In the last three years, Australian houses have gone from boom to bust and now back to boom again. I have written in the past about how crazy the property cycle is, and recently, a buying frenzy has pushed prices back toward previous highs. Many are calling the market up 10% over the next year, but property is not a short-term trade. If you buy today and sell in a year up 10%, you would be lucky to make anything after paying entry and exit costs.

So, the real question from here for all residential property investors, is how much can you expect house prices to rise over the next 5-10 years.

A bold prediction

I’m going to make a brave call. My call is there are limits to how high housing prices can go. I know, I know. I sound crazy. Especially given Australian house prices over the last 30 years. But hear me out.

If house prices grow at 10% p.a. for the next 20 years, and wages/rents kept going up at their historical rates then:

- The median Sydney house price would be over $7m

- The median Sydney house price would be 45x higher than the median wage.

- Even if you managed to scrape together the 5% deposit (only twice the median annual pretax salary) to qualify for one of #ScottyFromMarketing’s 95% mortgages, the mortgage payment would come in at almost 3x the median pretax salary

If that is a realistic vision of society to you, then you can stop reading. Gear your heart out and buy a house. Hell, grab a bunch.

If you are interested in looking at what the limits could be, then read on.

Some assumptions

There are significant links between property prices and the availability of debt. The financial crisis showed this internationally. The Royal Commission into banking showed this in Australia. Even the Reserve Bank agrees. When the amount of debt available rises, so do property values. When debt slows down, property values fall.

The Federal Government seems hellbent on forcing more debt onto borrowers. So, I’m going to assume that credit is available for the moment. I do have some concerns that Australians generally are close to their debt limits, and I have even more significant concerns over COVID-19:

But ignore my fears for the moment.

There are a host of other factors that can affect property prices. I am assuming none of these change significantly: generous tax breaks, limited supply, historically high immigration levels, high stamp duty, limited land taxes, continuing to tolerate money laundering, foreign demand.

What are the limits to residential property?

I’m going to argue four other factors constrain how high property prices can go:

- The relative cost between renting and a mortgage. If the mortgage on the median house is (say) double the cost of renting the same home, then more people will rent.

- The affordability of a mortgage. If the mortgage on the median house takes up (say) 70% of the median pretax wage, then more people will rent.

- The affordability of a deposit. If the deposit on a house becomes too high relative to wages, then more people will rent

- The returns to investors. If investors are not getting an adequate return, then, in the long term, they will stop investing.

I’m going to ignore number 4 for this post. As of the latest tax office stats, more than 60% of all investors have recorded an income loss on property each year since 2003. During two of the greatest house price booms Australia has ever seen. Clearly, most are investing in Australian property the hope of capital gain.

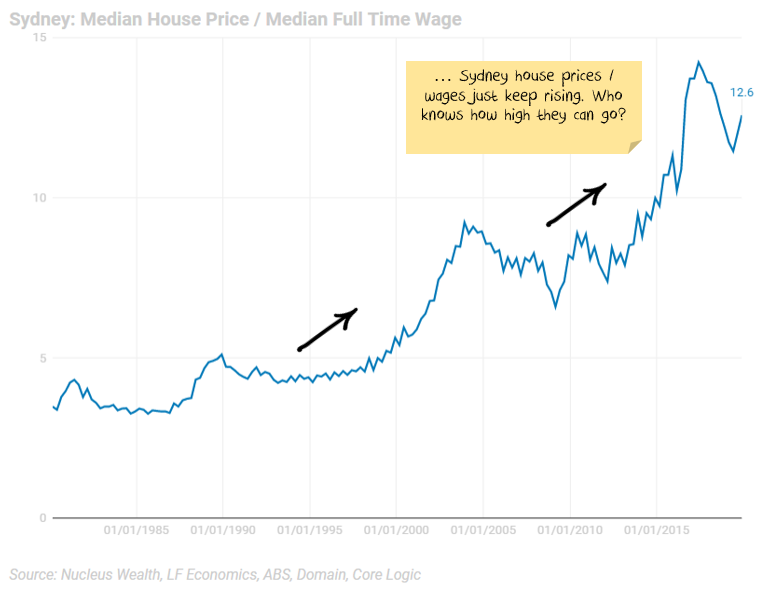

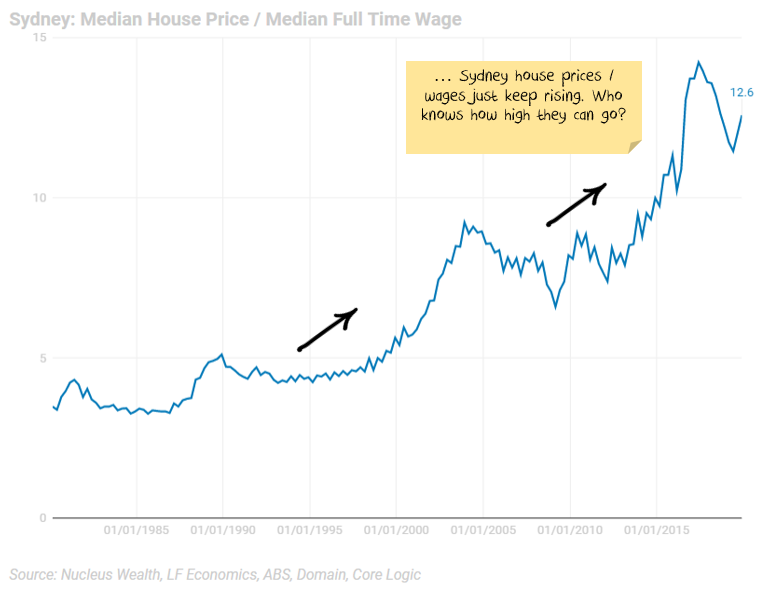

I’m also going to ignore number 3, deposit affordability. Not because I think it is unimportant. There are two reasons: (a) affording the deposit is less important than affording the repayments and (b) I just don’t know what levels constrain the ratio of house prices to worker incomes as the following chart for Sydney shows:

Three scenarios

I’m going to show the limits using three scenarios from this online calculator. I’m going to focus on Sydney houses for simplicity. The story is the same for Melbourne, and you can use the calculator to run a similar analysis on other states or on apartments.

- Economic Boom: Rents grow at 6%, wages grow at 4%, inflation 3% and interest rates rise to 7%

- Purgatory: A continuation of the last few years. Inflation and wage growth stay below 2%, rents grow a little lower than inflation. Interest rates don’t change.

- Economic Bust: Interest rates fall another 0.75%, inflation falls to 1%, wage growth falls to 1%, rents fall 1%p.a.

Graphically, the scenarios look like this:

Limit 1: Mortgage Payments to Rent

Take the interest cost of a mortgage (with a 20% deposit) and divide by the rent. When this ratio gets high, say a mortgage was double the cost of renting, then potential homeowners will prefer to rent rather than buy.

In contrast, when the interest cost of a mortgage is lower than the price of renting, then more renters prefer to become homeowners.

To illustrate, look at the chart for Melbourne or Sydney houses below. The median has varied between about 80% and 200% on this ratio. i.e. in 1998 if you bought a median property, then your mortgage cost was 20% cheaper than the cost of renting the same property. By 2010, the cost of your mortgage was double the cost of renting.

It seems that anything above 150% is unsustainable – especially for units, and 200% appears to be a barrier for houses. This makes sense. Paying double the rental cost in interest should discourage buyers.

Limit 2: Mortgage Payments to Wages

Take the interest cost of a mortgage (with a 20% deposit) and divide by the median wage. When this ratio gets high, say the interest payments on a mortgage was taking more than 70% of the pretax median wage, then potential homeowners will prefer to rent rather than buy.

To illustrate, look at the chart for Melbourne or Sydney houses below. The median has varied between about 30% and 80% on this ratio. i.e. In 1998 if you bought a median property, then your mortgage cost was 30% of the median full-time wage of an employee in that state. By 2008, 80% of a (pretax!) wage would be needed just to pay the mortgage.

Scenario 1: Economic Boom

The problem with this scenario is that if there is a boom then interest rates rise also which will cap house price rises.

Source: nucleuswealth.com/property-calculator

Scenario 2: Purgatory

The problem with this scenario is not that house prices fall, its that they rise only a little. Which means that if you borrow against the property you will likely lose money.

Source: nucleuswealth.com/property-calculator

Scenario 3: Bust

As you would expect this is not pretty for house prices. If you didn’t borrow money, you won’t lose that much as the rent you receive would offset most of your capital losses. You would probably only be out entry and exit costs (which are not insignificant). If you did borrow money, you will be a long (long) way under.

Source: nucleuswealth.com/property-calculator

The Upshot

The problem is house price growth has been driven by falling interest rates and there are only a few rate cuts left.

Can I engineer a case where you do make money? Sure. But it involves unlikely scenarios where wages and rents increase rapidly while interest rates stay low. Or it involves suggesting that the median home buyer will pay all their post-tax income in interest and prepared to pay interest costs more than double the cost of renting an equivalent house.

The story is not as bad in markets outside of Melbourne and Sydney, but the theme is the same.

Just to be clear, I am assuming house prices are limited by:

- the cost of a mortgage relative to the cost of renting

- the cost of a mortgage relative to wages

If I am right, the investment outcome is that even in the boom conditions, you are unlikely to make a profit if you borrow most of the money. In negative scenarios, you are likely to make significant losses. I don’t like those odds.