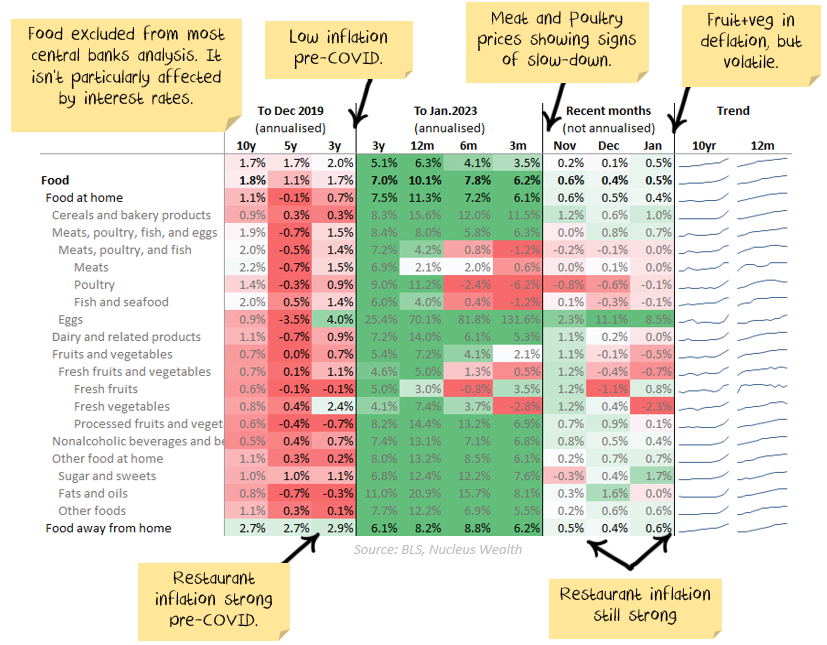

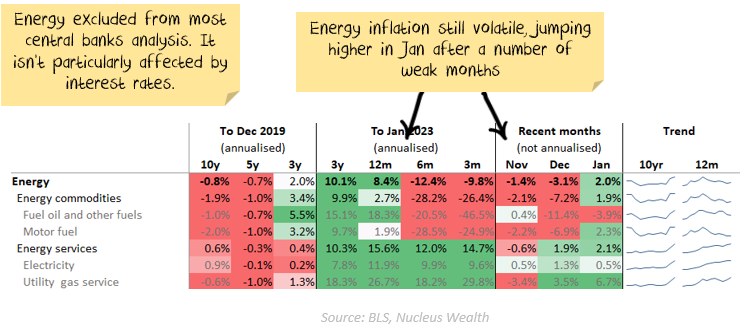

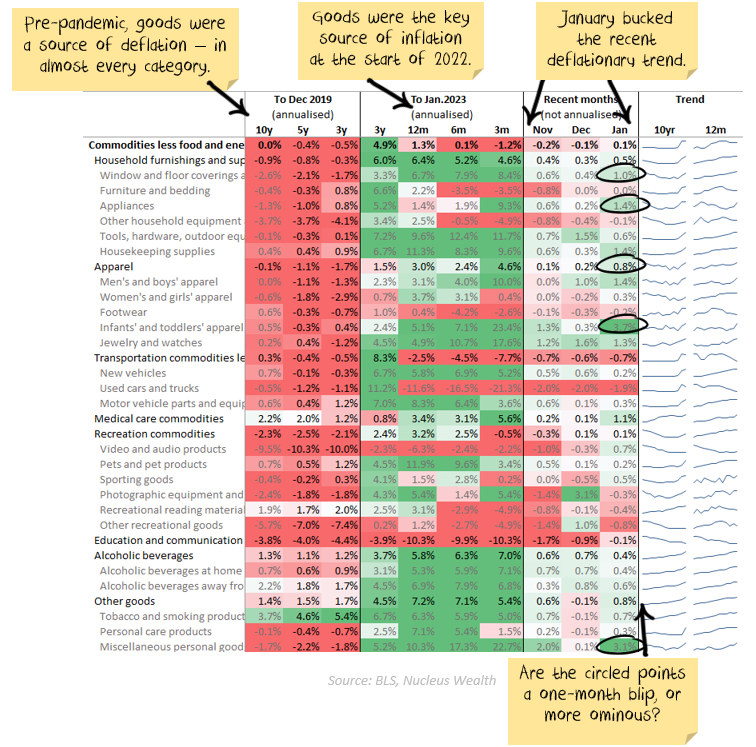

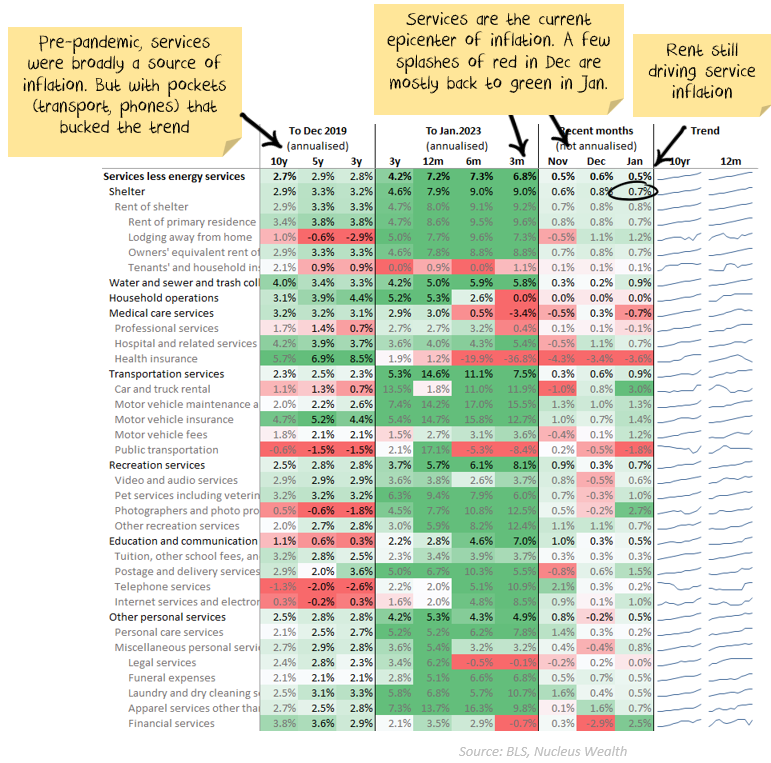

US inflation came in higher than expectations. Now, month-to-month inflation numbers can be volatile. But there are more than a few data points in this report that are reversing the recent trend of falling inflation. If your view is that inflation is heading for deflation, then this report was not your friend.

See the tables below:

Going forward

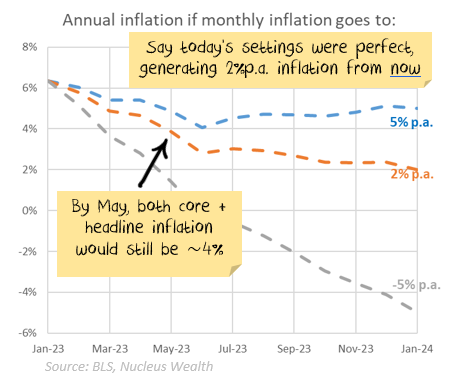

The way the maths are at the moment, annual inflation is going to remain high for some time. If inflation went immediately to a 2%p.a. rate, by May both core and headline inflation would still be around 4%:

The stock market reaction was all over the place. It was a confusing report. Many positive trends from last month have either stalled or reversed.

My expectation is that:

- central banks want to ensure inflation is truly dead before reversing course

- headline annual inflation figure will stay high until May at least

- rates will stay high until its too late and inflation turns into very low inflation or deflation

This report doesn’t preclude a continued fall in inflation, but it doesn’t support it either.