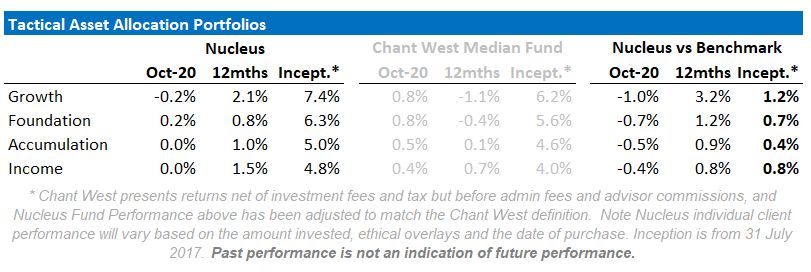

October saw domestic multi-asset portfolios achieve small gains with Australian equities the prime driver. International markets fell reflecting uncertainties of the US election and the deteriorating lockdown situation in Europe. Australia equities gained with the improving situation in Victoria with respect to Covid shutdowns, and proved one of the better equity markets over October as investors sought refuge from the US and European declines.

Our portfolios underperformed peers this month reversing last month’s trend as our lower Banking exposure in the Australian equities meant we didn’t fully capture the upswing. Over the month we tweaked our Australian Equity exposure to take profits in iron ore/property and rotate from some defensive stocks to growth stocks. We increased our exposure to equities just prior to the US election.

Economic cycle background

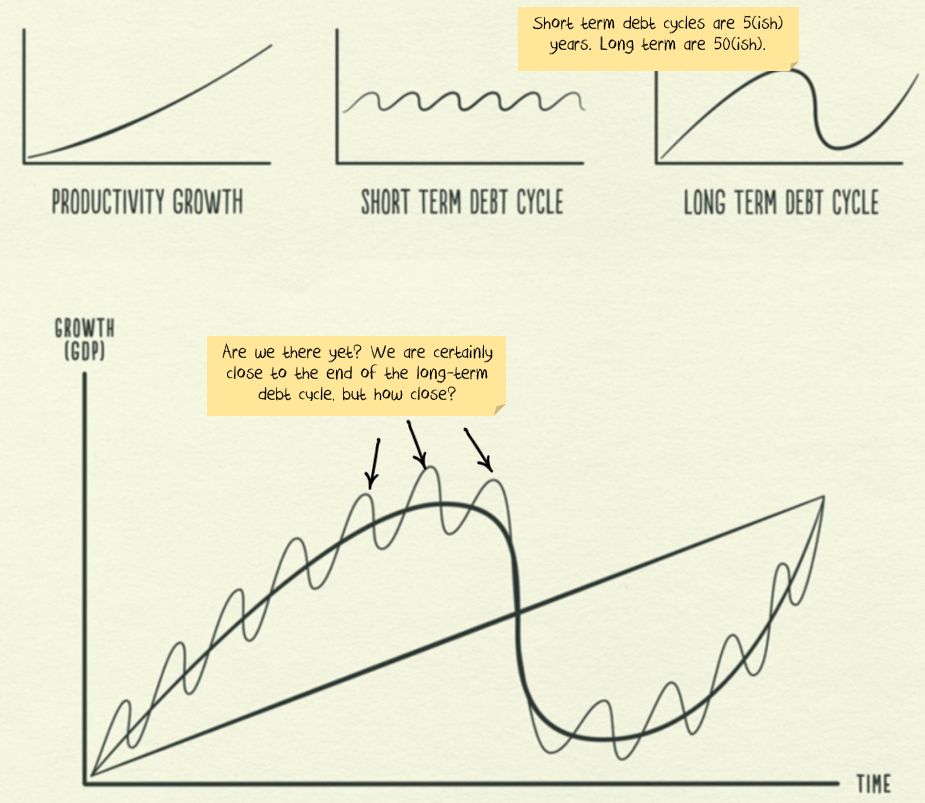

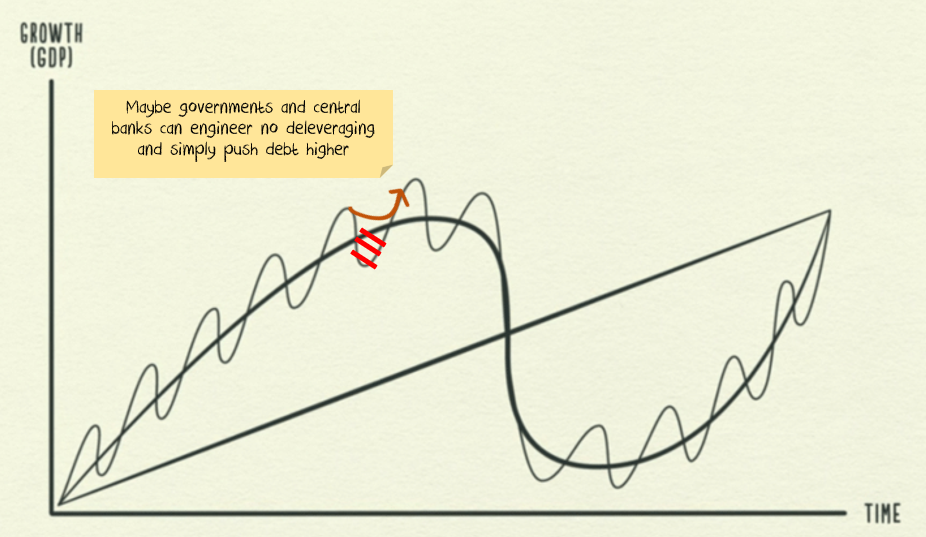

Ray Dalio has a series of explanatory videos that talk about debt cycles and in particular the contrast between a short debt cycle and a long debt cycle.

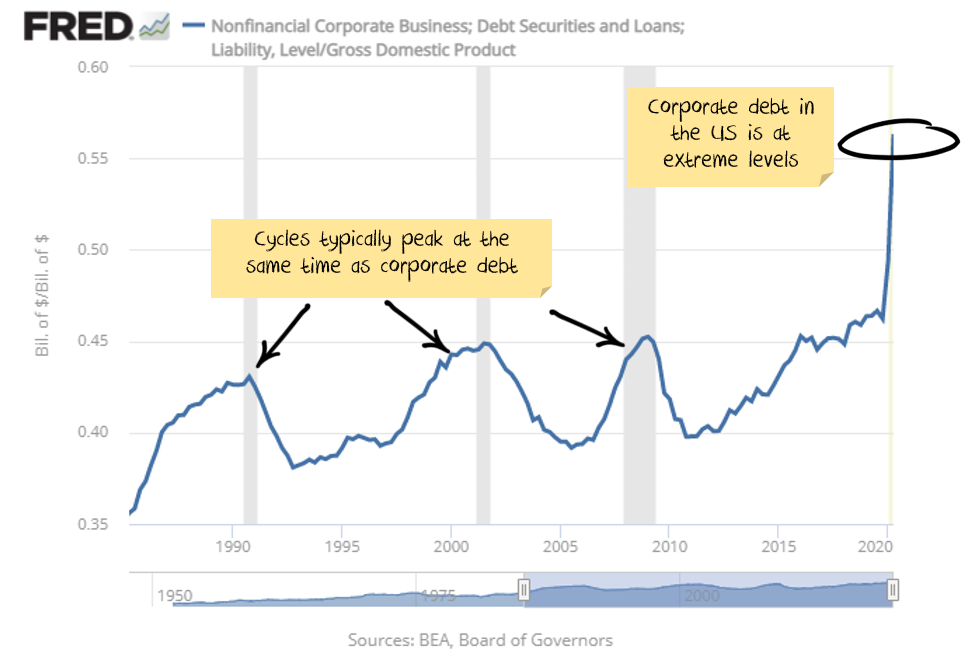

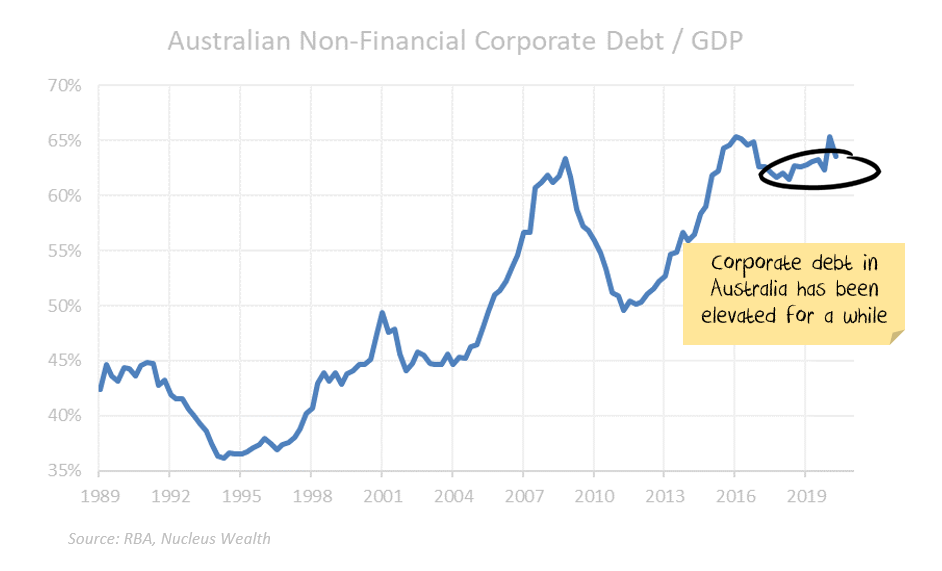

With record levels of corporate debt around most of the globe:

COVID-19 lockdowns suggested that this would be the end of the current short term debt cycle and potentially the end of the current long term debt cycle.

Governments and central banks to the rescue

Swift intervention by central banks and governments hit pause on the start of deleveraging. In effect they threw a lot of money at the economy, most ended up cushioning the blow for people who suffered from the shutdown. But a significant amount also ended up with people who didn’t suffer. Also, without travel, many more affluent people travelled less and consequently increased their saving and investment.

Also, evictions and bankruptcies were made more difficult, and interest-rate holidays on loans given. The new rules prevented negative outcomes while encouraging positive ones. The stock market boomed.

Is capitalism finished?

We have been cautious on risk for months, avoiding the crisis at the start, but with minimal participation in the market recovery. And, to date, we have been wrong. We did identify the most likely reason to be wrong would be if governments would take ever more extreme steps to cancel capitalism. And that is what happened.

In many countries, “extend and pretend” has replaced the threat of bankruptcy. Someone who can’t pay their rent is not evicted but allowed to accrue debt. Don’t foreclose on those who can’t pay their interest. Instead, build up their interest payments into a larger debt burden.

The end game seems to be a cohort of zombie consumers and businesses. Weighed down by debt burdens too massive to ever pay off, but supported by interest rates low enough to keep them from defaulting.

US Treasury Secretary Mnuchin is letting several minor lending programs expire at the end of the year, to the loud complaints of many – including the US central bank. Many programs will likely be re-instated once Biden is in power. In other countries, there is very little consideration given to finishing similar programs.

It would seem we have a zombie future.

Can the debt cycle blast higher?

The question from here is whether a new debt boom can be launched without the old one ever having peaked.

Until recently, I thought the odds favoured the end of the cycle. I was wrong.

I’m still sceptical of a debt boom for businesses. Governments and central banks will try, but debt levels are already high and further interest rate reductions will be limited.

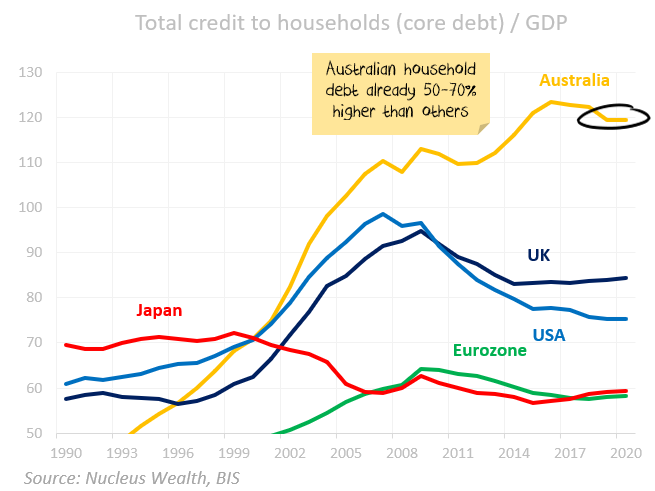

Another household debt boom is possible. Although Australia has already played this card:

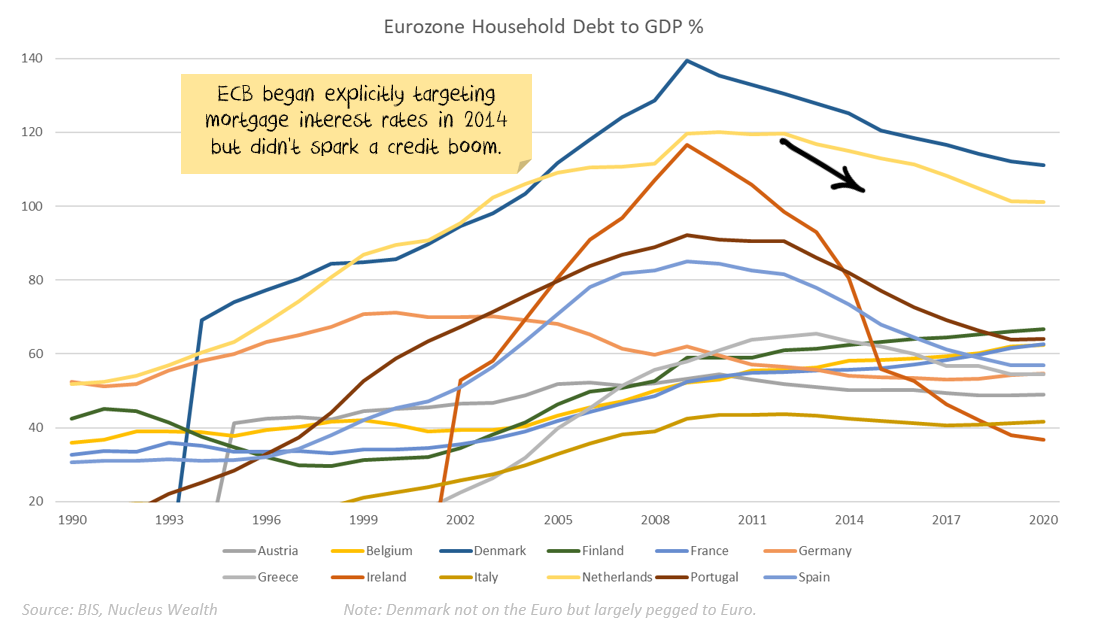

The other difficulty is that despite the European Central Bank’s best efforts, household debt has been declining across much of the Eurozone.

The most likely outcome now appears to be continued increases in government debt, but limited increases in corporate debt. Household debt is an open question.

Are we reduced to watching governments and central banks?

Mostly. It seems clear that policymakers have decided on zombification. Limit bankruptcies. Increase debt. Never raise interest rates again.

It doesn’t make for a healthy economy. But it limits short term pain which appears to be the current goal of every politician.

The economic plan is to try to get a debt-funded consumer boom going so that bankruptcy protection and consumer support can be removed.

Policy mistakes are what matters from here. The goal? Prevent a business cycle from occurring.

Indications that a normal business cycle is occurring will be a sign to sell. Too much support and markets will grind higher.

Performance Detail

The Tactical Growth Waterfall chart below breaks down this return showing Australian Equities essentially offsetting International Equity weakness. Bonds were steady leading up to the expected November rate cut decision.

Over the month we took some profits from our Iron ore producers and property managers. We rotated out of defensive stocks Ramsay/Telstra into growth stocks Computershare (leveraged to M&A activity) and Treasury Wines (leveraged to a China rebound). Our Bond and International exposures remained unchanged.

Asset Allocation

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.