the Upside

The latest monthly CPI indicator for October showed inflation once again running hotter than expected. Headline inflation rose to 3.8%, up from 3.6% in September, and trimmed mean inflation increased to 3.3%. Both measures remain well above the RBA’s 2–3% target band. While the central bank places more weight on quarterly than monthly readings, the last quarterly print was hardly reassuring either—trimmed mean inflation came in at 3.0%, touching the very top of the target band.

Taken together, the monthly and quarterly indicators paint a consistent picture: inflation is not falling quickly enough to justify rate cuts anytime soon.

Markets increasingly accept that rate cuts are unlikely before mid-next year, and even that timing depends on one of two things: either inflation needs to drop meaningfully, or unemployment needs to rise sharply. Without a significant deterioration in the labour market, the RBA has little justification to ease, especially at a time when price pressures remain sticky.

RBA officials have repeatedly emphasised that they will only loosen policy when they are confident inflation is on a sustained path back to target. The current data gives them no such confidence.

A Different Policy Mandate: Why the RBA Doesn’t Behave Like the Fed

Investors often fall into the trap of benchmarking the RBA’s behaviour against the U.S. Federal Reserve. But the two central banks operate under different policy cultures and mandates.

RBA: Inflation First

The RBA’s dual mandate—price stability and full employment—often looks, in practice, like a hierarchy rather than a balance. Markets tend to perceive the RBA as heavily inflation-focused, giving limited weight to wage growth or employment softness until it becomes acute.

With inflation still above target and unemployment at 4.3%, the RBA has “perfect cover” to keep rates where they are. The central bank is also conscious of rising house prices and renewed speculative borrowing by property investors. Cutting rates into that environment risks reigniting one of Australia’s most persistent structural vulnerabilities: a housing market prone to boom-bust cycles fueled by cheap credit.

Federal Reserve: Employment First

The U.S. Federal Reserve, by contrast, is widely viewed as placing greater emphasis on employment conditions. With inflation falling more convincingly in the U.S., the Fed has scope to begin considering cuts earlier.

In effect, the policy instincts diverge: the U.S. is looking for reasons to cut, while Australia is looking for excuses not to.

When Would the RBA Cut?

Rising unemployment remains the one factor that could force the RBA’s hand. If unemployment climbs to 4.6% or above, it would exceed the RBA’s own forward forecasts—which project unemployment to remain near 4.4% through 2027. A meaningful overshoot would indicate that the labour market is weakening more quickly than expected, applying pressure for policy relief.

Second-Round Energy Inflation Keeps the RBA on Edge

Energy costs continue to play a significant role in Australia’s inflation profile, driven partly by the expiration of government subsidies that had temporarily softened electricity and gas bills for households and businesses.

This produces a chain reaction:

-

Government support rolls off

-

Electricity and gas costs jump

-

Business input costs rise

-

Firms pass these costs to consumers

-

Broader CPI categories experience secondary price increases

These second-round effects are exactly what the RBA worries about—because unlike one-off shocks, they propagate through the entire consumer basket and are extremely difficult to “trim out.” Australia’s trimmed mean reading captures these broadening pressures, which is why it continues to edge higher.

Wage Growth Divergence: A Policy-Driven Dilemma

Australia’s wage dynamics reflect an unusual imbalance. Private-sector wage growth sits around 3%, while public-sector wages are rising at almost 4%.

This matters for two reasons:

1. The Non-Market Sector Is Driving Wage Growth

The non-market sector—which includes healthcare, education, and the public service—accounts for over 30% of all jobs and is largely insulated from interest-rate pressures. Wage increases here are primarily dictated by government decisions rather than market forces.

2. Nearly All New Jobs Are Coming From Government-Funded Sectors

Since early 2023, almost four out of every five new jobs created in Australia have come from the non-market sector. This surge in government-funded employment is the main reason unemployment remains low, even as private-sector hiring slows under restrictive monetary policy.

The result is a form of policy conflict: the RBA is tightening to suppress demand and wage growth, but the government is simultaneously stimulating wage and employment growth in sectors outside the RBA’s reach.

This is why many economists argue that Australia’s inflation challenge is policy-driven, not demand-driven.

The Limits of Monetary Policy

Unlike fiscal authorities, which can adjust migration settings, housing policy, public-sector wages, and energy subsidies, the RBA has one primary tool: the cash rate. In the current environment, that tool is proving blunt.

Many of Australia’s core inflation pain points sit outside monetary policy’s immediate influence:

-

Housing costs driven by population growth and limited supply

-

Energy inflation driven by global markets and domestic policy shifts

-

Non-market wages shaped by government decisions

This policy mismatch contributes to what increasingly resembles a low-growth, high-inflation environment.

Australia Edges Toward a Stagflation-Like Mix

Australia is now dealing with an uncomfortable blend of:

-

Low productivity growth

-

Weak per capita GDP growth (negative in nine of the past 12 quarters)

-

Stubborn inflation

-

Rising unemployment

While not a perfect match for 1970s-style stagflation, the ingredients are there. The economy is slowing, but not in a way that reduces inflation cleanly. Instead, price pressures remain elevated because so many are structural or policy-driven, not cyclical.

The RBA has openly acknowledged this bind. It is trying to cool inflation without pushing unemployment too high, all while productivity languishes and household budgets remain squeezed.

Investment and Market Implications

High interest rates, while painful for borrowers, have important implications for markets.

Speculative Bubbles Are Harder to Sustain

The U.S. AI boom—one of the most pronounced equity bubbles of the last decade—relied heavily on cheap capital. As long as global rates remain elevated, speculative excess is harder to fuel. High policy rates act as a natural constraint on bubble dynamics.

RBA’s Next Move Is Likely Down—But Not Soon

The next rate move from the RBA will likely be a cut, but only when either:

-

inflation falls convincingly, or

-

unemployment rises sharply

Neither appears imminent, which is why mid-2026 is viewed as the earliest likely window.

External Pressures: China and Commodities

A weakening Chinese economy or increased supply from the Simandou iron ore project in Africa could push iron ore prices lower. This would weaken the Australian dollar, potentially adding imported inflation pressures that the RBA cannot ignore.

Valuations: Australia vs. International Markets

| Market | Valuation Characteristics | Key Exposure | Investment Stance |

|---|---|---|---|

| International | Bifurcated: AI sector at 25–30x P/E while the rest is average to cheap | AI | Overweight |

| Australia | Broadly expensive | Housing & commodities | Underweight |

Australia’s market tends to lag in tech exposure while remaining heavily tied to resources and property—two sectors that face meaningful macro headwinds.

Closing Thoughts: Watching the RBA’s Tightrope Walk

As I reflect on the RBA’s position, I find myself oscillating between sympathy and frustration. Sympathy because the central bank is clearly working with a limited toolkit in an environment where many inflation drivers are beyond its control. Frustration because the policy mix—fiscal expansion on one side, monetary tightening on the other—feels increasingly incoherent, leaving households caught in the crossfire.

But one thing seems clear: this standstill won’t last forever. If unemployment rises more sharply than expected, the pressure to ease will mount quickly. If inflation finally breaks lower, the RBA will breathe a sigh of relief. Until then, we’re all watching the same tug-of-war play out—hoping that the rope doesn’t snap.

If you'd like to take control of your strategy, you can register on our portal to access our professional-grade investment tools or book a call with our team to get advice on how to build a portfolio that is aligned with your goals.