September 2025 Performance

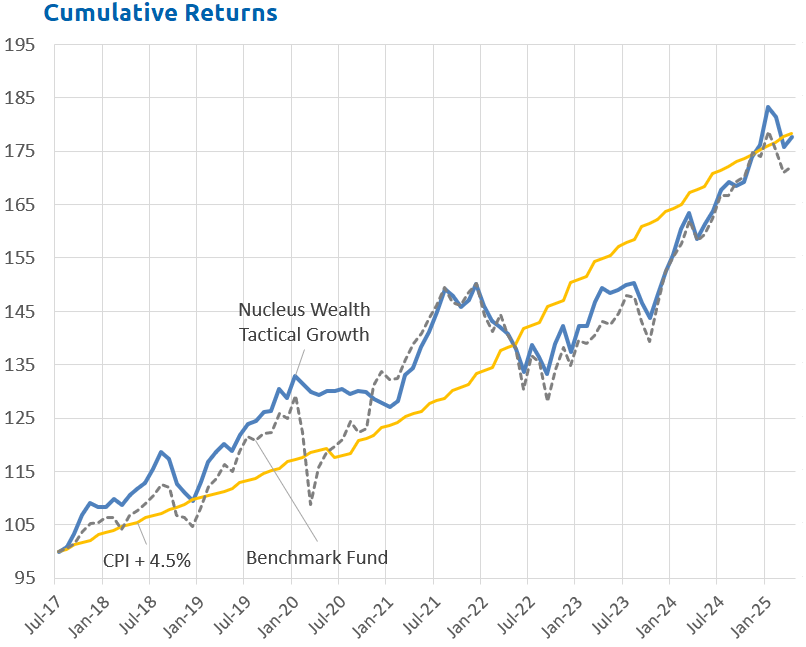

The 12 months ending 30 September were volatile. But, after all was said and done, our international fund finished up 25%, our Australian fund finished up over 10%. Our tactical growth finished up over 14%. All of our funds look attractive relative to their benchmarks, especially as they were all significantly less volatile than the market.

But the outlook is as uncertain now as it has been any time in the last few years. Putting together an investment strategy in this environment is difficult to say the least.

Contradictions abound

As is the usual state of affairs under Trump 2.0, there are plenty of contradictions that investors need to grapple with:

- Company earnings can be dramatically different to GDP growth. Currently, earnings look far stronger than the US economy.

- Politics in the US is fraught. The current trajectory is toward a considerably more dictatorial regime. That doesn't mean a weaker economy/stock market (at least in the next few years). But extended government shutdowns and civic strife would.

- Regulations have been removed. Potentially enough to create future risks for consumers. But, company earnings will be higher.

- Tariffs are pushing up inflation, and reduced immigration is pushing up wages - both short term effects. But a weaker economy due to the same effects reduces the medium term risk.

- Governments around the world seem much more comfortable spending money and going into debt. Long term yields are rising, increasing the capital cost for companies. But, company profits are likely to be the key beneficiary.

- Valuations are extended. But, only really for a handful of the largest stocks. Small, medium stocks are arguably below average in valuation. And the largest stocks have the best growth.

Net effect: position for an earnings boom, keeping a close eye on economic landmines.

The two most topical contradictions are the first and the last:

Currently, corporate earnings look far stronger than the US economy

The central message is counterintuitive: stock markets and the real economy often travel on different tracks. GDP growth is a poor guide to equity returns across both developed and emerging markets. Index structure, firm concentration, foreign revenue exposure, policy regimes, and sectoral balances do more to shape equity outcomes than headline GDP.

In the United States, these forces are powerful and as diverse as they have been in a long time:

- Large-cap, global firms dominate the index and harvest significant profits from abroad. A weaker dollar can lift earnings even if domestic growth slows.

- Fiscal deficits support corporate profits at a macro level. You can think of US economy as being (mostly) three entities: Government, Households and Businesses. The government is running large deficits, households are muted in spending, which means surpluses for Businesses.

- Trade frictions favour large, diversified firms over smaller, domestic ones.

- The AI capex boom is concentrated. It channels cash to a handful of large suppliers and platform owners.

The result is a market that can rise—even when parts of the real economy feel flat. Or vice versa.

INSERT CHART

Extended Valuations and their three caveats

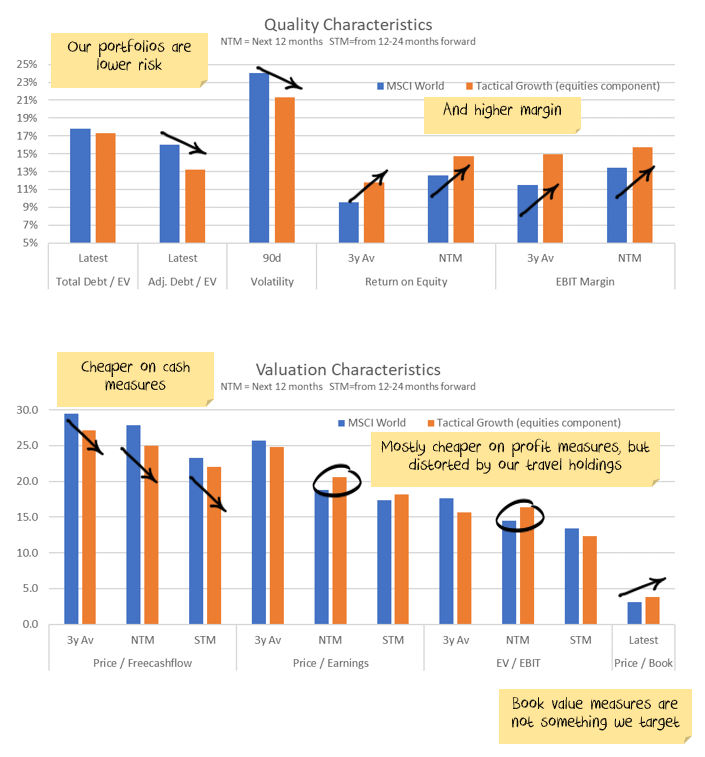

Headline market valuations, particularly when measured by forward price-to-earnings (P/E) ratios, suggest that stocks are expensive. However, when we separate companies into groups based on their size, it becomes clear that only the biggest stocks — typically high-growth, mega-cap technology and consumer firms—are pulling overall averages higher.

Caveat 1: The mega-caps are expensive, but others aren't

Caveat 2: Within mega-caps, some of it is just sector allocation

Caveat 3: Within mega-caps, maybe it is the growth outlook?

What does this mean for stock selection?

The sustainability of today’s tech-driven expansion is the key variable. Two broad scenarios are possible:

-

A whimper: Growth slows as orders for early-stage companies in data center infrastructure taper off, leading to a gradual deceleration.

-

A bang: Excessive valuations and funding shortages eventually hit unprofitable tech firms, triggering a sharp unwind reminiscent of past cycles.

Valuations today are a study in contrasts. The giants look stretched, but much of the market sits at fair or even attractive levels. That means investors aren’t forced into an all-or-nothing stance—they can lean into areas where multiples remain reasonable while avoiding the extremes.

Cycles never end on schedule, and expensive doesn’t always mean imminent collapse. Tech strength may keep pulling indices higher for longer, especially with falling rates and subdued growth elsewhere. But earnings revisions, not headline valuations, will decide which companies deserve their price tags.

Right now, the opportunity lies in the middle ground: quality businesses outside the most crowded names, trading at fair prices with sustainable growth. Staying invested, but selective, is the strategy that best matches today’s uneven market landscape.

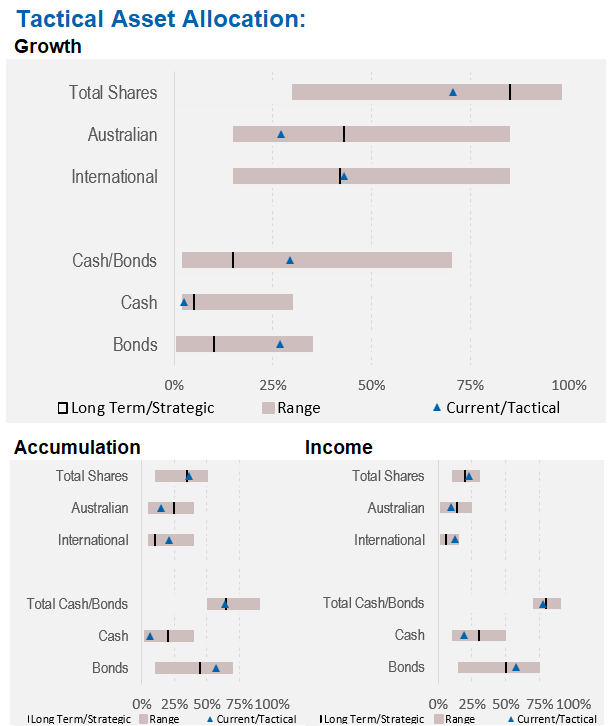

Asset allocation

We are underweight shares overall, significantly underweight Australian shares. We are overweight bonds, and with lots of foreign cash:

Performance Detail

Core International Performance

September saw the bull-run restart with semiconductors once again at the fore. Our new portfolio addition at the beginning of the month, the European semiconductor maker ASML, proved timely with a nice contribution in its first month. Currency proved a drag as the AUD strengthened across the board.

Core Australia Performance

Australian equities languished this month, with growth stocks and healthcare out of favour, offset to some degree by strength in the Gold sector.