Waiting for Godot

The definition of luck is just the combination of preparation and opportunity. When it comes to financial markets, it is easy to look back on historical charts, pick a low point and say, “If only I had the funds available on this particular day, I would have picked up the bargain of a lifetime and made some money”.

This scenario is why people decided to sit in cash (or an equivalent, like a term deposit), hoping for that unlikely but possible major correction that provides the opportunity to buy at fire-sale prices. And who could blame them?

The reality, unfortunately, appears to be a little different. If we use the most recent market correction, March 2020, as an example, both the extreme volatility of the stock market, combined with the fact that the global pandemic had just begun, left a lot of investors with little appetite to throw caution to the wind and dive into equities.

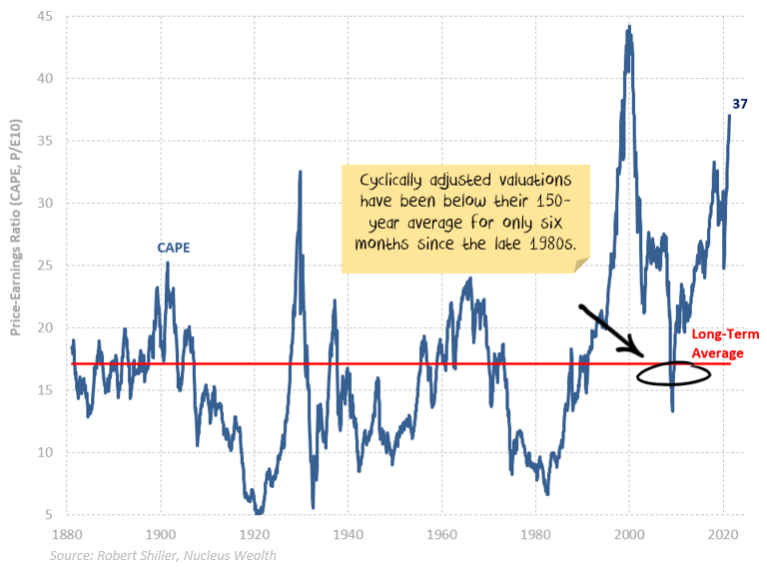

An often-cited metric for determining the stock price is the Cyclically Adjusted Price/Earnings Ratio (CAPE), which indicates the comparative worth of shares now against the ten year inflation adjusted earnings. Quoted in ‘times earnings’, shares generally may be cheap at 10x (or ten times earnings), fair value 20x and expensive 30x.

Continuing on with the Pandemic Crash example, during this time, the market CAPE fell, of course, but only down to an historically expensive level.

Say in the late 1980s you decided to only buy shares if they were below average on a CAPE basis. In the last 33 years, you have had one chance to buy shares and would have spent the remainder of the time out of the market!

Valuation is important, but strong earnings growth can offset its importance.

Growing into valuations

It is well known that the market diverged from reality, tearing away and ignoring the calamitous potential that COVID could (and arguably did) have on many economies across the world.

Presently, valuations look high, no question. However, there is a growing risk that corporate earnings, fuelled by COVID related belt-tightening, record low cost of capital for growth and economies re-emerging from their pandemic slumber, may now actually grow into these valuations. In this case, anyone still on the platform holding out for the next opportunity to step into cheap markets will stand to miss out on significant returns.

So now the question remains, when is the next one? The correct answer is ‘nobody knows, and therein lies the actual risk. How long can an investor suffer paper losses by being out of the market (also known as opportunity cost) whilst waiting for the subsequent correction in a time of rock bottom returns on cash?

As most portfolio managers know, the answer can lie somewhere in the middle. One of the more common mistakes investors make, either through inexperience or a lack of time to properly devote to the practice of investing, is to forget about the ability to hedge out risk.

In this case, keeping a certain amount invested means that if they are wrong about the central decision, there is still some exposure in the event of onward marching prices.

Tranching In

One approach is to ‘tranche in’ capital, starting with a small percentage to ensure the above. As long as the investment is liquid enough, it can then allow either additional increases or decreases as the ensuring situation dictates. This approach also lowers the likelihood that, regrettably, the investor sits entirely out of a stock market price cycle.

If you feel you may be in a similar situation, are less than enamoured with cash like returns for the foreseeable future and want to do something about it, feel free to book a call or check out what a starting investment can look like for your circumstances through our no-obligation online onboarding portal.

Tim Fuller is Head of Advice at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Tim Fuller is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd - AFSL 515796.