Investors seem to be looking at the same data and drawing vastly different conclusions. It’s like there are two utterly different investment markets in the one picture, depending on how you look at it.

Stagflation

In the first investment market, stagflation is inevitable. The debate is whether central banks should worry about stagnation more or inflation more.

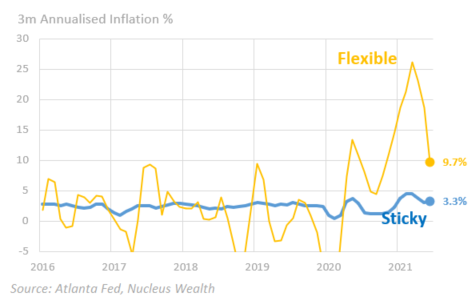

In the second, supply disruptions and pandemic driven demand changes are causing price spikes. As these spikes ease, prices fall back again. Annualised inflation will stay high for at least another six months, just on low base effects. But on shorter time frames, the US inflation peak is already in:

Metals and minerals

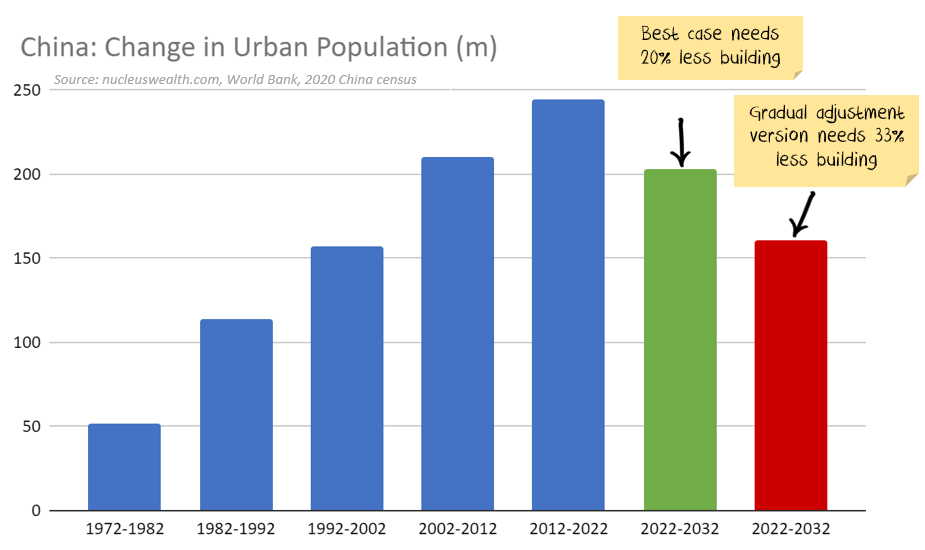

In the first investment market, buying commodities will save you from the ravages of inflation. Chinese property construction has slowed, but China will likely start spending again. Evergrande is a problem, but too big to fail. China will have to stimulate, it will be onwards and upwards for commodities.

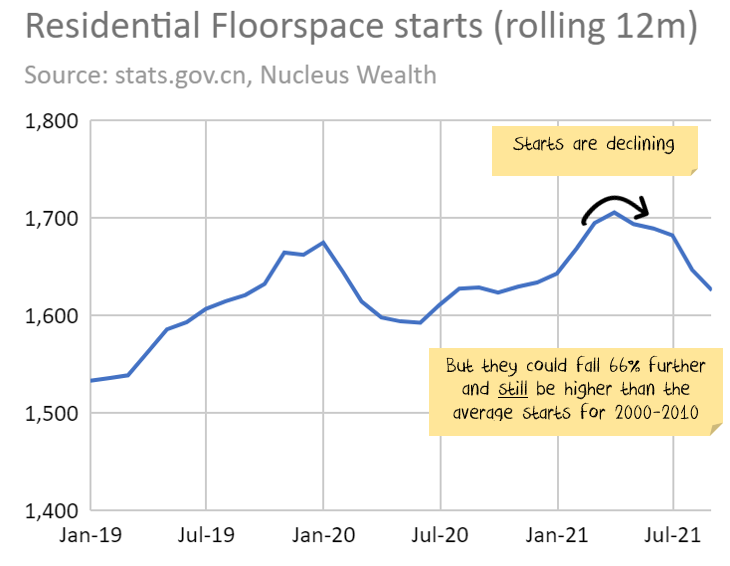

In the second, dramatic declines in demand by the largest consumer of commodities in the world, Chinese housing construction, is an ominous sign. Especially with many commodities trading close to inflation-adjusted all-time price highs. Evergrande is a symptom of a bloated Chinese property development sector, 50% larger than the rest of the world’s property developers combined. Evergrande is merely the first, there is a lot more to come. Metals are the last places to be invested if Chinese property construction slows.

Supply Chains

In the first, supply chains are broken. Transport costs were spiralling higher even before the latest surge in energy prices. Just like in the 1970s, higher transport costs will leak into higher prices, leading to wage rises and stagflation.

In the second, a spike in the demand for goods, combined with pandemic led staff shortages has led to a traffic jam in logistics. Transport prices have spiked higher as high-value goods try to pay to get to the front. But it isn’t a “forever” rise in prices. In the last week, a number of major international transport providers reported 3Q earnings. The general theme? Shortage of supply, log-jammed ports meant volumes were down while prices skyrocketed. Inflation needs prices to keep rising year after year. The current set-up is for high prices until the “traffic jam” clears. At which stage prices will quickly revert – and potentially go lower through productivity improvements spurred on by the current high prices.

What could clear the traffic jam? Reopening economies will lead consumers back to services, reducing demand for goods. Power induced shutdowns in China will unblock the other end. The end of the Christmas rush will also help. Beyond that it is difficult to tell – traffic jams are notoriously difficult to predict the duration of.

Energy Costs

In the first investment market, booming demand has outstripped the energy sector, left bereft of supply by ESG maniacs. The only cure is years of higher prices until supply can come back on stream. Thermal coal is up 450%+, European gas 1,000%.

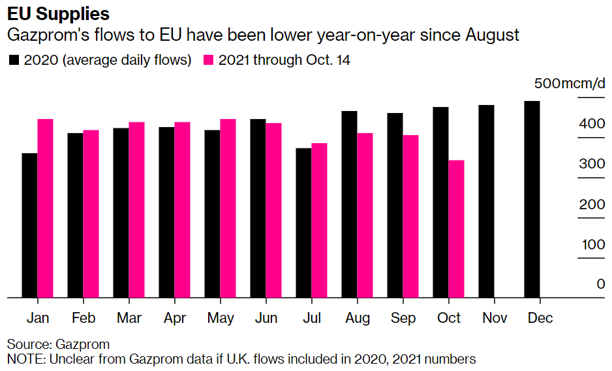

In the second investment market, the same goods demand spike that led to supply chain traffic jams has led to increased power demand in China. On the other side of the ledger, floods in coal mining states, reduced hydroelectricity in other states, accidents, reduced imports and COVID all combined to denude supply. A perfect storm of negative events. These will not last forever. Already the logjam is clearing. Europe is a different matter. Low wind output didn’t help, but a more important factor has been the plunge in Russian gas:

Maybe there are perfectly innocent explanations. Maybe the lower volumes are there to “incentivise” Germany to sign off on the recently build Nord Stream 2 pipeline. Either way, the situation is cyclical, not structural.

Having said that, weather could make the situation worse. A cold winter, disruptions to major coal suppliers in Indonesia or Australia and energy prices could rocket even higher. Predicting lower energy prices is easy. Predicting the timing is the difficult part.

Net effect

Wall St brokers are largely pitching investors the first story. You make much better commissions convincing investors to blow the bubble bigger. They will seamlessly and shamelessly switch to the second story when the currently predicted five years of inflation morphs into five months of inflation.

I’m more comfortable with the second story. Braver traders might want to surf the price waves driven by narrative. But iron ore and lumber have recently shown us that prices can halve in a matter of weeks. I prefer to bet on a lower tide.

We are reaching an inflection point. Our portfolios are conservatively positioned, risks are high. Unfortunately, once again we are waiting for government responses to determine our investment outlook. Our expectation is that China will try to smooth the property slowdown, but won’t reverse course in the short term. As I have said many times, and will no doubt continue to say:

We are not in a normal market. We are reliant on government and central bank support. So policy error remains the number one risk.