There is sometimes confusion about the returns available on property in a self-managed super fund (SMSF) – especially as the mathematics starts to get confusing with relative rates of return, real vs nominal and opportunity cost vs risk, before tax and after tax returns. If you’d like to see how an investment property would serve you, you can use our property calculator. But I have a much easier way to explain why it is so compelling in a SMSF, and I’m going to break it down into simple maths that anyone can understand.

Let’s say you and your partner are both in your early fifties, have spent 30 years working in nurse/teacher/fireman/public servant type jobs and have managed to (between both of you) accrue $250,000 in super.

You are probably in an industry super fund, and paying less than 1% per annum in costs let’s say $2,000 to keep the maths easy. You also have a normal tax accountant who charges you $200 to do your taxes each year. Your “net worth” so to speak, to the finance industry is $2,200.

But, $2,200 is barely the fortnightly lease payment on a decent BMW. How can you increase that $2,200 to an amount that will actually make a dent in the private school fees of the hard working financial sector employees who are managing your money?

It would also be helpful if rather than paying your fees annually you could front load most of your fees and pay them up front so everyone can benefit now rather than having to wait for you to pay fees each year.

Enter property in an SMSF.

Let’s take you out of your $250,000 super fund and roll you into a brand new $700,000 apartment with a $500,000 loan (allowing $50,000 for stamp duty and expenses).

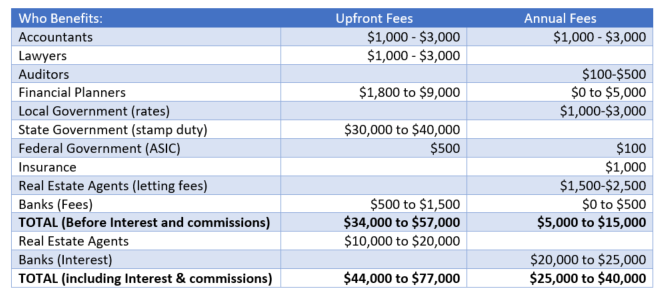

Upfront fees. $1,000 to $3,300 to your accountant. Legals? $1,000 to $3,000. Stamp Duty: $30,000 to $40,000 depending upon the state. Bank Valuation and other fees $500-1,500. Sales commissions are officially paid for by the vendor, not you. But all that means is that the sales commissions on your new apartment are embedded in the price. Add another $10,000 to $30,000.

Plus now you have an annual $2,000 to $3,000 in accountants fees. And at 4.5% investor interest rates you are in for $22,500 in interest payments. Maybe you are paying annual financial planning fees. At 1% that’s another $2,500.

With gross rental yields around 4%, you get income of $28,000 per year. Then you pay strata, insurance, rates, letting fees etc which means you are probably losing a few thousand each year.

Thankfully negative gearing gets you a discount. Oh. That’s right, an SMSF only pays 15% tax, which means there are almost no negative gearing benefits.

So let’s go through the maths:

If you leave your $250,000 in super:

If you create an SMSF to buy a $700,000 property:

Sure, you will wipe out close to 25% of your entire savings in upfront fees alone. And your annual fees are at least double what they were, probably triple. But just look at the list of people who will benefit from your largesse: accountants, lawyers, governments, real estate agents and banks. That’s a lot of lobbying power – both to lobby you to put your super into property via an SMSF, and to lobby the government to keep the changes that allow you to borrow in your SMSF despite numerous warnings and objections from more independent observers.

Hopefully, you can see now why property is so compelling in an SMSF.

Maybe not for you, admittedly, but for almost everyone else in the game it makes perfect sense.

Damien Klassen is Head of Investments at Nucleus Wealth.