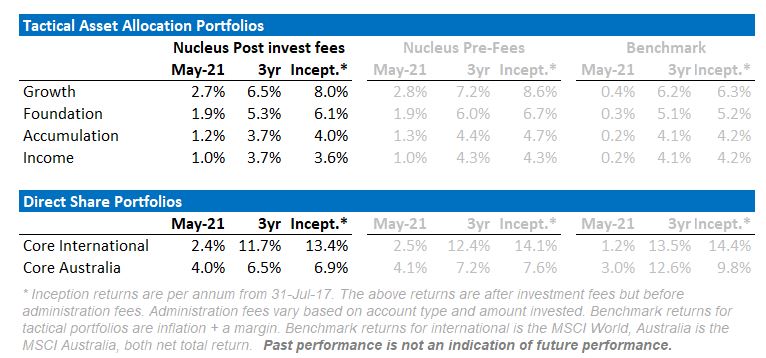

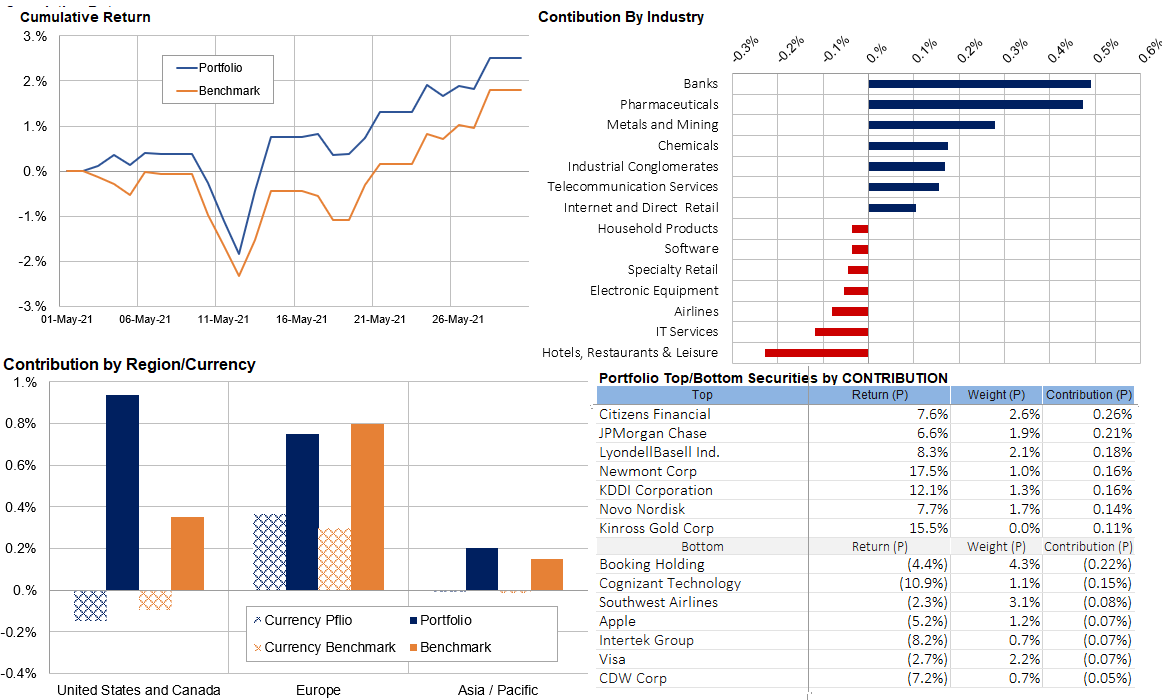

The market seems to be oscillating between value and growth months. In May it was the turn of value portfolios (including ours) to outperform. Our direct equity portfolios beat benchmarks by over 1% on the month and our tactical asset portfolios finished up between 1% and 2.7%.

We have, however, called time on the value trade. The current inflation spike looks to be short term and will likely recede over the next six months.

Portfolio Repositioning

We repositioned portfolios accordingly in early June.

Our bond holdings were huddled at the short end of the curve, largely protected from rising rates. While bond yields did rise over the last few months, the bond market never really believed the “inflation is back” story. Bond pricing looks about right given the risks, and so we don’t feel the need to take too much of a bet in either direction. We are now much more “normally” positioned.

In our share portfolios, we have made some substantial changes to reduce weight to the stocks we perceive will be the losers from the new environment: banks, resources and value stocks.

The replacements are similar to the winners from 2020: quality growth (think profitable technology) and defensive. In effect it is a barbell portfolio containing part:

- Defensive stocks that are interest-rate sensitive. i.e. stocks whose valuations will benefit from lower interest rates

- Quality growth stocks. In a low growth world, stocks that can grow considerably above-trend become more attractive

If you were looking for maximum returns, you might buy “junk” growth stocks, ones with little to no earnings which often perform best in this type of environment. We look at our portfolios differently though. Risk is an important factor, and the junk growth stocks are far from cheap and have as much downside as they do upside.

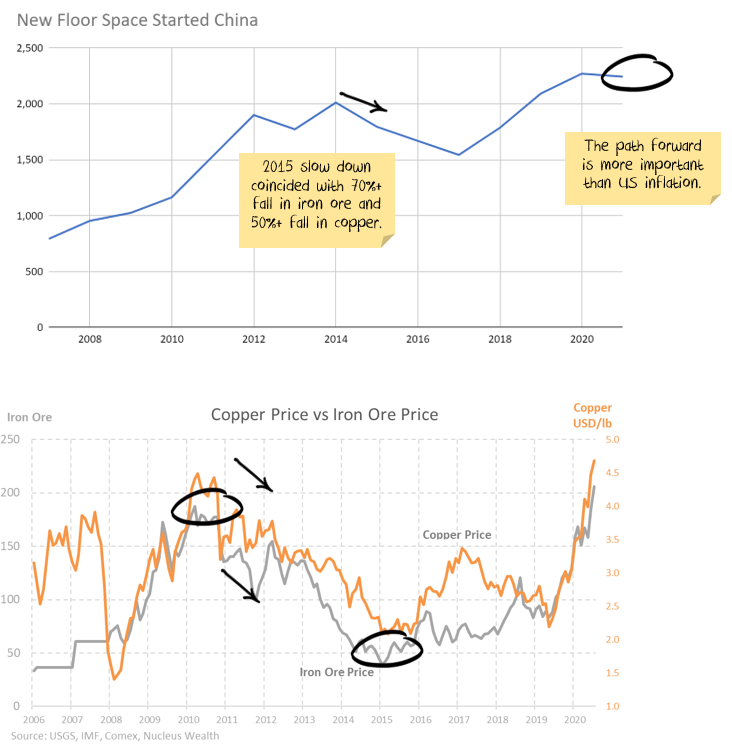

Chinese growth is a major consideration. Debt growth has slowed considerably, and a broad range of measures are rolling over. There is a reasonable risk case that current conditions morph into a 2015-style Chinese slowdown which saw commodity prices tumble 50%+ and share prices down 10-15%. I’m much more comfortable owning quality stocks in that type of environment.

Over the month we put up a number of posts on inflation. This is the final in our series of four posts on the contrarian view for inflation. This time we look at what to do from an investment perspective.

The inflation head-fake

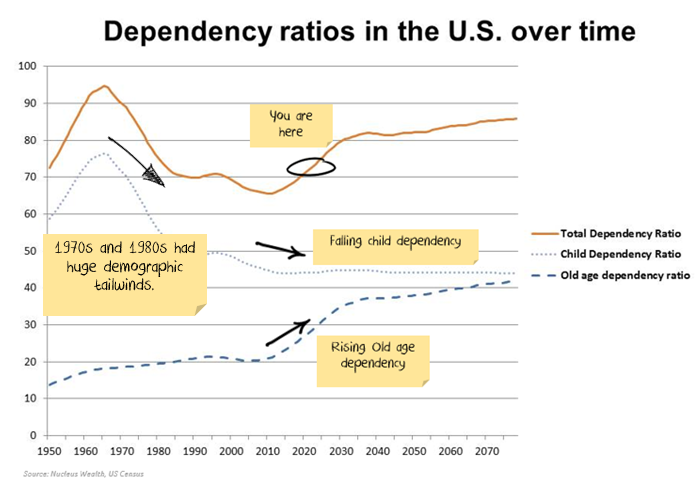

In part one, we looked at inflation today not being the same as inflation in the 1970s.

We looked in particular at issues that caused inflation in the 1970s and how the rules have changed since then. We looked at technology being inherently deflationary. Net result: a financial system overengineered to prevent inflation.

We looked at changes in inflation expectations and how it took 20 years to fall despite persistently low inflation. We looked at trade, demographics, debt accumulation and manufacturing. Net Effect: All suggest inflation will be harder to create.

Interested in discussing an investment with Nucleus Wealth with a member of a financial advice team? We offer complimentary sessions to discuss how the themes we discuss are affecting markets and how our portfolios are positioned to take advantage of them

In part two, we approached the China inflation problem. Namely that commodity inflation is far more leveraged to Chinese stimulus than developed market stimulus.

We broke down the numbers to show that a bet on commodity prices is, in effect, a bet on Chinese housing construction. And the signs are ominous.

In part 3, we looked at the inventory supercycle. First we looked at how an inventory cycle disproportionally affects manufacturers on both upwards and downwards. We are in the upcycle now.

In addition to the usual cycle effects, retail demand has been juiced by a mix of stimulus cheques, lack of services, pent up savings. Consumers have been spending on goods because they couldn’t spend on services. Manufacturing supply has been limited by COVID, the Suez canal blockage and changing demand patterns.

But inventory cycles are short. The price signals of today are building the excess capacity of tomorrow. The signs are good for economic growth but are not indicative of rampant inflation.

How should this shape your investment

The factor rotations that have dominated stocks this year can be divided into three narratives:

- Good news is bad news because rising inflation will drive bond yields higher and stock prices lower.

- Bad news is good news because low inflation will keep yields low enough for stocks to remain high.

- Good news is good news because Goldilocks inflation is enough to pop the “growth” stock bubble, but it will be offset by the rise of “value” stocks.

So far this calendar year, the last narrative has been the right one. If I may say so, it is also the narrative promulgated by Nucleus. So we positioned our post-COVID portfolio to capture the value upside and dodged growth stocks. We have outperformed in 2021 as a result.

Conditions are changing

But, now, we are of the view that underlying conditions are in for a material change. The narrative and the sectors that outperform will change as well.

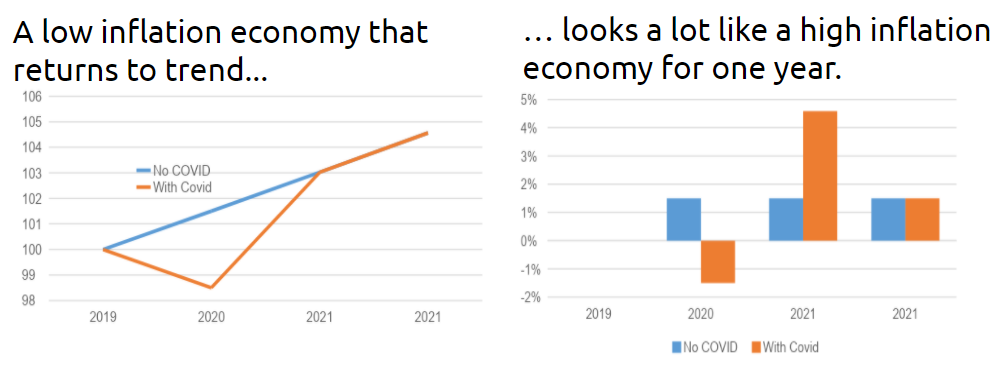

Later this week, we will see a big US inflation number from supply-side bottlenecks, commodity prices and COVID demand distortions. In our view, it is a head fake.

The run-up in supply-side prices directly results from an inventory supercycle triggered by stimulus, economic reopening, and exaggerated goods demand from locked-down consumers. All will end over the next few quarters as US growth slows materially into a fiscal cliff.

Secondly, the run-up in commodity prices is the direct result of the same inventory supercycle cycle in China. Plus Wall Street piling in with dubious notions of a commodity supercycle leading to hoarding and a financial bid for hard assets.

That, too, is going to fall away as China tightens on property.

Thus, both supply-side bottlenecks and Chinese commodity demand are going to ease in H2 and much more again in 2022.

Inflation drivers will reverse

With this background, current inflation drivers are going to reverse sharply on both a base effect and absolute basis in H2 and more in 2022.

So, the question arises: what to do now with your asset allocation? The current rotation into value will not fare well in this scenario. Indeed, it will be the worst place to be as equity duration risk disappears for a time.

There are three main options as to how the market treats the factor rotation changes:

Option 1: Good news is good news

Inflation falls back and lifts corporate profits even more supporting ongoing high valuations, but “value” gives way to mid-cycle “quality”.

In this scenario, you want to own longer duration bonds plus quality growth equities.

Aussie government bond yields will likely fall (and prices rise) as the China slowdown bites. Iron ore is, particularly, at risk. The quality end of FAANGS are also attractive given their earnings and assets offer growth plus more reliable “quality” returns. Defensives like utilities and consumer staples also recommend themselves. Long forgotten REITS historically have been good performers in that type of environment. However, given elevated vacancies, work from home and uncertainty in the sector, we opt for less traditional REITs in our portfolio. American Tower, which owns mobile phone towers and leases them to Telcos, is one example. Storage REITs are another.

Option 2: Bad news is good news

Inflation falls, yields collapse and stocks violently rotate back to the “growth” stock bubble.

In the second scenario, longer duration bonds rise (yields fall) plus growth equities catch a bid. This is not for the faint of heart. If the non-profitable growth bubble re-inflates, it will be temporary. This scenario is best characterised as a tradeable bear market rally.

Option 3. Good is bad news

Central banks commit a policy error by following hawkish leads in China, NZ and Canada. The Fed tightens directly into the growth and inflation cliff ahead (even discussion of taper will be enough). This will deliver a growth shock to markets right alongside the deflation shock. It will force yields higher briefly before equities tumble. The entire reflation trade could collapse until the Fed reverses course.

In the third scenario, a larger allocation of longer-duration bonds is the key. Equity allocations should be cut and repositioned like scenarios one or two.

Uncertainty is high

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might reverse its tightening on property sectors. Biden may get through additional stimulus, driving increases to minimum wages.

If we knew for certain inflation would fall, and tail risks would be quiet, then a barbell portfolio with long-dated bonds, defensive equities and growth equities would be a good option. Underweight banks, resources, cyclical equities. Overweight international stocks.

This is our aspirational portfolio. But it isn’t time to go 100% there yet. The inflation scare will probably ebb rather than collapse. We are progressively shifting our portfolios as pricing permits.

We have been hiding at the short end of the bond yield curve, mostly protected from rising yields. It is time to normalise that exposure. We were hoping that the inflation scare would give us a chance to buy long bonds at better prices. As described above, that could still happen so we are not pushing too far into long bonds just yet.

Australian equities have been a good source of investment performance in recent months. Now, they are facing a higher risk of reversal. It is time to use the high prices here to switch to international equities. We are building the defensive side of the portfolio up, changing out of value winners like resources, banks and cyclical industrials. A more aggressive switch into quality/growth is ahead if we see the opportunity developing.

Nothing lasts forever!

The three scenarios represent an investment horizon of 12-18 months as the inventory supercycle and commodities bubble deflate owing to a combined Chinese and US growth air pocket that ends the great stimulus and global reopening boom.

From there, we will still have low unemployment in the US with a large $400bn per annum Biden stimulus lifting US growth towards 3% per annum for years. This holds out the real prospect for better wage gains and a grind higher for inflation through the cycle.

Therefore, we expect further dynamic portfolio management ahead.

Staying nimble is vital in this post-pandemic world.

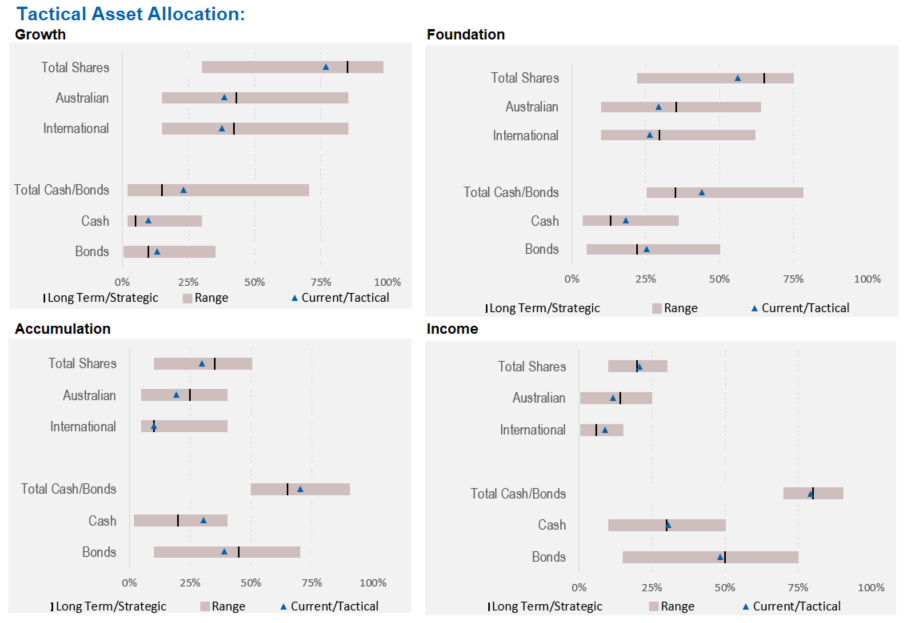

Asset Allocation

As the switch into value continues, the key for us is maintaining protection. Markets continue to be expensive and while the grind higher is likely, there are also considerable downside risks.

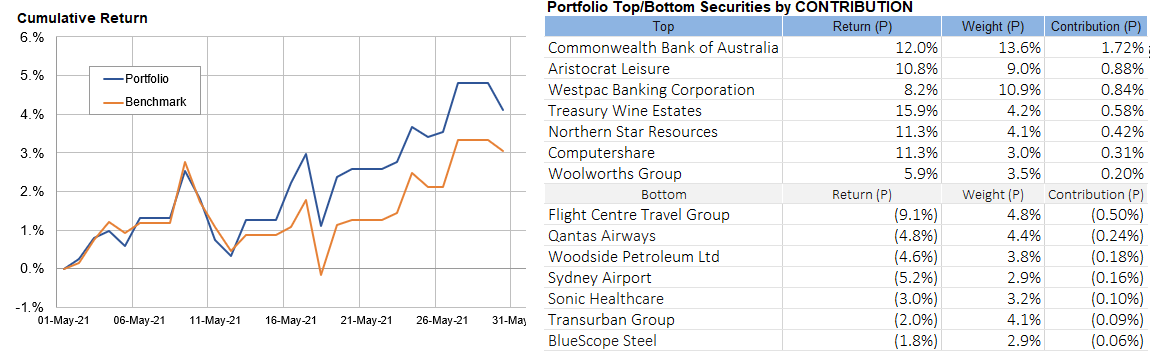

Performance Detail

After a sell-off mid-May, the equity markets rebounded and continued to climb over the month, maintaining the year-to-date momentum. Our Core portfolios performed strongly, outperforming their respective indices, as our Cyclical stocks and Gold offset the sell-down in Travel and Technology stocks.

Core International Performance

Our international portfolio saw a 2.4% increase over May helped by US banks and Gold stocks, but our European Stocks put in a strong contribution this month. The currency effect further assisted our European returns while the stronger USD saw some modest headwinds for our North American exposures. Towards the end of the month, we took profits in some of our Gold and US Banks and increased exposure to REITs and other financial service providers.

Core Australia Performance

The Core Australian portfolio outperformed the index this month as Banks put in a strong performance month and USD earners reversed last months weakness. Travel stocks were hit as Covid-19 fears resurfaced domestically. Over the month we trimmed out CBA, exited Worley and re-assigned it to CSL.

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.