Over the weekend, China issued a sweeping directive to rescue its property sector. This was on top of further signs it is relaxing the COVID-zero policy. At face value, it is a major recalibration of its pandemic response.

It is hugely important for Australia. Around 30% of the ASX is in mining and energy stocks, and there is a massive exposure to government revenue via high commodity prices.

If it is a change. There are two ways to read the string of announcements:

- China is starting down the “whatever it takes” path. The current policies may not be enough, but they are a sign that China will keep adding more stimulus until the problem is fixed.

- The sixteen elements of the plan do not change the fundamental demand for new construction. For the most part, you can categorise the elements as either (a) directives to various banks to lend more to developers, mostly focussed on completing existing projects (b) reduced debt constraints or rules on individuals buying houses. The plan is to avert catastrophe rather than return to the old normal.

The stock market has already assumed the first is true. I suspect the second is more likely.

Having said that, we did remove our underweights to resources. Stocks are clearly in a celebratory mood, and there are risks standing in front of that train. However, we will be looking for the opportunity to go back underweight as the second scenario becomes apparent.

The 16-point plan

1. Lenders directed to support property development loans

2. Home-buying requirements for individuals eased, reduced deposits

3. Ensure “continuous and stable” fundraising by construction companies

4. Extension on developer borrowings

5. “Support” for bond issuance by quality developers will be supported

6. Trust companies are encouraged to provide developers funding support over mergers and acquisitions.

7. Special loans from specific banks for unfinished projects make it to completion

8. Additional support to encourage banks to lend to ensure residential project completion

9. Banks and asset management companies are encouraged to support acquisitions of property projects by stronger developers from weaker rivals.

10. Market-based approaches including bankruptcy and restructuring

11. Leniency to be shown on existing homebuyers’ mortgages if their property purchasing contracts have been changed or if they are under Covid-induced unemployment.

12. Buyers’ credit scores will be protected in some cases mortgage boycott issues.

13. A restriction on bank lending to developers can be “temporarily” eased and Banks which have breached the cap will be given extra time to meet the requirement.

14. Financing rules related to property project acquisitions will be temporarily “optimized”

15. Financial institutions encouraged to increase lending on rental properties

16. Measure to diversify fundraising for rental properties

Why won’t Chinese demand bounce to prior levels?

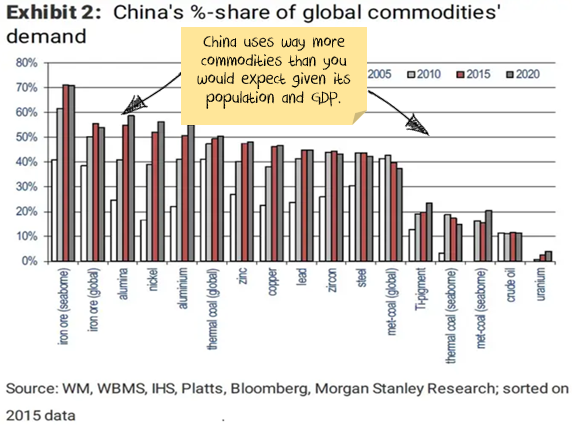

China uses an incredible amount of commodities relative to its size:

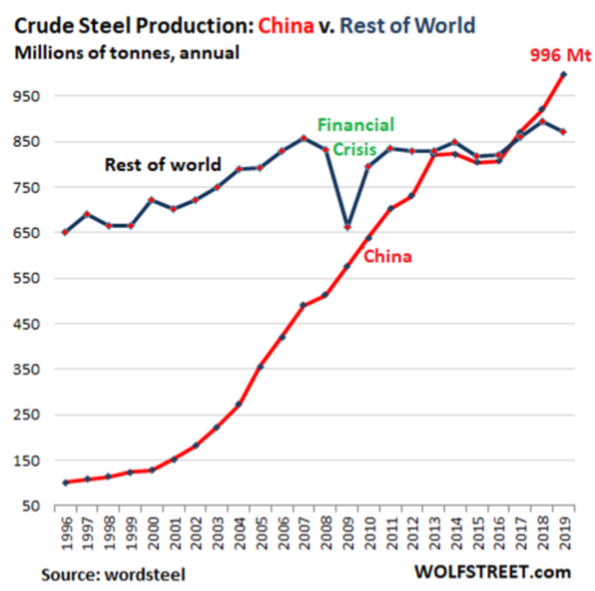

This is not a long-term phenomenon. It has arisen in the last 20 years. Here is the chart for steel; other commodities are similar:

Why does China use so much more commodities than you would expect based on population or economic size?

Partly because of the growth in exports. China now makes up almost 20% of goods exports. But this is not really new Chinese commodity demand – just displaced demand from other countries. And it is not the main source of demand.

Chinese apparent steel demand per capita is about double the average developed country when you strip this out.

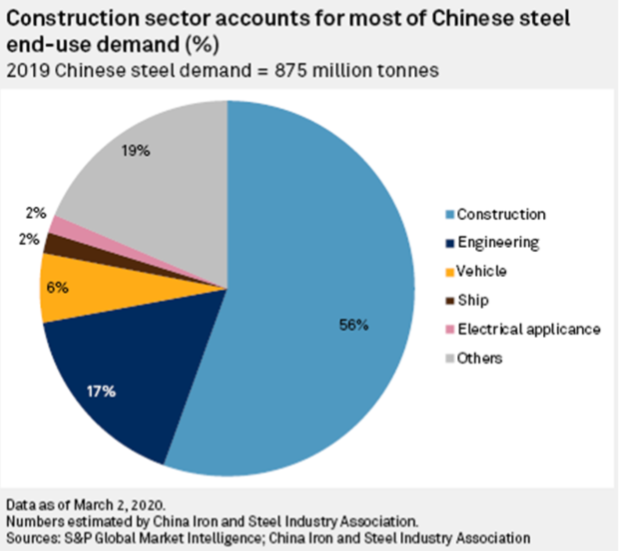

The real culprit is the Chinese construction sector:

Highrise > Infrastructure

The big consumer of steel is high-rise buildings. Far more than other infrastructure – even railways are not that steel-intensive. Side note: bridges are steel-intensive, but there are just not that many built.

In 2020, China announced lending conditions on property developers called three red lines. It is trying to slow the property lending market, which has grown around 600% over the past decade. In addition, over the last few years there have been dozens of other minor changes to slow credit to the property sector.

So far, it is working. Maybe too well:

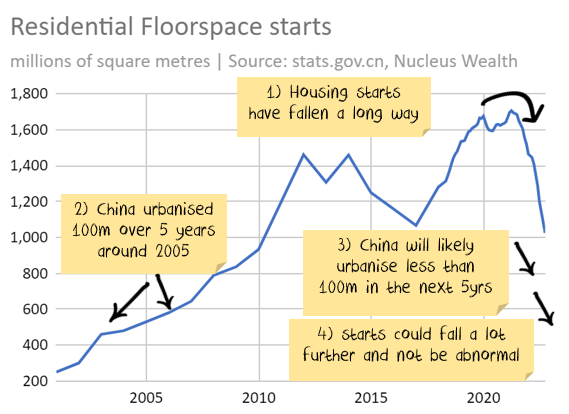

The question now is what is the right level for housing starts to return to:

- If you benchmark to the last 5 years, housing starts could grow 60%.

- If you measure it by other countries (including China itself), housing starts could fall another 40% to reach the level of similar countries.

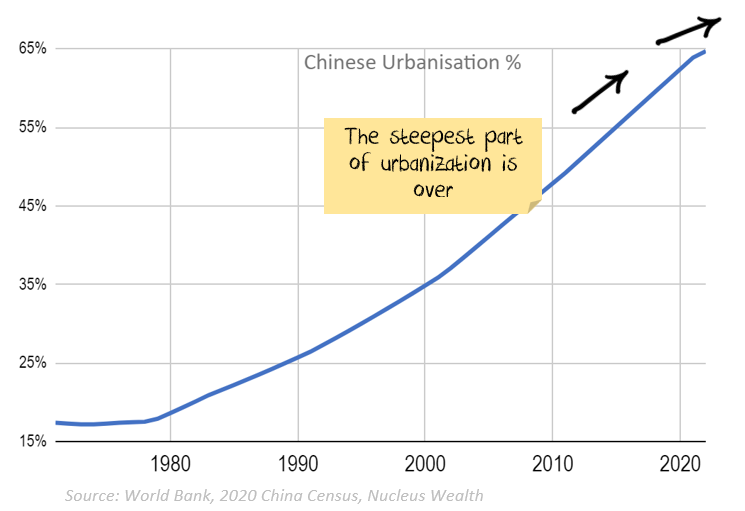

In China, urbanisation is the key

China has moved an incredible number of people to cities in the last twenty years. In recent years it has been around 25m people per annum.

But the problem is demographic:

- China’s population growth is very low and likely to keep falling. It is expected to be negative before 2050.

- There are already 65% of people living in cities, up from 15% in the 1970s

- Most countries top out in the low 80% urbanisation levels

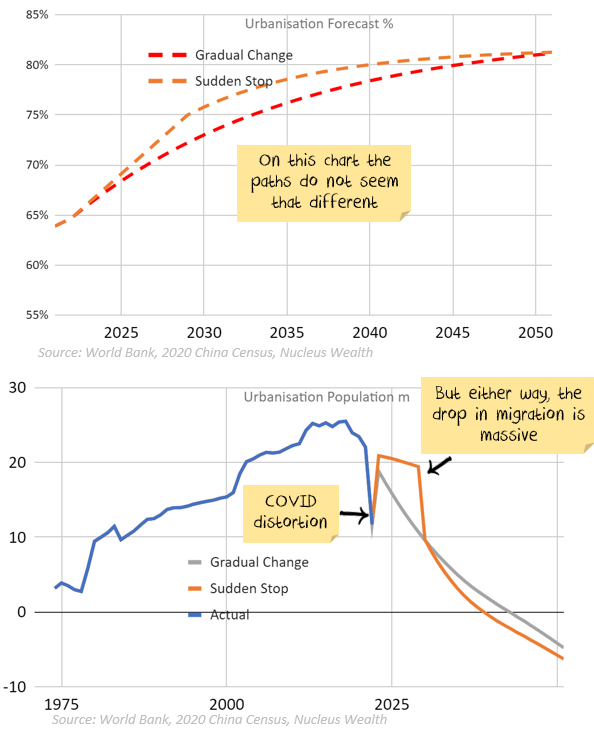

When will China slow its urbanisation?

There are 25m people per year moving to cities now. A smooth fall like we have seen in other developing nations would see less than 20m moving to cities and falling over time.

Or will it be a sudden stop? i.e. will China try to keep moving 20m+ people to cities until there are no more people left. The difference in the number of people is stark:

I don’t know which it will be. I’m guessing it will be the sudden stop given China’s history. But maybe COVID will be enough to drop the rate for a few years. The main point is that there is structural downside risk. i.e. the amount of commodities needed for building in China could halve in the next ten years. Which would be around 20% of the total worldwide demand for many commodities.

Empty Apartments

Estimates are that around 20% of Chinese apartments are unoccupied. This is about 50-60m apartments.

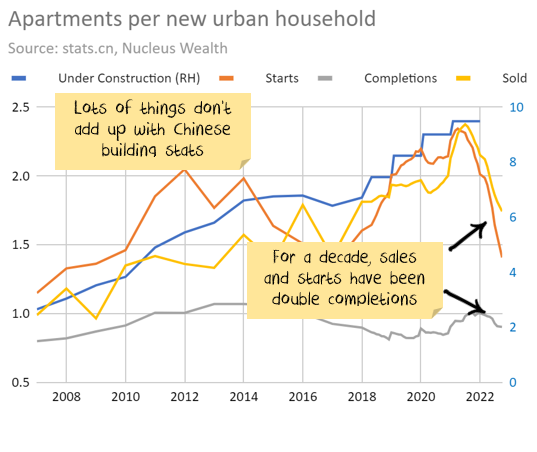

Chinese construction numbers are difficult to know how to assess. New starts have consistently been around double the completions. This means that the number of apartments “under construction” keeps growing, suggesting something wrong with the starts number. However, sales are about the same as starts. So maybe a Chinese habit of building an apartment but not installing the fixtures (painting, kitchens, electrical etc) is partly to blame? i.e. many investors own an unfinished apartment. When they rent it or move in, they can install the fixtures and not worry about depreciation in the meantime.

Additionally, apartment sizes are growing while people per household is shrinking. There are a lot of moving parts. What it does mean is:

- The number of apartments completed seems to be about the same as the number of people moving to cities.

- The number sold and started appears to be about double the number of people moving to cities.

- There is enough housing stock currently under construction to cater to about 9 more years of demand.

- There are enough empty apartments to cater to another 4-5 years of demand.

The net effect is that China can easily afford to slow down construction for years (decades?) without causing problems for its urbanisation plans.

Residential investment measured in dollars

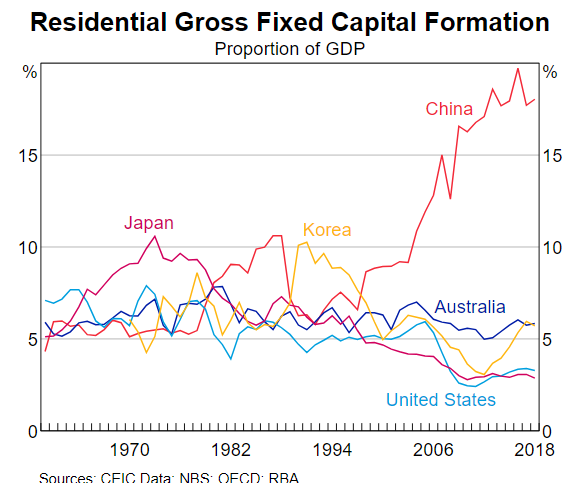

Expressed another way, residential investment in China as a proportion of GDP is:

- double the level of Japan before its housing crash

- three times higher than the US before its housing crash.

Again, on its own, this suggests a longer-term downside for commodity demand. But it needs a catalyst. The overspending has already lasted a decade. It could continue for years.

And one more way to look at it. China makes up about 3% of global stock markets. In the property development sector, China makes up over 50% of the market capitalisation. China does property development on a scale never seen before.

Three red lines created a catalyst

In 2020, China announced lending conditions for property developers called three red lines. It is trying to slow the property lending market which has grown around 600% over the past decade. The central bank also announced caps on property lending by commercial banks, land supply policy reform and reduced credit creation. China has intentionally been trying to slow credit to the property sector.

Now the question is whether the most recent changes are designed to:

- re-ignite the building boom or

- simply prevent the problems in the property development sector from spiralling out of control.

I can’t see signs of the first, it looks more likely to be the second.

Note that there is a lag to both the change in credit and the effect of fewer new housing starts. Best guess is somewhere around 12 months. So it will take time to see the effects if the building boom genuinely is back.

Three areas to watch

Last year, we highlighted the dangers as:

1. Credit locking up in the property development sector.

This is happening right now. The new measures are designed to ease this problem. The average yield on dollar bonds issued by junk-rated Chinese companies has more than doubled, and capital raising is difficult.

Twelve months ago we thought the options looked like the following:

- If there are no meaningful measures, then we are looking at a full-blown financial crisis. Very negative for stock markets, particularly Australia.

- More likely, steps will be implemented to help the better companies but not let up on over-indebted companies.

- At the bullish end, China could over-egg the response, opening up the credit taps. This scenario would be short term positive for stock markets, particularly commodities, subject to the below risks.

The new measures still seem to be like scenario b) above rather than scenario c).

2. Property buyer confidence

China has some of the most expensive housing in the world relative to income. Should buyers lose faith in the value of properties, then a house price crash could result. This could occur even if the first issue is solved. Which would leave developers in a much worse position.

There are signs that Chinese property buyers are spooked. There is not a lot in the measures to solve this problem. Watch this space.

3. House price wealth effects

This is the problem facing almost every country. High property prices increase inequality, reduce economic growth and damage productivity. But all of those are longer-term problems.

The short-term effect of rising prices is to increase spending and consumer confidence. And politicians love short-term gains at the expense of long-term losses. Falling home prices offer the opposite.

The problem is worse for China than elsewhere. Both homeownership and investment in real estate are much higher in China than in most other countries.

Net effect

This is China’s fourth attempt in the past dozen years to wean itself off its property construction addiction. They lost their nerve on three prior occasions. These announcements might be signs that China has once again lost its nerve. As an Australian investor, we need to respect the upside risk that such a pivot would create for commodity prices and the Australian dollar. Especially when coupled with reopening plans.

But, we also need to recognise that the just announced measures are not enough to re-ignite the property boom. There will need to be more announcements. And if they do not come, investors will need to be ready to pivot. In that scenario there is considerable downside for the Australian dollar and commodities.

And there is one more major risk. Suppose China has returned as a demand driver in the commodity space. If so, this will add to inflation, and the US central bank is more likely to keep raising interest rates until it breaks something else.

Take us on your daily commute! Nucleus Investment Insights is available in Podcast form on iTunes and all major Android Podcast Platforms.