January saw equity markets take a breather after a strong rally into the end of the year. Equity markets were mixed, the Dow down 2%, S&P 500 down 1% while Nasdaq powered on +1.4%. Globally, France lost 2.7%, the United Kingdom slipped 0.8%, Japan added 0.8% while here in Australia we edged forward 0.3%. Defensive assets, such as high-quality bonds, were on the back foot in the first weeks of the month, but as risk assets sold off, government bonds regained some of their losses.

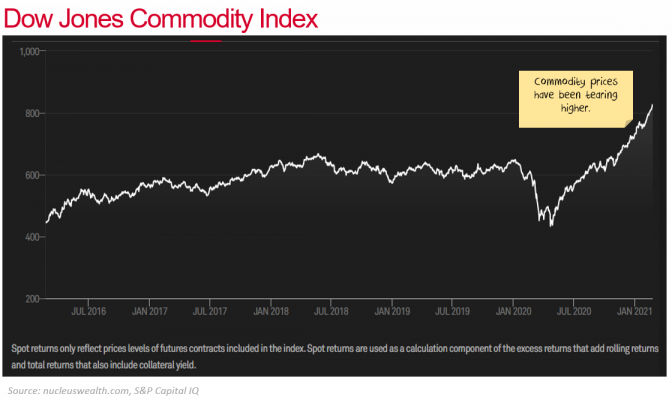

We spent the month shifting into stocks and bonds that will protect us more if inflation expectations rise. While rising inflation expectations were a minor feature in January, so far in February markets have been reflecting higher inflation expectations and we expect this to continue.

*****

Inflation spurt will likely be temporary

In many countries, “extend and pretend” has replaced the threat of bankruptcy. Someone who can’t pay their rent is not evicted but allowed to accrue debt. Don’t foreclose on those who can’t pay their interest. Instead, build up their interest payments into a larger debt burden.

The end game will be a cohort of zombie consumers and businesses. Weighed down by debt burdens too massive to ever pay off, but supported by interest rates low enough to keep them from defaulting.

In short, policymakers have decided on zombification: limit bankruptcies; increase debt and never raise interest rates again. It doesn’t make for a healthy economy. But it limits short-term pain which appears to be the current goal of most politicians.

This zombification is inflationary in the recovery phase but deflationary soon afterwards as oversupply swamps demand.

We are, therefore, suspicious that beyond 2021/22 we are entering a new inflationary cycle, as some have posited.

But there will be a spurt

For almost the past 15 years many economists have been forecasting a dramatic return to inflation driven by central bank largesse. The most fearful of these suggest that inflation is an inevitable consequence of quantitative easy and that Weimar Germany / Zimbabwe hyperinflation is not far off. So far they have been wrong.

They are about to have their day in the sun. Or at least something that looks like the start of their day in the sun. Inflation will bounce hard over the next six months, especially in the US on the back of a number of factors:

- Shortages from supply chain disruptions and lockdowns

- Structural changes in consumption following COVID

- Structural changes in supply chains following COVID

- Inventory cycle rebuild

- Government stimulus giving money to people who aren’t working

- The increased minimum wage in the US

- Lower US dollar

The Value stock rotation lives and dies on this narrative.

It can continue with inflation and rising market interest rates or end without it, culminating in a return to Growth stocks. We are positioning for a run to Value that lasts for 6-12 months. For it to continue, we will need to see more policy innovation, especially the putative integration of fiscal and monetary policy worldwide.

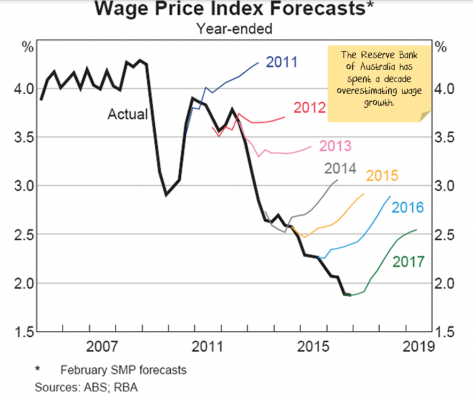

Until lowflation returns

For the past dozen years inflation has disappointed, continually falling below central bank expectations. This is for a number of reasons, the key ones include:

- High unemployment / low wage growth

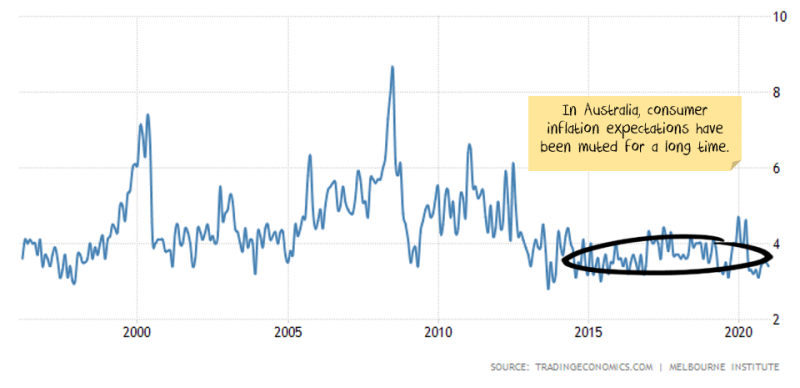

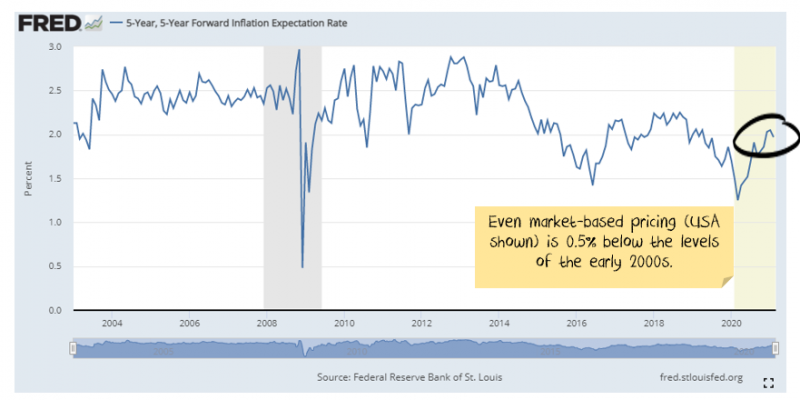

- Low expectations

- Technology advances

- Globalisation leading to a flatter supply curve

- High levels of debt

- Inequality

- Falling lending growth in China

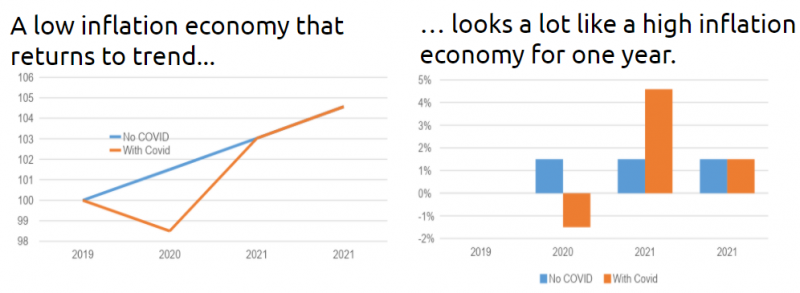

The 2021/22 inflation mirage

With this in mind, the important investment factor for 2021 will be managing the inflation scare, followed by its likely disappointment.

There are a number of factors that could extend the duration of the elevated inflation, the chief being government stimulus. We are expecting it to be six months or more before it is time to switch back into the stocks that are resistant to deflationary pressures.

*****

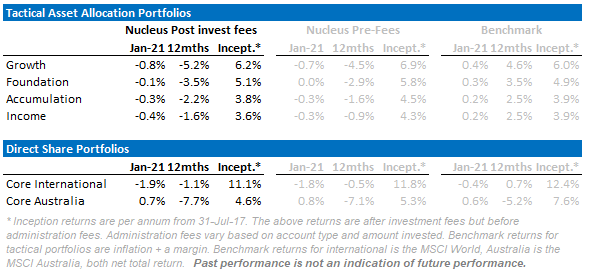

Performance Detail

Initially, the global roll-out of vaccinations and the promise of further fiscal and monetary stimulus spurred the market but as vaccine supply and effectiveness concerns reared the markets sold off especially when inflation data around the world came in higher than expected, adding to fears of higher-than-expected yields and a reversal of easy monetary policy.

Investor enthusiasm was further supported by a strong start to the fourth-quarter earnings season. With 37% of the S&P 500 index companies reporting by month-end, with ~80 %reported a positive earnings surprise.

Our defensively positioned portfolios underperformed our Benchmarks this month as our repositioning into the travel sector in late 2020 was sold off over January with the vaccine supply and efficacy concerns. Over the month we increased our weightings to banks and domestic equities in general.

*****

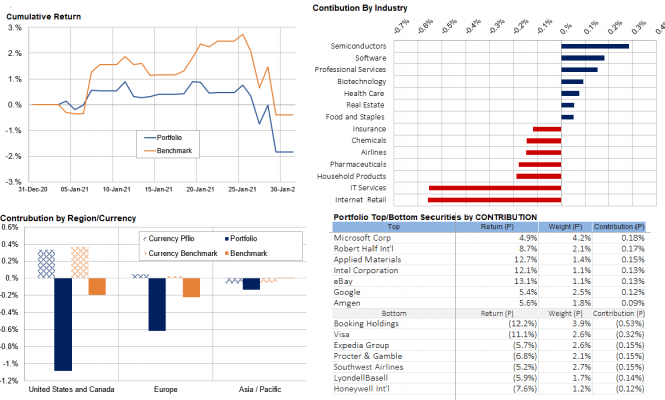

Core International Performance

Our international portfolio saw a 1.8% decline over January as travel stocks plummeted at the end of the month on vaccine efficacy and supply fears. While this impacted January performance we note these stocks have more than recovered in February. A further detractor was our exposure to more value-based stocks that took a breather after their Santa rally. After a strong quarterly performance, the AUD seemed to have settled at these levels and gave some assistance to performance.

During the month we increased our allocation to the international banking sector, lightened our property trust allocation and took some profits from our Honeywell investment.

*****

Core Australia Performance

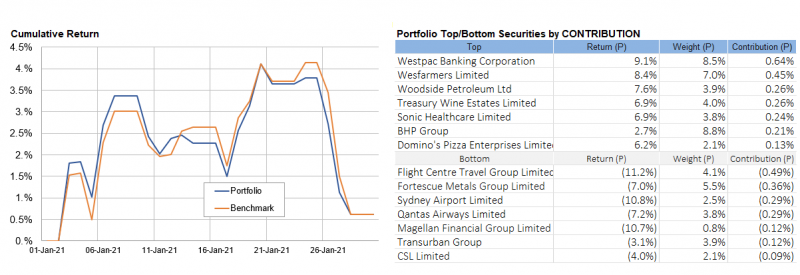

The Core Australian portfolio saw a small gain over the month mirroring the benchmark. A strong showing from the banks and growth stocks offset the continued travel-related stock weakness.

We repositioned the portfolio to increase our bank weighting (primarily CBA and Westpac), reflecting our view that inflation expectations are what the market will focus on. To make way we lightened stocks with international exposure: Computershare, Brambles and Magellan. Late in the month we reduced our Iron Ore exposure given its strong run over the past three months.

*****

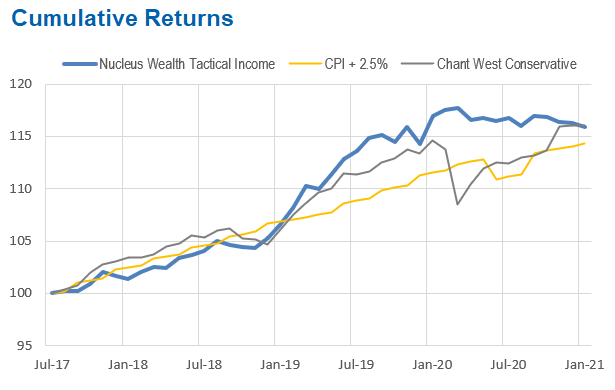

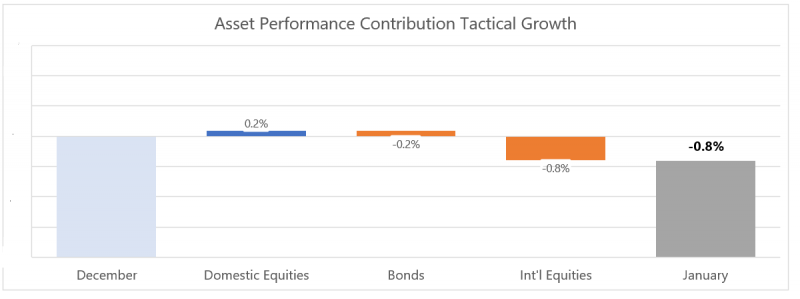

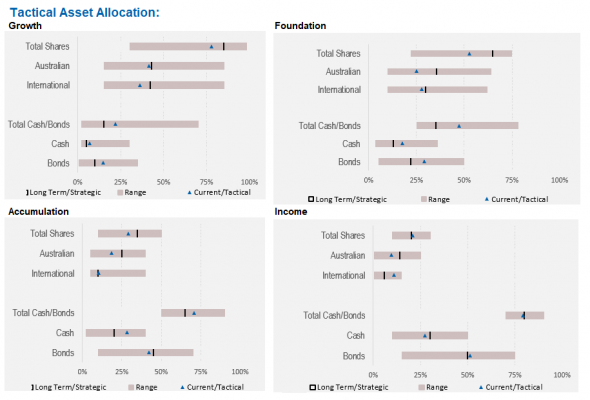

Tactical Portfolio Performance

The performance of the Tactical portfolios saw the Domestic allocation perform while International underperformed due to the travel stocks dip mentioned previously. Over January we repositioned the portfolios, decreasing the Bond exposure and increasing the allocation to Domestic Equities. In the Growth portfolio, we increased equities again to capture the expected 2021 catch-up growth.

__________________________________________

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.