April 2023 Performance

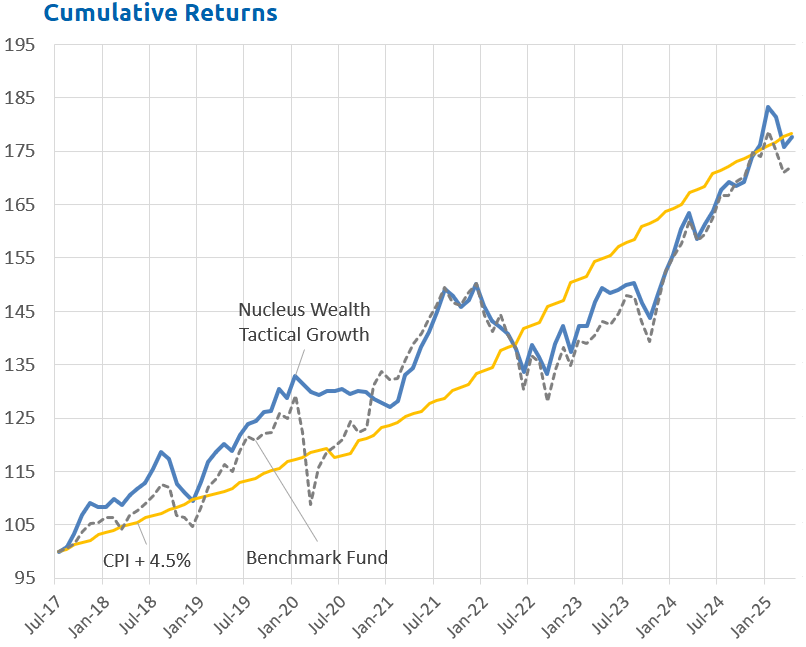

During April, our equity portfolios significantly outperformed their benchmarks, bolstered by our defensive and underweight resources and bank stock exposures. The ASX rose 1.8% and the MSCI World rose 3.1%, our Australian portfolio rose 3.1% and our international rose 4.4%. Our tactical portfolios underperformed a little given their conservative stance. Bonds were largely unchanged.

Looking forward, we expect weak stock markets as the central banks raise rates to slow demand, shrinking company profits.

With that in mind, the key factor to watch in the coming months to tell if we are wrong or right is the change in corporate profitability. The recent reporting season in the US showed some signs of weakening earnings, but not enough to confirm our thesis yet. Earnings continued to be downgraded, but not significantly enough for markets to fall.

Hard vs soft mixed signals

In financial jargon, data types range between soft and hard. Soft data consists of surveys and forecasts. Less reliable but usually much more timely. Hard data consists of confirmed results. Hard is much more reliable but arrives after the fact. Successful investment requires interpretation of the soft data - if you wait for the hard data, markets will have already moved.

Right now, there are mixed signals. The soft data mostly screams "beware". The hard data is mostly benign.

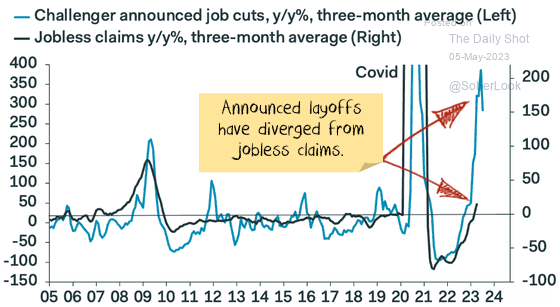

Usually, soft data leads hard data. For example, when it comes to employment:

- First, surveys say businesses are planning to slow hiring.

- A few surveys later, they show hiring slows.

- Then announcements of layoffs.

- Finally, we see the unemployment rate rise.

Sometimes, it is different. The soft data signals a problem, but something intervenes, and the problem doesn't make it to the hard data. That may be the case this time. But there is such a broad and persuasive set of soft data showing problems that it is difficult to believe the soft data is wrong.

The bond market believes the soft data, it has rate cuts and a recession by the 4th quarter. Equity analyst forecasts do not:

And the stock market definitely has not priced in the soft data:

Credit Crunch

A banking crisis has been playing out over the last few months. I initially thought that, on its own, the banking crisis wouldn't create major issues. I'm slightly less certain of that this month, as banks continue to fail. Regardless, I'm much more confident that the credit crunch following the banking crisis will create major issues. So, it is a question of "when", not "if".

I'm expecting bank funding costs to increase. Deposits to flee the smaller banks. Both have already started.

As a consequence, banks scale back their lending. Interest rates charged are higher. Corporates bear the brunt, the US falls into recession and default rates spike. Inflation is no longer a concern.

Net effect: a mini-banking crisis, followed by a credit crunch, possibly followed by a traditional banking crisis.

The soft data is pointing in that direction:

Jobs and inflation are the most lagging indicators.

Some indicators are early warning signs. Employment and the inflation rate are not. They are usually the most lagging indicators, not falling until after the recession has already started. Not rising until after the recovery is already well underway.

There are some divergent indications in both. They are off the extreme highs but are not falling as quickly as leading indicators suggest:

Does this mean that something is different this time? Or is it merely a sign that jobs and inflation are following their typical path and are lagging the cycle? The second explanation still seems the most likely.

Earnings are still too high.

One of the key features of the last year has been the ability of companies to expand margins, using inflation as a cover to push through price increases. But that is coming to an end.

Sales growth remains relatively good, but this is largely a function of inflation:

Analyst forecasts are still too optimistic.

Add in that a host of forward indicators (soft data) are pointing to significant weakness. Capital expenditure intentions, financial conditions, CEO confidence, sector downgrades all point in the same direction. Earnings forecasts are too high.

Is something different this time? Or is it just that analyst forecasts are too optimistic at macro turning points, as they usually are. My money is on the second.

China to the... rescue?

In November, China issued a sweeping directive to rescue its property sector. At face value, it was a major recalibration of its property crackdown.

These settings are hugely important for Australia. Around 30% of the ASX is in mining and energy stocks, and there is a massive exposure to government revenue via high commodity prices.

There are two ways to read the string of announcements:

- China is starting down the “whatever it takes” path. The current policies may not be enough, but they are a sign that China will keep adding more stimulus until the problem is fixed.

- The plan does not change the fundamental demand for new construction. For the most part, you can categorise the elements as either (a) directives to various banks to lend more to developers, mostly focussed on completing existing projects (b) reduced debt constraints or rules on individuals buying houses. The plan is to avert catastrophe rather than return to the old normal.

The stock market assumed the first was true. We suspected the second. It is still early, but the statistics support our view:

This is China’s fourth attempt in the past dozen years to wean itself off its property construction addiction. They lost their nerve on three prior occasions. These announcements were thought to be a sign that China had once again lost its nerve. The policies so far do not support that view.

We took off our underweights to commodities on the Chinese announcements. We went back underweight earlier this year when it became clear the policies are not enough.

Net Effect

The credit crunch is growing, bankruptcies are climbing, company earnings are sliding lower, and China is not coming to the rescue. Valuations are in the most expensive 20% of historical ranges. None of those factors encourage me to buy more stocks.

Investment Outlook

I have some pretty clear ideas about which trends are sustainable and which ones aren't in the long term. However, the short-term is far less clear:

- The banking crisis is morphing into a credit crunch. This is the number one issue over the next few months.

- The sanctions on Russia are unlikely to be lifted anytime soon. The short-term effect was commodity shortages. In the longer term, it seems likely that we will see a re-orientation, Russia will supply more to countries like China and India, less to Europe. For some commodities (oil, wheat) this will be easier. For others (gas) it will be extremely difficult.

- The geopolitical energy crisis in Europe has eased on the back of much warmer weather. Australian energy price caps have pushed down energy prices. There will be a rush to alternative energy sources in the mid-term.

- Supply chains continue to improve.

- Governments continue to withdraw (or not replace) stimulus. There will be a fiscal shock into 2023. The question is whether the private economy will be strong enough to withstand it. Leading indicators suggest profits will be lower.

- Central banks have made it clear that they will try to solve the Russian-induced energy issues and supply chain-induced inflation by raising interest rates. The odds of a policy error have increased significantly.

- China still has not bailed out the property sector. Last year's changes are not a bailout... but they may morph into one. China is trying to ensure that houses under construction get built, small businesses have access to credit, infrastructure building continues, and failing developers do not crash the economy. China is yet to show any signs of turning back to the old days of debt-driven property developer excesses. In the short term, commodities have been booming. If China doesn't continue to roll out new measures, the commodity market will deflate again.

It is still not the time for intransigence. Events are still moving quickly. But we have positioned the portfolio towards the most likely outcome and are gradually increasing the weights as more data arrives.

Bond yields have risen significantly. If the world heads for a recession this is a buying opportunity. In the short term the narrative "high inflation, central banks raising rates = sell bonds" seems to be coming to an end. Although there may be another last hurrah as the US central bank looks to rein in the stock market optimism.

The mix of higher volatility, leading to deleveraging of risk parity trades and momentum means yields could yet go higher. We are invested for bond yields to reverse.

Asset allocation

After being very expensive for a number of years, stock markets are now merely expensive. Debt levels are extremely high. Earnings growth had been really strong but has come to a halt. There are signs it is starting to reverse.

Markets are supported to a great degree by central banks and governments. Policy error is every investor's number one risk.

But, any number of other factors could force this off course and see unexpected inflation. COVID mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might decide again to supercharge property investment.

We are significantly underweight Australian shares, and as noted above, overweight bonds, with the view that the Australian market is more quickly affected by rising interest rates and more affected by a global recession:

Performance Detail

Core International Performance

April saw global equities continue to rise as markets bubbled upward, buoyed by good results from key large capitalisation technology players. Our portfolios outperformed their benchmarks in all geographic regions with Europe once again a standout. Pharmaceuticals continued to recover their year-to-date slump and technology earnings surprised to the upside leading to a strong rise, even banks recovered this month. The weakening AUD helped returns this month except in Asia. Having positioned the portfolio into more Defensive stocks last month we refrained from further changes in April.

Core Australia Performance

Australian equities had a quiet month driven by some recovery in bank stocks but weakness in the iron ore miners. Our significant gold exposure continued to be the primary contributor as gold rallied. No changes were made this month.