Are you actually ready to invest?

Are you waiting on the sidelines for the right moment to invest if markets head south?

If your answer is yes, are you actually ready? You might think you are but there are things that you can do to make sure that if the opportunity arises you are truly ready and are not wasting days with things that could have been done earlier.

Often market bottoms happen very suddenly and they can bounce back quickly. The unprepared are often left waiting on the sidelines missing the best risk to reward opportunities. There is a conception out there that It is difficult to time the market but there are also some obvious signs that markets are bottoming or turning and professional money managers have a much better chance than retail investors at knowing and seeing these signs.

An example is a very large volume down day or series of down days but the market refuses to fall any further. This is where the dumb money is panicking and selling and the smart money is buying. This is effectively creating a floor in the market where the professionals are buying up from all those that are willing to sell at those levels. The market then rebounds to the upside once all the excess supply is absorbed. When all the people that were going to sell have sold already often there is very little resistance (selling) left for the market to move higher. That is why markets can rebound quickly and often do so on low volume.

Here are some practical steps you can take to ensure you are actually ready and don't miss out.

Do you have an account open with Nucleus Wealth?

If not you can set up an account through our onboarding portal here. It only takes about 15 minutes to create an account if you have all your details at hand. Once you have submitted your account, it usually takes about 1-2 business days for us to open the account with our trading partner Praemium. Once open, we then send you your account details and the BPAY details with the account funding instructions. Once you fund your account via BPAY it can take up to 2 days for the money to arrive in your account. Once the money lands in your account we will automatically trade the next business day according to the portfolios selected (self-directed) or recommended (limited advice).

As you can see, this whole process takes time. If you think the market is bottoming and you don't want to wait two days for BPAY and another for trading you can always fund your account now, instructing us to wait in cash until you think the market has bottomed. We will let you know what we are doing and when we are buying via our blogs and podcasts but this is ultimately up to you to decide if this is your strategy.

You want to have everything in order ready to pull the trigger and gain a good entry point if this is what you are waiting for.

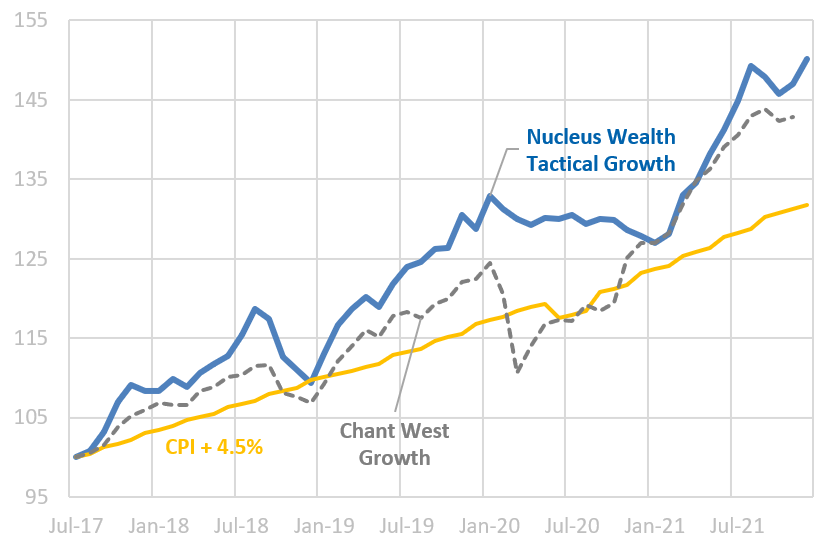

It’s also really important to note that market timing is Nucleus Wealth’s bread and butter. It’s the basis of our flagship Tactical investment models. In these, we dial up and down the amount of defensive assets (cash and bonds) and vice versa growth assets (shares) depending on the market view of our internal investment team. This is designed to allow you to employ a professional investment management team to watch these events all day and every day, to relieve you of the stress of having to do it yourself. Click here to see how the portfolios work in more detail.

Currently, we are heavily weighted towards cash and defensive assets waiting for the right time to reallocate this into growth assets. As mentioned we manage this market risk for you and time the market on your behalf. If you are a long term investor and are ready to invest this may be the best strategy as by doing this you are outsourcing the management of your funds to a professional money manager.

If you need any help setting up your account or want clarification on how our portfolios work please book a call with me or the team here.

One final point to note is that sitting in cash, waiting and hoping for a market correction is not a great strategy and the opportunity cost is you may be missing out on higher returns. People can be left on the sidelines for years waiting for the right moment to invest and the evidence shows that you are better off just putting your capital into the market and riding out any volatility or market corrections. Please have a read of this article here that addresses this in more detail.

Samuel Kerr is a Senior Financial Adviser at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Samuel Kerr is an Authorised Representative of Nucleus Advice Pty Limited, Australian Financial Services Licensee 515796. And Nucleus Wealth is a Corporate Authorised Representative of Nucleus Advice Pty Ltd.