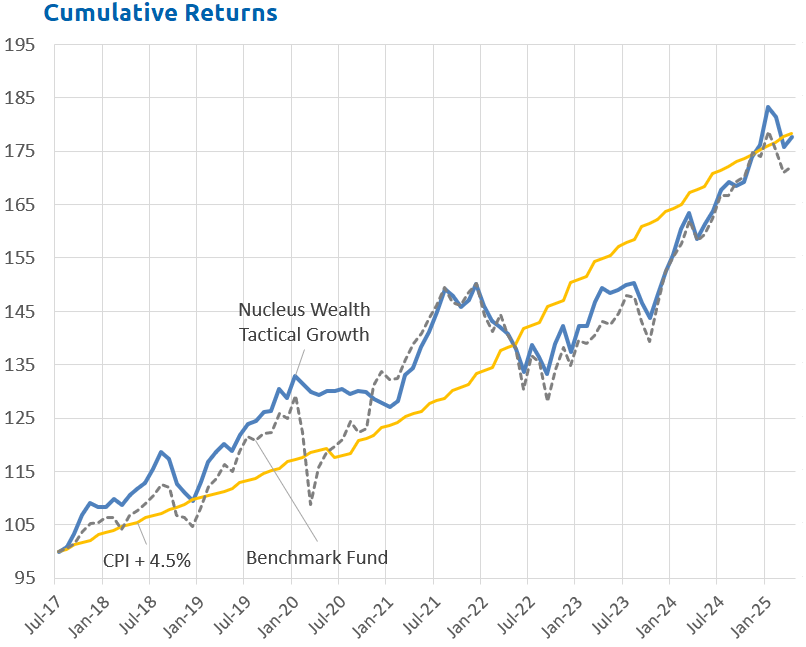

August 2022 performance

August was a tale of two halves. Global markets rallied for the first half of the month, and then gave it all back. Finishing down 4% in US dollar terms and down 2.5% in Australian dollars by the end of the month. September has been following a similar pattern. While our Australian portfolio outperformed on the back of a lower exposure to resources, our international lagged the world market due to higher exposure to quality stocks. Quality continues to be an investment factor that has been underperforming. The bond market reversed the gains of the prior month and our tactical funds all finished down.

We continue to expect weak stock markets as the central banks raise rates to slow demand, shrinking company profits. With that in mind, the key factor to watch in the coming months to tell if we are wrong or right is the change in corporate profitability.

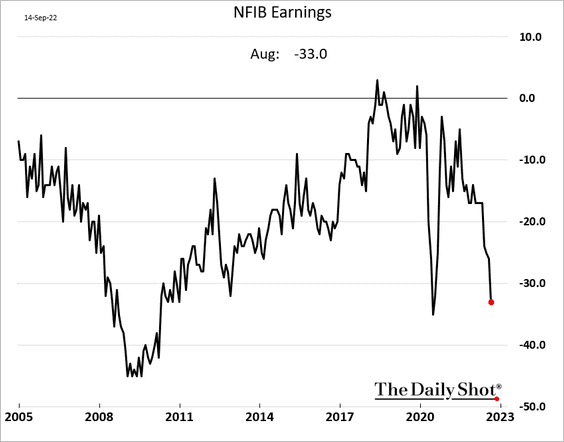

Forward earnings indicators continue to weaken

The next step in our outlook is for earnings to fall, which we are expecting over the next six months.

Early indicators (i.e. surveys and forecasts rather than hard data) have turned down, some quite decisively.

Pick any forward indicator of aggregate earnings, and chances are that it is suggesting a big fall. Whether it be based on a mix of manufacturing surveys, currency and interest rates:

or ones that prefer confidence measures and housing starts:

All tell the same story. Earnings are likely to fall.

Analyst earnings forecasts are declining

In contrast, forward earnings themselves are only just starting to turn negative:

The change is clear, but the magnitude is still small.

Keep in mind that analyst forecasts themselves largely come directly from companies. The companies typically build them up from expectations of the front-line sales staff. These staff are quite likely to base the growth on what they have seen in the past few months. The staff are not generally looking at macroeconomic factors, like the record speed of interest rate hikes to make their forecasts. For this reason, analyst forecasts, while generally good at forecasting, tend to lag at turning points in the economy.

So, analyst forecasts will be a confirming factor. But if we wait for earnings to crash before selling equities it will be too late.

Sector earnings are consistent with a downturn

Super high energy prices are holding up earnings in that sector. However, other sectors are in decline:

Economic theory suggests that when going into a recession first the consumer discretionary sector profits fall, then the IT and industrials before the more stable sectors. Often energy is a laggard - the oil price spiked to $140 even as the financial crisis was unfolding in 2008, before crashing to $40 less than a year later.

Sometimes, in a recession, the consumer staples sector profits rise for the first year before falling as the economy recovers. This is usually due to the trading down effect, for example, consumers switching from eating out to cooking for themselves.

This time, so far, has been different. The slightly puzzling feature has been a raft of downgrades in the consumer staples sector as well. I'm not expecting that to turn into a more ominous earnings crash, but we need to be alert to the possibility.

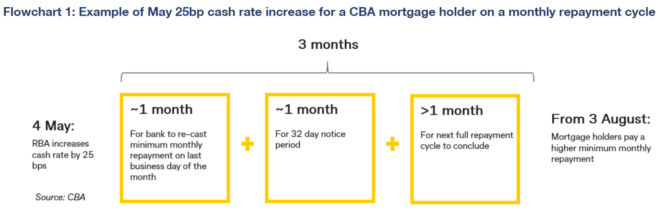

Monetary policy acts with a lag

The lag can be broken into four parts for Australia:

- Delayed direct impact of rate rises. Typically rate rises take 2-3 months before affecting cash flow for a borrower. i.e. only 0.25-0.75% of recent increases have actually been felt by borrowers so far.

- Delayed effect due to greater than usual concentration of fixed-rate mortgages. In March 2020, the Reserve Bank also introduced a facility where they lent directly to the banks at 0.1% for three years. This facility (and other market interventions) allowed banks to drop three-year fixed mortgages to around 2%. In response, fixed mortgages went from 10-15% of refinancing to over 40%. These will roll off, but in the interim, there are far more people who will be unaffected by the rate rises until they refinance.

- Delayed indirect impact of rate rises. Once borrowers repayments have actually increased, it will still take some time for them to notice and change their spending patterns. So, for businesses that rely on consumer demand, it can take another few months before the effect flows through.

- Delayed 2nd order and above effect. The economic multiplier compounds the effect for months going forward. i.e. consumers spend less (say) on eating out which means that restauranteurs have less money to spend and then may lay off staff who also reduce spending. The effect of this echoes multiple times through the economy. Typical estimates suggest 1-2 years for changes in monetary policy to have its full effect.

In other countries, like the US, the effect is even more delayed as most mortgage holders outside of Australia have fixed rather than variable mortgages.

The US first hiked rates in March 2022. The effects would not be felt in the first quarter. The second quarter earnings, which have only just been reported, would have seen very little impact from rate rises. The third quarter numbers, due out in another month, will start to see the effect.

Net effect: signs to date are consistent with a large earnings decline

The next few months will be key to proving or disproving this outlook.

Interest rate rises work well on demand-side inflation, much less well on supply-side inflation. This leaves central banks in an unenviable position. They are nonetheless pushing forward with raising rates to try to bring down inflation that is largely supply-side driven. And so the danger is that they do too much to try and influence a measure that they have little control over.

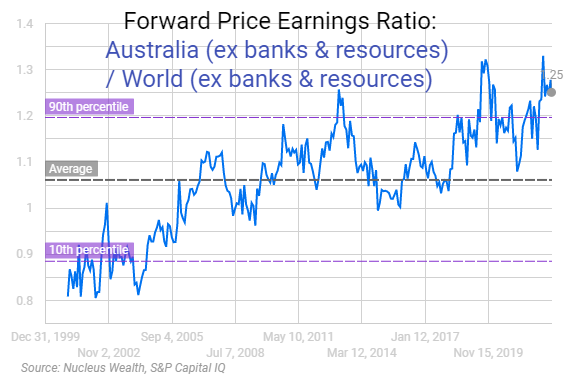

Valuation

Stock valuations came back to the upper end of reasonable levels last month. But, with earnings falling, valuations are starting to look more expensive again. Valuation does matter. But earnings growth matters more. In a good year, earnings can easily grow 20% or more, making an expensive market fair value. The danger is that earnings can also fall quite precipitously. And today, in my assessment, that is where the danger is.

At an aggregate level, earnings growth still looks OK. But most of the growth in the last reporting season came from energy and resources. And, effectively, central banks have promised to kill commodity prices to bring down inflation.

Earnings forecasts are still for another 20% combined growth over 2022 and 2023. In the face of a recession, that is heroic. Even if there is not an economic recession, I'm expecting a sharp slowdown in profits as higher interest rates bite.

Earnings are more likely to be flat over two years, with risks to the downside. On that basis, stocks would still be at the more expensive end of historical ranges. Heading into a potential recession, that is not where you want valuations to be.

For Australia, the matter is even more pressing. Valuations are not cheap. At an aggregate level, the Australian market looks OK, but that is because it is dominated by banks and resources which tend to trade on lower multiples than other sectors.

If you split Australia into its component parts, then:

- Australian banks are very expensive relative to world banks

- Australian resources are slightly expensive relative to world resources

- Ex-banks and resources, Australia is very expensive vs the world ex-banks and resources

Have we seen this all before?

- Globalised supply chains reversing into more local production due to geopolitical tensions

- A pandemic disrupting supply chains

- A surge in inflation due to supply issues

- Central banks hiking rates into a supply-side shock

Yes, we have. Following World War I, all of the above factors were in place.

By 1920, inflation in the US was running at 15%. The US central bank hiked rates from 3.5% to 5.6% to curb demand. By 1921 the US was in a depression, with inflation of -10%.

The analogy is not exactly the same. But, trying to use interest rates to solve supply chain problems is at the core. There are more similarities than there are differences.

Investment Outlook

I have some pretty clear ideas about which trends are sustainable and which ones aren't in the long term. However, the short term is far less clear:

- The sanctions on Russia are unlikely to be lifted anytime soon. The short term effect is probably commodity shortages. In the longer term, it seems likely that we will see a re-orientation, Russia will supply more to countries like China and India, less to Europe. For some commodities (oil, wheat) this will be easier. For others (gas) it will be extremely difficult.

- The Omicron variant looks to be resolving in the direction we expected, ripping through economies without too much harm and leaving behind an acceptance that COVID is endemic. In China, however, rolling lockdowns will likely continue for the rest of the year.

- The geopolitical energy crisis in Europe has turned acute and infected Australia. This will subtract from European and Australian growth in the short term, there will be a rush to alternative energy sources in the long term.

- Supply chains continue to improve.

- Governments continue to withdraw (or not replace) stimulus. There will be a fiscal shock in 2022. The question is whether the private economy will be strong enough to withstand it. Leading indicators suggest profits will be lower.

- Central banks have made it clear that they will try to solve the Russian induced energy issues and supply chain induced inflation by raising interest rates. The odds of a policy error have increased significantly.

- China still has not bailed out the property sector. China is trying to ensure that houses under construction get built, small businesses have access to credit, infrastructure building continues, and failing developers do not crash the economy. But China is yet to show any signs of turning back to the old days of debt-driven property developer excesses. Unless they change, this will deflate the commodity market.

It is still not the time for intransigence. Events are still moving quickly. But we have positioned the portfolio towards the most likely outcome and are gradually increasing the weights as more data arrives.

Bond yields have risen significantly. If the world heads for recession this is a buying opportunity. The problem in the short term is that the narrative "high inflation, central banks raising rates = sell bonds" is surging still.

And the mix of higher volatility, leading to deleveraging of risk parity trades and momentum means yields could yet go higher. We invested for bond yields to reverse.

Asset allocation

After being very expensive for a number of years, stock markets flirted with fair value last month. Since then, with rising prices and falling earnings, valuations are now slightly expensive. Debt levels are extremely high. Earnings growth had been really strong but has come to a halt. There are signs it is starting to reverse.

Markets are supported to a great degree by central banks and governments. Policy error is every investor's number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might reverse its tightening on property sectors. Biden may get through additional stimulus, driving increases to minimum wages.

We are significantly underweight Australian shares, and as noted above, overweight bonds, with the view that the Australian market will be the one most affected by a slowdown in China and a global recession:

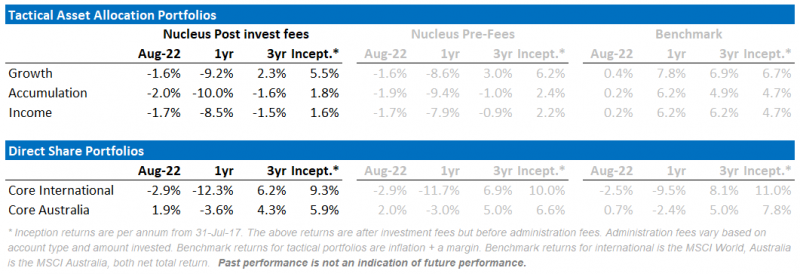

Performance Detail

Core International Performance

August saw the equity market continue to rally before fading to book a loss. Our portfolio continues to track the index with US stocks outperforming but this was more than offset by our European stock underperformance. USD strength helped peg back some of the stock weakness. At this stage, we have refrained from changing the portfolio composition.

Core Australia Performance

Domestically August was a volatile month that saw our portfolio outperform on the back of Growth stocks staging a recovery after reporting better than expected results while Defensives disappointed. No changes were made to the portfolio this month.