Customisable

Our system allows you to customise your investment to suit the ethical preferences that matter to you, not the fund manager.

To do this, we offer around 100 different tailoring options to customise your portfolio.

transparent

We provide you:

- A company profile on each company you own and why it is in your portfolio.

- Detailed dashboards showing how your portfolio is positioned.

- A detailed performance report each month, with a focus on current positioning and what we expect from markets.

Safe

Our portfolios are actively managed, and limited to blue chip International and Australian stocks, cash and government bonds. In addition, we intently target high quality stocks to reduce risk.

Screens

You can exclude the below to customise your portfolio

- No Fast Food

- No Genetically Modified Foods

Click get started to see which stocks are excluded in each screen.

Tilts

You can add the below to customise your portfolio

- Weight Loss Drug Producers

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

- Defense Contractors

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

ethical investment

We have ethics. Integrity, honesty, reliability.

However, when it comes to investing, the questions become more nuanced and the answers often depend on the individual.

For example, some people like nuclear power for efficiency and carbon reduction benefits. Other people believe the risks to the environment and contamination are too high.

At Nucleus, we don’t dictate the ethics. You choose from over 30 different ethical overlays over your portfolio so that we don’t buy stocks that conflict with your beliefs.

ethical investment

We have ethics. Integrity, honesty, reliability.

However, when it comes to investing, the questions become more nuanced and the answers often depend on the individual.

For example, some people like nuclear power for efficiency and carbon reduction benefits. Other people believe the risks to the environment and contamination are too high.

At Nucleus, we don’t dictate the ethics. You choose from 20 different ethical overlays over your portfolio so that we don’t buy stocks that conflict with your beliefs.

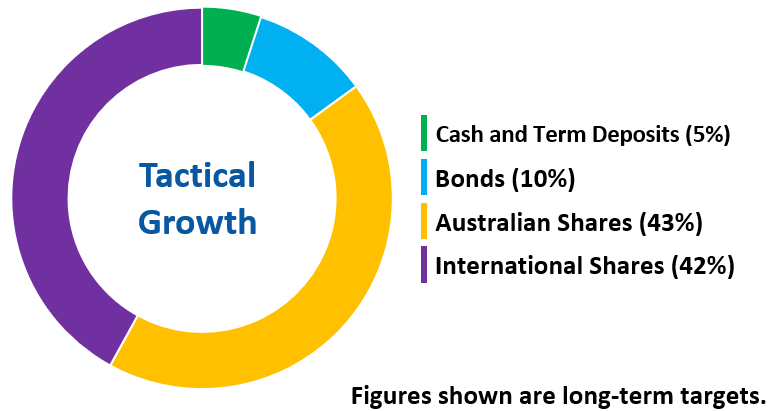

Tactical Investment Options

These portfolios feature "Tactical Asset Allocation", meaning the amount of Cash, Bonds and Shares in each portfolio is adjusted by Nucleus Wealth to take advantage of global macroeconomic themes and to help protect the portfolio during volatile market conditions

Through our onboarding portal you can select any of the portfolios, a blend of several, or receive a recommendation of an appropriate blend for you using our free online advice tool

Features

High growth portfolio for investors who are comfortable with higher levels of volatility and have a longer investment timeframe

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 90% share exposure. Target allocations are shown in the following pie chart

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum Investment is $10,000. For additional information, please visit our portfolios page

- Benchmark is Australian Inflation (CPI) + 4.5%

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Features

Conservative portfolio for investors who do not have an income requirement

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 50% share exposure. Target allocations are shown in the following pie chart

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum Investment is $10,000. For additional information, please visit our portfolios page

- Benchmark is Australian Inflation (CPI) + 2.5%

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Features

Conservative portfolio for investors who have a preference for income rather than capital gains

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 30% share exposure. Target allocations are shown in the following pie chart

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum Investment is $10,000. For additional information, please visit our portfolios page

- Benchmark is Australian Inflation (CPI) + 2.5%

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

TACTICAL PORTFOLIOS

These portfolios feature "Tactical Asset Allocation", meaning the amount of Cash, Bonds and Shares in each portfolio is adjusted by Nucleus Wealth to take advantage of global macroeconomic themes and to help protect the portfolio during volatile market conditions

Through our onboarding portal you can select any of the portfolios or a blend of several, or receive a recommendation of an appropriate blend for you using our free online advice tool

Features

High growth portfolio for investors who are comfortable with higher levels of volatility and have a longer investment timeframe

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 90% share exposure. Target allocations are shown in the following pie chart

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum Investment is $10,000. For additional information, please visit our portfolios page

- Benchmark is Australian Inflation (CPI) + 4.5%

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

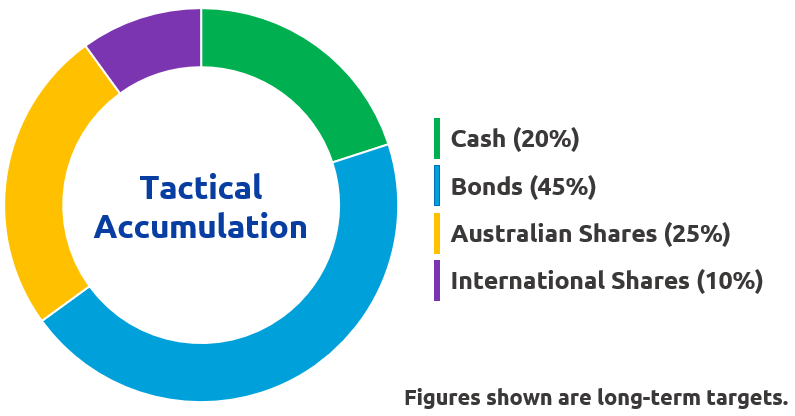

Features

Conservative portfolio for investors who do not have an income requirement

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 50% share exposure. Target allocations are shown in the following pie chart

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum Investment is $10,000. For additional information, please visit our portfolios page

- Benchmark is Australian Inflation (CPI) + 2.5%

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

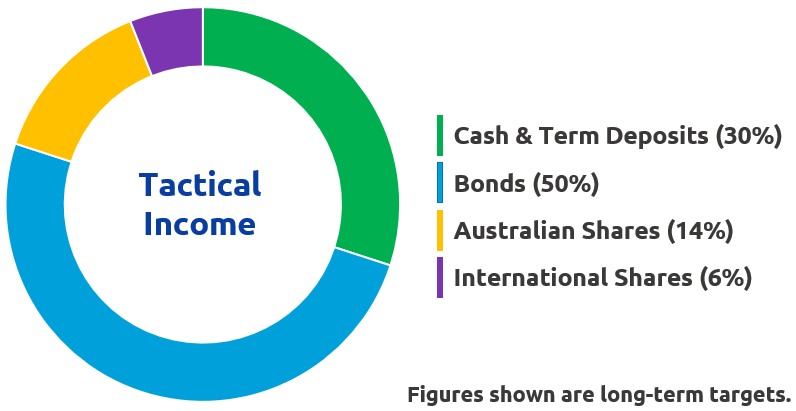

Features

Conservative portfolio for investors who have a preference for income rather than capital gains

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 30% share exposure. Target allocations are shown in the following pie chart

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum Investment is $10,000. For additional information, please visit our portfolios page

- Benchmark is Australian Inflation (CPI) + 2.5%

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

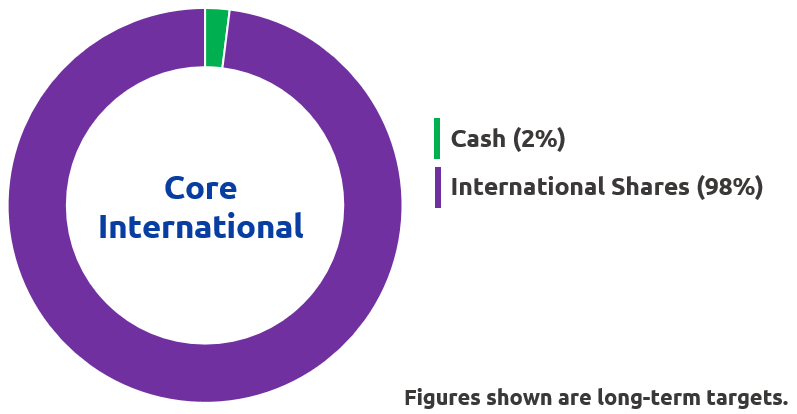

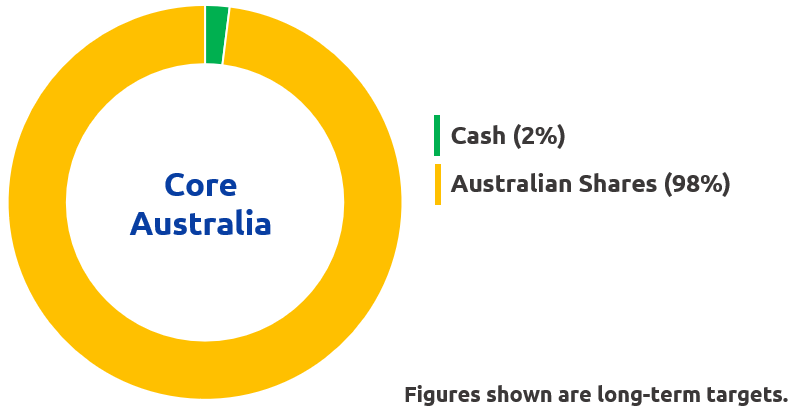

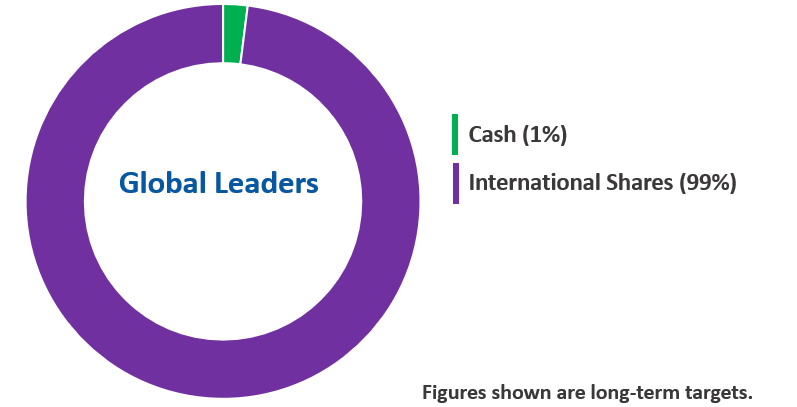

Core Share Investment Options

These portfolios hold only Australian or International shares respectively, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios

Through our onboarding portal you can select any of the portfolios or a blend of several, click here to begin customising your portfolio

Features

A portfolio of leading global companies' shares (60-80 holdings)

- Actively Managed, meaning we monitor stock prices and buy or sell accordingly, whilst ensuring a diversified mix of sectors

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the International share component of the portfolio for them

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum investment: $70,000

- Benchmark is the MSCI World Index

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

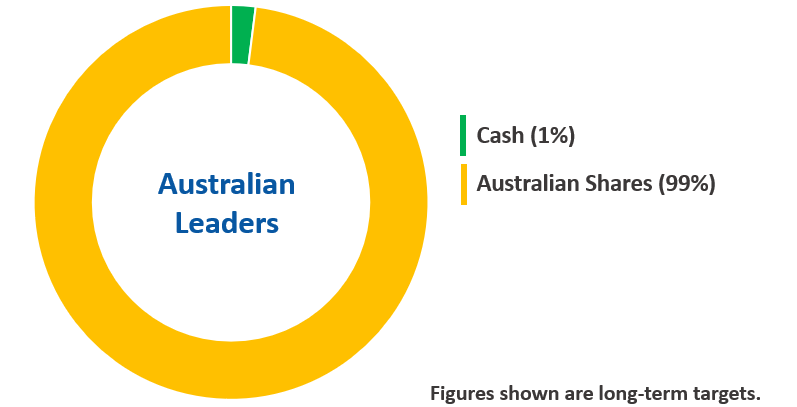

Features

A portfolio of leading Australian companies' shares (20-30 holdings)

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets, whilst ensuring a diversified mix of sectors

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the Australian share component of the portfolio for them

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum investment: $25,000

- Benchmark is the MSCI Australia index

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

CORE SHARES PORTFOLIOS

These portfolios hold only Australian or International shares respectively, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios

Through our onboarding portal you can select any of the portfolios or a blend of several, click here to begin customising your portfolio

Features

A portfolio of leading global companies' shares (60-80 holdings)

- Actively Managed, meaning we monitor stock prices and buy or sell accordingly, whilst ensuring a diversified mix of sectors

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the International share component of the portfolio for them

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum investment: $70,000

- Benchmark is the MSCI World Index

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Features

A portfolio of leading Australian companies' shares (20-30 holdings)

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets, whilst ensuring a diversified mix of sectors

- By using Separately Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the Australian share component of the portfolio for them

- Full ethical overlay, allowing you to exclude themes you don't support from your portfolio

- Minimum investment: $25,000

- Benchmark is the MSCI Australia index

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

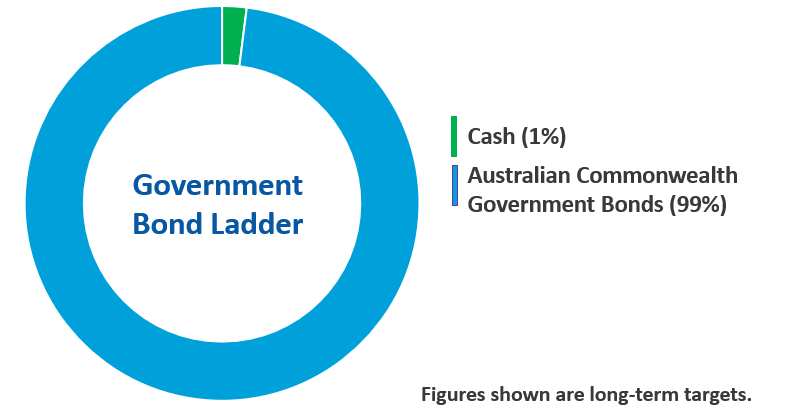

PASSIVE DIRECT INDEXING PORTFOLIOS

Passively managed investment solutions for those who are happy to receive indexed returns whilst paying lower fees. These portfolios hold only Australian or International shares or ASX listed Bonds, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

Features

A portfolio of the largest global shares by market capitalisation (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: To provide an exposure to a basket of the largest global stocks.

- Investment strategy: The model provides exposure to a portfolio of the largest global equities by market capitalisation. The model will generally hold the 40 (by default) largest shares listed in developed markets.

-

Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Global Equities exposure

-

Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

-

Minimum investment: $10,000 (platform dependent)

- During periods when small companies outperform larger ones the portfolio may underperform, and vice versa.

-

Portfolio is unhedged so investors are exposed to AUD movements

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.17% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

Features

A portfolio of the largest ASX listed companies' shares (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: This is a passive strategy designed to provide an exposure to a basket of the largest Australian stocks.

- Investment strategy: The model provides exposure to a portfolio of the 25 (by default) largest companies on the ASX.

- Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Australian Equities exposure

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

- View the Target Market Determination for this portfolio

-

Fees

- Our investment management fee is 0.17% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

Features

A portfolio of Australian Commonwealth Government Bonds listed on the ASX.

Fees

- Our investment management fee is 0 to 0.11% of your account balance per annum.

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.11%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

PASSIVE DIRECT INDEXING PORTFOLIOS

Passively managed investment solutions for those who are happy to receive indexed returns whilst paying lower fees. These portfolios hold only Australian or International shares or ASX listed Bonds, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

Features

A portfolio of the largest global shares by market capitalisation (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: To provide a return before fees approximating the S&P Global 100 Index in Australian dollars. Measured over a five year rolling average.

- Investment strategy: The model provides exposure to a portfolio of the largest global equities by market capitalisation. The model will generally hold the 40 (by default) largest shares listed in developed markets.

-

Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Global Equities exposure

-

Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

-

Minimum investment: $10,000 (platform dependent)

-

Benchmark is the S&P Global 100 Index in AUD

-

During periods when small companies outperform larger ones the portfolio may underperform, and vice versa.

-

Portfolio is unhedged so investors are exposed to AUD movements

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.17% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

Features

A portfolio of the largest ASX listed companies' shares (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: This is a passive strategy designed to provide a before fees return in line with the S&P/ASX 20 Accumulation Index over rolling five year periods.

- Investment strategy: The model provides exposure to a portfolio of the 25 (by default) largest companies on the ASX.

- Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Australian Equities exposure

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

- Benchmark is the ASX20 Index

- View the Target Market Determination for this portfolio

-

Fees

- Our investment management fee is 0.17% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

Features

A portfolio of Australian Commonwealth Government Bonds listed on the ASX.

Fees

- Our investment management fee is 0 to 0.11% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.11%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

We use Nucleus Wealth because of its ethical standards and good performance. We are entirely satisfied with its structures and communicative process

Charles

/ 75+ years old

Nucleus Wealth was very easy to use, the support team is great and happy to answer any questions. They exceeded expectations and I would recommend their service.

Virginnia

/ 46-55 years old

Fund performance was excellent during challenging conidtions. For me it was an excellent alternative to most domestic (AU) investment options such as ASX, and as such really helped to diversify internationally and minimise risk. Staff have been easy to communicate with. I was also pleased to make use of the ethical & environmental filters.

Dave

/ 36-45 years old

The Nucleus Wealth offering from risk profile assessment and platform asset management is incredibly easy to use. The customer support is responsive, informative, polite and caters to a wide group of investor experience. The service overall has exceeded my expectations and prove the benefits of an active fund manager in these uncetain times.

David

/ 36-45 years old

Nucleus Wealth offer a great product with outstanding dashboard tools that allow investors to drill all the way down into their investment and view each holding. Great customer support. Strongly recommend.

Richard

/ 25-35 years old

Nuclear Wealth aligns well with my investment thesis, had great customer service and communicate often through interestomg podcasts

Jason

/ 36-45 years old

The team has been very helpful and accommodating with my needs. Have recommended it to friends

Jarek

/ 36-45 years old

Nucleus Wealth was relatively easy to use. The customer support options were quite good. Nucleus Wealth’s service generally met my expectations. I would definitely recommend it to friends.

Patrick

/ 46-55 years old

Nucleus Wealth was easy to use, though charting options were not straight forward. The customer support was excellent. I would definitely recommend it to friends.

Russel

/ 25-35 years old

Stay in contact

- Register to receive email updates

- Subscribe to our free weekly podcast

- Add us to your preferred social media

Speak to someone

- Give us a call on 1300 623 863

- Book a call with a financial planner

Responsible Investing Disclaimer

Nucleus Wealth offers all investors the option to tailor their investment portfolios according to the investor’s own brand of personal ethics. While Nucleus Wealth maintains ethical standards of integrity, honesty and reliability, it does not seek to impose these on its investors. Rather, Nucleus Wealth offers investors a system of investment that incorporates three core strategies: (i) customisable; (ii) transparent; and (iii) safe. Within this, investors are given the ability to customise their investments insofar as it aligns with their ethical preferences, rather than that of the fund manager, by using screens and tilts. Once the investor’s portfolio has been adjusted, Nucleus Wealth provides the investor with a company profile, access to performance dashboards and detailed monthly performance reports of each company within the investor’s portfolio to further inform the investor on their investment decision and the company’s ethical standing as it aligns with the screens and tilts opted for. Nucleus Wealth utilises a number of domestic and international sources to identify whether companies from particular countries or sectors fall within the categories of screens and tilts which the investor may choose to apply. While Nucleus Wealth undertakes its own fundamental analysis on each company, there is also the risk that investors could reach a different conclusion to Nucleus Wealth on whether a company falls within the frame of responsible filters being applied. For more information visit Nucleus Wealth's responsibility-related statements.