March 2025 Performance

For the second month in a row stock markets have tumbled in the first week of the month. As such, last month’s performance is far less meaningful than current conditions.

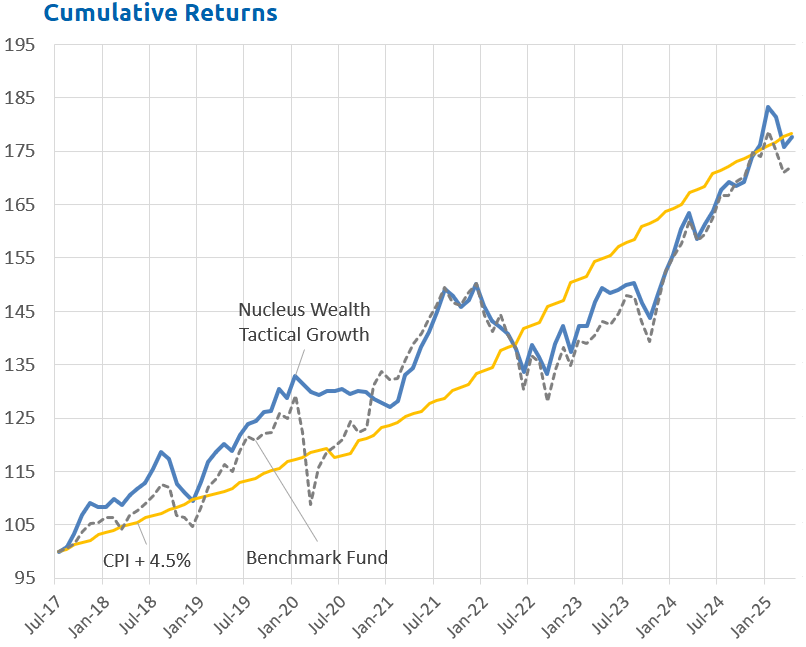

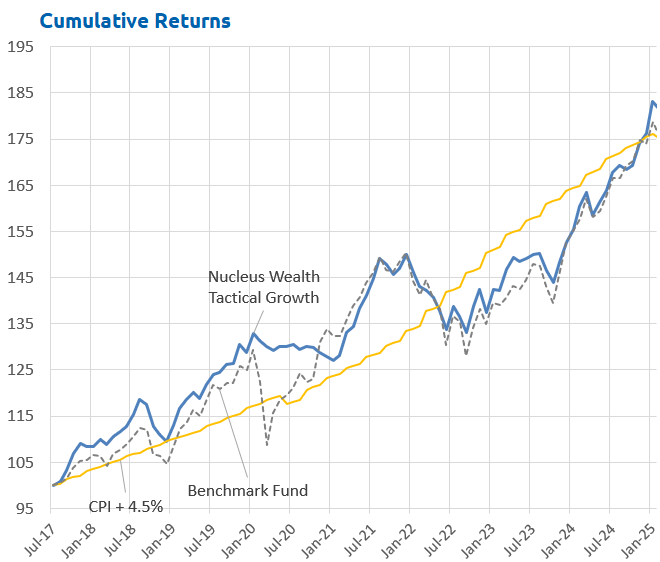

Our pitch to investors is that we want to lean into the cycle. Sell some stocks when they seem overvalued, switch into bonds, then buy them back when stocks fall. But we don’t go from 0 to 100 and back again. It is about leaning into the cycle, when we are more certain and returning to benchmark when not.

The damage so far

Broadly, in our tactical growth portfolio:

- The ASX is off around 15%. We were already 20% less than benchmark weight.

- Global markets are off 17-18% in USD terms, but the Australian dollar has fallen, so more like 10% for Australian investors. We are a little underweight international, relying on the Australian dollar to cushion the downside, which it has so far.

- Bonds are up 2–3%. We are overweight bonds, with a reasonable amount of duration.

- The Australian dollar is down 7%. We are holding around 8% in foreign currency and so benefitted from the fall.

The net effect is that the the typical growth multi-asset (or superannuation) fund is probably down around 11%, we currently 4(ish)% better than that at least. If we time the bottom right, then investors will have finished considerably ahead. But timing the bottom is easier said than done.

The trillion-dollar question

When to start buying?

It is true stock markets are currently on sale: 15-20% off their recent highs. But are stock markets offering a bargain? Or is the sale because earnings are about to become rotten?

The trade war will damage the economy. Analyst forecasts for 12%+ growth in 2025 and 2026 are wrong and will come down substantially.

Our base case is that consumers and small businesses will bear the brunt of the pain. The last few years have shown that larger companies are more likely to have the pricing power to shift most of the burden to others. But they won’t be immune.

The bear case for large companies is that this morphs into a deep global recession, weak growth smashing demand and increasing unemployment. However, the US Central Bank is reticent about cutting rates because of the impact of tariffs on inflation. The more reciprocal tariffs, the deeper the recession.

The bull case is a mix of various hopes:

- Maybe Trump will change his mind.

- Maybe Trump will be overruled by the House and Senate sometime soon. At worst in a little less than two years after the mid-terms.

- Tax cuts and stimulus are probably coming soon(ish). The mayhem around tariffs may accelerate the process.

- The US Fed may ride to the rescue with deep interest rate cuts and liquidity.

- The rest of the world remains OK, government stimulus and lower interest rates offset US weakness.

If this is the case then earnings are just trimmed, not slashed.

Our base case is somewhere in-between. Earnings get hit, growth slows markedly, then the calvary arrives with stimulus, interest rate cuts and tax cuts. Too late to save the economy from a sharp slowdown / mild recession, but early enough to avoid a deep recession.

Back-of-the-envelope maths

These numbers assume US markets are off another 4–5% Monday, as futures are indicating.

Global markets, ex financials and resources (after tonight) will probably be on 17.5x forward earnings:

That is bang on the average for the past 25 years. It will be 5% below the 10-year average. In the last few downturns, valuations bottomed out at levels 10-15% below today’s prices. But, that assumes no change to earnings. Take another 10% off earnings, and that would suggest markets could fall 20%(ish) from here if (a) earnings fall and (b) they bottom out at similar valuation levels to prior crises.

What are the big issues with that analysis? First, the earnings band of possibilities is wide. Really wide. A full-blown recession could see earnings off 25%. A mild slowdown might see earnings only off 5%.

More importantly, markets rocketed off those bottoms every time. You had a few days to grab those lows before they were gone. It is not realistic to expect that you can pick the bottom exactly.

Musings on the bottom

We are definitely looking at stocks today which we think are bargains. In a round number sense, at an S&P 500 index level of 4,600 is a rough target for wanting to buy – IF fundamental outlook is similar to today. That level will change if the outlook gets worse or better.

In the low 4,000s we are likely closing our eyes and buying stocks.

Australian thoughts

China may decide to re-stimulate the property market. It is bad policy. China knows it, but maybe China thinks it has no other choice. That is the key to watch. That would be a big positive for Australia. Otherwise, Australia is likely to suffer as China does.

Australia, as a small consumer and large exporter, lives in a glass house. It is unlikely to want to throw any tariff stones.

But, that means a flood of cheap goods will be diverted from the US to any country that will take them. Which will be another nail in the coffin for what is left of local manufacturers. And, the end of goods inflation. With weak global growth, energy prices will finally ease, and we expect rate cuts to be the order of the day.

This means a lower Australian dollar, lower interest rates. If immigration continues to be high, then house prices may well be strong.

Is there method behind the tariff madness?

I suspect less than you might like. But, there are suggestions of a “Mar-a-lago Accord” based on a paper by Stephen Miran, who is the Chairman of the Council of Economic Advisors. He has publicly said that people are reading too much into his paper. But, the Project 2025 authors said the same. So who knows?

The paper basically says the US dollar is too high and creates trade deficits. To fix:

- The US needs to create bargaining leverage. They can do this through tariffs and security zone withdrawal threats.

- Then, the US exploit the leverage. They do this through deals with individual countries to increase their currency / lower USD in return for lower tariffs / security “guarantees”.

The above is a greatly simplified summary. And there are a bunch of other assumptions and possible unintended consequences. But it seems like step 1 is largely complete.

The other broad macro outcome comes from Treasury Secretary Scott Bessent. Bessent is looking for 3-3-3. 3% GDP growth, 3% bonds and a 3% gov’t deficit. Basically, he wants to reduce the public sector and then release private sector through reduced regulation and less “crowding out“.

What can go wrong?

Both of the above plans ask for short-term pain in return for a longer-term gain. Slow the US economy down now in order to have it roaring by the mid-term elections.

There are three things that can go wrong:

- The theory might be wrong. In my view the broad thrust is OK, but the details matter. The argument that the pendulum has swung too far toward low tariffs might have merit. Particularly for countries like China. The response being to shove the pendulum further in the opposite direction than it has ever been doesn’t feel like the right answer.

- The execution could go wrong. The slowdown might spiral out of control. A well-articulated trade policy that uses high tariffs as a stick and low or zero tariffs as a carrot could well be the answer. Tariffs that are here one day, gone the next, and then back again on the third day are probably not the answer.

- Trump might change his mind. After a few months of short-term pain, could Trump fire Bessent and Miran, turning to a new economic svengali? Sure. Who knows what comes then.

What is the reward?

The perfect outcome for Trump is a Reagan/Thatcher-style economic boom as companies are set free. Earnings boom for stocks.

The alternative is stagflation. A low growth, high inflation economy. And maybe a reasonable-sized recession in the interim.

Markets have switched from pricing the former to the latter.

The difference in stock earnings is night and day between the two options. The real change in risk has been all about the execution of the plan. To put it lightly, complicated execution plans do not seem to be Trump’s forte.

Net effect

We are expecting company earnings to get hit, economic growth to slow markedly. Then we expect the calvary to arrive with stimulus, interest rate cuts and tax cuts. Too late to save the economy from a sharp slowdown / mild recession, but early enough to avoid a deep recession.

But, it is not not time to be dogmatic in our outlook. Markets are going to be volatile. The cavalry might arrive earlier, it might arrive too late. When it does, markets will probably rally faster than you have a chance to buy.

For buy-and-hold investors with a longer term outlook, you have a chance to buy at 25 year average valuation rates, and at a discount to the 10 year average. Absent a true disaster, returns are likely to be solid. Maybe you can time the bottom better, maybe not. It is worth considering.

Asset allocation

We are underweight shares overall, significantly underweight Australian shares. We are overweight bonds, and with lots of foreign cash:

Performance Detail

Core International Performance

March saw the Bear market in full swing, with all growth stocks in retreat and only defensives in positive territory. Currency only helped the European stocks as the AUD treaded water with the USD. Early in the month we pivoted toward Europe given the election results and bought German stocks, Bunzl, Gea and Wartsila.

Core Australia Performance

Australian equities pulled back this month in line with international trends, with growth stocks once again the poorest performers. We took some profits in Aristocrat, North Star and CBA early in the month.