Investment Options

ACTIVE MULTI-ASSET PORTFOLIOS

These portfolios feature "Tactical Asset Allocation", meaning the amount of Cash, Bonds and Shares in each portfolio is adjusted by Nucleus Wealth to take advantage of global economic themes and help protect the portfolio during volatile market conditions

Through our onboarding portal you can select any of the portfolios, a blend of several, or receive a recommendation of an appropriate blend for you using our free online advice tool

Features

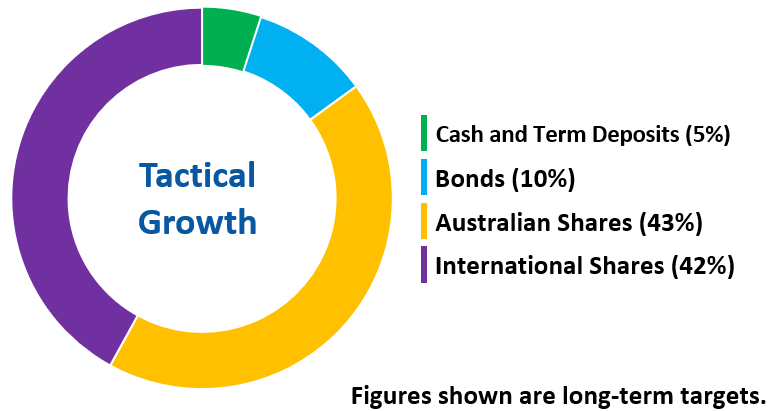

High growth portfolio for investors who are comfortable with higher levels of volatility and have a longer investment timeframe

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 98% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000

- Benchmark is Australian Inflation (CPI) + 4.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

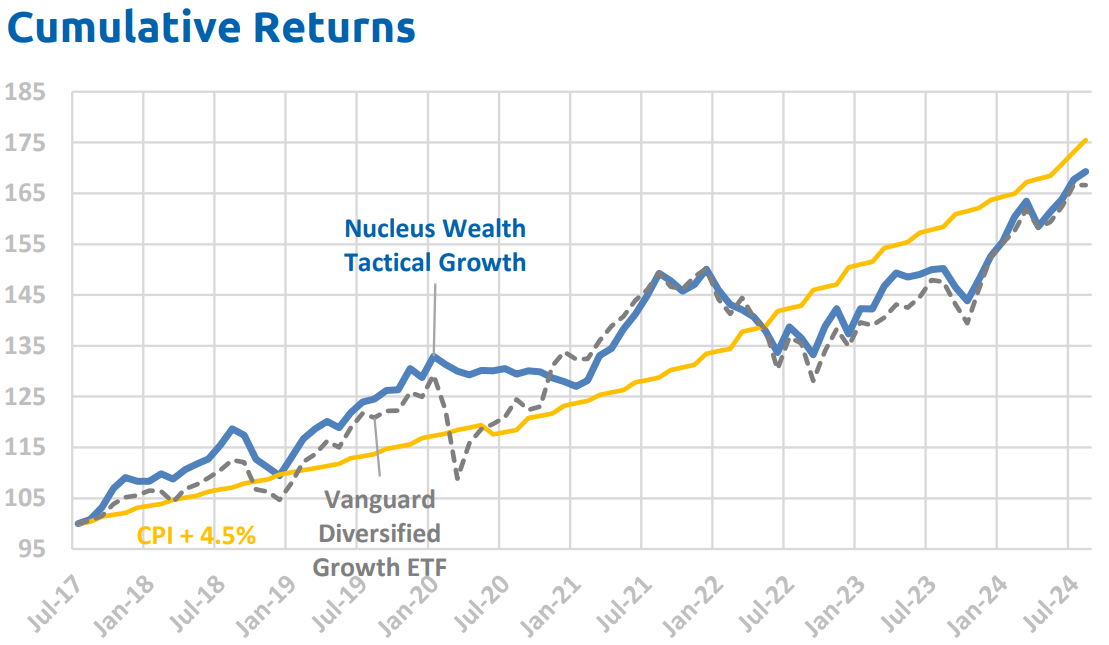

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Features

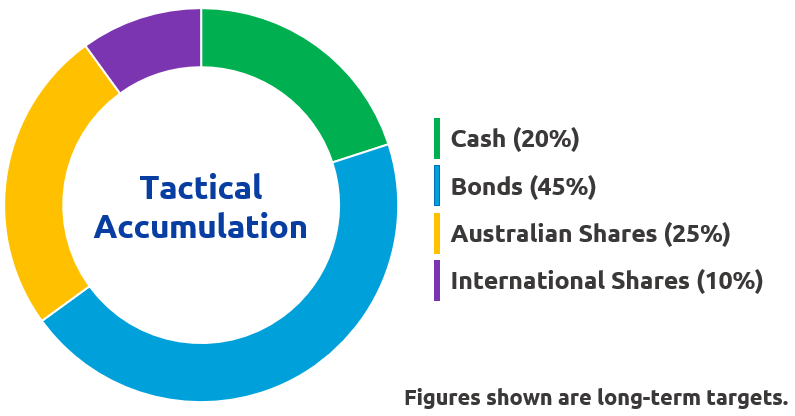

Conservative portfolio for investors who do not have an income requirement

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 50% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000

- Benchmark is Australian Inflation (CPI) + 2.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

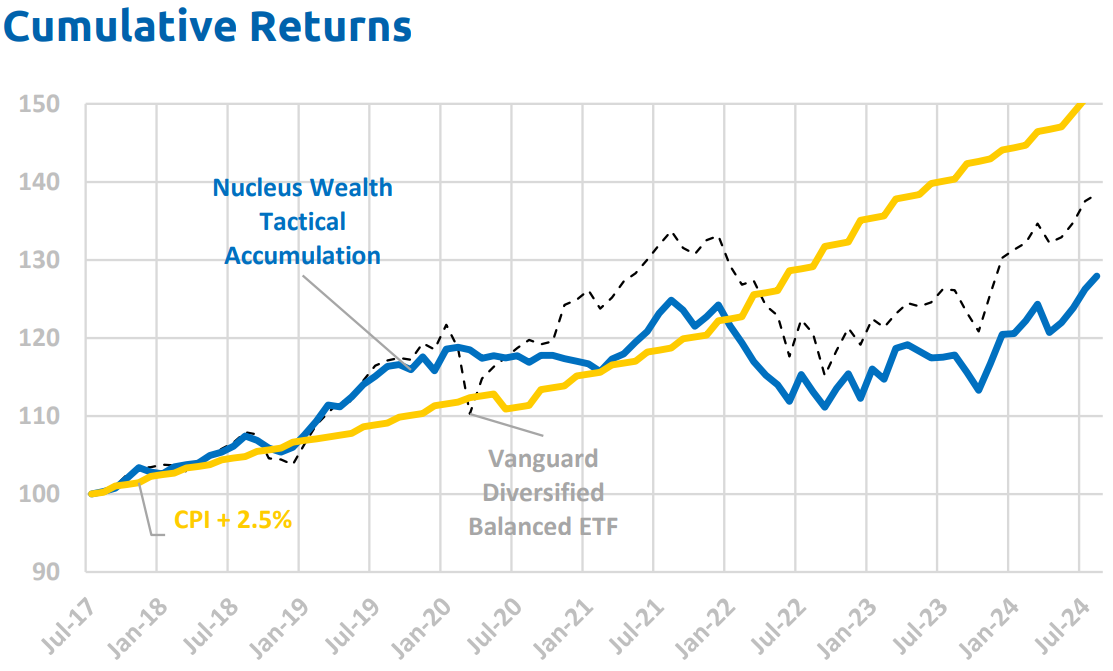

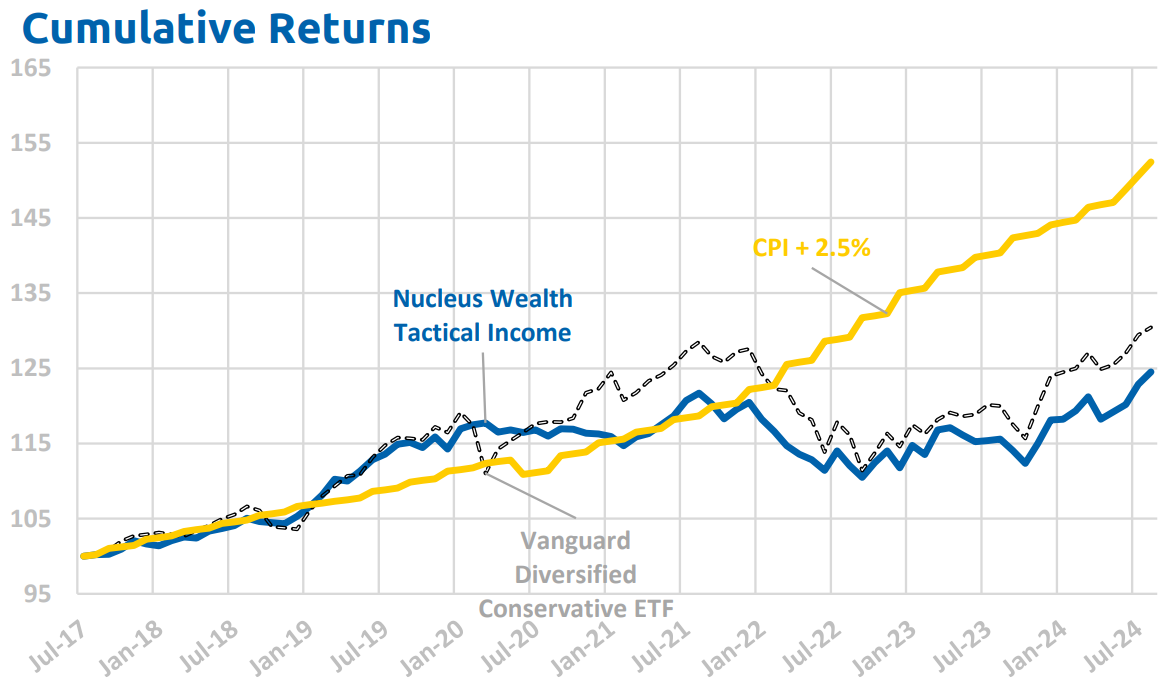

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Features

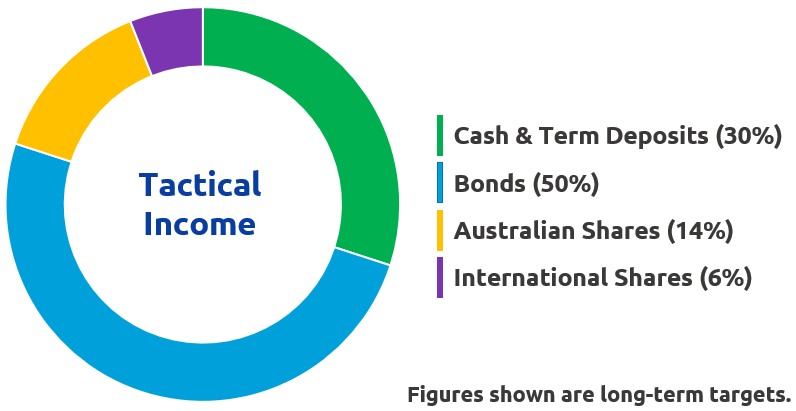

Conservative portfolio for investors who have a preference for income rather than capital gains

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 30% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000

- Benchmark is Australian Inflation (CPI) + 2.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

ACTIVE MULTI-ASSET PORTFOLIOS

These portfolios feature "Tactical Asset Allocation", meaning the amount of Cash, Bonds and Shares in each portfolio is adjusted by Nucleus Wealth to take advantage of global economic themes and help protect the portfolio during volatile market conditions

Through our onboarding portal you can select any of the portfolios, a blend of several, or receive a recommendation of an appropriate blend for you using our free online advice tool

Features

High growth portfolio for investors who are comfortable with higher levels of volatility and have a longer investment timeframe.

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets.

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio.

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 98% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000.

- Benchmark is Australian Inflation (CPI) + 4.5%.

- View the Target Market Determination for this portfolio

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Features

Conservative portfolio for investors who do not have an income requirement

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 50% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000

- Benchmark is Australian Inflation (CPI) + 2.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Features

Conservative portfolio for investors who have a preference for income rather than capital gains

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 30% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000 (for lower investment balances, please contact us)

- Benchmark is Australian Inflation (CPI) + 2.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

ACTIVE SHARE PORTFOLIOS

These portfolios hold only Australian or International shares respectively, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

Through our onboarding portal you can select any of the portfolios or a blend of several, click here to begin personalising your portfolio

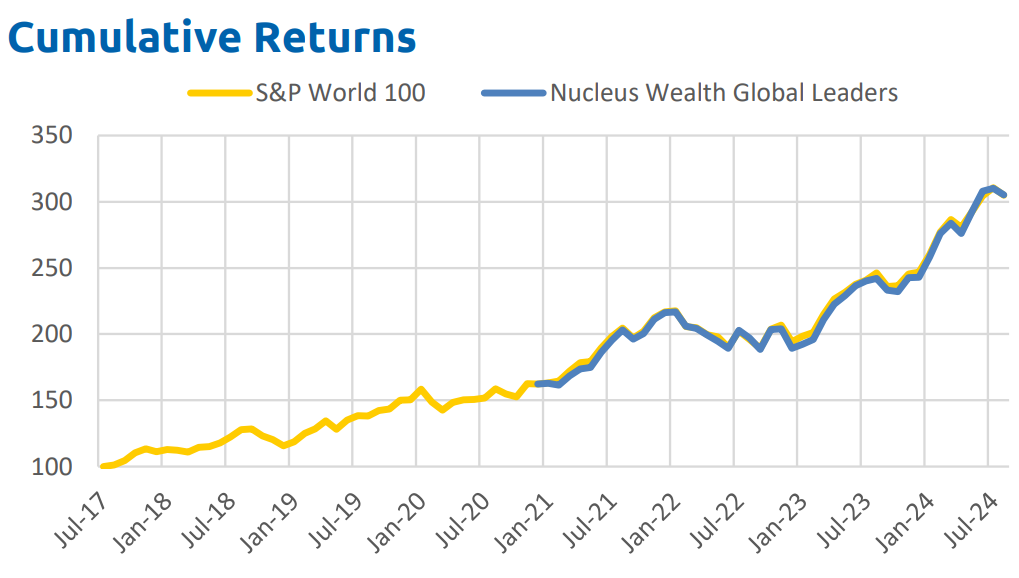

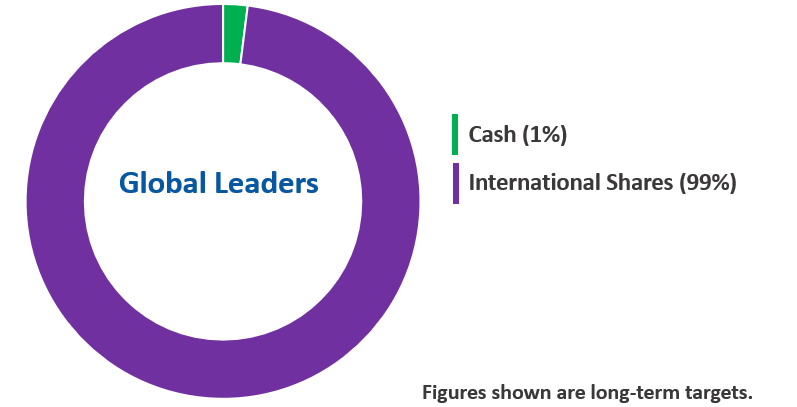

Features

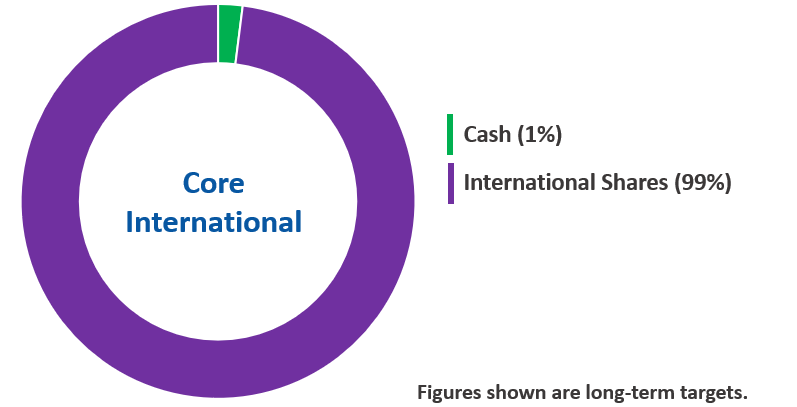

A portfolio of leading global companies' shares (60-80 holdings)

- Actively Managed, meaning we monitor stock prices and buy or sell accordingly, whilst ensuring a diversified mix of sectors

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the International share component of the portfolio for them

- Personalise with our ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

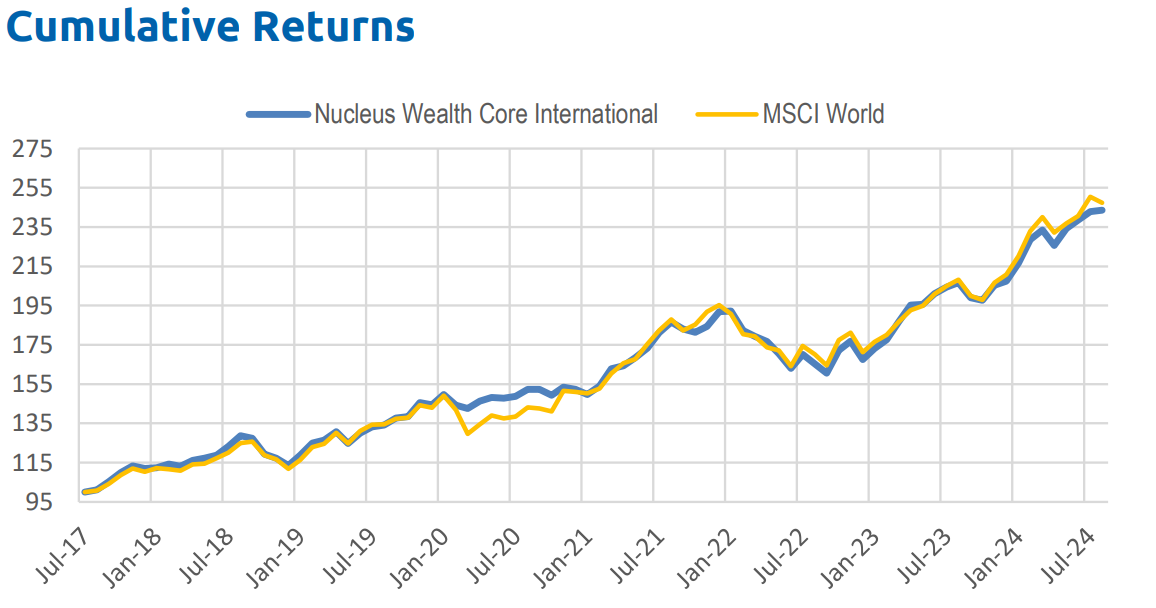

- Benchmark is the MSCI World Index

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

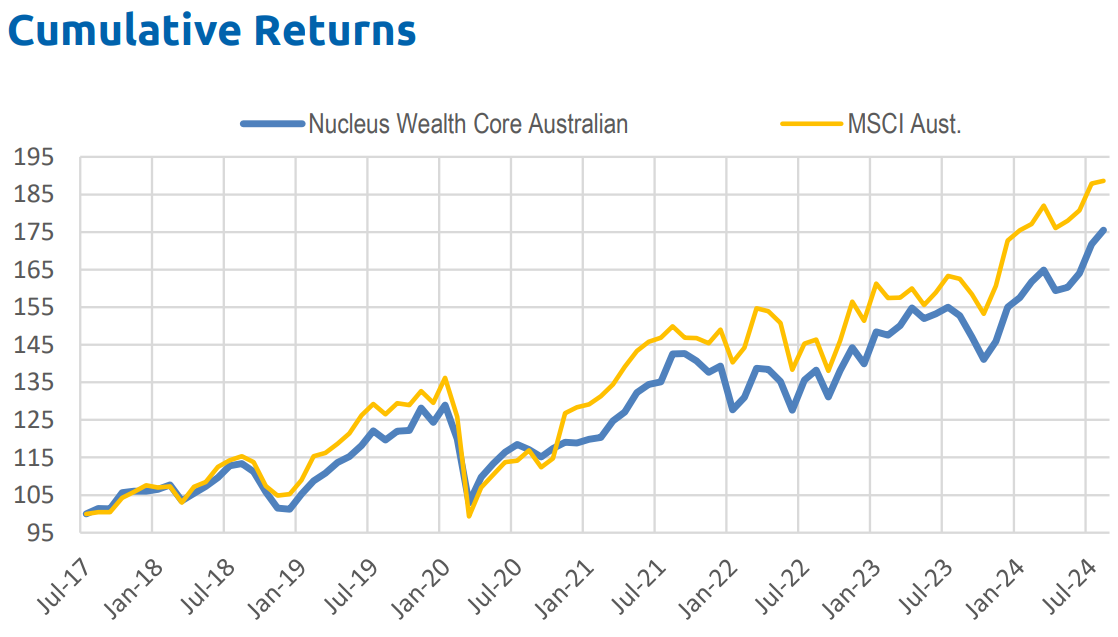

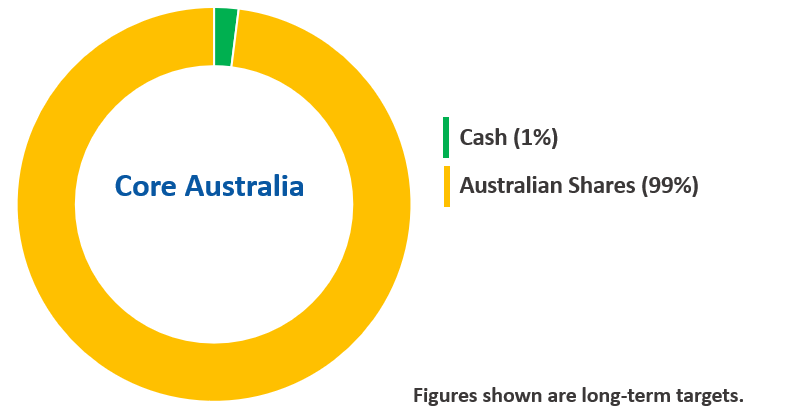

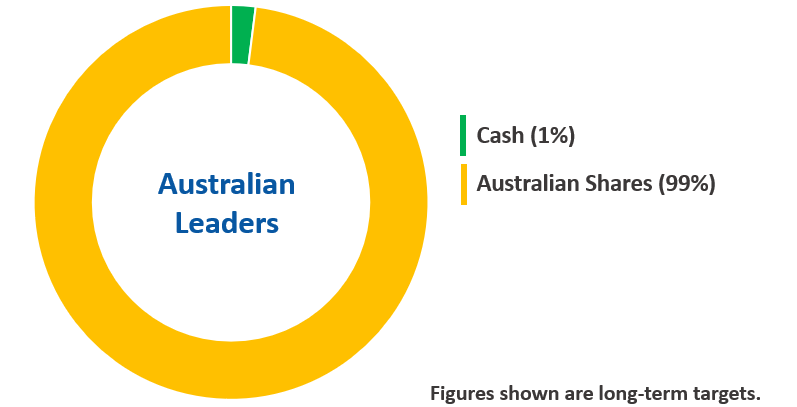

Features

A portfolio of leading Australian companies' shares (20-30 holdings)

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets, whilst ensuring a diversified mix of sectors

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the Australian share component of the portfolio for them

- Personalise with our ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

- Benchmark is the MSCI Australia index

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

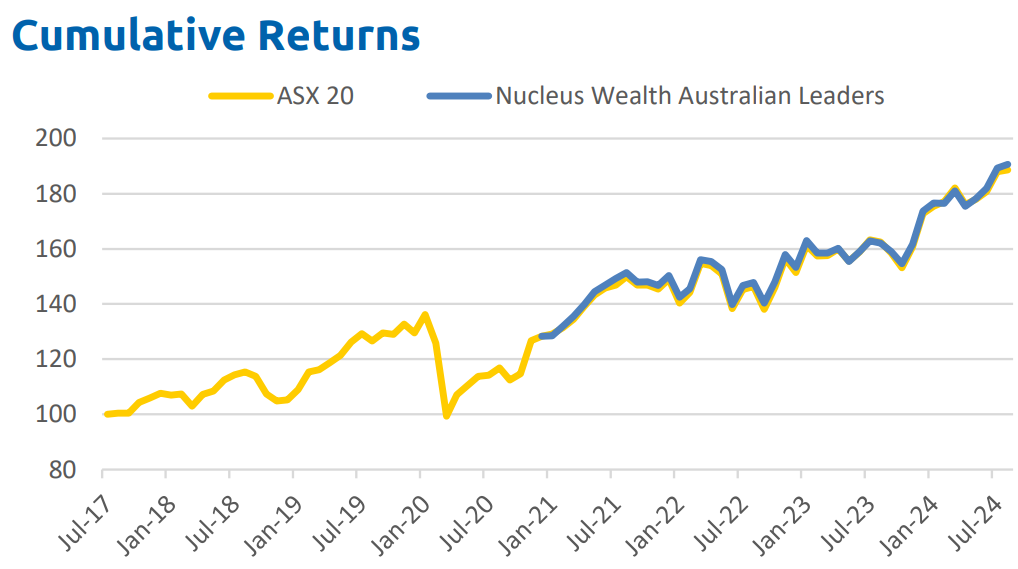

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

ACTIVE SHARE PORTFOLIOS

These portfolios hold only Australian or International shares respectively, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

Through our onboarding portal you can select any of the portfolios or a blend of several, click here to begin customising your portfolio

Features

A portfolio of leading global companies' shares (60-80 holdings)

- Actively Managed, meaning we monitor stock prices and buy or sell accordingly, whilst ensuring a diversified mix of sectors

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the International share component of the portfolio for them

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

- Benchmark is the MSCI World Index

- View the Target Market Determination for this portfolio

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Features

A portfolio of leading Australian companies' shares (20-30 holdings)

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets, whilst ensuring a diversified mix of sectors.

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio.

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the Australian share component of the portfolio for them.

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent).

- Benchmark is the MSCI Australia index.

- View the Target Market Determination for this portfolio

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

PASSIVE DIRECT INDEXING PORTFOLIOS

Passively managed investment solutions for those who are happy to receive indexed returns whilst paying lower fees. These portfolios hold only Australian or International shares or ASX listed Bonds, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

Features

A portfolio of the largest global shares by market capitalisation (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: To provide an exposure to a basket of the largest global stocks.

- Investment strategy: The model provides exposure to a portfolio of the largest global equities by market capitalisation. The model will generally hold the 40 (by default) largest shares listed in developed markets.

-

Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Global Equities exposure

-

Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

-

Minimum investment: $10,000 (platform dependent)

- During periods when small companies outperform larger ones the portfolio may underperform, and vice versa.

-

Portfolio is unhedged so investors are exposed to AUD movements

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.17% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

Features

A portfolio of the largest ASX listed companies' shares (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: This is a passive strategy designed to provide an exposure to a basket of the largest Australian stocks.

- Investment strategy: The model provides exposure to a portfolio of the 25 (by default) largest companies on the ASX.

- Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Australian Equities exposure

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

- View the Target Market Determination for this portfolio

-

Fees

- Our investment management fee is 0.17% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

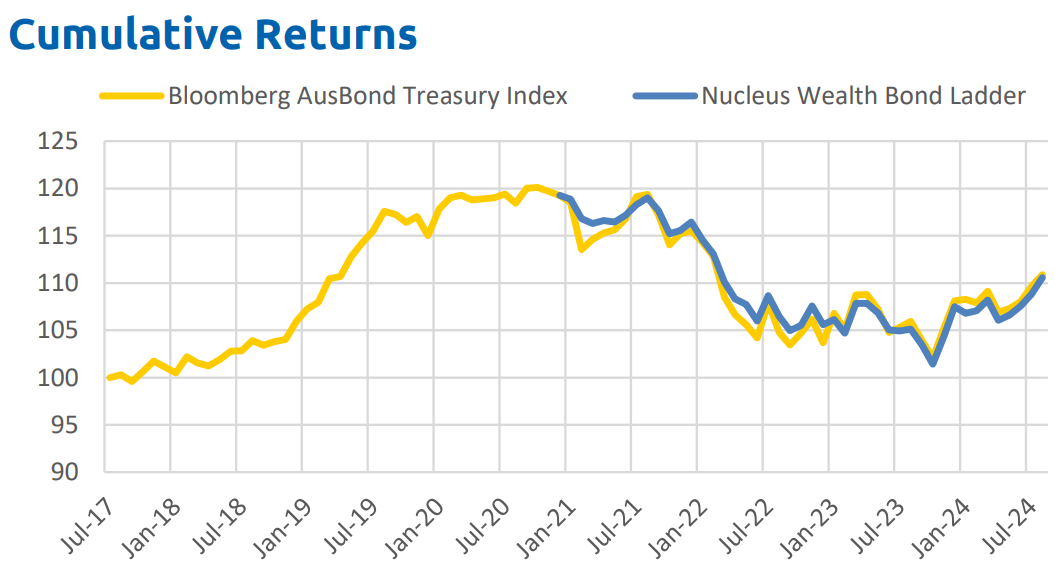

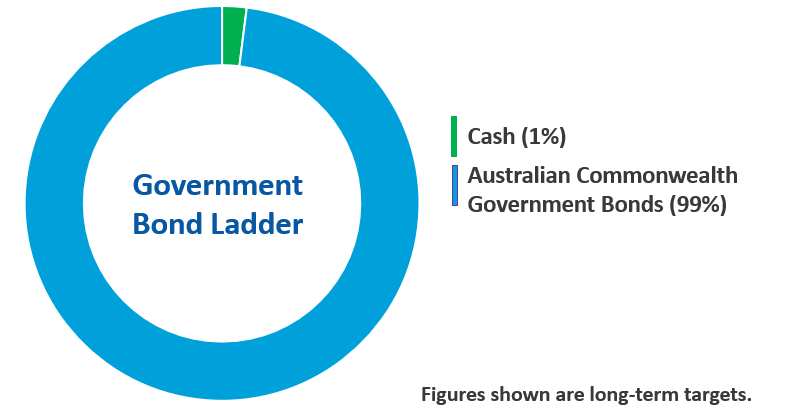

Features

A portfolio of Australian Commonwealth Government Bonds listed on the ASX.

Fees

- Our investment management fee is 0 to 0.11% of your account balance per annum.

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.11%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

PASSIVE DIRECT INDEXING PORTFOLIOS

Passively managed investment solutions for those who are happy to receive indexed returns whilst paying lower fees. These portfolios hold only Australian or International shares or ASX listed Bonds, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

Features

A portfolio of the largest global shares by market capitalisation (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: To provide a return before fees approximating the S&P Global 100 Index in Australian dollars. Measured over a five year rolling average.

- Investment strategy: The model provides exposure to a portfolio of the largest global equities by market capitalisation. The model will generally hold the 40 (by default) largest shares listed in developed markets.

-

Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Global Equities exposure

-

Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

-

Minimum investment: $10,000 (platform dependent)

-

Benchmark is the S&P Global 100 Index in AUD

-

During periods when small companies outperform larger ones the portfolio may underperform, and vice versa.

-

Portfolio is unhedged so investors are exposed to AUD movements

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.17% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

Features

A portfolio of the largest ASX listed companies' shares (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: This is a passive strategy designed to provide a before fees return in line with the S&P/ASX 20 Accumulation Index over rolling five year periods.

- Investment strategy: The model provides exposure to a portfolio of the 25 (by default) largest companies on the ASX.

- Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Australian Equities exposure

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

- Benchmark is the ASX20 Index

- View the Target Market Determination for this portfolio

-

Fees

- Our investment management fee is 0.17% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

Features

A portfolio of Australian Commonwealth Government Bonds listed on the ASX.

Fees

- Our investment management fee is 0 to 0.11% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of August 31st 2024 and after investment fees (of 0.11%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.