November saw a sharp rebound in both bonds and equities. Expectations of a soft landing have become entrenched as falling inflation encourages markets to dream.

With that in mind, the key factor to watch in the coming months to tell if we are wrong or right is the change in corporate profitability. The recent reporting season in the US showed some signs of weakening earnings, but not enough to confirm our thesis yet. Earnings forecasts have been drifting lower, but the valuation effect of falling interest rates has overwhelmed any earnings issues.

Sectors for 2024

There are three types of trends that investors should be aware of. Long, medium and short.

Navigating the investment landscape requires understanding how different trends impact the market. This post zeroes in on mid-term trends crucial for shaping your portfolio’s sector and stock composition.

There are major macroeconomic trends. Demographics, debt cycles, and major social phenomena. But these are long-term. They tend to play out in 30-50 year cycles. See here for more. They matter, but there typically aren’t short-term implications. And these trends are more about whether you are generally looking for stocks/risk investments or bonds/defensive investments rather than individual stocks and sectors.

The short-term trends are the week-to-week and month-to-month trends that comprise much of the daily financial press.

What I want to discuss today are the mid-term trends. These are the ones that influence the sector and stock composition of your portfolios. But the effects are measured in years rather than days.

Most important? You need to be careful about buying in at the top of the hype cycle – ensure you’re not overpaying for assets.

Theme 1: Energy

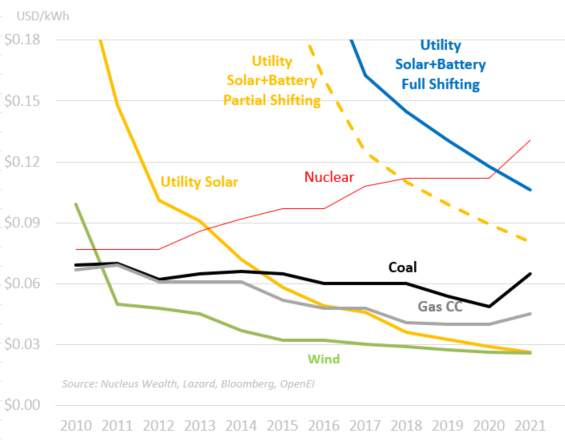

Solar and wind power are becoming the cheapest forms of energy. However, they are variable and require energy storage to be comparable to coal, gas or nuclear.

The price of solar has plummeted over the last few decades, and battery costs are also falling. Solar is now the cheapest form of energy in many locations, and solar + batteries are closing in fast. Solar + batteries have already started to push out diesel and other higher-cost versions of electricity in remote areas.

The question is when this trend of falling costs ends. The answer, which I will detail a different day, seems to be no time soon.

Government policy globally is also firmly behind increased renewables. Last year was the most extensive buildout ever seen for new solar.

So, how do you want to get investment exposure?

Energy Option 1: Power Producers

The problem with the producers is that if you build a solar farm this year, and then I build a solar farm next year, I will likely have a lower cost of production than you. Plus, capital demands are high. Government policy might change.

Energy Option 2: Manufacturers

China is heavily subsidizing both battery and solar technology, making it difficult for companies to compete. Furthermore, the technology is changing rapidly. Batteries for homes need to supply steady power, while batteries for cars need to supply lots of power quickly. Solid-state and sodium batteries are going mainstream in the next few years.

There is also a wide range of different solar technologies. Current manufacturers may be superseded. And while it is still very embryonic, there have been some recent interesting breakthroughs in fusion technology. These should at least register as a tail risk for these companies.

Energy Option 3: Service companies

Regardless of the technology, someone needs to build the infrastructure, transmission lines, and transformers to plug these into the network.

Investing in technology providers and service providers is where I currently prefer to play the energy theme.

Energy Option 4: US Gas

This is a more nuanced argument. Big picture: US gas prices are a fifth to a tenth of what you might pay in Europe. The US is expected to roughly double its production of LNG, with much of it going to Europe and some to Asia.

Net effect, specialist gas producers in the US should see the gap between US and global gas prices fall.

Theme 2: Obesity Drugs

I recently covered this in more detail here. A new class of anti-obesity drugs have come out with impressive results. The side effects have been limited as they rely mainly on suppressing appetite.

Increasing obesity has been a 50-year trend:

Obesity Option 1: Drug manufacturers/patent holders

Obesity drug manufacturers are the obvious target. Share prices are not cheap for these companies, but there is still an investment case given the expected growth.

Obesity Option 2: Health and life insurers

Fewer sick people and longer life spans from reduced obesity will benefit healthcare and insurers.

We recently looked at elevated mortality rates post-COVID, and these companies might have other investment benefits.

Obesity Option 3: Underweight healthcare more generally

A significant amount of money is spent on healthcare, typically on other diseases, because of obesity. Heart disease, respiratory problems, diabetes, sleep apnea and a host of other health issues are made considerably worse by obesity. Will obesity drugs decrease the demand for other healthcare drugs and services? Quite probably.

Theme 3: Onshoring

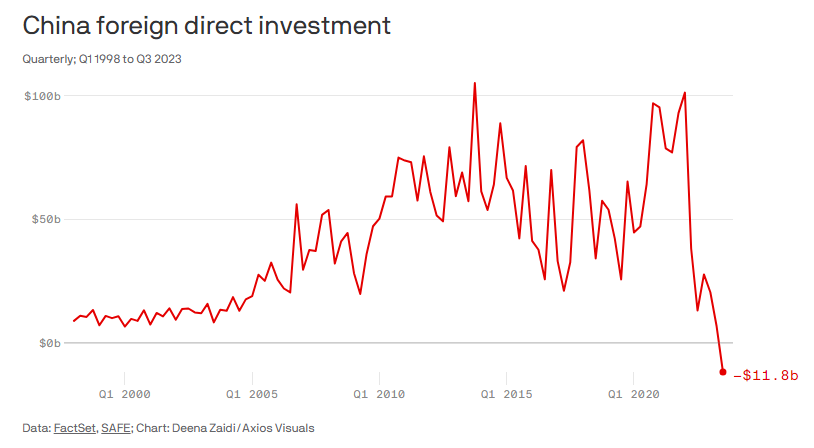

There has been a change in the dynamic between China and the rest of the developing world, particularly the US. With Trump’s tariffs and COVID-19 supply chain issues, companies are incentivized to diversify and move their processes out of China. The US government is also putting crackdowns on technology going to China. This has created a scenario where companies are moving operations back to the US and automating them.

The data is a little messy at the moment. You can make an argument that onshoring is not occurring, but instead, Chinese exports are simply being redirected through other countries.

However, the more compelling argument shows that foreign direct investment in China has come to a shuddering halt. Companies may not be rushing to exit China but are certainly directing new investment elsewhere:

Onshoring Option 1: Robotics manufacturers

Robotics and automation are the big winners for most re-shoring.

Onshoring Option 2: Service companies

Commercial construction and service companies to new factories are a secondary beneficiary. But harder to get a pure exposure to. The ongoing weakness in the office market is also affecting these companies.

Theme 4: Cloud Computing and Artificial Intelligence

The next theme is cloud and AI computing. We have discussed Nvidia, which has a great outlook and profits growing quickly. However, I have questions about the share price and maintaining their market share.

The industry will grow quickly. And many big players are trying to catch up with Nvidia. It would be surprising if none of them take at least some market share. Companies like Intel, Google, Amazon, Apple and AMD are all working on their own chips.

Additionally, there is an ongoing trend towards cloud computing. Companies have long known running their servers on the cloud can be much cheaper than locally. The pandemic accelerated the change as companies catered to work from home.

We’re looking for companies that benefit from increased data centres and cloud computing spending. Big names include Microsoft, Google, and Amazon. We like the AWS side of Amazon’s business, but we’re waiting for the right price before buying. Microsoft and Google have been more reasonably priced. We also like some of the semiconductor stocks that “make the machines that make the machines”.

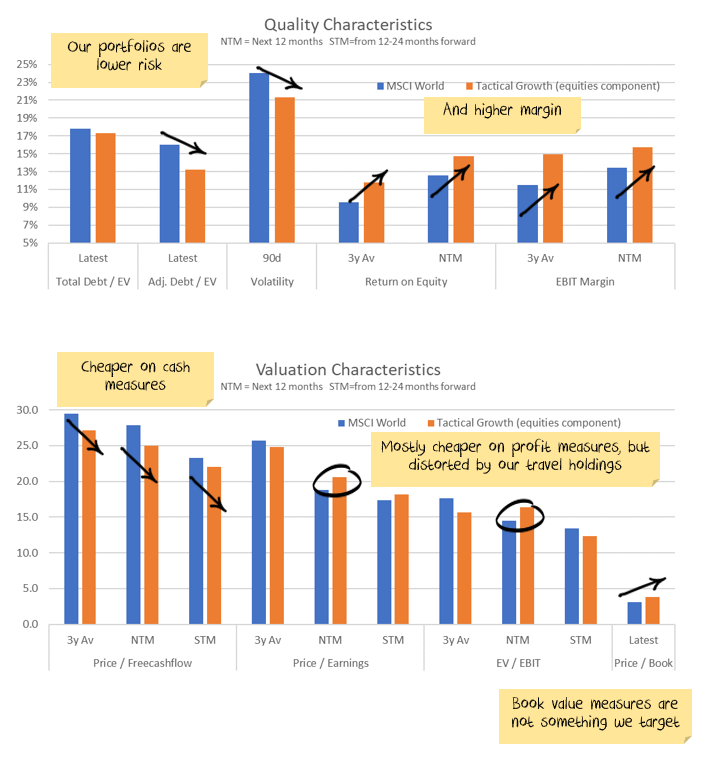

Theme 6: Quality Companies

Elevated inflation allowed companies to increase their prices. However, inflation has slowed dramatically and has turned into outright deflation in many sectors.

What we need now are companies that can hold on to the price increases that they pushed through. More commodity-like products will not be able to do this. Shipping, lumber, and many manufactured goods have all seen prices plummet.

You need quality companies with economic moats, high margins, and pricing power.

Theme 7: Underweight Value stocks

The other side of the quality trade above is to underweight value stocks. These stocks will have to give back margin gains.

Theme 8: China in terminal decline

China has gone ex-growth. It has demographic issues. China has spent an extraordinary amount on building and infrastructure. It has a massive debt burden built up over the past few years. I’m expecting them to replay the Japanese lost decade.

The companies that benefitted most from the “China Rising” trend will be the ones to lose the most. Avoid these companies.

Theme 9: Driverless car & Electric Vehicle competitors

Electric vehicles are not yet economically viable for typical drivers due to the cost of batteries. They are economical for many commercial vehicles.

Battery prices keep falling, so broader economic viability is not far off.

More importantly, after years of disappointment, driverless cars look to be taking off. Google’s Waymo appears to be entering the start of an exponential growth phase. If successful, the number of cities serviced could skyrocket.

Electric vehicles make sense for driverless taxis, as customers don’t need to worry about recharging the batteries. The key issues for the automotive sector are:

- One driverless taxi can replace 5-10 cars

- Most people don’t care about the brand of their taxi

- Electric vehicles require far less servicing and parts

The revenue to the entire sector might halve.

Investment Overview

Each of these themes has a fundamental side and a valuation side. It is entirely possible to get the fundamentals right but buy the stocks at far too expensive prices.

Investment Outlook

I have some pretty clear ideas about which trends are sustainable and which ones aren’t in the long term. However, the short-term is far less clear:

- The banking crisis is morphing into a credit crunch. This is the number one US issue over the next few months.

- The sanctions on Russia are unlikely to be lifted anytime soon. The short-term effect was commodity shortages. In the longer term, it seems likely that we will see a re-orientation, Russia will supply more to countries like China and India, less to Europe. For some commodities (oil, wheat) this will be easier. For others (gas) it will be extremely difficult.

- The geopolitical energy crisis in Europe has eased on the back of much warmer weather. Australian energy price caps have pushed down energy prices. There will be a rush to alternative energy sources in the mid-term.

- Supply chains continue to improve.

- Governments continue to withdraw (or not replace) stimulus. There will be a fiscal shock into 2024. The question is whether the private economy will be strong enough to withstand it. Leading indicators suggest profits will be lower.

- Central banks have made it clear that they will try to solve the Russian-induced energy issues and supply chain-induced inflation by raising interest rates. The odds of a policy error have increased significantly.

- China still has not bailed out the property sector. Changes so far are not a bailout… but they may morph into one. China is trying to ensure that houses under construction get built, small businesses have access to credit, infrastructure building continues, and failing developers do not crash the economy. China is yet to show any signs of turning back to the old days of debt-driven property developer excesses. If China doesn’t continue to roll out new measures, the commodity market will deflate again.

It is still not the time for intransigence. Events are still moving quickly. But we have positioned the portfolio towards the most likely outcome and are gradually increasing the weights as more data arrives.

Bond yields have risen significantly. If the world heads for a recession this is a buying opportunity. In the short term the narrative “high inflation, central banks raising rates = sell bonds” seems to be coming to an end. Although there may be another last hurrah as the US central bank looks to rein in the stock market optimism.

The mix of higher volatility, leading to deleveraging of risk parity trades and momentum means yields could yet go higher. We are invested for bond yields to reverse.

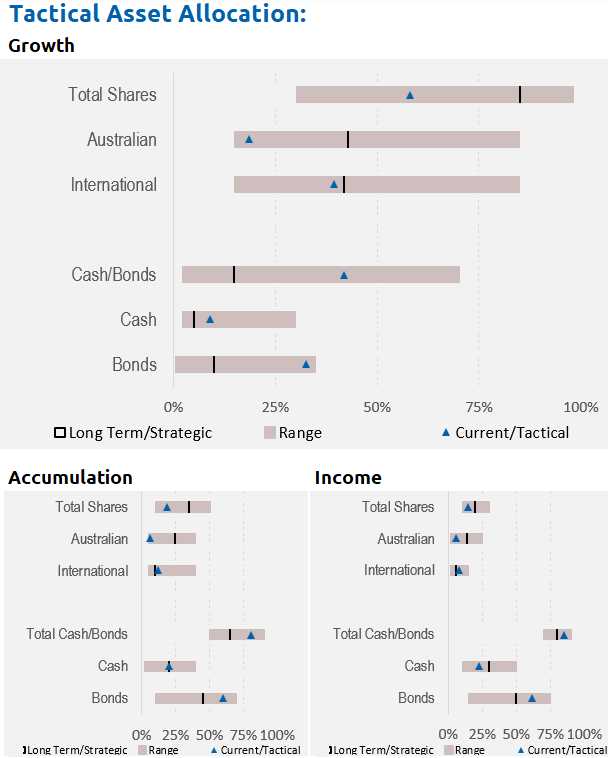

Asset allocation

After being very expensive for a number of years, stock markets briefly touched off average value before becoming expensive again. However, debt levels are extremely high. Earnings have been going backwards, and seem overly optimistic in 2024.

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Energy prices could jump higher, increasing inflation. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might decide again to supercharge property investment.

We are significantly underweight Australian shares, and as noted above, overweight bonds, with the view that the Australian market is more quickly affected by rising interest rates and more affected by a global recession:

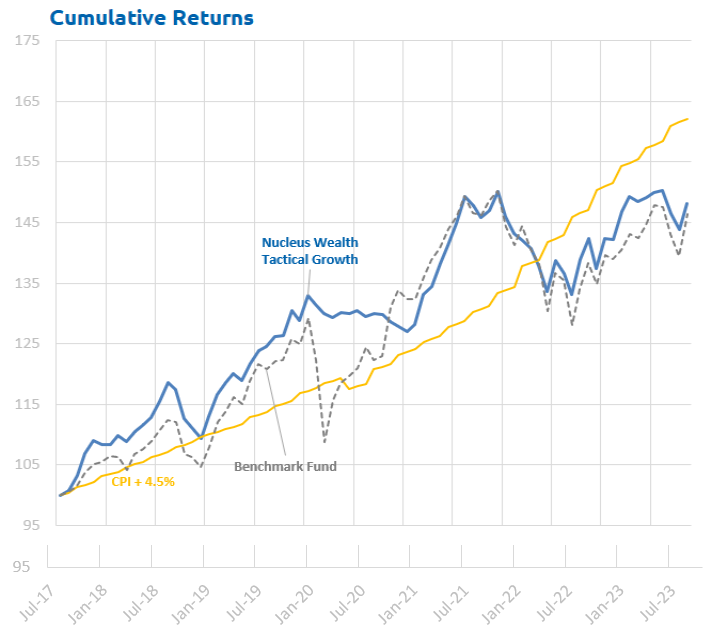

Performance Detail

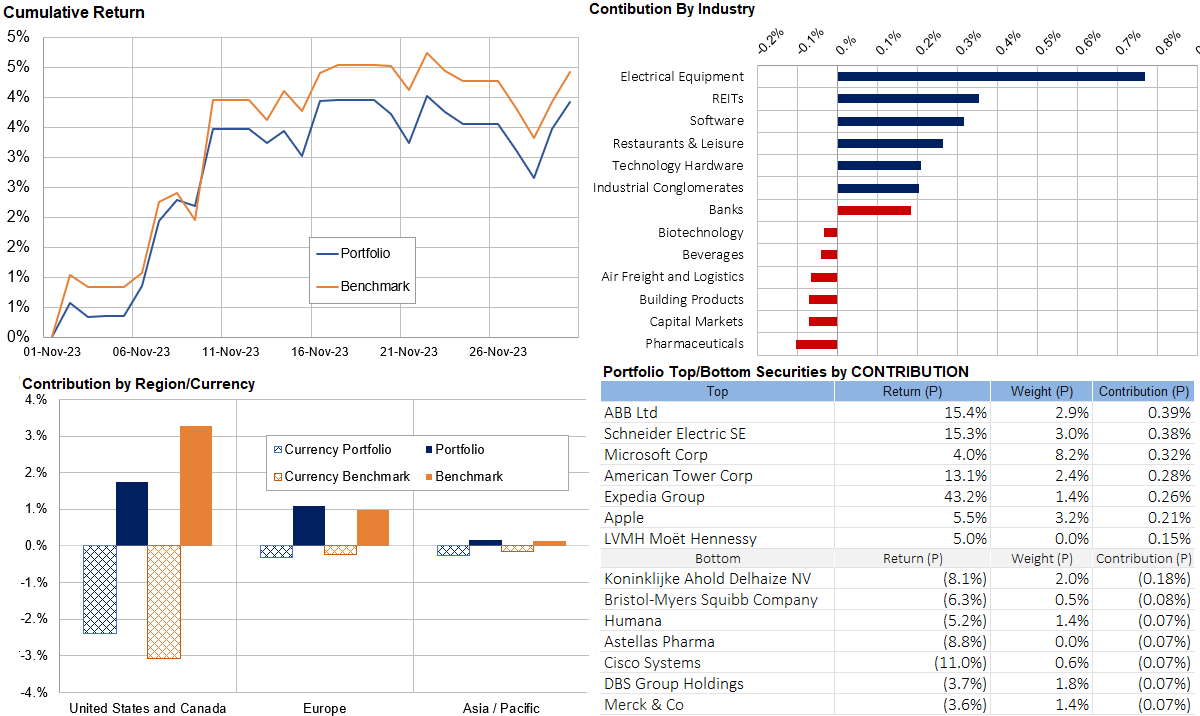

Core International Performance

November saw a sustained recovery in equity indices reversing the downward trend seen since August. Our portfolio tracked the benchmark over the month but our lower exposure to the magnificent seven meant our US returns lagged peers. This month saw the electric equipment providers boom while the defensive pharmaceuticals took a breather. Currency proved a drag as the AUD strengthened over the course of the month. We took the opportunity this month to reinforce our thematic strategy removing car manufacturers, some luxury goods providers and underperforming pharmaceuticals while buying into Pepsico, health insurers and the Intel recovery story.

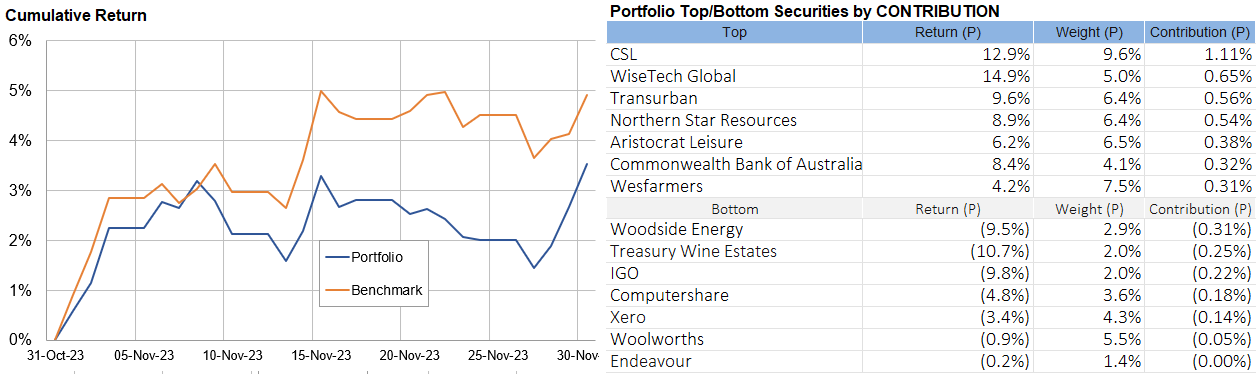

Core Australia Performance

Australian equities underperformed as Consumer staples, Energy and Lithium stocks were hit while Treasury Wine waned as it capital raised for what looks like a strategic yet expensive acquisition.

Portfolio Yields

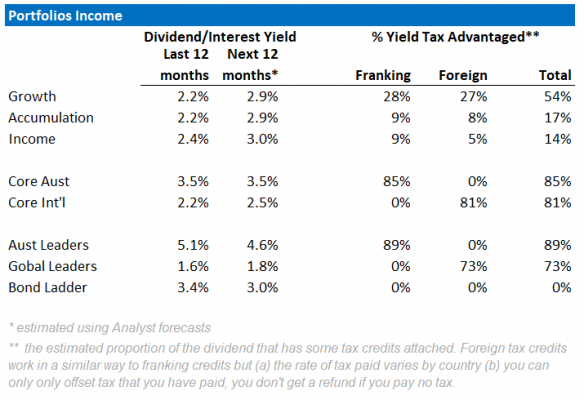

This table shows the income yields of our various portfolios, including their proportion of Franking and Foreign tax paid over the past 12 months.

We also include an estimate of forecast yield (next 12 months), assuming no change in current tactical allocations and stock composition. There is an element of rising yields, as global interest rates rise. Offsetting that however, is the possibility Australian equity yields may fall as commodity-driven mining companies have lower profits to pay out. Our underweight Resource position in Core Australia portfolio should help maintain its yield.