June 2018 Performance

June continued to see positive returns across our portfolios, our Australian fund was up 2.3%, International up 1.3% and the tactical funds up between 0.3% and 0.9%. These returns were supported by a fall in the Australian dollar, which added significantly to performance in June.

June was a strange month from a performance perspective. World share markets fell in US dollar terms, on the back of weakening fundamentals in Europe and rising trade tensions, but the rising Australian dollar more than offset those falls for Australian investors. However, the Australian share market added 3.7% - in spite of weakening Australian fundamentals and (as Australia is a small, open economy) greater exposure to a trade war.

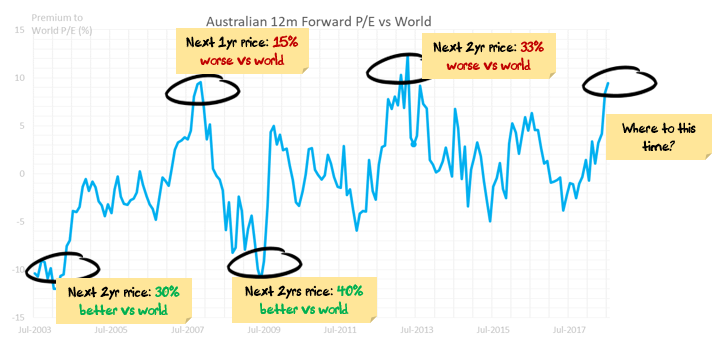

Australian shares are now up almost 10% in 3 months, a peculiar outcome over a period where the Australian dollar has fallen 4% and Australian forward earnings have been downgraded by 3% (vs upgrades of 6% in the US). This means Australian valuations are now 10% higher than the world average. Over the past 15 years or so, Australian valuations of 10% more/less than the world has represented a limit for the Australian market and a sell/buy signal:

Now, this valuation method is pretty simplistic, but it illustrates what we are seeing across a range of other metrics. A counter-argument would be that if earnings growth and the outlook was stronger in Australia then the higher valuations could be justified. This is not the case - in fact, Australia earnings continue to diverge lower vs world earnings:

And, if you just look over the last month, examining how earnings forecasts have changed, it is clear that Australia and Emerging Market earnings are suffering the most:

So, this begs the question: is the stock market seeing some other strength that isn't being reflected in analyst forecasts or foreign exchange markets?

Our take is no. The fundamentals are moving largely in the direction that we have discussed on many occasions: US strong, Europe weakening, Chinese growth slowing, Australian earnings down and further downside risk from a slowing China, declining property market and slower mortgage growth.

From time to time markets will dislocate from fundamentals before regaining their senses. In our view, June is an aberration rather than a sign that Australia is turning around.

The dilemma we are trying to address in the portfolios is how to get enough exposure to the final leg of the bull market while maintaining downside protection in case markets unravel earlier than expected. As a result our portfolio is a little bi-polar at the moment, with a range of higher quality stocks that are exposed to continued US growth offset by a larger number of defensive holdings. As many traditionally defensive sectors (utilities, REITs, infrastructure) are expensive, our defensive holdings stretch across a range of consumer staples sectors.

We are sitting on a considerable cash balance in all of our Tactical portfolios – our Tactical Growth fund targets a 10% exposure to cash and bonds, our weight is currently 35%. We have even more cash in the more conservative funds. We have been holding part of that cash in a range of international currencies and so have benefitted from the falling Australian dollar.

For more information on how we position client portfolios to help maximise upside but more importantly, mitigate potential downsides, check out our upcoming live webinar on the topic.

June Performance

The returns above include fees and trading costs on a $500,000 portfolio. Note that individual client performance will vary based on the amount invested, ethical overlays and the date of purchase. The benchmark returns do not include fees. See performance section below for relative returns.

Individual Stock performance

This month Technology service providers like Google outperformed, but Technology manufacturers (like Micron and Applied Materials) gave back some of their May gains with looming trade war fears. Hardest hit was WH Group (HK) which is a large pork importer and is expected to be affected by the retaliatory tariffs. Despite AbbVie's poor showing, the remainder of the Health sector lifted the performance of the portfolio.

Domestically the defensives of Woolworths and Wesfarmers(Coles/Bunnings) outperformed while the Telstra and hospital operator Ramsay derating continued. The greatest detractor to overall portfolio performance was our underweight in Banks which had a sharp bounce in the second half of June.

Investment Outlook

The fundamentals for shares look good, valuations don’t. Which, despite all of the ups and downs of the last few months is largely where we have been for the past year.

From an investment perspective, our three major concerns are:

- Europe: The major long-term issue is still the significant imbalances between Germany and most of the rest of the Eurozone. We note that recent issues in Italy are a symptom of the underlying problem - not the actual problem. Growth is also clearly weakening.

- China: Rebalancing is occurring, the question is how fast Chinese authorities allow it to occur.

- Trump: Tax cuts are now impacting economic statistics which are looking strong, add to that an increase in US oil drilling and wage inflation is finally showing signs of life. These are both one-off gains and so the key risk is that the Fed over-reacts to the signs of strength.

Tactical Asset Allocation Portfolio Positioning

In our tactical portfolios, we own cash, bonds, international shares and Australian shares. We tend to blend these portfolios for clients so that each investor receives an exposure tailored to their own risk and income requirements.

The broad sweep of our asset allocation over the last 18 months was to ride the Trump Boom, switch into Europe in March / April last year as the US became overvalued and then switch back into the US as the Euro rallied and the USD fell.

We have been using rallies in stock markets to reduce our holdings.

We remain underweight shares in aggregate, overweight international shares and significantly underweight Australian shares.

Tactical Foundation Portfolio

Our tactical foundation portfolio is designed for investors with lower balances, it uses exchange-traded funds for its international exposure rather than direct shares. The reason for this is parcel sizes, you can’t buy half a Google (Alphabet) share directly and so we use exchange-traded funds which buy baskets of stocks instead. The tactical portfolio is a balanced fund, not as aggressive in its holdings as the growth fund nor as conservative as our income fund.

In May this fund increased by 0.9%. The fund continues to be underweight Australian stocks.

Equities

We have a reasonable tech / IT exposure. The rising spectre of a potential trade war saw some significant price falls in this sector last month, before coming roaring back in May. We used April's price falls as an opportunity to buy more. There are a number of smaller tech stocks that we own, in particular, a range of semiconductor stocks where we like the growth outlook. It is worth noting that part of the reason for Apple increasing the price of its latest phone is an increase in memory and components. This is a positive for semi-conductor stocks more generally, especially if a “feature war” breaks out in the smartphone space. We current hold a range of stocks that should be helped by this trend (Lam, Applied Materials, Skyworks, and to a lesser extent Cisco). We recently bought Alphabet (Google), Western Digital and Micron following recent price falls.

We are currently holding a larger than usual number of consumer staple stocks in our portfolio - traditional defensive sectors like Property Trusts, Utilities and Infrastructure are generally very expensive and so we are using a group of more stable industrial stocks like Kelloggs, Johnson & Johnson, Unilever, Kimberly-Clark plus a range of smaller stocks as an alternative. Over June we sold down more of our telco and infrastructure holdings.

We are underweight energy. In particular oil producers. This has not been a good call over the last six months, and our outperformance has been despite the underweight to oil rather than because of it.

We have been doing a lot of soul-searching on this call. The broad overview is:

- Oil demand remains strong, and with (relatively) synchronized global growth we expect this to continue.

- The supply side is stronger. US production continues to reach new highs, Libya and Nigeria’s production recovered from interruptions. The lone negative is Venezuela continuing to decline. The ability of US shale oil to react quickly to higher prices means that supply is much more responsive than its been in the past. The US has now become an exporter of oil.

- On the political side is where we see most of the action. OPEC and Russia are withholding supply to keep the price high, and US bombing in Syria plus Trump threats raise the spectre of sanctions returning to Iranian production.

- On the trading side, speculators hold record balances. This can be read two ways: (1) everyone else is going long, the oil price is going higher (2) the oil price has been pushed to current levels by speculators and will fall when they unwind their positions.

So, the question from here is whether we hedge our risk to political events by buying oil stocks in the face of fundamentals that suggest the oil price should be materially lower. If the risk were greater or the oil price lower, I would probably hedge. Given the current situation and current prices, we are going to stay underweight oil. But the debate rages on.

Our sole holding in the energy sector, Neste Energy is up around 70% over the past few months, which has shielded our portfolio from the rising oil price. Neste is a Finnish oil refiner, making a significant investment in green technologies and is well regarded by a number of sustainable rating firms including being in the Global 100 most sustainable companies, the Dow Jones Sustainability index and CDP.

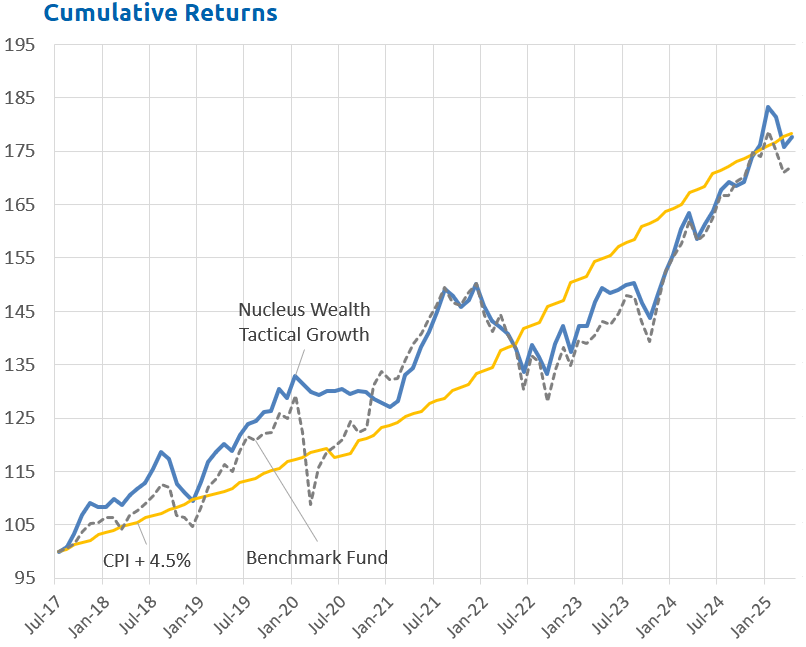

Performance to date

Portfolio performance can be cut a number of different ways. At its most basic level, you should care about the total return. At the next level, you should care about the total return relative to some sort of benchmark.

As you dig deeper, you should also be interested how the return was achieved – for example if your fund manager is taking lots of risk but only performing slightly better than the market then you should be concerned. Similarly, if you can get market returns but at a much lower risk then that may be an appropriate trade-off.

Our portfolios to date have been both out-performing benchmarks, and taking less risk. The disclaimer is that they have only been running for eleven months, and that is not enough time to make definitive judgements.

The returns above include fees and trading costs on a $500,000 portfolio. Note that individual client performance will vary based on the amount invested, ethical overlays and the date of purchase. The benchmark returns do not include fees.

Epilogue

In summary, our view continues to be that Australian investors are better off holding international investments at this point in the cycle.

We retain relatively large cash balances to hedge against volatility and to look for a cheaper entry point. If markets continue to be weak then we will look to buy more equities. We are concerned about the potential for trade wars, which will be a key focus for us over the next few months.

Our intention is that our portfolio is positioned to take advantage of our key themes but minimise risk in the event that our themes take longer than expected to resolve themselves.

We usually find that big picture macro themes take a long time to resolve themselves in financial markets, but when macro theme resolve themselves they do so quickly – usually too quickly to reposition your portfolio if you are not already invested.

Damien Klassen is Head of Investments at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Integrity Private Wealth Pty Ltd, AFSL 436298.