Two of the best-performing stocks in our portfolio over the last year or so have been Eli Lilly and Novo Nordisk, due to their successful obesity drug rollouts. The question is whether there is more growth to come or if the share prices have run too far.

Both have taken 1st-generation drugs that had daily injections, nausea, and 5% weight loss and replaced them with 2nd-generation drugs that have 15% weight loss, reduced nausea, and weekly injections. However, the drugs are difficult to manufacture, and there have been supply constraints. This has limited the (already impressive) revenue growth.

The 3rd generation is in trials at the moment, with closer to 20% weight loss and a range of other improvements like easier production, oral medication, monthly injections and reduced nausea.

The real question is where to from here?

The mega-bear argument is that the obesity drugs won’t expand meaningfully because either:

- more severe side-effects will start showing up (not yet true in a meaningful sense, but always a risk)

- backlash as more data emerges about how they change brain chemistry (the changes are likely true, this might actually be part of the reason why they work, hard to say about the backlash)

- mass adoption won’t occur because people like food (there is certainly anecdotal evidence of people no longer taking the drugs because they prefer to eat junk food, and they don’t enjoy food as much while on the drugs)

The mega-bull argument suggests

- doctors will prescribe them for everything from heart disease to sleep apnea to knee replacements. A host of ailments would benefit from patients losing weight

- manufacturing issues and side effects will become trivial with newer generations

- health insurers will greatly encourage the use with the view that spending $x on a client to bring their weight down will save multiples of $x by avoiding future medical costs. Maybe governments might take the same view.

- we will all be popping them like multi-vitamins for vanity reasons.

Working out where the truth lies is difficult.

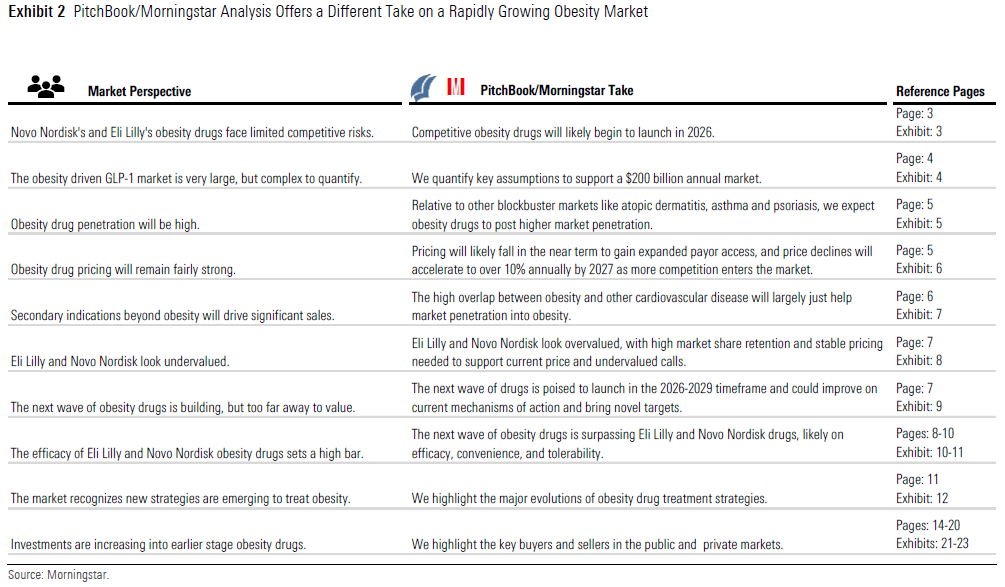

Morningstar’s view

Morningstar has had a shot at it in a recent report.

Their view? The market for the drugs will be quite large, pricing will be difficult and competitors will take market share. They think the two incumbents are too expensive (although they have had the same view for a number of years).

What are the key assumptions?

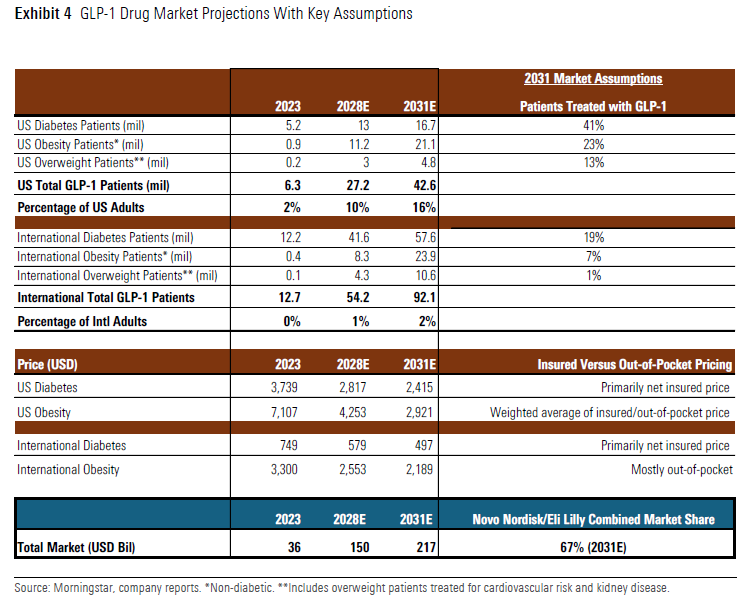

The pricing is hard to tell. It will clearly come down, and Morningstar have diabetes pricing down 35% and obesity down 60% by 2031. I don’t have any problem with that estimate, I suspect the fall in obesity pricing will even be more.

On the market share front, they have Eli Lilly and Novo Nordisk with 2/3rds of the market by 2031. My guess would be that this is a little low. But it is really hard to estimate. More complex drug markets with continued improvements tend to be dominated by a handful of companies. Off-patent and over-the-counter drugs (which weight loss drugs will not be for decades) often see the major companies with something like 40% of the market or less. My expectation is that the market share of the biggest players will still be 95%+ as improvements to the drugs are rolled out. But will there be a 3rd or 4th company in the space with a meaningful market share? That is much harder to tell.

The biggest assumption, though, is the number of obese and overweight patients. Morningstar have 60m people. Could that be 160m people instead? That would still only be 50% of all obese people in developed economies… Then add the overweight but not obese market. A 10% share of that market would give you another 40-50m people. And what about the vanity market? If erectile dysfunction drugs can have 20m+ users, then another 10-20m in the vanity market would seem like a low estimate. Add developing markets. Clearly not big in terms of percentages, but if you add together the richer part of the population (the part who would be prone to being overweight and could afford treatment) in places like India and China, you might find tens of millions more customers.

Back of the envelope valuation

Let us say, in really broad terms, that Novo and Eli Lilly have about $500-550 billion each in their current price for weight loss drugs.

My rough, back of the envelope numbers suggest that if you can get about $125b of revenue by 2031 per company then you can justify $500-550 billion. Any higher and you are looking at a reason to buy.

$125 billion of revenue seems like a lower-end estimate to me, with lots of upside risk.