Aussie inflation gauge plummets

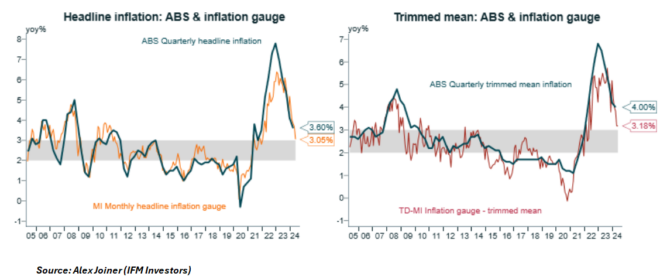

The Melbourne Institute’s headline and trimmed mean inflation gauge continue to lose steam.

While May's print was solid (i.e., 0.33% headline, 0.28% trimmed mean), it was far less strong than at the same time in 2023 and 2022 (at 0.8% month-on-month and 0.7% month-on-month) at the trimmed mean level, respectively.

These base effect impacts saw the year-on-year inflation gauge "plummet on all measures", according to Alex Joiner at IFM Investors, to 3.05% headline and 3.18% trimmed mean.

"The quarterly pulse is also relatively soft", noted Joiner.

The next chart from Justin Fabo at Antipodean Macro shows that the "net share of Melbourne Institute’s inflation gauge basket rising in price has fallen steadily and was at a relatively low level in the three months to May":

When viewed alongside the run of weak economic data, which will be augmented by Wednesday's Q1 nation accounts, it suggests that rates will remain on hold for the time being.