About us

Nucleus Wealth was born from the idea that everyday people should have the transparency, customisation and access to quality investment management that is typically reserved for high net worth and sophisticated investors.

We do this by using technology to control costs and ensuring that our efforts are spent on the real job at hand, which is providing a superior investment outcome for our clients.

We pride ourselves in having some of the best brains in the business analysing investment opportunities on a global level. We do this through our partnership with a proven team of investment professionals.

Damien Klassen

Chief Investment Officer

Damien has a wealth of experience across international equities (Schroders), asset allocation (Wilson HTM) and he helped create one of Australia’s largest independent research firm, Aegis Equities. He lectured for over a decade at the Securities Institute, Finsia and Kaplan and spent many of those years as the external Chair for the subject of Industrial Equity Analysis.

Damien runs the investment side of Nucleus Wealth, selecting stocks suggested by analysts and implementing the asset allocation.

Damien started Nucleus Wealth after 20+ years in financial markets. He wanted to come up with an investment solution for ordinary investors that delivers the same types of personalised investment portfolios high net worth investors use.

David Llewellyn-Smith

Chief Strategist

David runs a prominent investment blog, co-authored of The Great Crash of 2008 with Ross Garnaut, was the editor of the second Garnaut Climate Change Review and was former editor-in-chief of The Diplomat magazine.

For years, Damien and David discussed the potential to create an investment firm to invest in the themes that both had pursued independently, and by 2016 platform fees had reduced low enough that the strategy could be invested in without the investment platforms making more than the investors!

David is the Asset Allocation strategist, his main role being to drive debate and decisions on whether to own cash, bonds, Australian stocks or International stocks.

Leith van Onselen

Chief Economist

Leith is the chief economist and so a natural fit for our Asset Allocation team – converse in the themes of the portfolio and with an in depth knowledge of the Australian economy and its drivers. He specialises in the Australian economy and for over a decade worked at the Australian Treasury, the Victorian Treasury and Goldman Sachs.

Radek Zeleny

Senior Investment Analyst

Radek came to Nucleus Wealth via Mainstreet, and Radek has over 20 years experience in a wide range of analyst/quant roles across a number of stockbroking/research houses that include BZW, Abn Amro, BBY, and Aegis and CBA Equities research. Radek spends most of his time trawling through stocks looking for value traps and problems.

Aileen Chong

Operations Manager

Aileen completed a Bachelor of Environments degree at the University of Melbourne and has over seven years of customer service experience across multiple industries. At Nucleus Wealth she upkeeps client relationships, maintains their accounts and assists in implementing the company’s policies and processes.

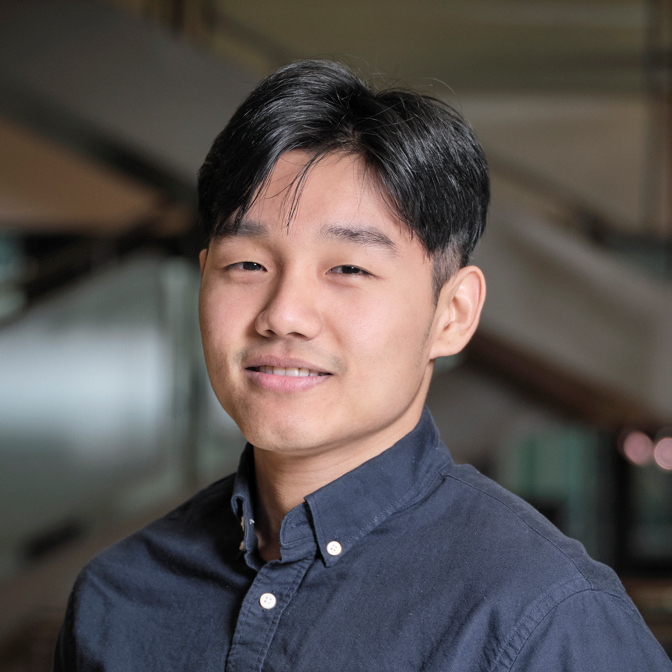

Abiral Rai

Software Engineer

Abiral has a Bachelor’s Degree in Information Technology focused on Mobile App Development from the Academy of Information Technology and has also completed the Australian Computer Society (ACS) Professional Year Program. He manages technology at Nucleus Wealth, developing and executing assets to ensure the reliability, durability and security of Nucleus Wealth.

Shelley George

Director

Shelley is a CFA® charterholder and holds a Bachelor of Commerce (Finance and Econometrics). She has over a decade’s experience working in financial services. She built the multi-asset class dealing capability at AustralianSuper, has dealt across global equity, derivative, currency, and bond markets, and performed small capitalisation Australian equity analysis.

Samuel Kerr

Responsible Manager

Samuel has a Master of Financial Planning and a Bachelors degree in Psychology. He has worked in Financial Services since 2017 as a Financial Adviser and Mortgage Broker. Sam is a dynamic individual and has a real passion for investing and compound interest. He prides himself on his professionalism and ethical conduct, always striving for the best outcomes for his clients. He really enjoys helping people achieve their goals and loves the investment journey.

Stock Selection

The final pieces of the puzzle are the analysts behind the stock selection.

Damien runs quantitative processes to generate the stocks to buy, but the problem is that quantitative processes often generate “value traps” – stocks that look like they are high quality but aren’t.

Damien spent a number of years working with Simon O’Donnell and David Lennan at Wilson HTM where they were investment managers. He also had Simon as a client when Simon was head of financial planning at Commonwealth Private Bank and Damien was head of research at Aegis Equities.

Nucleus Wealth has a history of shared investment methodology with Integrity, and so Simon and David are involved in a range of investment processes across Nucleus – challenge the views and ensure that the investment standards are enforced.

David and Simon run Australian portfolios for high net worth individuals and have a wealth of experience investing in all assets. So, Nucleus spends a lot of time with Simon and David discussing investments in Australian stocks.

Asset Allocation

Damien Klassen

David Llewelyn Smith

Leith van Onselen

Stock Selection

Damien Klassen

Radek Zeleny

Simon O’Donnell

David Lennan

Operations

Shelley George

Samuel Kerr

Aileen Chong

Abiral Rai

Have further questions or want to learn more about Nucleus Wealth? Get in contact with us here