Nucleus Insights - Employment up Wages Down What gives?

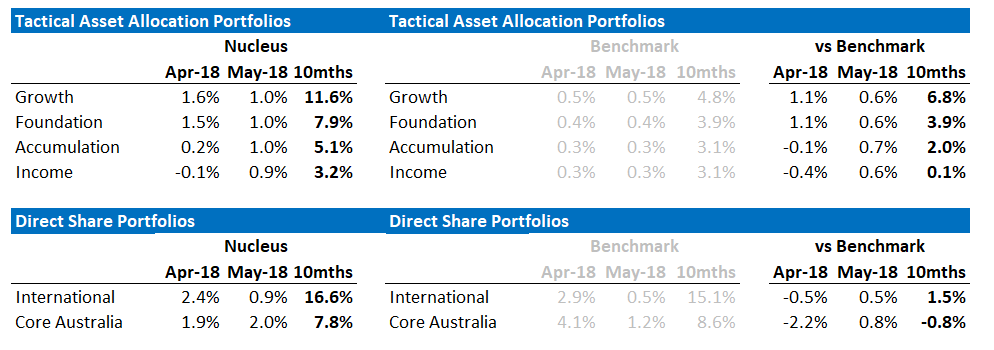

Join Leith Van Onselen, Damien Klassen and Tim Fuller having a look at the Australian Labour market as it stands today. Whats the state of play? Where is the labour market trending in Australia? Do we have a new employment boom on our hands? Tactics used at Nucleus Wealth to position portfolios for ...