Note: This is the first instalment of our performance report looking at our Australian and International direct share portfolios which are fully invested in shares. The second instalment is the asset allocation performance report that will come out after the returns for comparable funds become available.

September saw global equities with their first monthly negative return since bottoming in March. This reflected a pullback in a soaring US technology sector and investors worried about stalled fiscal stimulus talks in Washington, the upcoming election, and new coronavirus cases in Europe. After a strong August, the Nasdaq made its all-time high on September 2nd before going into a tailspin. It was joined by all the global indices as a risk-off mood gripped the market. As September came to a close, the market cut its losses and rose strongly as US legislators appeared to reopen stimulus talks. However, all major global indices ended in the red apart from Japan, up 1% over the month.

Domestically the ASX 200 had a poor month with a 3.7% drop and the AUD fell almost 3% vs the USD.

Our Core portfolios continue to outperform over September. At this point in the cycle, we have positioned our portfolios to a more defensive stance. The balance is in owning enough quality and growth stocks to share in the upside, without abandoning Value stocks to protect us from the downside. Currency proved a tailwind for Core International as the AUD weakened.

Naive Quantitative Factors

In the tables below, we look at a number of naive quantitative factors. i.e. factors that generate buy signals for stocks based purely on quantitative metrics without consideration of other factors. These factors are also known as “smart beta”. We use these as an interesting window into what the market is paying for, though we caution investors against using them without understanding the fundamental and macroeconomic drivers.

Value

Over 2020 so far, naive Value strategies (those that just buy the cheapest stocks on historical measures) have dramatically underperformed. That continued in September. We note better-targeted Value metrics, like cashflow (FCF / Price) have done much better than those that rely on accounting measurement (E / P or inverse Price to Earnings). Dividend yield continues to be a reverse indicator:

Note: Numbers are the percentage returns over the relevant period.

Note: Numbers are the percentage returns over the relevant period.

Source: Capital IQ, Nucleus Wealth

Low Volatility

Not far behind Value Strategies for poor performance in 2020 are strategies that target low volatility. These had a particularly bad September.

Ordinarily, you would expect low volatility to help in a falling market. Part of the reason is sector selection, previously stable sectors like Property Trusts have been hit hard by COVID-19. In industries like Healthcare, low volatility stocks have beaten high volatility convincingly.

The other part of the story is (in my view) that the popularity of this strategy meant overpriced securities. i.e. valuations are still unwinding in this sector.

While we didn’t have a lot of exposure to this theme last year for valuation reasons, we have been increasing our exposure in recent months.

Capital Efficiency

Naive Capital Efficiency strategies performed OK in September, mostly adding to their generally good performance over 2020.

We contend that traditional Capital Efficiency ratios have been distorted over the last 20 years due to accounting changes. We target Capital Efficiency quite differently in our portfolios.

Earnings Quality

The performance of Naive Earnings Quality strategies have been erratic for the year, and that continued into September. High-profit margins and income stability have been good factors. With all of the shutdowns, supply chain issues and disruption, it isn’t surprising working capital measures haven’t given any help to investors. I expect this will be the case for some time yet.

Price Momentum

Price Momentum is a strategy that essentially keeps buying stocks whose price is going up, selling what is going down. It has been a strong performer all year and had a good September.

We tend not to invest in this strategy as it requires frequent trading.

Core International Performance Insights

Each month we intend to present a selection of charts/tables that will visually show how the portfolio is performing.

Our portfolio outperformed its benchmark over the month. Currency proved a tailwind as September, and the weaker AUD helped returns.

Regionally our European investments are doing very well. At the same time, our overweight in US Value stocks meant we didn’t suffer as severely from the US tech sell-off. The TopBottom table reflects this as our FAMGs (Facebook, Apple, Microsoft and Google) were top detractors while the Top10 is full of European Defensives.

During the month, we further de-risked the portfolio by down weighting Apple and Microsoft while up weighting defensives like Newmont (Gold producer), Johnson & Johnson, and Telenor (Emerging Market Telco).

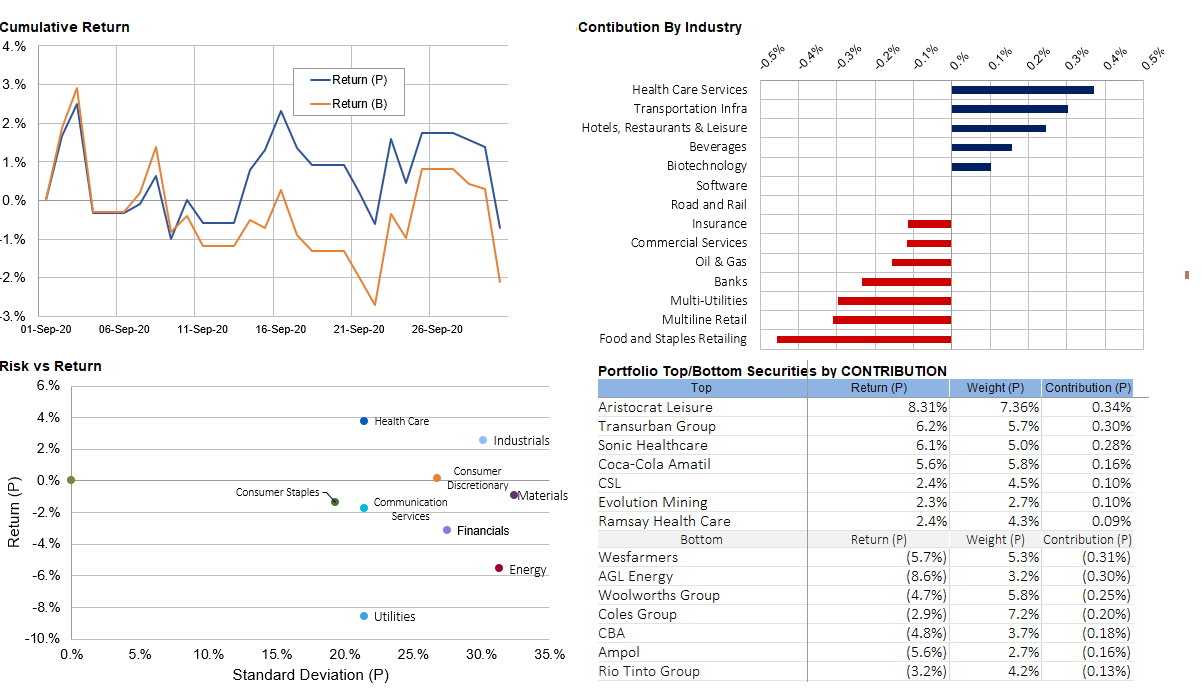

Core Australia Performance Insights

The Core Australian portfolio initially closely tracked its index over the month. But, as the correction gained momentum, our considerable overweight in Gold producers protected the portfolio as did our underweight Energy position. Traditional defensives like Woolworths, Coles and Wesfarmers were underperformers as they failed to recover from the September correction. Toward the end of September, we down-weighted the gold producers and Telstra.

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.