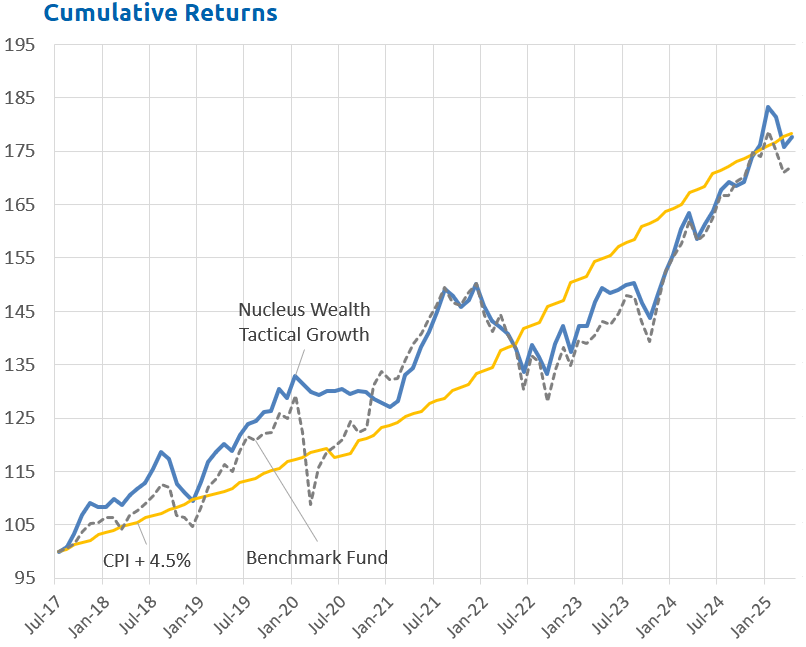

A microcosm of overpriced stockmarkets

The issue with stock markets is not that they are broadly overvalued. The overvaluation is mainly concentrated in the largest AI stocks that also have the best growth. The problem is that if you want to diversify, the rest of your choices are often reasonably priced but have a much poorer growth ...