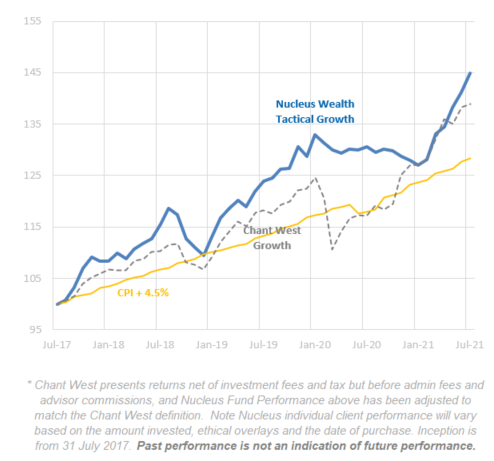

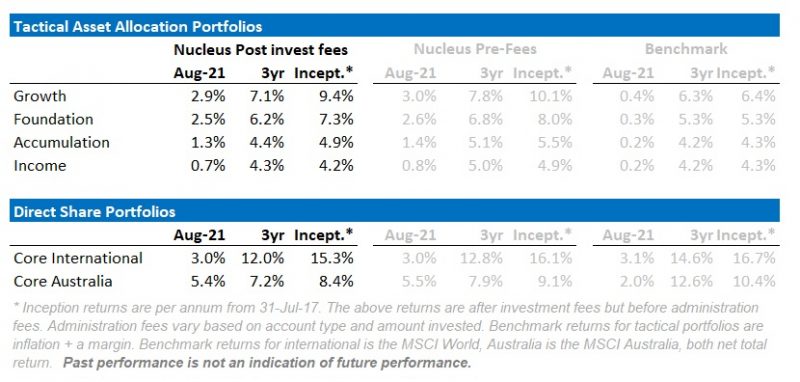

August was another strong month for the stock market. Our tactical portfolios performed well, Growth led the way up 2.9% over the month. We spoke last month about selling Australian stocks into the rallies, believing there will be a slow down in the next few months led by China and so far in September that has proven to be the case.

Chinese property is the key risk right now. If central banks and governments revert to stimulus, then the market will probably go higher. Our view is that governments won’t act quickly this time. The US central bank has been talking tapering, so it needs to reverse course. China is trying to slow the property developers, but there are signs that it may have gone too far too quickly with a range of warning signs.

Caution is the byword.

We expect international equities provide some protection from a growth slowdown. We expect the Aussie dollar to continue to fall. This will hedge the downside under the worst scenarios while still providing some upside in the better ones.

COVID-19

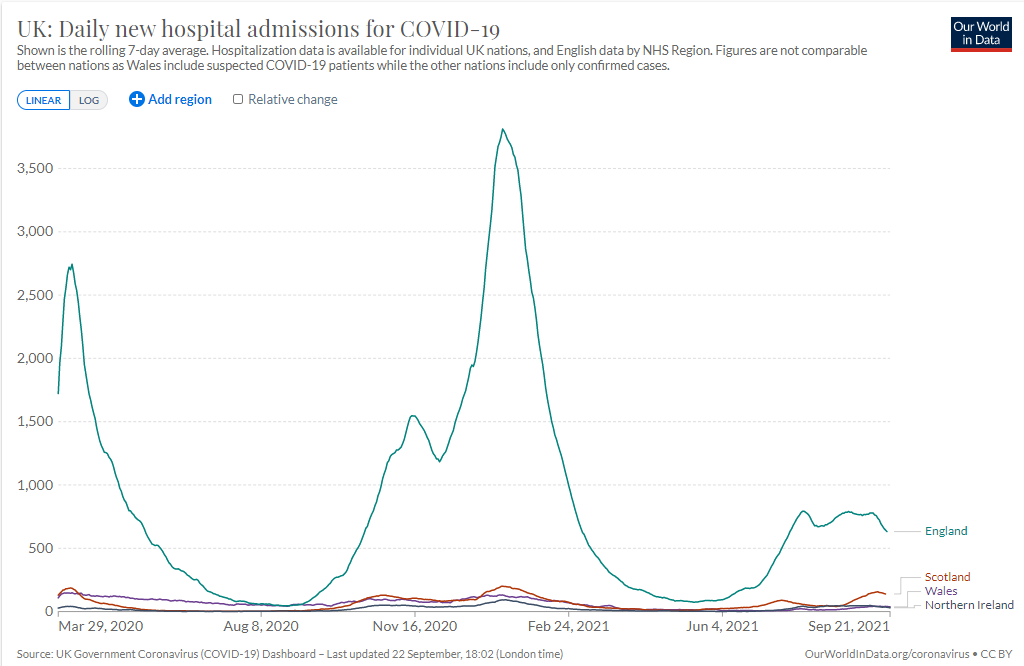

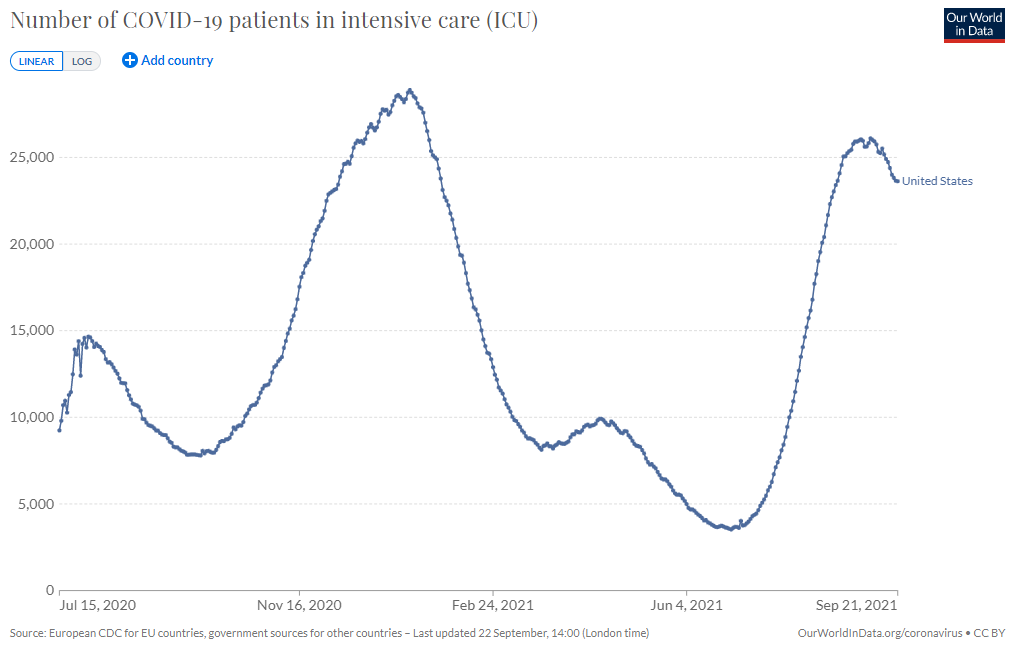

There are two main countries to watch. The UK is the primary test case. What happens when a (mostly) vaccinated population opens up without regard to the virus. Case counts are up. Hospitalisations are up but nowhere near prior levels. Vaccinated people appear well protected from the most negative outcomes.

The US is effectively experimenting with 50 states having varying lockdown rules, vaccination levels and economic support. Clearly, US vaccination levels are not high enough. However, cases look to have peaked and hospitalisations are trending down.

The most interesting factor is going to be the effect on consumption. At some stage, countries will treat the COVID as endemic and return to more normal consumption patterns. US restaurant bookings are only slightly down vs 2019 baselines. Germany, the UK and Ireland table booking are all running significantly above 2019 levels. Consumers look to have reached a point of resilience with respect to the virus.

Asset allocation

Stock markets are expensive. Debt levels are extremely high. Earnings growth has been really strong, but is looking like it may be slowing. And government/central bank support continues.

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

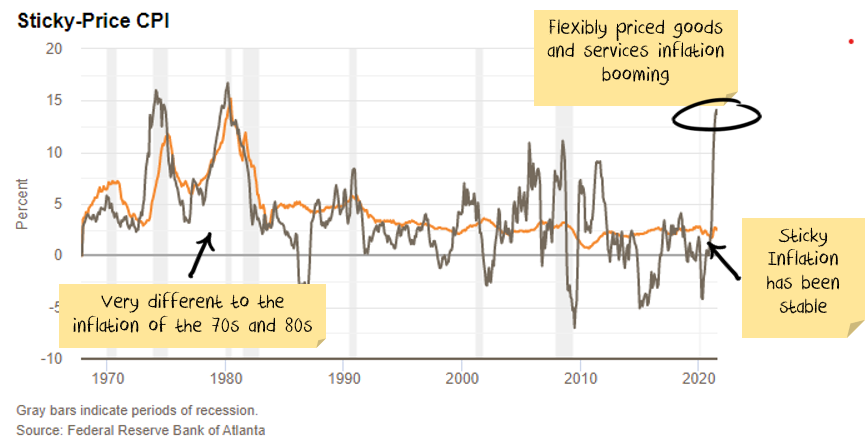

But, any number of other factors could force this off course and see unexpected inflation. Mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might reverse its tightening on property sectors. Biden may get through additional stimulus, driving increases to minimum wages.

We are significantly underweight Australian shares, with the view that the Australian market will be the one most affected by a slowdown in China:

Australian equities have been a good source of investment performance in recent months. We switched out of them and into international equities and cash. So far, the timing has been good. We have largely built the defensive side of the portfolio up, changing out of value winners like resources, banks and cyclical industrials.

Inflation Update

We covered inflation in a lot of detail in our four-part series earlier this year. So far, the inflation cycle is playing out largely as foreshadowed. In particular, the inventory supercycle.

Inflation is still elevated, but the categories are not the types of categories where entrenched inflation shows up:

Evergrande: Don’t mistake the symptom for the cause

Evergrande is not a rogue operator. Evergrande is merely the largest and most indebted property developer in a country full of large, indebted property developers. How China deals with Evergrande and its debt problems is critical for the next decade of Chinese growth, commodity prices and inflation globally.

We wrote about the urgency four months ago, suggesting that we thought the issue would come to a head in the next 3-6 months. And it has.

Some background first.

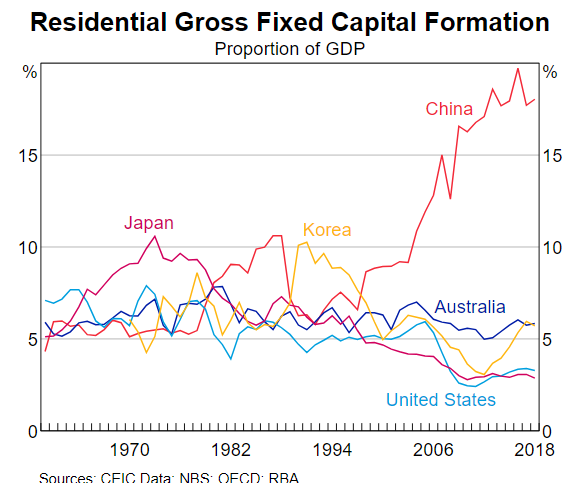

Urbanization is the key.

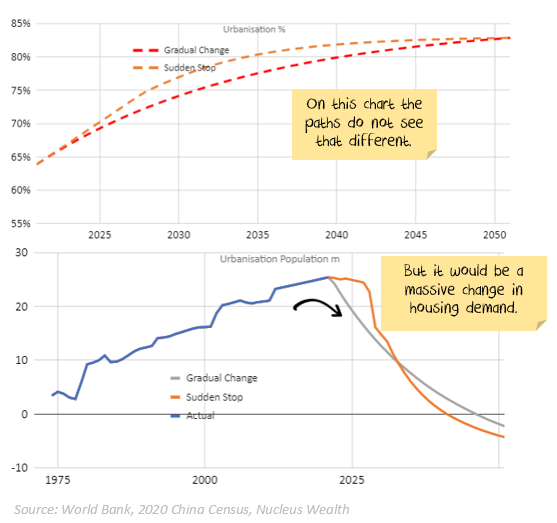

China has moved an incredible number of people to cities in the last twenty years. In recent years it has been around 25m people per annum.

But the problem is demographic:

- China’s population growth is very low and likely to keep falling. It is expected to be negative before 2050.

- There are already almost 65% of people living in cities, up from 15% in the 1970s

Most countries top out in the low 80% urbanization levels.

When will China slow its urbanization?

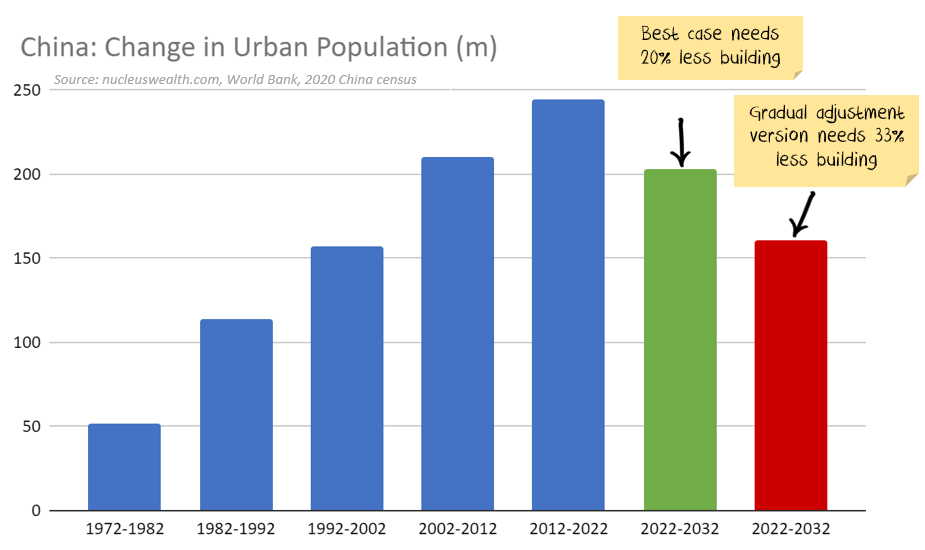

There are 25m people per year moving to cities now. A smooth fall like we have seen in other developing nations would see 20m people or less moving to cities by 2025 and falling over time.

Or will it be a sudden stop? i.e. will China try to keep moving 25m people to cities until no more people are left? The difference in the number of people is stark:

I don’t know which it will be. The main point is there is structural downside risk to the number of buildings needed in either case.

Empty Apartments

Estimates are that around 20% of Chinese apartments are unoccupied. This is about 50-60m apartments.

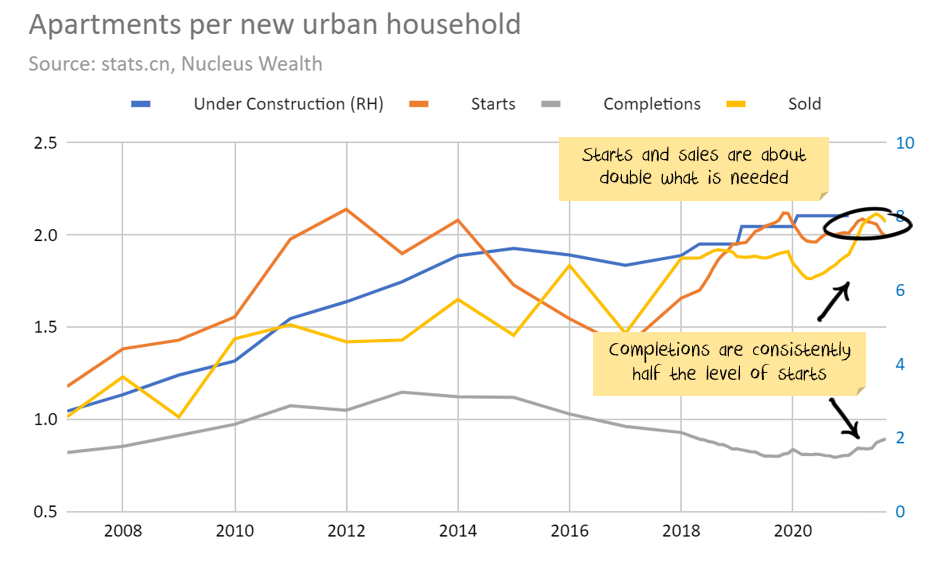

Chinese construction numbers don’t add up, which makes analysis difficult:

- New starts have consistently been around double the completions.

- This means that the number of apartments “under construction” keeps growing, suggesting something wrong with the starts number.

- However, sales are about the same as starts.

Probably a Chinese habit of building an apartment but not installing the fixtures (painting, kitchens, electrical etc.) is partly to blame. i.e. many investors own an unfinished apartment. When they rent it or move in, they can install the fixtures and not worry about depreciation in the meantime.

Additionally, apartment sizes are growing while people per household is shrinking. There are a lot of moving parts. What it does mean is:

- The number of apartments completed seems to be about the same as the number of people moving to cities.

- The number sold and started appears to be about double the number of people moving to cities.

- There is enough housing stock currently under construction to cater to about nine more years of demand.

- There are enough empty apartments to cater to another 4-5 years of demand.

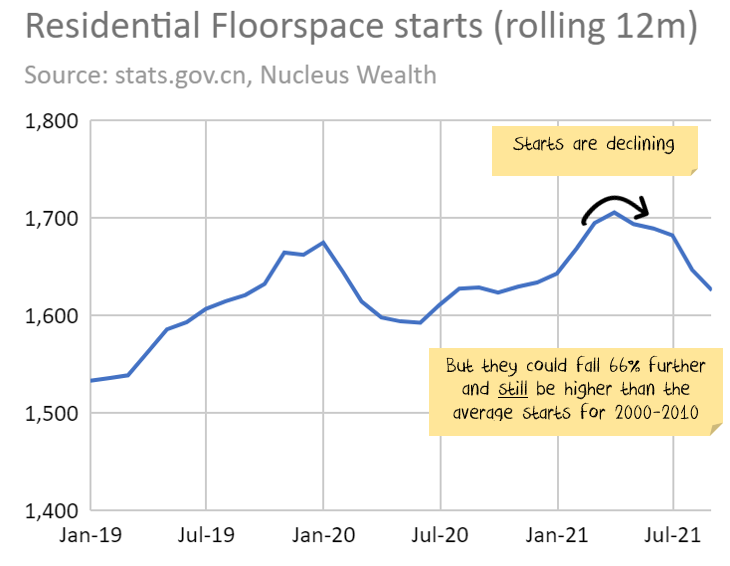

The net effect is China can easily afford to slow down construction for years (decades?) without causing problems for its urbanization plans.

This is not China’s first rodeo.

This is the fourth instalment of Chinese attempts to rid itself of its troublesome property development sector. The first began in 2011. It was ramped up again in 2015 and 2019. Each time, the failing growth that followed has spooked policymakers into more stimulus.

China keeps returning to this program for one reason. Its property market excesses are the key threat to its economic development path. Property is both the source of its enduring catch-up growth and its doom if allowed to run too far. No other Chinese sector misallocates capital and kills productivity on such a massive scale. If not restructured, it will drag China into the middle-income trap of weak income, stalled growth and declining efficiency.

There is now a short-term catalyst.

In 2020, China announced lending conditions on property developers called three red lines. These conditions are now being enforced. It is trying to slow the property lending market, which has grown around 600% over the past decade. In addition, there have been dozens of other minor changes to slow credit to the property sector.

So far, it is working. The Evergrande problem problems show it might be working too well.

Note China will once increase credit again to the sector in the future. It is not a one-way ticket.

However, the long-term trend is down. The downtrend will be punctuated by bursts of credit to strengthen the Chinese economy when it weakens.

The question is whether Chinese authorities will fold quickly this time or want to see more reform before relenting. I am expecting the latter.

Evergrande but one of many

Evergrande is significant partly because of how big it is. But, more importantly, whatever solution is applied to Evergrande will need to be applied to hundreds of other property developers.

The total value of listed companies globally in the Real Estate Developers or Homebuilding industry is a little under USD1 trillion. More than half of those companies are listed in China or Hong Kong. China spends far more on its property sector than any other country:

Plus, on average, Chinese and Hong Kong property developers have 3.5 times more debt than developed market companies.

China needs to restructure away from property. It knows what the problem is. But it is not a small problem. China could, in theory, bailout Evergrande tomorrow. Hell, it could bail out the entire sector. But the cost would be astronomical.

Three areas to watch

With so much of the Chinese economy based on the housing market, China can ill-afford to abandon the sector to market forces. A steady transition appears to be the intention, but the risk is that circumstances move too quickly. The dangers are:

1. Credit locking up in the property development sector.

This is happening right now. The average yield on dollar bonds issued by junk-rated Chinese companies has doubled to around 16% since the start of the year. Recent signs are not good.

We are expecting to see some sort of government announcement in the short term to reduce the stresses:

- If there are no meaningful measures, then we are looking at a full-blown financial crisis. Very negative for stock markets, particularly Australia.

- More likely, steps will be implemented to help the better companies but not let up on over-indebted companies.

- At the bullish end, China could over-egg the response, opening up the credit taps. This scenario would be short term positive for stock markets, particularly commodities, subject to the below risks.

2. Property buyer confidence

China has some of the most expensive housing in the world relative to income. Should buyers lose faith in the value of properties, then a house price crash could result. This could occur even if the first issue is solved. Which would leave developers in a much worse position.

There are nascent signs that Chinese property buyers are spooked. Watch this space.

3. House price wealth effects

This is the problem facing almost every country. High property prices increase inequality, reduce economic growth and damage productivity. But all of those are longer-term problems.

The short term effect of rising prices is to increase spending and consumer confidence.

And politicians love short term gains at the expense of long term losses. Falling home prices offer the opposite.

The problem is worse for China than elsewhere. Both homeownership and investment in real estate are much higher in China than in most other countries.

Net effect

Transition away from a real estate centric economy is a good thing for China! But the transition will be difficult. This is their fourth attempt in the past dozen years, having lost their nerve on three prior occasions.

We are reaching an inflection point. Our portfolios are conservatively positioned, risks are high. Unfortunately, once again we are waiting for government responses to determine our investment outlook. Our expectation is that China will try to smooth the property slowdown, but won’t reverse course in the short term. As I have said many times, and will no doubt continue to say:

We are not in a normal market. We are reliant on government and central bank support. So policy error remains the number one risk.

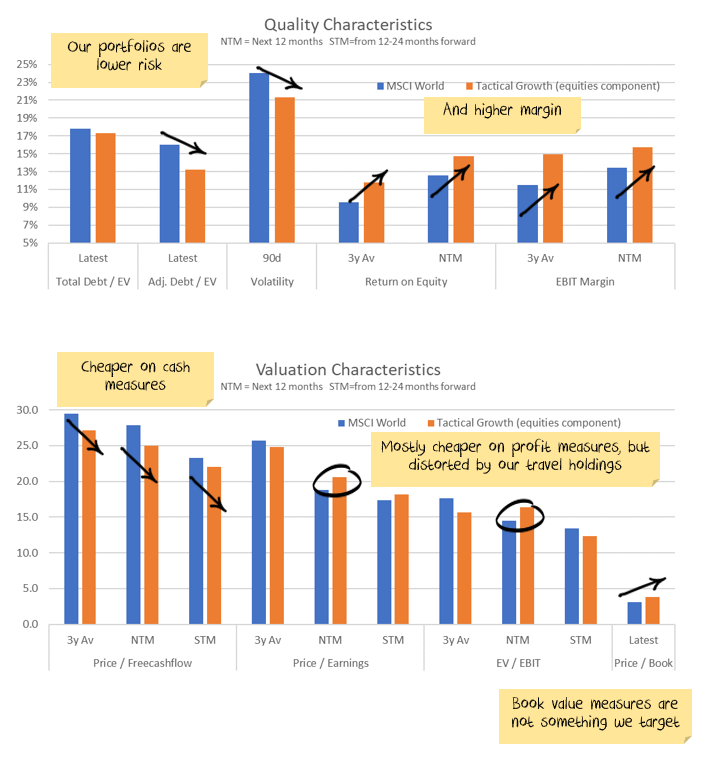

Performance Detail

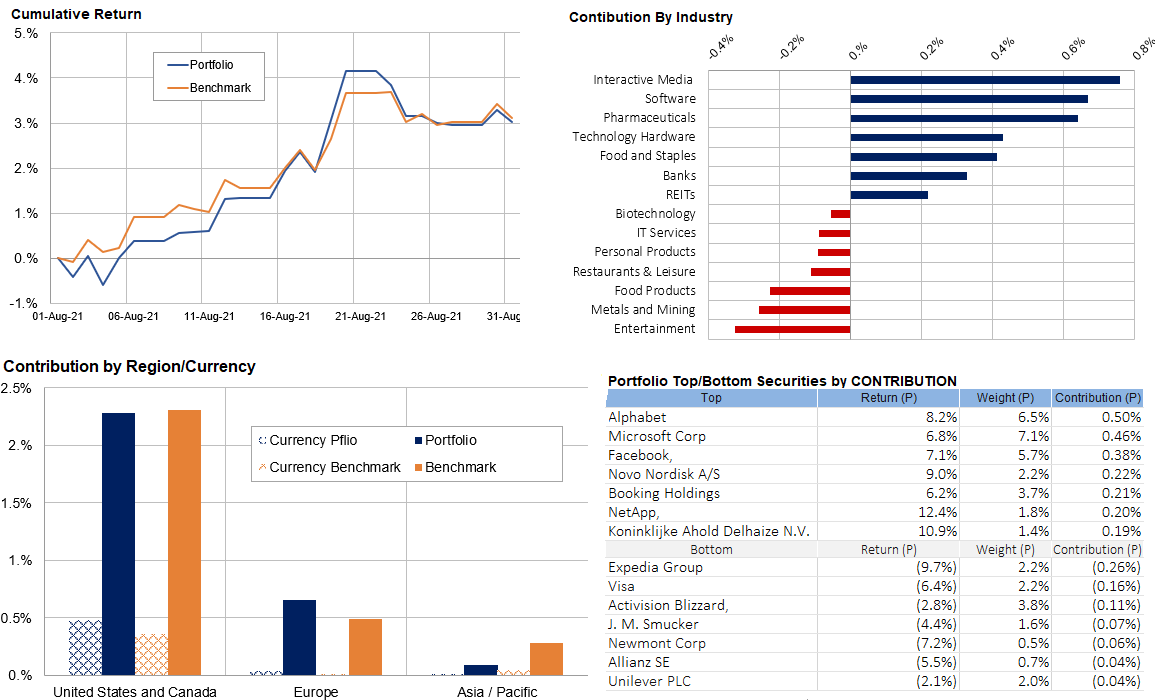

Core International Performance

August saw the move to Technology/Growth and especially the FAANGs continue albeit at a slower pace than the record-breaking July. Regionally the US remained the prime driver with Asia/Europe minor contributors.

Overall the currency effect was minimal with some benefit from AUD weakness vs the USD. Over the month we took some profits in Honeywell, Recordati, and Shell and repositioned our Japanese holdings toward a more technology/growth mix adding Nintendo, Hitachi, and Astellas Pharma to the portfolios.

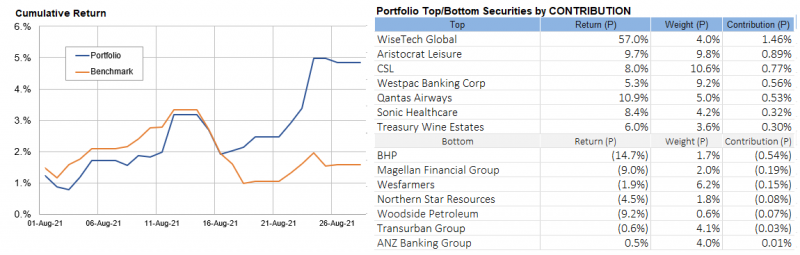

Core Australia Performance

The Core Australian portfolio outperformed the index in August as all our domestic growth plays surged, Wisetech the standout. BHP and Woodside were the key detractors as they announced their Petroleum deal. Over the month we trimmed our Magellan and BHP exposure.

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.