Stock markets continued to rally in January and the start of February to recover most of the losses from late 2018, at the same time Australian government bonds have begun to price a slowing Australian economy which led to a strong performance from all of our portfolios. International +4.3%, Tactical Growth +3.4% and Tactical Foundation +2.2% were the best performers. We have been using the strength in markets to take further profits on our equity holdings – we are now at the minimum weight for Australian shares across all tactical portfolios, including zero-weight in Tactical Income. We are decidedly conservative and defensive across all tactical portfolios. One remaining sentiment positive event is a trade deal between China and the US – we expect some sort of announcement shortly which could spur stock markets higher, but we believe: a comprehensive deal is unlikely, the announcement is likely to be more style than substance, and any stock market gains will be short-lived.

The other major risk is our bet against the lucky country. Australia rolled from a mining boom into a housing boom, all the time building up more and more debt at the household level to world-leading levels. Concurrently, at government levels, one-off gains from mining and housing booms have been funnelled into recurring expenditure and tax cuts. The conditions for a reckoning have been in place for many years, but Australia has managed to avoid the reckoning through a mix of:

- External good fortune: a massive increase in debt-fuelled Chinese building sparking demand for iron ore and coal

- The good fortune of gas discoveries: gas discoveries created a historically huge level of capital expenditure on gas infrastructure and LNG plants, turning Australia (soon) into the world’s largest exporter of LNG

- The good (?) fortune of lax regulation: poor regulatory oversight allowed Australian consumers to borrow far beyond their means, pushing an otherwise ordinary housing cycle into a housing boom

Rather than use the booms to re-engineer the Australian economy to rebalance to a more sustainable footing, Australia has doubled down each time: spending the proceeds of the booms on tax cuts / increased government spending, allowing the gas giants to dictate policy so that gas royalties are reduced to levels far below other countries while domestic gas prices soar to be among the highest in the world, allowing a higher Australian dollar and higher gas prices to hollow-out non-resource industries. At each step of the way, short term gains have been taken at the expense of long term gains, often at the urging of vested interests.

Each of these factors seems to have come to an end. The gas capital expenditure, which added well over 10% to Australia GDP over a number of years is largely finished. The production phase of the major projects has little effect on the Australian economy as the projects are largely owned by foreign entities who pay minimal royalties and have enough tax losses to avoid income tax for many years. While China may continue to build at record levels, there is downside risk rather than upside. Finally, the royal commission into the banks has raised the prospect that the banks have been involved in predatory lending – this has led to a sharp contraction in the amount of lending which in turn accelerated the fall in house prices.

We may be wrong and Australia might get lucky again. Just recently another mining accident in (key competitor) Brazil has curtailed iron ore production – to the benefit of Australian producers, maybe more of these events will emerge. Maybe a comprehensive trade deal between the US and China will spur the global economy. The odds are though that the run of good fortune is over, and with the Australian stockmarket at a 10% premium to world markets, on far worse earnings growth, we believe the current run-up in stock markets is giving Australian investors one more chance to position their portfolios.

For most of 2018, we grappled with the dilemma of how to get enough exposure to the final leg of the bull market while maintaining downside protection in case markets unravelled earlier than expected. We are not expecting much positive news for stocks and so 2019 will be about how to get downside protection.

A resolution to the US/China trade war is one possible positive catalyst, however, we believe the intrinsic issues between China and the US run so deep that any announcement in the next few months is likely to be made to appease the egos of the leaders rather than as a long term solution. If this were to occur, our instinct would be to take further profits on shares and increase our bond/cash holdings further.

For the most part, we expect 2019 to be about avoiding accidents. Brexit, the rise of extremist parties in Europe, slowing growth plus too much debt in China, trade wars, emerging market crises and a slow-motion Australian housing crash will all present their challenges. If every accident is avoided then the stock market could eke out reasonable returns – but our base case is that the best returns are likely early in 2019 before slowing global growth (particularly in China) becomes apparent.

Australian Shares in 2019

Often the worst performing asset class of one year is one of the best in the next year. We are not expecting this to be the case for Australian shares.

The Australian share market starts the year facing a falling housing market, some of the weakest profit growth in the developed world, some of the highest interest rates in the developed world, growth slowing in (key customer) China and one of the most expensive share markets in the world.

The Australian market seems to us to be a one-way bet on China launching another major stimulus package, which will, in turn, boost demand for Australian iron ore and coal. This is possible, and maybe even likely if conditions get worse in China. However, there are a number of differences this time:

- China has more debt than before. And additional debt is less and less effective at producing growth. Net effect: China needs to incur far more debt than they ever have to produce far less growth. There is a question mark over China’s willingness to do this. We expect China probably will, but that economic conditions will need to worsen markedly before their hand is forced.

- Trade wars. China already runs a significant trade surplus with most countries. With tariffs, trade wars and a slow global economy there is downside risk to Chinese industrial production. i.e. there are other parts of the Chinese economy that will be competing with infrastructure for government stimulus, and these parts of the economy don’t use anywhere near as many Australian commodities.

- China already spending a massive amount on capital expenditure. There is scope for China to grow its infrastructure spending, but the key driver of much of China’s growth is home building which is already running at close to record levels. This limits the growth possible.

With those points in mind, and Australian stocks seemingly already pricing in a China bailout, we are opting to invest elsewhere. All of our portfolios are at, or close to minimum weights for Australian stocks.

2019’s number 1 issue: Chinese growth

First some background:

- China has serious longer-term economic issues that we have discussed on numerous occasions. China is running a Gerschenkron economic growth model, which has been run by many countries in the last 50 years including Russia, Japan, Cuba, South Korea and a number of Latin American countries. This growth model works for countries that have been underinvested. By repressing consumption, these countries can increase savings and investment and then, for a period of time, generate growth that more than makes up for the repressed consumption. When the investment stops generating adequate returns, the debt burden begins to grow and the country needs to change its growth model or go through a debt crisis. China is at the debt accumulation stage where the debt burden needs to grow significantly to maintain growth. This is not an imminent issue but it is clearly unsustainable.

- The problems have been getting worse in recent years. China has made several attempts to rebalance its economy away from capex driven growth. Each time China has slowed sharply enough that the attempts to rebalance have been abandoned.

- Growth is slowing in China despite record home building. There is scope for China to grow its infrastructure spending, but the key driver of much of China’s growth is home building which is already running at elevated levels.

- The US/China trade war is exacerbating the problem. Tariffs get the most headlines but in our view, the concerted and relentless release of hacking stories across multiple countries is likely to be more damaging in the long term as companies in developed markets shift structurally away from incorporating Chinese technology.

- China also has a number of other constraints. Cutting interest rates and reducing the currency might spark capital outflows and further US sanctions.

Question 1: Can a weak stock market prompt Trump to make a trade deal with China?

Yes is the short answer. However, it is unlikely to be an all-encompassing fix to the issues between China and other countries. Cancelling a few tariffs will not solve China’s trade issues and trade is not the only consideration in the growth issues facing China.

Question 2: Does weaker Chinese growth mean a bigger Chinese government spending package is coming, and a weaker global growth outlook mean that it is coming sooner?

Markets are certainly pricing it this way. The iron ore stocks, in particular, have reacted to poor Chinese growth numbers by outperforming rather than underperforming – seemingly pricing in the expectation that China will need major stimulus yet again.

Question 3: Does a weak stock market suggest another “Shanghai accord” is likely?

In 2015 China went through a similar period of weak growth, stock markets declined and the oil price plunged. The situation ended with the US Fed pausing its upgrades and the US dollar stopped rising. The rumour is that a secret deal was made between central banks at a meeting in Shanghai to limit the USD which would give room for China to stimulate its economy.

Given the trade tensions and a US economy growing quickly, this did not look likely 4 months ago. Fast forward to today and a deal is now more possible.

Tactical Asset Allocation Portfolio Positioning

In our tactical portfolios, we own cash, bonds, international shares and Australian shares. We tend to blend these portfolios for clients so that each investor receives an exposure tailored to their own risk and income requirements.

The broad sweep of our asset allocation over the last 18 months was to ride the Trump Boom, winding back on equities as share markets advanced and topping up when they fell but maintaining an underweight position in shares. Now, it is about an appropriate level of protection as the current business cycle draws to a close.

We have positioned our portfolios to be underweight shares (and significantly underweight Australian shares), overweight bonds and overweight cash.

Over / Underweight positions by portfolio

Domestically in the lead up to release of the Royal Commission findings due in early February, the Australian Banks were sold off over January as investors feared the worst. While most stocks had good recoveries in January, resource, steel and sold-off growth stocks had the biggest rebounds.

In our portfolios, we are limited to being +/-15% over or underweight any one sector. While we are at minimum weight to Australian banks, due to the size of the sector we still have exposure.

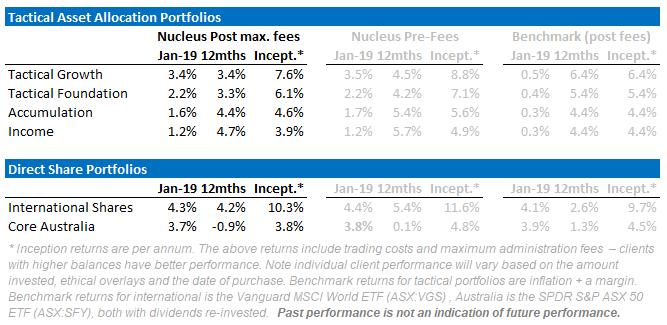

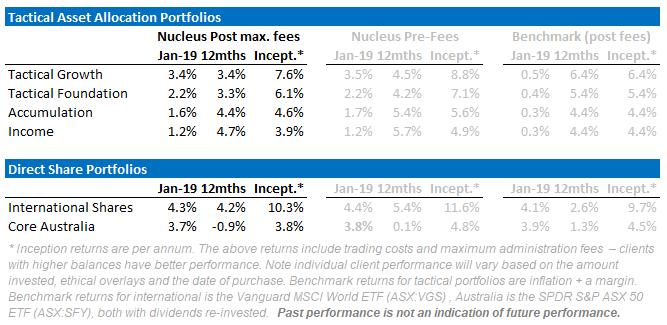

Performance to date

Portfolio performance can be cut a number of different ways. At its most basic level, you should care about the total return. At the next level you should care about the total return relative to some sort of benchmark.

As you dig deeper, you should also be interested how the return was achieved – for example if your fund manager is taking lots of risk but only performing slightly better than the market then you should be concerned. Similarly, if you can get market returns but at a much lower risk then that may be an appropriate trade-off.

Our portfolios to date have been out-performing and taking less risk. The disclaimer is that they have only been running for 19 months, and that is not enough time to make definitive judgements.

For the sake of comparability, we have used the Vanguard MSCI World ETF (ASX:VGS) to compare to our international portfolio – VGS is an index fund investing in the same stocks that we do.

Source: Factset, Nucleus Wealth

When looking at the tactical funds, one of our key measurement criteria is volatility. All of our funds are significantly less volatile than the Australian share market – our income fund is around 80% less volatile, and our foundation fund is about 60% less volatile:

Source: Nucleus Wealth

Epilogue

In summary, our view continues to be that Australian investors should continue to hold minimum weights for Australian shares at this point in the cycle. Our intention is that our portfolio is positioned to take advantage of our key themes but minimise risk in the event that our themes take longer than expected to resolve themselves.

We retain large cash and bond balances to hedge against volatility and in the expectation that capital protection will be important during 2019. If markets continue to be rally then we will likely sell more shares. Our key focus is Chinese growth, gauging the extent of the slow down and the policy response.

Damien Klassen is Head of Investments at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Integrity Private Wealth Pty Ltd, AFSL 436298.