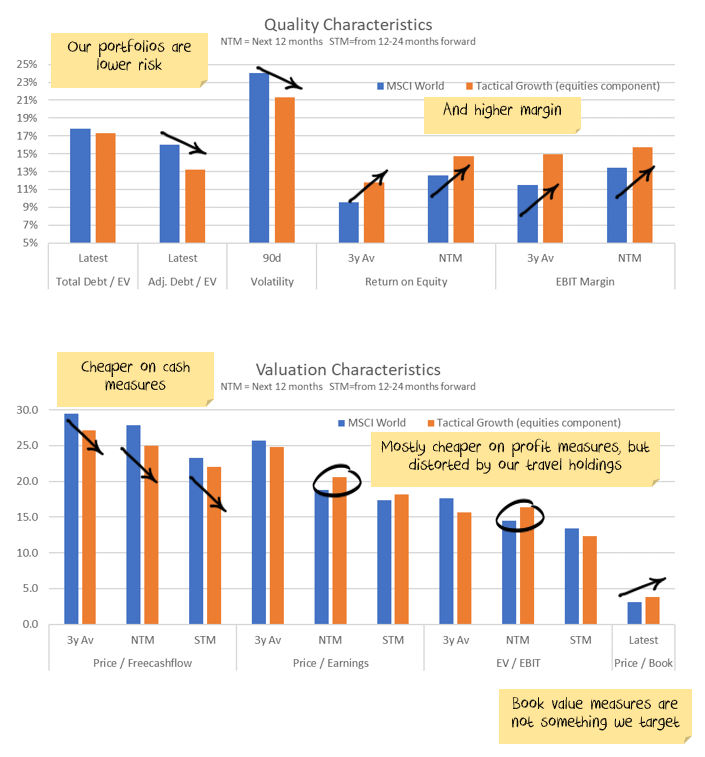

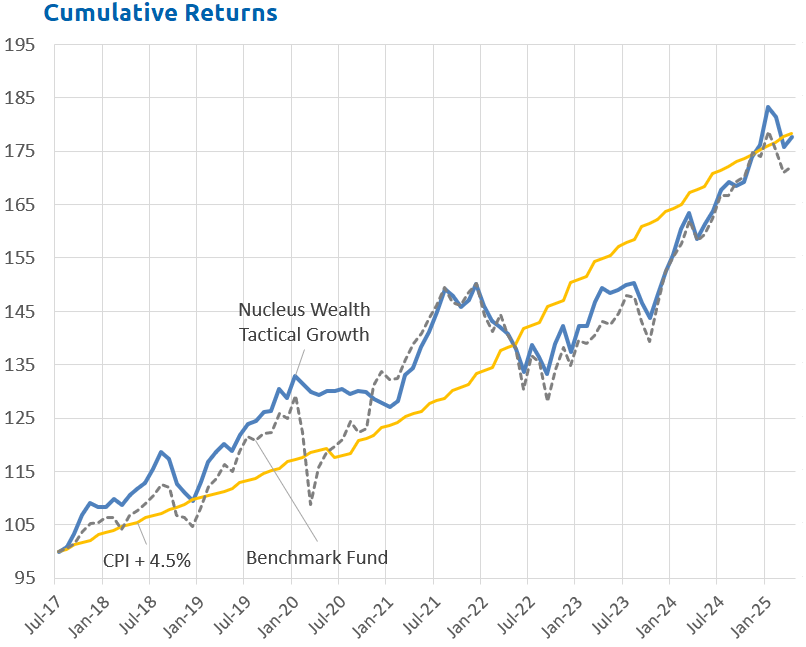

While December itself was weak, the 12 months ending on 31 December were a good year for international stocks. Being overweight internationally, with a healthy exposure to AI, our portfolios all outperformed their benchmarks. Our international fund finished up 20%, and our Australian fund finished up around 9%. Our tactical growth finished up around 11%. All of our funds look attractive relative to their benchmarks, especially as they were all significantly less volatile than the market.

January has seen some of the heat come out of prices, but the key story leading into reporting season is the strength of company earnings underpinning the market. While there are economic problems in many countries, they are mostly affecting consumers and workers - companies are doing pretty well.

Company Earnings vs Politics

There is a pretty big divergence in the state of politics in countries across the globe and company earnings.

There is clearly economic pain, or at least fear, among consumers and workers. Combined with fear of AI and immigration, historical political relationships are undergoing a turbulent reshaping.

In contrast, company earnings are looking really strong. Maybe a reasonable amount of that is causation rather than correlation? Higher company profits usually mean greater economic inequality. Greater economic inequality usually means more political turbulence.

As investors, we need to do three things:

- Separate political concerns from economic concerns.

- Separate economic concerns for households, governments or small businesses from economic concerns for listed companies

- Recognise when a system is fragile and could reach a breaking point

My take is that we are in a weakish growth phase, but company profits are booming. Politics is fraught, and needs to be watched closely.

Q1 earnings are about to start, and look good

Stocks are expensive on most simple metrics.

The question is whether earnings can grow fast enough to justify those prices. For now, the answer is yes. Forward earnings—the best simple proxy we have—is rising at a rising rate:

What stands out today is that the tail of the forecast curve is moving up fast. The second half of next year’s earnings estimates have climbed at one of the steepest rates in the last decade and a half. The early numbers for the year after that are also rising.

Early‑cycle optimism is not unusual. But, magnitude is notable. On current trajectories, we could see mid‑teens earnings growth if these trends hold. That is extraordinary this deep into a cycle.

Will it hold? Never bet the farm on a point forecast. I treat analyst estimates as a weather radar: useful for direction, unreliable for precision at long range. We have seen 15% growth expectations fade to flat within a year when conditions changed. The same could happen again. Watch the slope of forward revisions, and dig into the breadth.

Are upgrades concentrated in a handful of mega‑caps (mostly, but not exclusively), or are they broadening across sectors and regions? Breadth matters more than style narratives.

Right now, the AI‑driven capex wave remains intact. The ecosystem around it—semiconductors, cloud infrastructure, software, power equipment, and even parts of industrials—keeps printing solid numbers.

Margins are resilient despite higher wages, in part because pricing power has improved in concentrated industries and because the demand mix has tilted toward high‑margin digital products and services. Buybacks remain robust. Balance sheets for large caps are healthy. Interest expense is rising, but refinancing has been orderly.

This is the engine under equity prices. If it continues to hum, valuation worries can ease over time without a price crash. Fundamentals catch up. The risk is a rollover in the earnings line.

What could break the earnings story?

- A policy shock that endures. Tariffs that lift input costs and depress demand at the same time. A tax change that hits cash flows. A regulatory swing that curtails investment in a key growth area.

- A demand shock. If the consumer slows sharply and services spending stalls, revenue growth will slip. That would expose margins that look fat today.

- A financing squeeze. If high‑yield spreads gap and banks tighten lending standards more than they already have, small and mid‑sized firms will cut capex and headcount.

- A supply constraint that proves binding. AI is power‑hungry. Data center build‑outs require transformers, switchgear, and grid upgrades. If the bottlenecks worsen, revenue timing slips.

None of these are base case today. All are live risks. That is why I keep my eye on forward earnings, on breadth, on capex plans, and on credit spreads. When those turn, price follows.

Politics are going through a transformation

Against that earnings backdrop, politics feels both loud and fuzzy.

In many ways it comes down to Trump. But there is a lot going on elsewhere as well. Japan, Australia, Europe all have their problems.

The question of whether the U.S. president is fit to govern has regained heat. Each press conferences seems more rambling than the last.

Nobody seems to agree on what to make of Greenland’s bizarre cameo in the news cycle. It is messy. It is distracting. It adds to volatility.

This is where a simple rule helps me: separate talk from text. Markets overreact to talk. They should react to text. The “taco trade” captures this well. The idea is that when a leader announces an extreme policy, markets panic on headlines. But the leader then backs off, or institutions blunt the blow, and the policy is diluted or delayed. Traders who bought volatility on the headline and sold the panic often did well. Investors who dumped risk at the lows bought back higher days later.

There is truth here. But the taco trade can morph into a trap if you confuse showmanship with impotence.

Real policies do get implemented. Tariffs can stick. Alliances can fray. Institutions can fail to check rash decisions.

The U.S. system has checks and balances. It also has partisan incentives that can mute those checks. That is why I treat political risk as a fat‑tail distribution: low probability in any single week, high impact if it materializes.

Tail risks abound

- A durable tariff regime that raises costs across supply chains and provokes credible retaliation from Europe. A U.S.–EU trade war would not be a sideshow. It would hit autos, machinery, chemicals, and services. It would dent confidence and capex.

- A meaningful fracture in NATO. Even a serious threat to withdraw support would force Europe to rethink defense burdens, debt issuance, and industrial policy. That would ripple through currencies and rates.

- Domestic institutional stress. If rulemaking is sidelined in favor of unilateral edicts, if independent agencies are bent to political ends, then policy volatility rises. Businesses delay decisions. Multiples compress.

Balance that against two important constraints. First, markets themselves act as a brake. Trump is sensitive to stock market reactions. When equities swoon and credit spreads widen, rhetoric often softens. Second, the machinery of policy is slow. Most big changes have to pass through comment periods, court challenges, and congressional action. That lag creates time to reassess, reposition, and hedge.

So how do I put these threads together? My base case is simple: earnings strength supports risk assets, while rate normalisation—including in Japan—remains a headwind but not a killer.

Political risk is a tail that can wag the dog now and then. It is not, by itself, a reason to exit markets without a clear, durable policy path to justify it.

This is not a call for complacency. It is a call for discipline. Evidence, not noise, should drive changes in posture. In practice, that means I am watching a focused set of indicators and I am prepared to act if they flip.

Key things to watch

On earnings:

- Focus on forward 12‑month earnings and the slope of revisions. Up is good. Down is a warning.

- Look for breadth. Widespread upgrades beat a narrow AI‑plus‑a‑few story. If breadth improves, the market’s foundation strengthens.

- Examine margins and unit labor costs sector by sector. Resilient margins in the face of cost pressures suggest real pricing power. Cracking margins say the opposite.

- Track capex plans, especially in AI infrastructure and adjacent industries. Delays signal demand fading or supply constraints biting.

On politics:

- Separate rhetoric from rulemaking. Executive orders, formal notices, draft rules, and legislation matter more than press conferences.

- Watch hard policy markers: tariff schedules, quota rules, procurement guidance, and NATO commitments. These change incentives and cash flows.

- Study market reactions across assets. If equities drop but credit spreads and rates shrug, the move is probably noise. If credit spreads gap, the risk is real.

The net effect

What does this mean for actual positioning? I still want exposure to the earnings engine. High‑quality companies with strong balance sheets, free cash flow, and pricing power belong in the core. I want selective duration in sovereign bonds for ballast when growth scares hit, but I am wary of the longest maturities in markets where policy is shifting.

Diversification across regions, with awareness of trade‑sensitive sectors that could suffer in a tariff‑heavy world. Currency risk deserves closer attention than it got in the 2010s. If the yen strengthens on rising yields while U.S. rates drift lower, cross‑asset correlations will look different.

All of this comes with a humility clause. Forecasting is hard. The goal is not to call every wiggle. It is to prepare for the scenarios that matter. Japan’s long bond is not a trivial story, but I do not see it as the fulcrum of global risk today. Earnings are. The political theater is a source of volatility, sometimes a source of opportunity, and occasionally a source of genuine danger. Respect it without letting it drive every decision.

The market often rewards those who can hold two truths at once: yields can rise, and stocks can go up if earnings outpace the drag, and political noise can be loud while policy change remains slow. This week’s moves reinforced both truths. Watch closely, stay flexible, and let the numbers, not the narratives, lead.

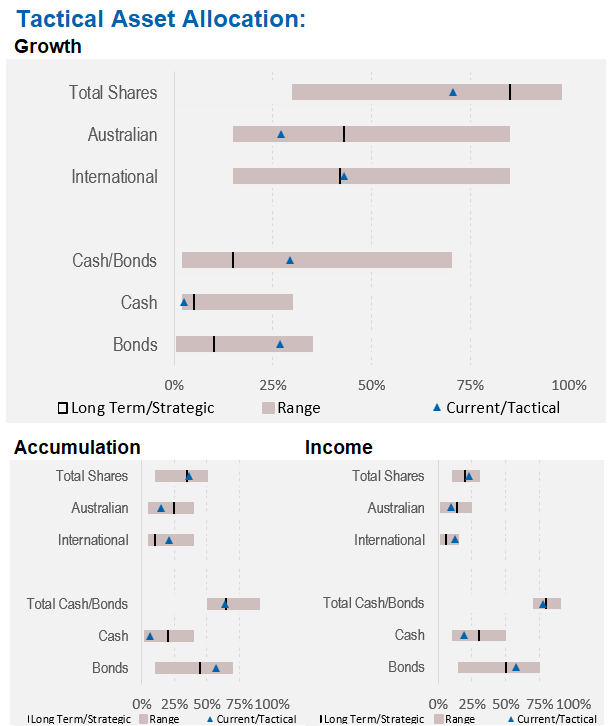

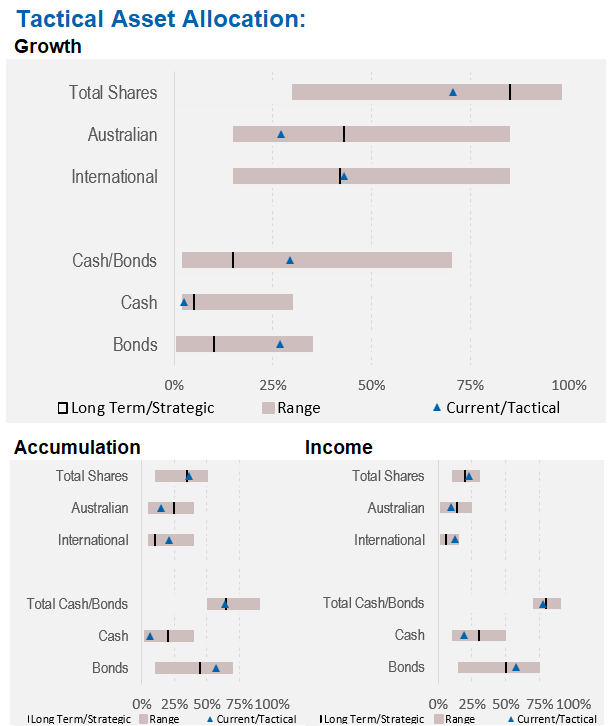

Asset allocation

We are a little underweight in shares overall, significantly underweight in Australian shares. We are market-weight bonds, with a little foreign cash:

Performance Detail

Core International Performance

The year ended on a downward beat as US stocks pulled back, while Europe had a good month. Currency was an overall detractor as $A strengthened.

Core Australia Performance

In December, the financial stocks recovered as the growth stocks lagged.