I’ve been having a second look at the private capital expenditure (capex) forecasts for Australia released last week. Capex is a key driver of economic cycles in Australia and getting an accurate read is critical to understanding the Australian economy – especially as capex was a significant detractor from GDP over the June quarter.

The good news is while the overall numbers were poor, there are some interesting sectors.

The bad news is the best performing sectors are those either reliant on government support (Health & Social Support and Education capex spending were both up 20%+ over the year) or simply a switch from public spending to private spending:

I need to preface all of this with the observation that some sectors of capex forecasts are not good – the forecasts are a classic case study in optimistic forecasting. The Australian Bureau of Statistics asks companies (a) how much did you spend in the last quarter (b) how much are you going to spend next quarter/six months and (c) how much are you going to spend next year.

The answer to question (c) for some sectors is almost invariably seriously underestimated, which affects the overall numbers. The median first forecast for total capex is usually nearly 15% too low because of some of the subsectors. But, strip this out, and look at the subsectors and more interesting data emerges:

One key sector we would love to get more statistics on is the construction sector – keeping in mind this is not total construction activity, just capex by construction companies themselves, not their clients. Unfortunately, this sector has such poor forecasts it renders the data all but unusable:

Aggregate capex is shown below, with the disclaimer that while many subcomponents of capex have a decent forecasting record, adding the good ones with the bad ones to create an aggregate number doesn’t fix the underlying problems:

Net effect

It is hard to be positive on capex.

The best case involves an “echo boom” in sectors reliant on government spending: health, education and utilities.

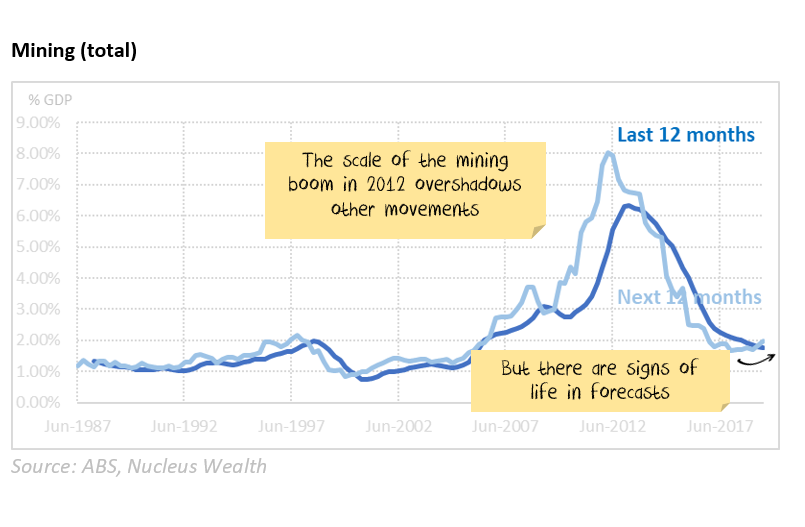

Mining capex has stopped falling, maybe mining capex will increase, but just as likely the falling iron ore prices and the trade war will see no meaningful increase.

Capex for Manufacturing, Transport, IT & Telecommunications look like continuing the decline – there does not look to be any private sector support for the Australian economy on the horizon.