Our digital advice offering is designed to help determine the appropriate investment portfolio for you, given your risk, income and ethical preferences.

It does this by asking you 12 questions about your experience, attitude and objectives of investing. As well as which, if any, of the ethical categories you'd like to apply.

We have a video available on the digital advice home page which explains the on-boarding process, and we highly recommend getting into the system and having a look. There is absolutely no obligation to submit.

Nucleus Wealth is the investment manager of investments made through this digital advice offering. This means they determine what investments are made on your behalf. They do this according to which portfolio options you choose to invest in (or are advised to invest in) and the rules of those portfolios. See the FAQs tab on "Portfolios" to find our more about the rules of each of portfolio.

Nucleus Wealth's investment team have over 100 years of combined experience in investing.

Praemium is a platform that administers investments and performs trading of stocks on behalf of Nucleus Wealth clients.

Nucleus Wealth chose Praemium as its investment platform because Praemium is fully backed by global and local banks, such as JPMorgan, HSBC and ANZ, offering the gold standard for client asset protection.

A Separately Managed Account is a portfolio of individual securities managed on the client’s behalf by a professional asset management firm, in this case Nucleus Wealth. Separately Managed Accounts offer the investor the benefits of direct share ownership. Dividends, distributions and franking credits are confined to the client’s account, whilst the client still has the hands off nature of a professionally managed investment solution. Separately Managed Accounts have been around for some time, and have grown in popularity in the last 5 years.

A self managed super fund (SMSF) is a superannuation trust structure that provides benefits to its members upon retirement. The main difference between Self Managed Super Funds and other super funds is that Self Managed Super Fund members are also the trustees of the fund. More information on Self Managed Super Funds here and here.

Individual - For clients looking to invest personal money in their own name (not in superannuation)

Personal Superannuation - For clients looking to rollover funds from their existing personal superannuation account, or looking to open a new account

Joint - For clients looking to invest personal money in the name of 2 people (e.g. the client and their partner)

Company - For clients looking to invest money in the name of a company they have control of

Trust with Individual Trustees - For clients looking to invest money in the name of a trust they control that has individual trustees

Trust with a Corporate Trustee - For clients looking to invest money in the name of a trust they control that has a corporate trustee

SMSF with Individual Trustees - For clients looking to invest money in the name of a Self Managed Super Fund they control that has individual trustees

SMSF with a Corporate Trustee - For clients looking to invest money in the name of a Self Managed Super Fund they control that has a corporate trustee

You can access the Product Disclosure Statement for our digital advice products through the on-boarding portal, keeping in mind that creating an application is without charge and completely obligation free.

Another advantage of doing the on-boarding process is that you will also get more accurate fee estimates once you get to the review stage.

If you do decide to submit an application you will also be emailed several documents, including the Product Disclosure Statement.

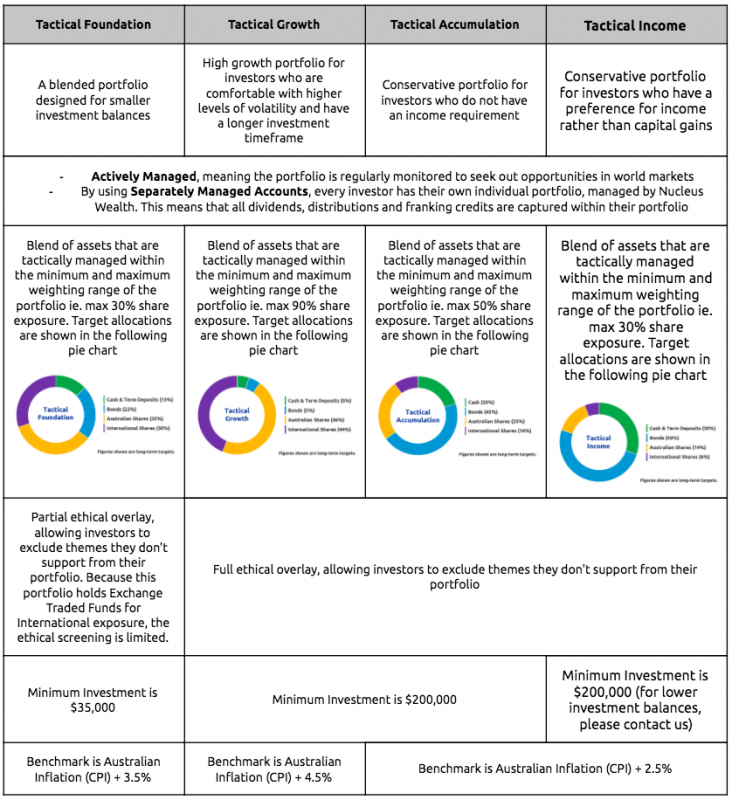

Tactical Foundation - $10,000

Tactical Growth - $200,000

Tactical Accumulation - $200,000

Tactical Income - $200,000 (for lower investment balances, please contact us)

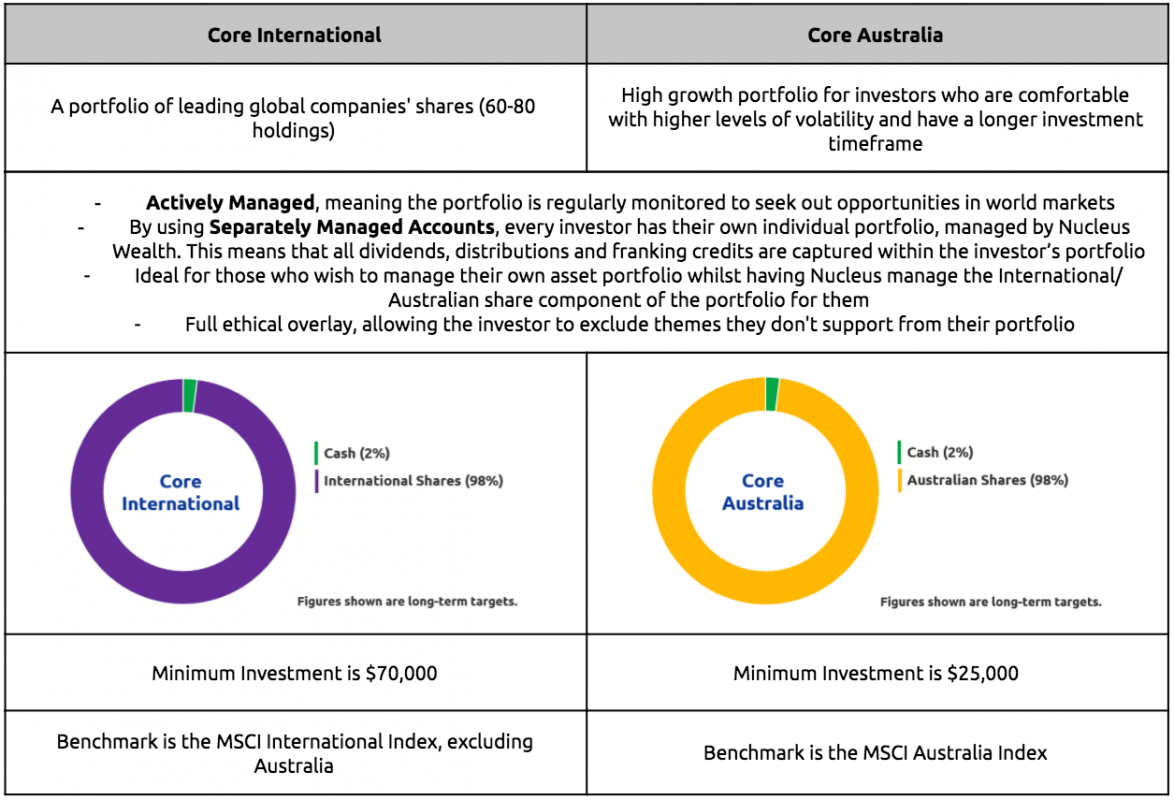

Core International - $70,000

Core Australia - $25,000

Nucleus Super - $35,000

These minimums are a guide to the investment required to get adequate diversification.

We use a third-party platform called GreenID, which cross-checks your data against several databases including the electoral roll. This is in compliance with the Anti-Money Laundering (AML) Laws.

Yes.

Omnibus cash deposits’ of the Scheme is protected up to $250,000 as it is held in a trust account with a covered Authorised Deposit-taking Institution.

The Financial Claims Scheme provides protection for depositors of banks, credit unions and building societies that are incorporated in Australia (also known as authorised deposit-taking institutions or ADIs), for deposits up to $250,000 per account holder per Authorised Deposit-taking Institution. The scheme aims to return deposits to account holders within seven days of activation of the Financial Claims Scheme.

The Financial Claims Scheme applies to a wide range of deposit accounts held with Authorised Deposit-taking Institutions that are incorporated in Australia, but only applies to deposit accounts with funds in Australian dollars. Under the Financial Claims Scheme an account holder can be the trustee(s) of a trust (e.g. the account holder is Praemium as trustee of the trust/Scheme).

The Scheme’s custodian, HSBC Bank Australia Limited, is an Authorised Deposit-taking Institution covered under the Financial Claims Scheme.

Other protection and assurance is that it is a registered managed investment scheme that is regulated by ASIC and assets are held by an external regulated custodian. Responsible Entity & custodian must comply with certain capital and investor protection requirements e.g. assets held on trust.

Regulatory Guide 133 can be found here, and Regulatory Guide 166 can be found here.